Uphold is a multi-asset crypto exchange platform and wallet designed for beginners and everyday investors, offering broad asset access, simple instant swaps, and strong transparency features across usability, asset coverage, and security. Its main drawback is the relatively high spread based pricing and limited advanced charting, which may matter for active traders or anyone placing frequent, higher volume orders.

What is Uphold and how does it work?

Uphold is a centralised, app based trading platform and multi currency wallet that lets UK users buy, sell, hold, and swap crypto and other asset types in one account. Trading is mainly spot and instant swaps, with pricing shown as a spread that typically averages 0.8% to 1.2% on major cryptocurrencies. It suits beginners and casual investors more than active traders who need advanced charting.

Is Uphold centralised or decentralised?

Uphold is a centralised platform, meaning trades are placed and settled inside Uphold’s own system rather than directly on a blockchain exchange. Users log in, complete identity checks, deposit funds, and trade within Uphold’s custody environment.

That said, Uphold also routes liquidity across multiple venues. In 2026, the platform is described as having connections to 28 decentralised exchanges and Layer 2 networks, plus expanded cross chain support through 45 blockchain integrations and 16 partnerships. In practice, this supports its fast “anything to anything” swaps, but the user experience remains that of a centralised exchange style app.

What is the core trading model?

Uphold is primarily a spot trading and instant conversion platform.

Key elements of the model:

- Spot buys and sells on cryptocurrencies like BTC, ETH, XRP, SOL, plus other supported assets

- Instant swaps between supported assets, often referred to as “anything to anything” trading

- Example: swapping GBP to ETH, or BTC to gold, without placing a series of separate conversions

- No mainstream derivatives suite, meaning no futures, perpetuals, or options for typical users

- Spread based pricing rather than a classic maker taker fee schedule

- Typical costs in the UK include spreads around 1.4% to 1.6% on BTC and ETH, with wider spreads on lower liquidity tokens that can reach 2.9% plus

- The platform may warn when spreads exceed 4%, giving users the chance to cancel before confirming

Uphold also supports more advanced order controls than its basic charts suggest, including limit orders, repeat transactions for recurring buys, take profit, and trailing stop orders.

How does it work day to day?

A typical UK user journey looks like this:

- Create an account and complete KYC: Verification uses a photo ID, selfie, and often proof of address. Onboarding is designed to be quick, with hands-on testing revealing the full sign up and security flow can take roughly 5 to 10 minutes, with checks commonly completing within 24 hours.

- Fund the account: Funding options mentioned include bank transfer and instant payment methods such as debit card, Apple Pay, and Google Pay. Card and instant methods are convenient, but typically carry a 3.99% deposit fee in the UK.

- Buy, sell, or swap assets: Users select the asset they want, choose the funding source, and confirm. Uphold shows a preview screen before execution, including the quoted price, the spread, and what the user receives.

- Hold, spend, or move funds out: Users can hold assets in the app wallet, withdraw to an external wallet (network fees can apply), or withdraw fiat to a bank account. UK bank withdrawals via Faster Payments with no platform fee, plus optional debit card withdrawals that can cost 1.75% with a £1 minimum.

Who is Uphold designed for?

Uphold is aimed at beginners and everyday investors who want a clean interface and quick access to multiple asset types in one place, plus freelancers or small businesses that may benefit from multi currency balances and simpler conversions.

It is best suited to:

- Beginners who value simple navigation, quick onboarding, and clear trade previews

- Multi asset users who want crypto plus fiat currencies and precious metals in one app

- Longer term, lower frequency investors who use recurring buys rather than high volume execution

It is less suited to:

- Active traders who rely on advanced charting, TradingView style analytics, or low fee pro style order books

- High frequency traders where spreads, especially on smaller tokens, can become expensive versus maker taker platforms

What assets can you access through Uphold?

- 300 plus cryptocurrencies after adding 74 new tokens in 2025

- Fiat currencies including GBP, USD, EUR and “30 plus” FX pairs referenced in the summary

- Precious metals including gold, silver, and platinum

- Selected US equities (availability depends on region and product access)

Minimums are positioned as low, with trading from around £1 and no fixed minimum deposit.

Where do regulation, custody, and transparency fit in?

- Uphold Europe Ltd is described as FCA registered for anti money laundering supervision as a cryptoasset firm

- The platform is also referenced as registered with FinCEN in the US as a Money Services Business

- A Proof of Reserves dashboard updates every 30 seconds, showing 100% plus backing of customer assets

- Additional security notes include two factor authentication, encryption, continuous monitoring, and a claim that around 90% of digital assets are held in cold storage, with solvency checks referenced as quarterly

- The platform has processed over $40 billion in transactions since launch, and is described as serving 10 million plus users across 150 plus or 184 plus countries

Cryptoassets remain high risk and price movements can lead to losses, and UK users should assume there is no investor compensation scheme protection for crypto balances if something goes wrong.

Uphold overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | Available in the UK and 150 plus countries globally |

| Exchange type (centralised or decentralised) | Centralised platform with liquidity routed across multiple venues |

| Regulator or registration status | FCA registered cryptoasset firm in the UK for AML and CTF compliance; registered with FinCEN in the US as a Money Services Business |

| Custody model (custodial or non custodial) | Primarily custodial, with optional self custody via Uphold Vault and the UpHODL Web3 wallet |

| Investor protection (usually none) | No FSCS protection for crypto assets; crypto is unregulated and high risk in the UK |

| Supported cryptocurrencies | 300 plus cryptocurrencies, including BTC, ETH, XRP, SOL, ADA, and many smaller tokens |

| Trading types (spot, derivatives, margin) | Spot trading and instant swaps only; no futures, options, or margin trading |

| Fiat on ramp and off ramp | Yes. Bank transfer, debit card, Apple Pay, and Google Pay supported in the UK |

| Trading fees | Spread based pricing. Typical spreads are around 0.8% to 1.2% on major cryptos, 1.4% to 1.6% on BTC and ETH, and up to 2.9% on smaller tokens |

| Deposit and withdrawal fees | Bank transfers free; card and instant payments around 3.99% deposit fee; debit card withdrawals around 1.75% minimum £1; crypto withdrawals subject to network fees |

| Security features | Two factor authentication, encryption, 24 7 monitoring, around 90% of digital assets held in cold storage, quarterly solvency checks, real time proof of reserves updated every 30 seconds |

| Mobile app and web platform | iOS and Android mobile apps plus web based platform with synced accounts |

| Ease of use level | Beginner friendly with a clean interface and quick onboarding |

What assets and markets are available on Uphold?

Uphold supports 300 plus cryptocurrencies alongside fiat currencies and precious metals, with trading mainly done through spot buys and instant “anything to anything” swaps rather than a deep order book. UK users can trade from £1, access stablecoin and FX pairs, and use liquidity routed across 28 DEXs and Layer 2 venues, but there are no futures or perpetuals for advanced derivatives trading.

Number and range of supported cryptocurrencies

Uphold’s crypto selection is one of its strongest points for UK users:

- 300 plus cryptocurrencies available in 2026

- 74 new tokens added in 2025, expanding coverage of newer and smaller cap assets

- Major coins are covered, including BTC, ETH, XRP, SOL, ADA, DOT

- The platform also supports themed crypto “baskets” for simple diversification, with examples like The Big Three (BTC, ETH, XRP) and sector baskets such as AI and Infrastructure

Because Uphold connects to multiple trading venues, it is often able to list tokens earlier than platforms that rely on a single centralised liquidity pool.

Spot markets and how trading works

Uphold is a spot focused platform.

Instead of a traditional exchange interface with a full order book and maker taker pricing, trading is built around:

- Instant buys and sells at a quoted price

- One step swaps between supported assets

- Example: GBP to ETH, BTC to gold, or USD to XRP without needing multiple conversions

- Advanced order types are available despite the simple charts, including limit orders, repeat transactions (daily, weekly, monthly), take profit, and trailing stop orders

Execution is designed to be straightforward, with a clear preview screen showing pricing before the trade is confirmed.

Derivatives or perpetuals

- No futures

- No perpetuals

- No options

- No margin trading

That matters for advanced traders, because it removes leveraged strategies and reduces product depth compared with exchanges that offer perpetual futures markets.

Stablecoins and fiat pairs

Uphold’s market coverage goes beyond crypto only platforms because it supports crypto, fiat, and commodities in one place:

- Fiat currencies include GBP, USD, and EUR, plus 17 more listed in the platform details, and 30 plus FX pairs referenced in the summary table

- Stablecoins are supported, and are priced more competitively than most crypto assets on the platform

- Typical pricing shown: stablecoins and major FX around 0.25%

- Users can move between stablecoins, GBP, and major crypto using the same swap flow, which is useful for reducing volatility without leaving the platform

This multi asset setup is part of what makes Uphold attractive to freelancers and users managing cross border balances.

Liquidity depth and market coverage

Uphold’s liquidity approach is different from classic exchanges. It aims for broad market coverage and reliable execution through routing:

- Connections to 28 DEXs and Layer 2 rollups help widen access to tokens and liquidity sources

- 45 blockchain integrations and 16 partnerships are referenced as improvements to cross chain swap capabilities in 2026

- For major assets, spreads are typically tighter

- 0.8% to 1.2% average spreads on major cryptocurrencies are quoted in the quick verdict

- Another set of UK figures cited: 1.4% to 1.6% on BTC and ETH, with 2.5% to 2.95% on many altcoins

- For lower liquidity assets, pricing can widen

- The platform may flag when spreads exceed 4% so users can decide whether to proceed

The trade off is that while coverage is broad and the swap experience is smooth, it is not built for traders who need deep order books, tight maker pricing, and pro level market analytics.

Supported asset classes beyond crypto

This is technically outside crypto markets, but it affects “markets available” on Uphold and helps explain why its asset coverage score is strong:

- Precious metals such as gold, silver, and platinum

- Selected US equities (availability depends on region and product access)

- A multi currency wallet design that supports moving between crypto, fiat, and metals in one step

Supported assets and markets score

Uphold scores strongly here because it combines 300 plus cryptocurrencies, multi asset markets, and wide liquidity routing across multiple venues. The main limitation is the lack of derivatives markets and a more basic pro trading environment for advanced users.

How good is the trading experience and toolset on Uphold?

Uphold delivers a clean, reliable, and beginner-focused trading experience across web and mobile, built around instant swaps rather than advanced exchange tooling. It supports multiple order types, fast execution, and cross-asset trading across 300 plus assets, but deliberately avoids pro-level charting, derivatives, or deep automation. Overall, usability is strong, while advanced analytics remain limited.

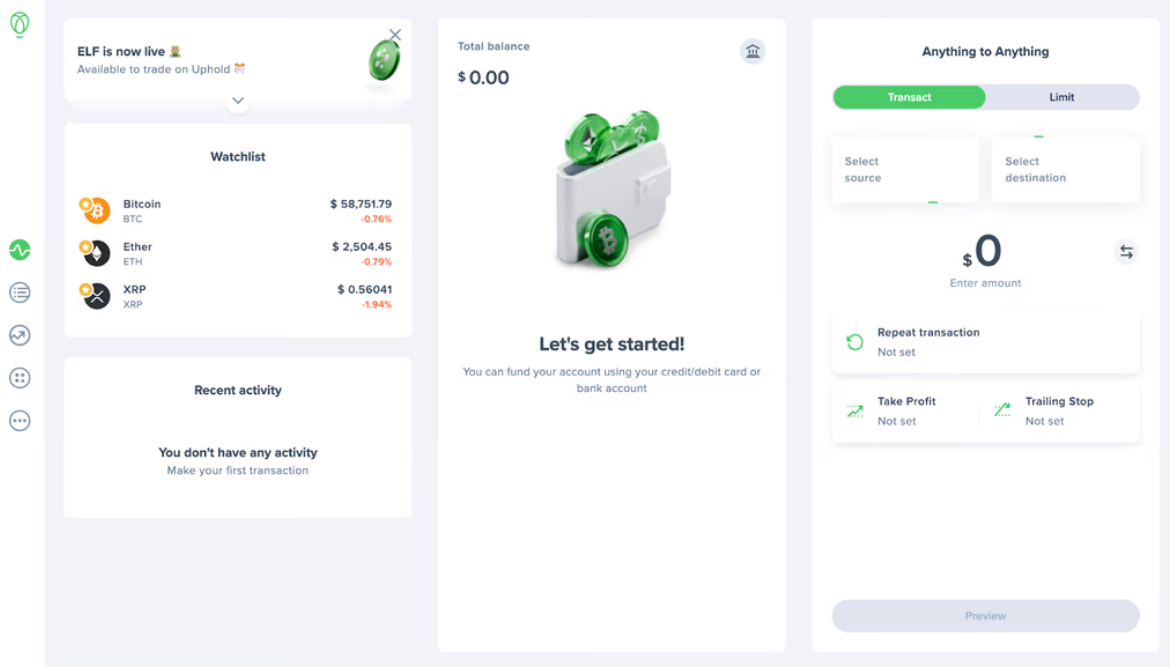

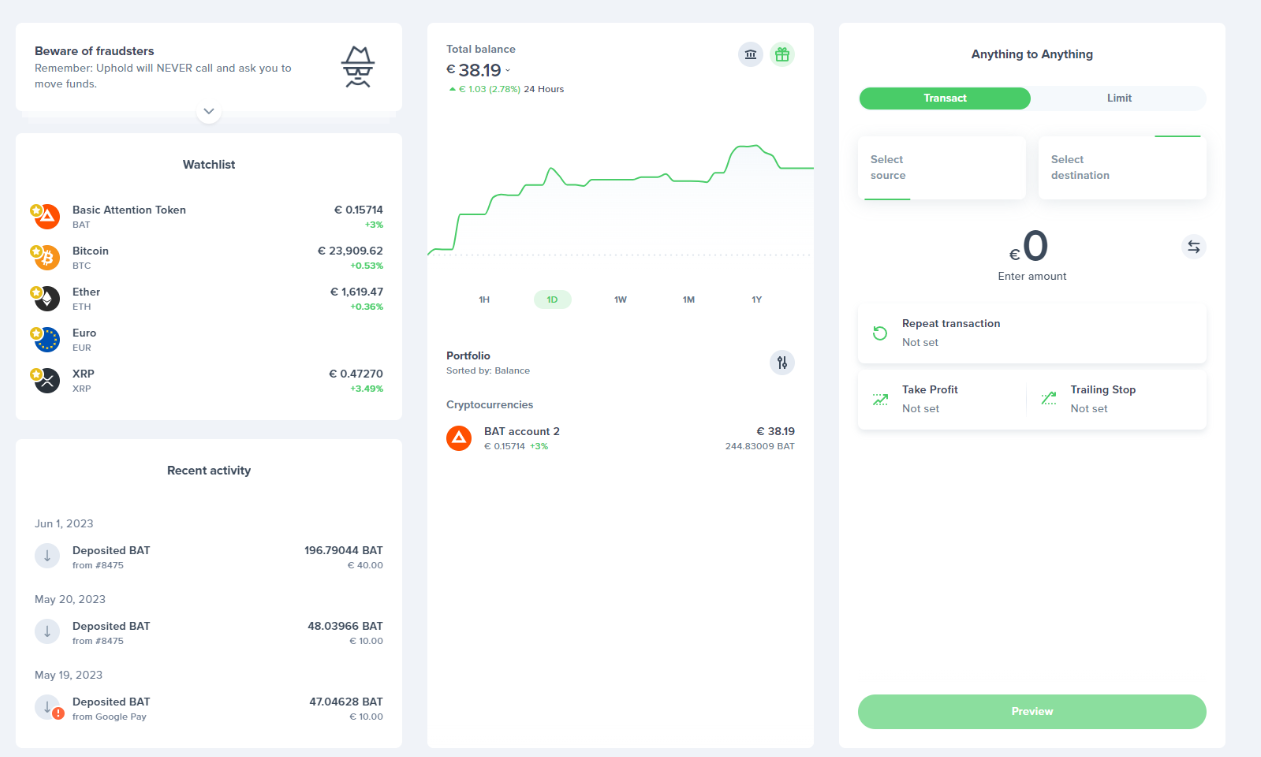

Web and mobile platform usability

Uphold’s web platform and mobile apps are closely aligned, offering a consistent experience across devices:

- Available on web, iOS, and Android, with full account sync

- Account setup, verification, and first trade typically take under 10 minutes, with KYC completion usually within 24 hours

- The interface is intentionally minimal, prioritising balances, recent activity, and simple trade flows over dense trading screens

- Users can buy, sell, or swap assets directly from a dashboard without switching between modes

This design strongly favours beginners, passive investors, and multi-asset users, rather than active day traders.

Order types available

Despite its simple layout, Uphold supports a wider range of order logic than many beginner platforms:

- Market style instant trades via quoted prices

- Limit orders to target specific entry or exit prices

- Repeat transactions for daily, weekly, or monthly investing

- Take profit orders to automatically sell at predefined gains

- Trailing stop orders to manage downside risk dynamically

All orders are previewed before execution, showing spreads, final pricing, and settlement timing.

Charting tools and indicators

Charting is one of Uphold’s clearest limitations:

- Charts are basic line charts, with no candlestick views

- No built-in technical indicators such as RSI, MACD, or moving averages

- No TradingView integration or advanced drawing tools

While users can view price history, market cap, 24-hour volume, and all-time highs, technical traders will need external charting platforms for analysis.

Advanced tools such as APIs or automation

Uphold offers selective advanced functionality, mainly outside traditional retail trading:

- Business and payments APIs are available for merchants and enterprise users

- API tools are designed for payments, conversions, and treasury management, not algorithmic trading

- No native support for trading bots or high-frequency automation

- Advanced automation is instead handled through recurring transactions and conditional orders

This positions Uphold more as a financial platform and wallet than a programmable trading exchange.

Performance and reliability

From a performance standpoint, Uphold scores well for everyday use:

- Trades execute quickly via its anything-to-anything swap engine

- Infrastructure now includes 45 blockchain integrations and 16 new partnerships, improving cross-chain reliability

- Liquidity is routed across 28 decentralised exchanges and Layer-2 networks, reducing single-venue dependency

- Proof-of-reserves updates every 30 seconds, confirming 100 percent plus asset backing

The platform has processed over $40 billion in transactions since launch and reports no successful hacks since operations began in 2015.

Trading experience and tools score

Uphold performs strongly on ease of use, execution reliability, and multi-asset flexibility, making it well suited to everyday investors and long-term holders. The absence of advanced charting, derivatives, and pro trading modes limits its appeal for active or technical traders, but aligns with its beginner-first design philosophy.

How competitive are Uphold’s fees and pricing?

Uphold uses a spread based pricing model with no maker or taker fees, meaning the cost of each trade is built into the quoted price rather than charged separately. This keeps pricing simple and transparent for beginners, but it is generally more expensive than pro level exchanges for frequent or high volume traders, especially on lower liquidity assets.

Trading fees structure

Uphold does not use a traditional maker taker model. Instead:

- There are no explicit trading commissions

- All costs are included in the spread shown before you confirm a trade

- Pricing is locked for around 18 seconds, allowing users to review the full cost

This approach removes hidden charges but means users cannot reduce fees by providing liquidity or trading higher volumes.

Spread costs by asset type

Spreads vary significantly depending on asset liquidity and market conditions.

| Asset type | Typical spread |

|---|---|

| Stablecoins and major FX | ~0.25% |

| Major cryptocurrencies (BTC, ETH) | ~1.4% to 1.6% |

| Average major crypto range quoted | ~0.8% to 1.2% |

| Altcoins and smaller tokens | ~2.5% to 2.95% |

| Precious metals | ~1.9% to 2.95% |

If market conditions cause spreads to widen above 4%, Uphold flags this clearly before execution so users can decide whether to proceed.

Deposit fees

Deposit costs depend on the funding method:

- Bank transfers (Faster Payments, SEPA, ACH): Free

- Crypto deposits: Free and typically instant

- Debit card, Apple Pay, Google Pay: Around 3.99% in the UK

The higher card fee is in line with industry norms for instant payments, but it materially increases the cost of smaller trades.

Withdrawal fees

Withdrawal charges are mostly limited and clearly defined:

- UK bank withdrawals (Faster Payments): Free

- Crypto withdrawals: Network or blockchain fees only

- Debit card withdrawals: 1.75%, with a minimum fee of £1

- Some smaller blockchain withdrawals may include a flat fee equivalent to $0.99, depending on network and transaction size

There are no inactivity fees or monthly account charges.

Indirect and potential hidden costs

While Uphold is transparent, there are indirect costs to be aware of:

- Spreads widen on low liquidity assets, making smaller or newer tokens more expensive to trade

- No fee discounts for high volume traders or advanced users

- No separate “pro” platform with reduced pricing, unlike some competitors

- Staking rewards are subject to a platform cut, ranging roughly from 3% to 34% depending on the asset and network

These factors mean long term, high frequency traders may pay more than expected compared with exchanges that offer tiered fee schedules.

Fees and pricing score

Uphold scores well for clarity and simplicity, with no hidden commissions and upfront pricing on every trade. However, its spread based model makes it less competitive for active traders, particularly on altcoins and instant card funded purchases. The pricing structure is best suited to beginners, long term investors, and users who value convenience and transparency over the lowest possible execution costs.

How secure is Uphold and how are assets held?

Uphold is primarily a custodial platform, meaning the exchange holds and safeguards most customer assets on their behalf, with optional self custody features for selected use cases. It uses standard account security controls and publishes a near real time Proof of Reserves feed that updates every 30 seconds and shows 100% plus backing of customer assets, but crypto remains high risk and not covered by UK investor compensation schemes.

Custody model

Uphold’s default setup is custodial:

- Crypto, fiat, and metals balances are held within the Uphold platform and managed through user logins rather than private keys controlled by the customer

- This model supports instant “anything to anything” swaps across 300 plus assets, but it also means users take platform risk (operational risk, custody risk, and counterparty risk)

Uphold also offers optional custody alternatives in specific areas:

- Uphold Vault is described as a self custody style option for BTC and XRP using a 2 of 3 multi signature setup

- Two keys are controlled by the user (Vault key and backup key)

- One key is held by Uphold

- A key replacement service is referenced as part of the Vault design

- UpHODL Web3 Wallet is positioned as a separate self custodial wallet that supports multichain assets (including BTC, ETH, XRP, ERC 20 tokens, and NFTs)

For most UK users, day to day holding and trading happens in the custodial wallet inside the Uphold app.

Cold storage practices

Uphold states that the majority of customer crypto is held offline:

- Around 90% of digital assets are held in cold storage (offline custody), which reduces exposure to online compromise

- The remaining portion is typically held in hot wallets to support withdrawals, swaps, and day to day liquidity

Cold storage reduces some technical attack surface but does not remove the broader risks of custodial platforms.

Account security controls

Uphold uses common, baseline security controls designed to reduce account takeovers:

- Two factor authentication (2FA) is required before users can fund and trade

- Encryption is used to protect sensitive credentials and private key material

- A 24/7 monitoring model is referenced via a Security Operations Center watching for suspicious activity

- Internal controls are mentioned, including strict admin access practices such as 2FA for administrative accounts and staff background checks

Proof of reserves and transparency

A standout feature is the Proof of Reserves approach:

- Uphold publishes a Proof of Reserves dashboard with updates every 30 seconds

- The dashboard is described as showing 100% plus backing of customer assets

- The platform is also described as maintaining a 100% reserve model, meaning customer assets are not loaned out under that model

This improves transparency compared with platforms that only publish periodic attestations, but it is still not the same as statutory investor protection.

Uphold is also described as holding over $2.7 billion in reserves.

Incident history and operational track record

From the information supplied:

- Uphold has operated since 2015 and is described as having had no successful hacks to date

- It states it undergoes regular security audits and penetration testing

- It is also described as being audited quarterly to verify solvency

Operationally, the platform is reported to have processed over $40 billion in transactions since launch and serves 10 million plus users globally. These scale metrics help contextualise maturity, but they do not reduce the underlying risks of holding crypto on an exchange.

Clear risk disclosures for UK users

Key points UK users should keep in view:

- Cryptoassets are high risk and prices can move sharply, including losses to zero in extreme cases

- In the UK, crypto trading is not regulated like investing in shares, and there is typically no FSCS protection for crypto holdings if a platform fails

- Custodial exchanges create counterparty risk: access can be restricted during compliance checks, disputes, or operational incidents

- Card and instant payment methods can add cost and may have separate dispute or chargeback dynamics, but they do not change custody risk for crypto once purchased

Security and custody score context

Uphold scores well on transparency through proof of reserves, plus common security controls like 2FA, encryption, and cold storage. The main trade off is that most users rely on a custodial model for day to day trading, and crypto holdings generally do not carry the same consumer protections as traditional UK regulated investments.

How do deposits and withdrawals work on Uphold?

Uphold offers a wide range of fiat and crypto on ramp and off ramp options, with low minimums and clear fee disclosures before confirmation. The process is designed to be simple and fast for everyday users, although instant payment methods come at a higher cost than bank transfers.

Fiat on ramp and off ramp support

Uphold supports multiple fiat funding and withdrawal methods, with availability depending on region.

For UK users, the core options include:

- Bank transfer (Faster Payments)

- Deposits: Free

- Withdrawals: Free

- Typically used for larger amounts due to lower fees

- Debit card

- Deposits: Around 3.99% fee

- Withdrawals: 1.75%, minimum £1

- Apple Pay and Google Pay

- Deposits: Around 3.99%

- Withdrawals: Free where supported

Fiat balances can be held in GBP, USD, EUR, and a wider set of 30 plus fiat currencies and FX pairs, allowing users to move between currencies inside the platform without leaving Uphold.

There is no fixed minimum deposit, and trades can be placed from as little as £1 or $1, which lowers the barrier to entry for new users.

Crypto deposit and withdrawal process

Crypto transfers on Uphold follow a standard wallet based model:

- Crypto deposits

- Users are provided with a unique wallet address for each supported asset

- Deposits are generally free, aside from the network fee paid by the sender

- Once the required number of blockchain confirmations is met, funds appear in the account

- Crypto withdrawals

- Withdrawals are sent on chain to an external wallet address

- Uphold does not add a percentage based fee, but blockchain network fees apply

- For some smaller networks or low value transfers, a flat fee equivalent to $0.99 may apply

The platform supports withdrawals across a large number of blockchains, reflecting its 45 blockchain integrations and expanded cross chain infrastructure.

Processing times

Processing times vary by method:

- Bank transfers (UK Faster Payments)

- Deposits: Same day in many cases

- Withdrawals: Typically one business day, sometimes faster

- Card and instant payment deposits

- Usually instant, allowing immediate trading

- Crypto deposits

- Dependent on blockchain confirmations

- Can range from minutes on faster networks to longer during congestion

- Crypto withdrawals

- Submitted quickly, but final settlement depends on network conditions

Uphold shows expected settlement times and transaction status clearly in the app and web dashboard.

Limits and minimums

Key limits and thresholds mentioned in the supplied information include:

- Minimum trade size: Around £1 or $1

- No fixed minimum deposit for bank or crypto funding

- Card and instant payment limits may apply depending on user verification level and region

- Bank wire deposits (US context): Free under $5,000, with a $20 fee above that threshold

Limits can increase after full identity verification, which typically completes within 24 hours.

Reliability and transparency

Uphold scores well for transparency around deposits and withdrawals:

- Fees are shown clearly before confirmation, including spreads and network costs

- Fiat withdrawals to UK bank accounts are fee free, which is not universal among crypto platforms

- The platform’s Proof of Reserves dashboard, updating every 30 seconds, helps reassure users that withdrawal requests are backed by available assets

- Users can track transaction history, timestamps, and status directly inside the app

That said, users remain exposed to operational and network risk, including blockchain congestion, compliance related delays, or temporary restrictions during account reviews.

Deposits and withdrawals score context

Uphold performs strongly on accessibility and ease of funding, with free bank transfers, instant crypto deposits, and very low minimums. The main trade off is cost: card and instant payment fees are high, and crypto withdrawals depend on external network conditions. Overall, the system is reliable and clearly presented, but best value is achieved through bank transfers rather than instant funding methods.

How trustworthy is Uphold in terms of regulation and support?

Uphold scores strongly on trust due to its multi jurisdiction regulatory registrations, unusual financial transparency, and a long operating history without major security breaches. While crypto assets themselves remain unregulated and high risk, Uphold’s compliance posture and disclosure standards place it above many retail crypto platforms.

Regulatory and registration status

Uphold operates as a regulated cryptoasset and payments platform, with registrations across several major jurisdictions:

- United Kingdom

- Operated by Uphold Europe Ltd, which is registered with the Financial Conduct Authority as a cryptoasset firm

- FCA registration covers anti money laundering (AML) and counter terrorist financing (CTF) obligations

- Crypto trading itself is not regulated in the UK, and there is no FSCS protection for crypto assets

- United States

- Registered with Financial Crimes Enforcement Network (FinCEN) as a Money Services Business (MSB)

- Subject to federal AML requirements and state level compliance where applicable

- European operations and global compliance

- Operates under multiple local registrations to support users in 150 plus countries

- Uphold reports compliance with GDPR, CCPA, and UK data protection standards

This structure means Uphold is not “licensed” in the same way as a stockbroker or bank, but it does operate within recognised financial crime and consumer protection frameworks in each region.

Jurisdictional transparency and corporate structure

Transparency is one of Uphold’s defining characteristics:

- Founded in 2014 by Halsey Minor and launched in 2015

- Headquartered in New York, with operations and offices across multiple regions

- Serves 10 million plus users globally

- Has processed over $40 billion in transactions since launch

- Has raised $74.9 million in funding across four rounds, including backing from Rosemoor Capital Management, Hard Yaka, and Ruttenberg Gordon Investments

Most notably, Uphold publishes a live Proof of Reserves dashboard, updating every 30 seconds, showing:

- All customer assets

- All platform liabilities

- A consistent 100 percent plus reserve ratio, meaning assets exceed liabilities

Unlike periodic attestations used by many competitors, this near real time disclosure allows users to independently verify solvency at any time. Uphold also states that customer assets are not loaned out under its reserve model.

Customer support channels and responsiveness

Uphold’s customer support offering is functional but relatively limited in scope:

- Self service help centre and FAQs

- Extensive knowledge base covering accounts, security, deposits, withdrawals, and trading

- Designed to resolve most common issues without direct contact

- Support ticket system

- Users can submit requests via an online contact form

- Tickets include a reference ID, timestamp, and status tracking

- Response times

- Average first response times of 15 to 30 minutes are frequently reported

- Responses are generally detailed and issue focused rather than automated

There is no live chat or phone support, which may be a drawback for users dealing with urgent account access or compliance related restrictions. Some user reviews reference frustration during account reviews or temporary lockouts, which is not uncommon for platforms operating strict AML controls.

Clarity of risk warnings and disclosures

Uphold is explicit and consistent in its risk disclosures, particularly for UK users:

- Prominent warnings that cryptoassets are high risk and users can lose all invested capital

- Clear statements that crypto holdings are not protected by the FSCS or equivalent investor compensation schemes

- Transaction preview screens show:

- The quoted price

- The spread

- Fees and expected settlement timing before confirmation

- Disclosure that spreads can widen during volatile conditions, with warnings shown when pricing exceeds 4 percent

Uphold also distinguishes clearly between:

- Custodial assets held within the platform

- Self custody options, such as Uphold Vault and the UpHODL Web3 wallet

- Region specific products, such as the Uphold Card or interest accounts, which are not universally available

This level of disclosure reduces the risk of users misunderstanding how products work or what protections apply.

Trust, regulation, and support score context

Uphold ranks highly for trust due to its FCA and FinCEN registrations, long operating history, no recorded successful hacks since 2015, and industry leading proof of reserves transparency. The main limitations are the lack of formal investor protection for crypto assets and a support model that relies heavily on tickets rather than live assistance.

Overall, it is one of the more credible and transparent multi asset crypto platforms available to retail users in 2026.

What are the pros and cons of using Uphold?

Pros

- 300 plus crypto assets plus fiat and metals in one account: Simple diversification across BTC, ETH, XRP, SOL, stablecoins, major FX, and precious metals without moving funds between platforms.

- Real time proof of reserves updated every 30 seconds: Clear visibility into assets and liabilities, with disclosure showing 100 percent plus backing rather than periodic attestations.

- Fast, beginner friendly trading flow: Account setup and verification can be completed in minutes, trades can start from around £1, and the interface stays consistent across web and mobile.

- Strong fiat access for UK users: Bank transfer deposits and UK Faster Payments withdrawals are fee free, while card, Apple Pay, and Google Pay add convenience when speed matters.

- Useful everyday features beyond trading: Recurring buys, limit orders, take profit and trailing stop orders, staking on 30 plus coins, and a UK debit card for spending crypto, fiat, or metals.

Cons

- Spreads are expensive versus pro exchanges: BTC and ETH spreads are commonly around 1.4 percent to 1.6 percent, smaller tokens can reach roughly 2.5 percent to 2.95 percent, and spreads can widen further in volatile markets.

- Card funding is costly: Debit card, Apple Pay, and Google Pay deposits typically cost around 3.99 percent, which materially increases total cost for frequent top ups.

- Weak charting and analytics: Charts are minimalist and there is no TradingView style tooling or a deep indicator set, which blocks technical analysis workflows.

- No derivatives markets: No futures, perpetuals, options, or margin trading, removing common tools used by advanced and active traders.

- Custodial risk and limited support channels: Most users hold assets custodially on Uphold, crypto is not covered by FSCS, and support is mainly ticket based, which can be frustrating during account reviews or access restrictions.

Who is Uphold best for?

- Beginners who want a simple, regulated onboarding process and an easy app first trading experience

- Multi asset users who want crypto plus fiat and precious metals in one account

- Altcoin focused users who want access to 300 plus tokens and frequent new listings, including 74 added in 2025

- Users who value transparency and want proof of reserves that updates every 30 seconds

- People who want to spend crypto day to day using the Uphold Card in the UK

Who is Uphold not ideal for?

- Low fee seekers who want tight maker taker pricing and fee tiers based on volume

- Active traders and technical analysts who need advanced charting, indicators, and deeper trading interfaces

- Derivatives traders looking for futures, perpetuals, options, or leverage tools

- Users who want live support via chat or phone for urgent account issues

- Anyone uncomfortable with custodial exchange risk, including the lack of FSCS protection for crypto holdings

How to get started with Uphold

- Create an account: Sign up with an email address and password on web or mobile.

- Complete verification: Provide a government issued ID, selfie verification, and proof of address if required. Verification often completes within 24 hours.

- Deposit funds: Add funds via bank transfer or crypto deposit, or use debit card, Apple Pay, or Google Pay if instant funding is needed.

- Place a trade: Choose an asset and buy, sell, or swap using Uphold’s anything to anything conversion flow. Use recurring buys, limit orders, take profit, or trailing stop orders if needed.

- Withdraw or secure assets: Withdraw GBP to a UK bank account via Faster Payments, send crypto to an external wallet, or move selected assets into Vault or a self custody wallet where supported.

How we tested and methodology

Each crypto exchange is assessed using a standardised six category scoring framework, with every category scored out of 5 to ensure consistency and fair comparison across platforms.

The six core scoring categories are:

- Supported assets and markets: Range of cryptocurrencies and other assets, market access, and product depth

- Trading experience and tools: Platform usability, order types, execution quality, and available trading features

- Fees and pricing: Trading costs, spreads, deposit and withdrawal fees, and overall cost transparency

- Security and custody: Custody model, cold storage practices, account security controls, and transparency measures such as proof of reserves

- Deposits and withdrawals: Fiat and crypto on ramps and off ramps, processing times, limits, and reliability

- Trust, regulation, and support: Regulatory registrations, corporate transparency, customer support quality, and clarity of risk disclosures

Scores are based on hands on testing of each platform, combined with detailed fee analysis, security and custody review, and platform usability checks across web and mobile. This approach is designed to reflect how a platform performs in real world use, not just how it markets itself.

FAQs

Does Uphold work in the UK?

Yes. Uphold is available to UK users and supports GBP features such as bank transfers (Faster Payments) and the Uphold Card in the UK.

Can Uphold be trusted?

Uphold has strong transparency features such as a Proof of Reserves dashboard that updates every 30 seconds and a 100% reserve model, plus it uses standard security controls like 2FA. Trust still depends on user expectations, as support complaints and account lockouts are commonly reported in user feedback.

Is Uphold regulated in the UK?

Uphold Europe Ltd is registered with the FCA as a cryptoasset firm for anti money laundering compliance. This is not the same as FCA regulation of crypto trading or FSCS protection for crypto holdings.

Is Uphold legal in the UK?

Yes. UK residents can legally use Uphold, and it operates in the UK under FCA cryptoasset registration requirements for AML controls.

Is Uphold as safe as Coinbase?

Both use mainstream exchange security controls and custody practices, and both rely on a custodial model for most users. Uphold stands out for real time Proof of Reserves transparency, while Coinbase is often stronger on advanced trading controls and institutional tooling, so the better fit depends on what “safe” means for the user.

How much are Uphold fees?

Uphold mainly charges via spreads rather than maker taker fees. Typical costs include spreads around 0.8% to 1.2% on major coins (BTC and ETH often quoted around 1.4% to 1.6%), stablecoins around 0.25%, and smaller tokens up to about 2.9% (often 1.9% to 2.95%); UK card deposits are about 3.99%, bank withdrawals via Faster Payments are typically free, and crypto withdrawals usually include network fees.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.