This guide compares the best crypto exchanges in the UK using clear, consistent criteria, including FCA registration, fees, GBP support, available cryptocurrencies, security, and ease of use.

Each platform is assessed side by side, so it’s easy to see which exchange fits your goals, whether you’re buying occasionally, trading actively, or holding long term.

The focus is on practical differences that affect costs, safety, and the overall experience for UK users.

Which is the best crypto exchange in the UK?

The best crypto exchanges in the UK for 2026, based on security, fees, and regulatory standing, are eToro, Kraken, and Coinbase. These platforms are registered with the FCA, offering secure, user-friendly, and cost-effective options for buying and trading, with Kraken best for low fees.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Top UK crypto exchanges

- Best Overall for Security & Fees: Kraken offers strong security, including proof of reserves, and low trading fees (0% – 0.26%).

- Best for Beginners: Coinbase is highly user-friendly, offering an easy-to-use interface, high security, and quick GBP bank transfers.

- Best for Social Trading: eToro is a popular choice for beginners, providing a regulated, user-friendly app, and copy trading features.

- Best for Variety & Features: Bitpanda and Uphold are noted for a wide selection of coins and staking opportunities.

- Best for Low Fees: CEX.IO is noted for competitive, low-fee trading.

Key considerations for UK users

- FCA Regulation: Always ensure the exchange is an FCA-registered cryptoasset business.

- Safety Features: Look for 2FA, cold storage (offline wallet storage), and insurance.

- Fees: Compare maker/taker fees, with Coinbase often ranging from 0% – 0.60% and Kraken from 0% – 0.26%.

- Bank Transfers: Platforms like CoinJar offer fast GBP bank transfers.

Comparison of the best crypto platforms in the UK

| Platform | FCA status (UK) | GBP deposits | Cryptocurrencies | Spot trading fees | Instant buy fees | Staking / earn | Other assets | Custody & security | Best for |

|---|---|---|---|---|---|---|---|---|---|

| eToro | FCA-registered cryptoasset business | Yes (FPS, cards) | ~100 | Spread-based ~1% on major coins | Included in spread | Not available in UK | Stocks, ETFs, CFDs | Segregated funds, cold storage, 2FA | All-in-one investing |

| Coinbase | FCA-registered cryptoasset business | Yes (FPS, cards) | 240+ | Advanced Trade: ~0.4% maker / 0.6% taker (lower with volume) | ~1.5%–3.99% | Limited staking (UK dependent) | None | 98% cold storage, insurance, 2FA | Beginners |

| Kraken | FCA-registered cryptoasset business | Yes (FPS) | 450+ | 0.16% maker / 0.26% taker | ~1.5%–2% | On-chain staking available | None | Proof of reserves, cold storage, 2FA | Low fees + pro tools |

| Bitpanda | FCA-registered (UK entity) | Yes | 500+ | Spread ~0.1%–0.15% | Included | Staking on 30+ assets | Stocks, ETFs, metals | Cold storage, insurance, 2FA | Multi-asset investing |

| Crypto.com | FCA-registered cryptoasset business | Yes | 250+ | ~0.075% maker / 0.075% taker | ~2.99% | Staking and earn products | None | Cold storage, insurance, 2FA | Mobile crypto ecosystem |

| Gemini | FCA-registered cryptoasset business | Yes | ~90 | 0.2% maker / 0.4% taker (ActiveTrader) | ~1.49% | Limited earn options | None | SOC 2, cold storage, insurance | Security-focused users |

| Nexo | Not FCA-registered (UK access allowed) | Yes | 100+ | 0.20% maker / 0.20% taker | Minimal spreads | Earn up to ~15% APY | Crypto loans, card | Proof of reserves, Ledger/Fireblocks | Earn + borrowing |

| CoinJar | FCA-registered cryptoasset business | Yes (FPS, cards) | 60+ | Exchange: 0.02%–0.10% maker, 0.06%–0.10% taker | ~1%–2% | Not available | None | 90% cold storage, SOC 2 | Simple low-fee investing |

| Revolut | FCA-registered (EMI licence) | Yes | 220+ | Revolut X: 0% maker / up to 0.09% taker | Standard app: ~1.49% | Staking on 10+ assets | Stocks, ETFs, ISAs | E-money safeguarding, cold storage | Casual crypto + banking |

| OKX | Not FCA-registered | Limited | 200+ | 0.08% maker / 0.10% taker | N/A | Staking, DeFi earn | Futures, margin | Proof of reserves, cold storage | Advanced traders |

| MoonPay | Not FCA-registered (payment provider) | Yes | ~80 | N/A | ~3.5%–4.5% card fees | Not available | None | Encrypted payments, 2FA | Fast card purchases |

13 best cryptocurrency exchanges in the UK

- eToro – Best for all-in-one investing with crypto, stocks, and ETFs in a regulated UK app.

- Coinbase – Best for beginners who want a trusted, FCA-registered crypto exchange.

- Kraken – Best for low fees and advanced trading tools.

- Bitpanda – Best for multi-asset investing across crypto, stocks, and metals.

- Crypto.com – Best for mobile-first users who want crypto trading, staking, and rewards.

- Uphold – Best for instant swaps between crypto, fiat, and commodities.

- Gemini – Best for security-focused investors who prioritise compliance and custody.

- Bitstamp – Best for reliable, low-cost crypto trading on a long-established, FCA-registered exchange

- Nexo – Best for earning interest or borrowing against crypto holdings.

- CoinJar – Best for beginners and long-term investors seeking low trading fees.

- Revolut – Best for casual crypto investing alongside everyday banking.

- OKX – Best for experienced traders who want very low fees and advanced features.

- MoonPay – Best for fast, card-based crypto purchases.

How these UK crypto exchanges were assessed

To compare UK crypto exchanges fairly, each platform was assessed using the same core criteria that matter most to UK users.

This includes UK regulatory status and safeguarding, trading and instant buy fees, GBP deposit and withdrawal support, range of supported cryptocurrencies, staking or earn features, overall ease of use, and who the platform is best suited for based on experience level and use case.

This approach makes it easier to compare platforms side by side and choose an exchange that fits your goals, risk tolerance, and how actively you plan to use crypto.

Below are our best crypto exchange UK reviews, designed to help UK users compare crypto trading platforms with confidence.

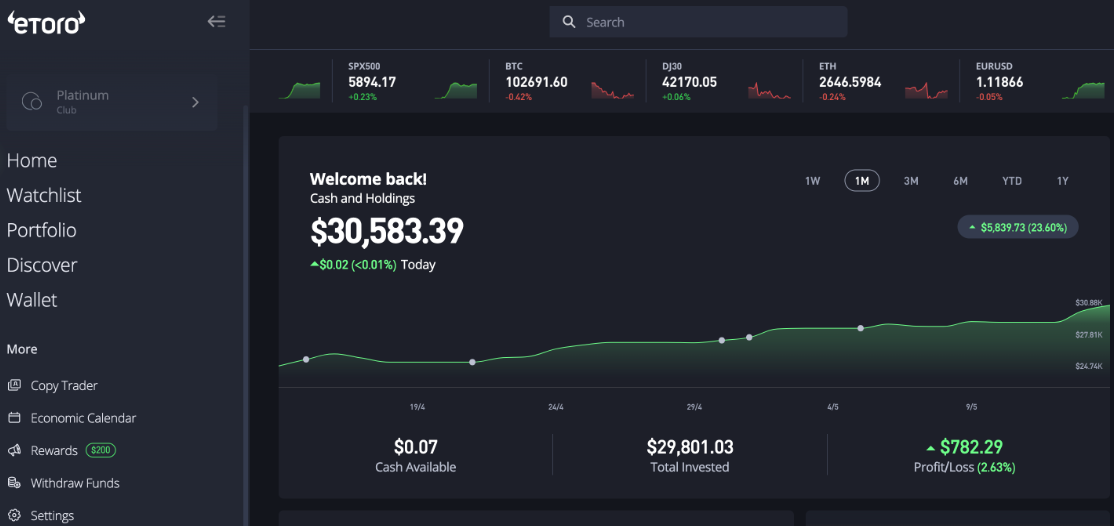

1. eToro – Best for all-in-one investing with crypto, stocks, and ETFs in a regulated UK app

Key information at a glance

- Key features: Social trading, CopyTrader, CopyPortfolios, demo account, integrated crypto wallet

- GBP support: Yes, plus 35+ other fiat currencies

- Number of cryptocurrencies: Around 100 assets available in the UK

- Trading fees: Spread-based pricing, typically around 1% on major cryptocurrencies

- Staking or earn features: Not available for UK users

- Other assets available: Stocks, ETFs, commodities, indices, CFDs (where applicable)

- Security and custody: Segregated client funds, cold storage, two-factor authentication

- UK regulation status: FCA-registered cryptoasset business, EMI licence

Is this crypto exchange safe and properly regulated for UK users?

Yes. eToro is registered with the Financial Conduct Authority (FCA) as a cryptoasset business and operates under UK financial promotion rules. Client funds are held separately, accounts are protected with two-factor authentication, and crypto assets are primarily stored using cold storage arrangements.

However, crypto investments are not covered by the Financial Services Compensation Scheme (FSCS), and users should be aware that losses are possible if markets move against them.

How competitive are this exchange’s trading fees and overall costs?

eToro uses a spread-based pricing model, rather than maker and taker fees. For major cryptocurrencies like Bitcoin, spreads typically start at around 1%, which is higher than some dedicated crypto exchanges but broadly in line with regulated, multi-asset platforms.

There are no deposit fees, but a $5 withdrawal fee applies, and GBP deposits are converted to USD, which can incur a currency conversion cost. Fees prioritise simplicity over raw cost efficiency.

Which cryptocurrencies, markets, and features does this exchange support?

UK users can trade around 100 cryptocurrencies, including major assets such as Bitcoin, Ethereum, and Solana. While the coin range is smaller than on specialist exchanges, eToro compensates by offering multi-asset access from a single account.

Key features include CopyTrader, which allows users to mirror other investors’ strategies, CopyPortfolios for diversified crypto exposure, and an integrated crypto wallet for storage and transfers.

How easy is this exchange to use for your experience level?

eToro is designed to be beginner-friendly. The platform offers a clean interface, clear order flows, price alerts, and a fully functional demo account with virtual funds. This makes it accessible for users new to crypto who want to practise before risking real money.

More advanced traders may find the platform limiting due to fewer order types and less granular fee control compared with professional crypto exchanges.

What are the main pros and cons of using this crypto exchange?

Pros

- FCA-registered platform with strong regulatory oversight

- Beginner-friendly interface and demo account

- Copy trading and social investing features are unique in crypto

- Access to crypto and traditional assets in one account

Cons

- Higher trading costs than some specialist exchanges

- No staking or earn products for UK users

- Assets are custodied by the platform unless withdrawn

- Withdrawal and currency conversion fees apply

What we think

TLDR: eToro is well-suited to UK beginners and casual crypto investors who value regulation, simplicity, and social trading features over the lowest possible fees. It is less suitable for advanced traders seeking deep liquidity, staking, or full self-custody by default.

Full eToro crypto exchange review and analysis.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

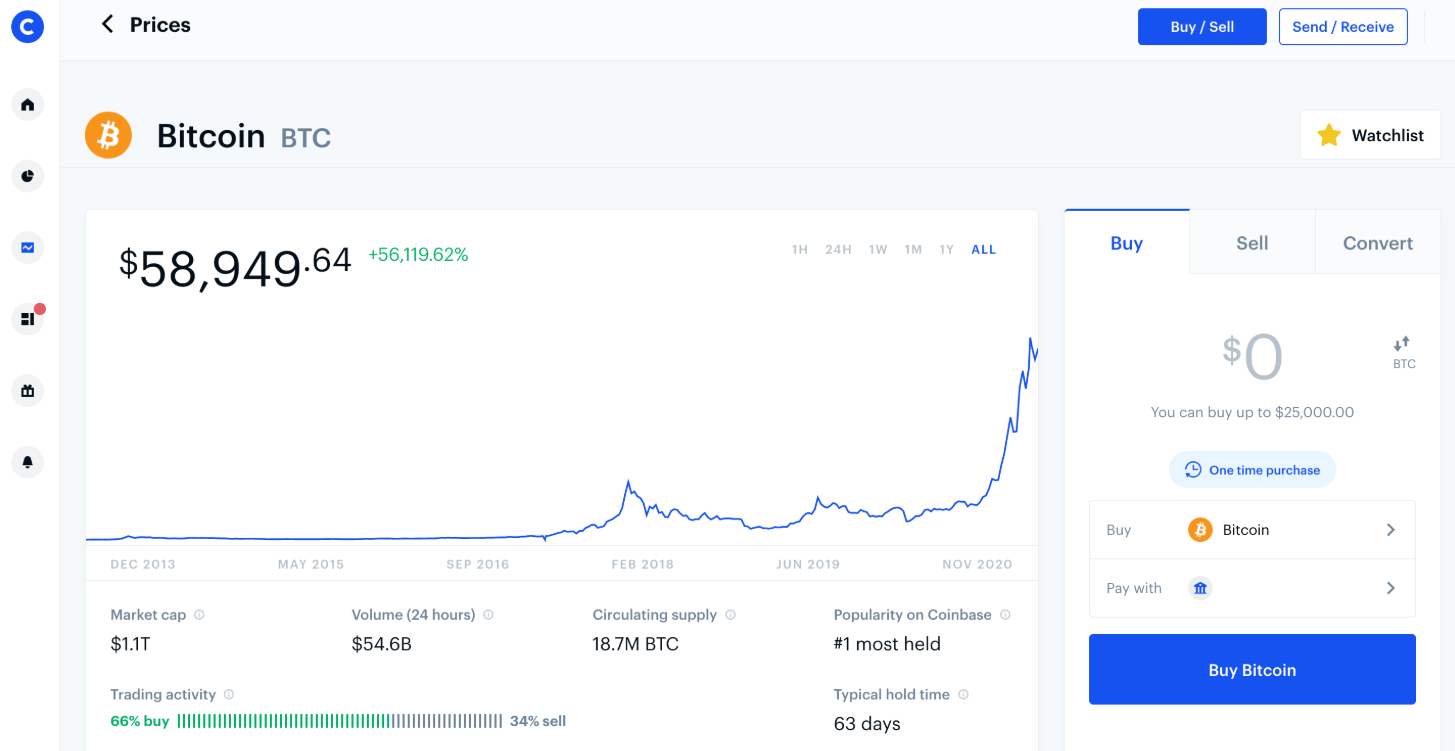

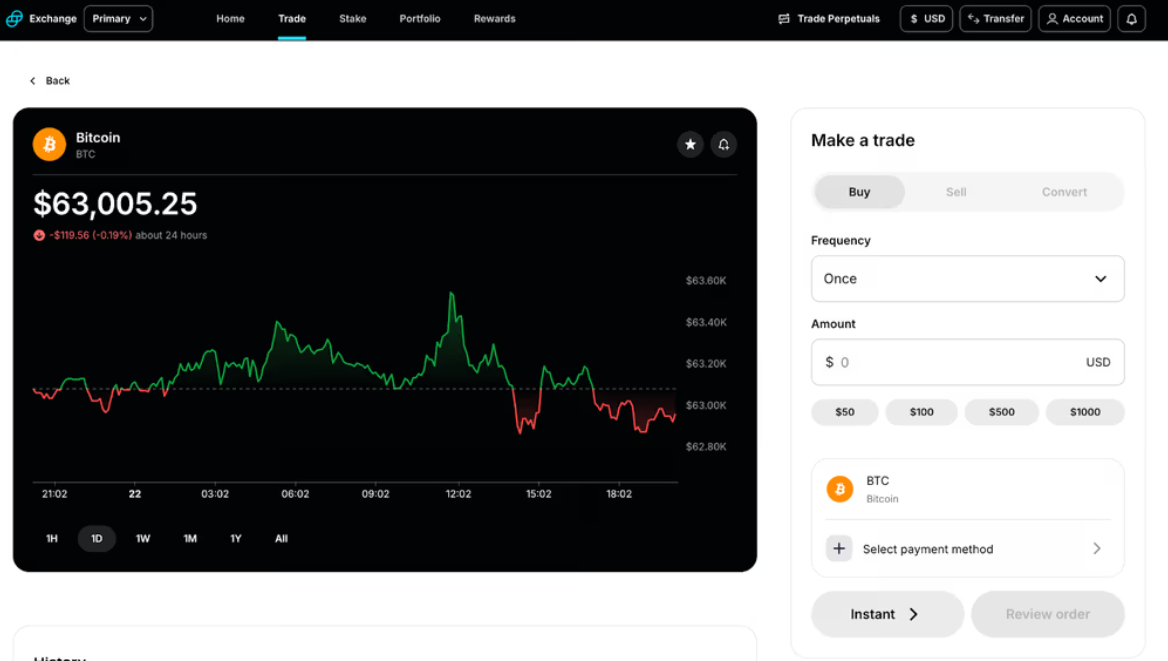

2. Coinbase – Best cryptocurrency exchange UK for beginners who want a trusted, FCA-registered site

Key information at a glance

- Key features: Simple buy and sell, Advanced Trade order book, recurring buys, Learn and Earn, Coinbase Wallet for self custody

- GBP support: Yes. GBP bank transfers and card payments supported, plus multiple other fiat currencies

- Number of cryptocurrencies: 250+ globally, around 150–200 available to UK users depending on FCA restrictions

- Trading fees: Standard Coinbase uses a spread of around 0.5% plus transaction fees of roughly 1.49%–3.99%. Advanced Trade uses maker and taker fees starting at 0.60% taker / 0.40% maker

- Staking or earn features: Staking available on around 8–10 assets, including ETH, SOL, ADA, and ATOM. Coinbase takes a commission of roughly 15%–35% of rewards

- Other assets available: Crypto only for UK retail users. No stocks, ETFs, commodities, or ISAs

- Security and custody: Around 98% of customer crypto held in cold storage, mandatory two factor authentication, optional self custody via Coinbase Wallet

- UK regulation status: FCA registered cryptoasset business and UK electronic money institution

Is this crypto exchange safe and properly regulated for UK users?

Coinbase is considered one of the safer options for UK users from a regulatory and operational perspective. Its UK entity is registered with the FCA for cryptoasset activities and authorised as an electronic money institution for fiat services. Coinbase is also a publicly listed US company, which adds transparency through audited financial reporting.

That said, cryptoassets are not covered by the Financial Services Compensation Scheme (FSCS). While Coinbase uses segregation, cold storage, and strong account security, users remain exposed to market risk and potential losses if crypto prices fall.

How competitive are this exchange’s trading fees and overall costs?

Coinbase fees are higher than most specialist crypto exchanges, particularly if trades are placed through the standard buy and sell interface.

On standard Coinbase:

- Spread: Around 0.5% on most trades

- Transaction fees: Typically 1.49%–3.99%, depending on payment method, trade size, and market conditions

- Small test trades can exceed 3% total cost, which is expensive by industry standards

On Coinbase Advanced Trade:

- Maker fees: From 0.40%, decreasing with volume

- Taker fees: From 0.60%, decreasing at higher monthly trading volumes

Advanced Trade pricing is more competitive but still generally higher than Kraken Pro or Binance style platforms. Coinbase One, a paid subscription, removes standard trading fees on simple trades but comes with a monthly cost that may not suit occasional users.

Which cryptocurrencies, markets, and features does this exchange support?

Coinbase offers one of the largest coin selections available to UK users, covering major assets like Bitcoin and Ethereum alongside a wide range of mid and lower cap tokens. This makes it suitable for diversification rather than only holding the biggest coins.

Key features include:

- Recurring buys for pound cost averaging

- Learn and Earn, which rewards users with small amounts of crypto for completing educational content

- Advanced Trade, offering limit orders, stop orders, and order book depth

- Coinbase Wallet, enabling self custody and access to decentralised apps

However, UK users do not have access to derivatives, margin trading, or non crypto asset classes within the same account.

How easy is this exchange to use for your experience level?

Coinbase is widely regarded as one of the most beginner friendly crypto platforms. Account opening is usually fast, the interface is clean, and buying crypto can be done in a few steps. Trades can start from as little as £2, which lowers the barrier for new users.

As experience grows, users can move to Advanced Trade without opening a new account. This makes Coinbase suitable for beginners who expect to become more active over time. The main usability drawback is that fees are often only clearly shown at checkout, which can make cost planning harder.

What are the main pros and cons of using this crypto exchange?

Pros

- FCA registered UK platform with strong compliance standards

- Very large cryptocurrency selection compared with most UK providers

- Beginner friendly app with Advanced Trade for more experienced users

- Staking available on several major proof of stake assets

Cons

- Standard trading fees can exceed 3%, which is high

- Fee structure is complex and not always transparent upfront

- Staking rewards are reduced by a relatively high platform commission

- No traditional investments like stocks or ISAs in the same app

What we think

TLDR: Coinbase is best suited to UK beginners and casual investors who value ease of use, a wide coin selection, and regulatory credibility over the lowest possible fees. Active or cost sensitive traders may prefer lower fee exchanges, but Coinbase remains a solid, well regulated entry point into crypto.

Full Coinbase crypto exchange review and analysis.

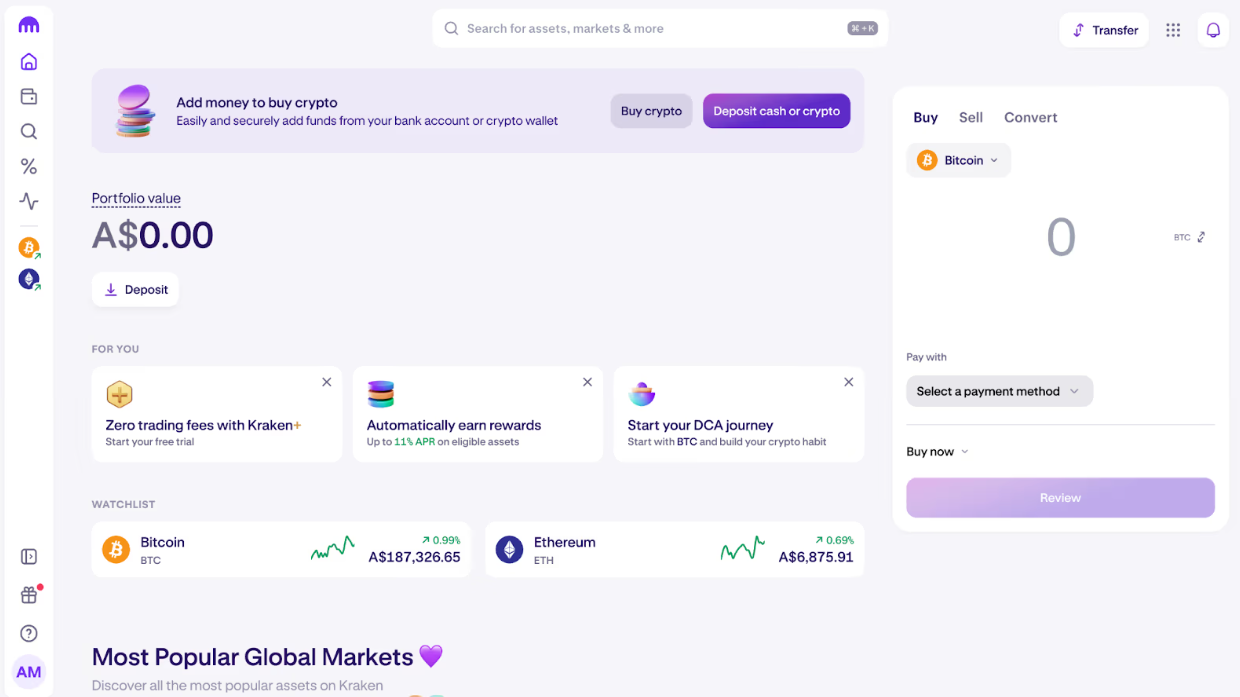

3. Kraken – Best for low fees and advanced trading tools

Key information at a glance

- Key features: Kraken Pro advanced trading, OTC desk, Proof of Reserves audits, Kraken Pay, API access

- GBP support: Yes. GBP bank transfers supported, plus multiple other fiat currencies

- Number of cryptocurrencies: 300+ available to UK users, with over 400 listed globally

- Trading fees: Kraken Pro maker fees from 0.25% and taker fees from 0.40%, with discounts at higher volumes. Standard instant trades cost around 1% plus spread

- Staking or earn features: On chain staking available on 20+ assets, including ETH, SOL, ADA, DOT, and ATOM

- Other assets available: Crypto only for UK retail users. No stocks, ETFs, commodities, or ISAs

- Security and custody: 1:1 Proof of Reserves, majority cold storage, two factor authentication, ISO certified security controls

- UK regulation status: FCA registered cryptoasset business and UK Electronic Money Institution licence

Is this crypto exchange safe and properly regulated for UK users?

Kraken is widely regarded as one of the more security focused crypto exchanges available to UK users. It operates in the UK through a regulated entity that is registered with the FCA for cryptoasset activities and also holds an EMI licence, allowing it to provide local GBP banking services.

Kraken has operated since 2011 with no confirmed loss of customer funds due to exchange level breaches. It also publishes regular Proof of Reserves audits to show client assets are held on a one to one basis. As with all crypto platforms, assets are not protected by the FSCS, and users remain exposed to market risk.

How competitive are this exchange’s trading fees and overall costs?

Kraken’s fees are generally more competitive than Coinbase and many UK app based platforms, particularly when using Kraken Pro.

On Kraken Standard:

- Instant buy and convert fees: Around 1% per transaction, plus a built in spread

- Additional charges may apply for card or PayPal payments

On Kraken Pro:

- Maker fees: From 0.25%, falling as volume increases

- Taker fees: From 0.40%, with further discounts at higher 30 day trading volumes

High volume traders can see fees drop well below 0.20%, making Kraken one of the cheaper regulated options for active UK traders. For casual users, Standard Kraken is convenient but noticeably more expensive than Pro.

Which cryptocurrencies, markets, and features does this exchange support?

Kraken offers one of the largest cryptocurrency selections available to UK users, covering major assets like Bitcoin and Ethereum alongside a broad range of altcoins and niche tokens. Listings are generally conservative, with a focus on liquidity and regulatory suitability.

Key features include:

- Kraken Pro, with advanced charting, order books, and multiple order types

- On chain staking, with rewards paid directly in supported assets

- OTC desk for large volume trades with reduced slippage

- Kraken Pay, enabling crypto and fiat transfers across supported currencies

UK retail users do not have access to crypto derivatives, margin trading, or ETFs due to local restrictions.

How easy is this exchange to use for your experience level?

Kraken is suitable for beginners, but it is not as immediately intuitive as Coinbase or eToro. The standard interface allows simple buying and selling, but the platform naturally encourages progression toward Kraken Pro, which has a steeper learning curve.

For experienced traders, Kraken Pro is a strong offering, providing deep liquidity, advanced order controls, and lower fees. Beginners may need time to adjust, but educational resources and clear fee structures help reduce confusion over time.

What are the main pros and cons of using this crypto exchange?

Pros

- FCA registered UK exchange with strong compliance credentials

- Very competitive fees on Kraken Pro, especially for active traders

- Large cryptocurrency selection with conservative listings

- Strong security track record and transparent Proof of Reserves

Cons

- Interface can feel complex for beginners

- Standard instant trades are relatively expensive

- No access to stocks, ETFs, or ISAs

- Crypto remains high risk with no FSCS protection

What we think

TLDR: Kraken is best suited to UK investors who value security, transparency, and low trading fees, particularly those willing to use Kraken Pro. Beginners can use the standard interface, but Kraken truly stands out for intermediate and advanced traders who want a regulated exchange with professional grade tools.

Full Kraken crypto exchange review and analysis.

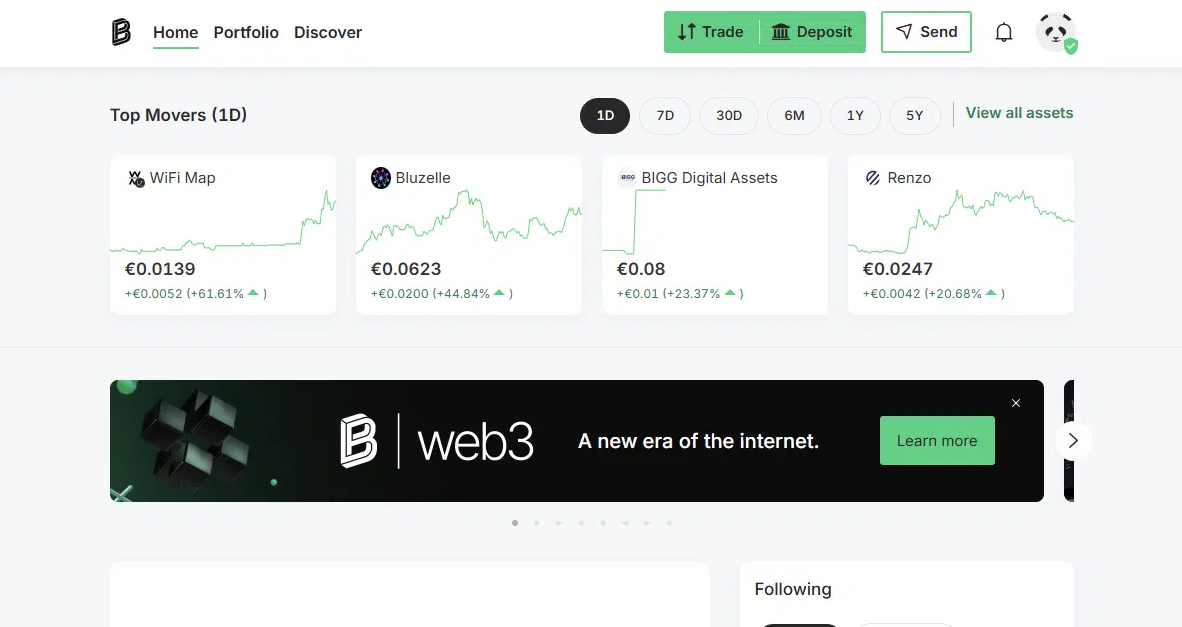

4. Bitpanda – Best for buying and holding the widest range of cryptocurrencies in the UK

Key information at a glance

- Key features: Simple buy and sell crypto broker, 600+ supported assets, crypto indices, Spotlight new-token feature, staking on 50+ assets, limit orders, beginner-friendly mobile and web platform

- GBP support: Yes, plus EUR and other supported fiat currencies

- Number of cryptocurrencies: 600+ cryptocurrencies available to UK users

- Trading fees: Flat spread pricing from 0.99% on Bitcoin, up to around 2.49% on some altcoins

- Staking or earn features: On-chain staking on 50+ assets with weekly rewards, no lock-ups for most tokens

- Other assets available: Crypto only for UK users (no stocks, ETFs, or commodities currently available in the UK)

- Security and custody: Cold wallet storage, two-factor authentication, withdrawal confirmations, ISO-certified data protection

- UK regulation status: FCA-registered cryptoasset business (AML registration, not FCA investment regulation)

Is this crypto exchange safe and properly regulated for UK users?

Bitpanda is registered with the Financial Conduct Authority as a cryptoasset business for anti-money laundering purposes. This means it meets UK standards for identity checks, transaction monitoring, and financial crime controls.

Cryptoassets held on Bitpanda are not protected by the FSCS, and the platform is not regulated like a traditional investment firm. From a security standpoint, Bitpanda has a strong record, with no publicly reported breaches and extensive use of cold storage, two-factor authentication, and audited operational controls.

How competitive are this exchange’s trading fees and overall costs?

Bitpanda uses a simple spread-based pricing model rather than maker and taker fees.

Key cost points include:

- Bitcoin trades typically start from around 0.99%

- Other cryptocurrencies can carry spreads up to 2.49%

- No deposit fees on bank transfer, card, or PayPal

- No withdrawal fees charged by Bitpanda (network fees still apply)

This structure is transparent and predictable but more expensive than advanced exchanges for frequent trading. Bitpanda is best suited to buy-and-hold investors rather than active traders chasing the lowest possible fees.

Which cryptocurrencies, markets, and features does this exchange support?

Bitpanda offers one of the largest crypto selections available to UK users, with over 600 cryptocurrencies supported.

Notable features include:

- Crypto indices that bundle multiple assets into a single investment

- Staking on more than 50 cryptocurrencies

- Spotlight feature for identifying new and emerging tokens

- Limit orders for basic price control

- Simple portfolio tracking across all holdings

The platform does not offer derivatives, margin trading, or futures to UK retail users.

How easy is this exchange to use for your experience level?

Bitpanda is designed with accessibility in mind. Account setup is quick, the interface is clean, and buying crypto can be done in minutes once verified. The mobile app mirrors the web platform closely and is well suited to long-term investors managing positions on the go.

While experienced traders may find the lack of advanced tools limiting, beginners and casual investors benefit from the straightforward design and minimal complexity.

What are the main pros and cons of using this crypto exchange?

Pros

- 600+ cryptocurrencies available, one of the largest UK selections

- No deposit or withdrawal fees

- £1 minimum trade size

- Strong security track record

- Simple app and web experience

Cons

- Spread-based fees higher than advanced trading platforms

- No margin, futures, or advanced trading tools

- Crypto-only offering for UK users

- Customer support can be slow during peak periods

What we think

TLDR: Bitpanda is one of the strongest options in the UK for investors who want maximum choice with minimal complexity. It excels for beginners and long-term holders who value asset variety, security, and ease of use over ultra-low trading fees.

Full Bitpanda crypto exchange review and analysis.

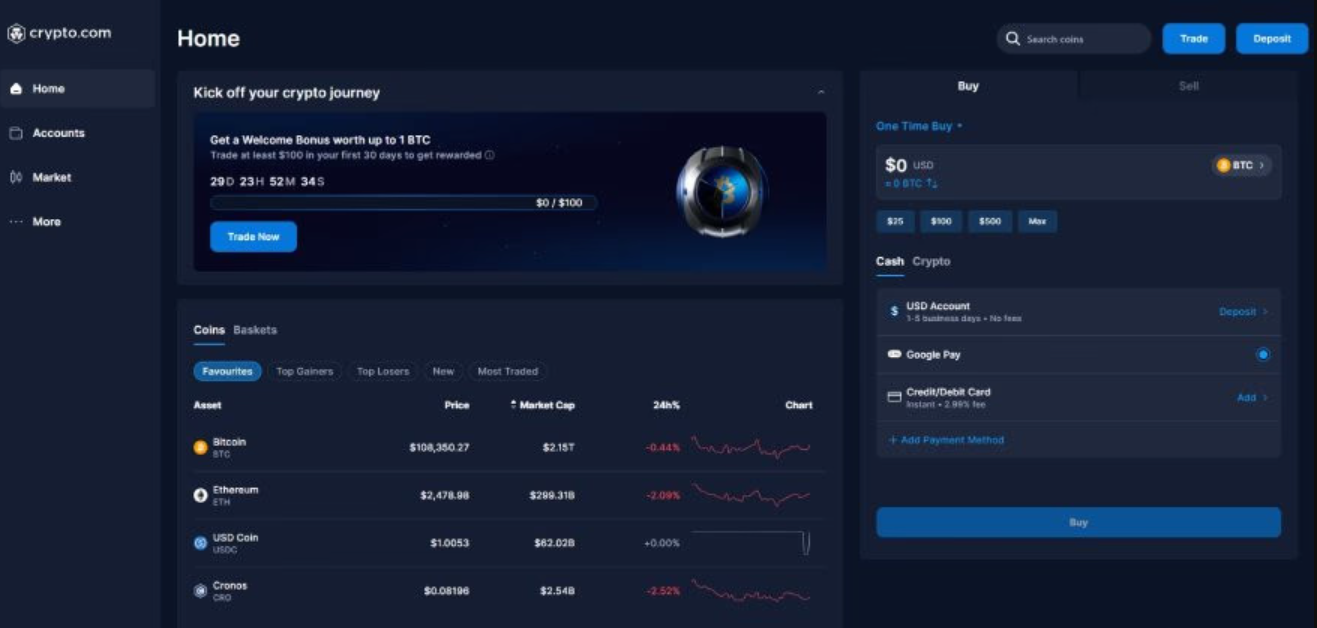

5. Crypto.com – Best for multi-asset investing across crypto, stocks, and metals

Key information at a glance

- Key features: All in one crypto app, Visa card, crypto baskets, Crypto.com Onchain wallet, Advanced Exchange with order book trading

- GBP support: Yes. GBP deposits and withdrawals supported, plus 20+ other fiat currencies

- Number of cryptocurrencies: 400+ listed, with around 150 available to trade directly in GBP pairs

- Trading fees: Maker and taker fees from 0.25% maker and 0.50% taker on the Exchange. In app trading can show 0% fee on some Level Up tiers, but the price can still include a spread

- Staking or earn features: On chain staking on 30+ assets, plus Earn style yield products depending on coin and term

- Other assets available: Crypto focused for UK retail users. No stocks, ETFs, commodities, or ISAs in the same UK app experience

- Security and custody: 1:1 Proof of Reserves, cold storage, multi factor login controls, withdrawal whitelisting, SOC 2 Type II, bug bounty

- UK regulation status: FCA registered cryptoasset business, EMI licence for fiat services

Is this crypto exchange safe and properly regulated for UK users?

Crypto.com is a relatively robust option for UK users because it is FCA registered for cryptoasset activities and also holds an EMI licence, which supports local GBP payment rails. Security controls are a key strength, including Proof of Reserves, cold storage, and layered account protection such as multi factor authentication and withdrawal whitelists.

It is still important to separate platform safety from investment safety. Crypto remains high risk, and UK users should not expect FSCS protection if something goes wrong.

How competitive are this exchange’s trading fees and overall costs?

Crypto.com can be low cost, but the real cost depends on whether trades are placed in the app or on the Exchange.

On the exchange:

- Maker fees start at 0.25%

- Taker fees start at 0.50%

- Fees can step down meaningfully as 30 day trading volume increases, with published tiers that can reach roughly 0.08% maker and 0.18% taker at higher levels

In the app:

- Trading can be convenient, but execution often includes a spread, even when a membership tier shows a 0% fee line item

- Crypto.com Level Up can reduce headline app fees. Example allowances highlighted in the UK marketing include:

- Plus: £3.99 per month with zero fee trading up to $20,000 per month

- Pro: £24.99 per month with zero fee trading up to $50,000 per month

- Private: CRO lock up for 12 months starting around £40,000 with unlimited zero fee trading in app

The key point is that spreads and network fees can still apply, so the all in price is what matters

Funding and cash costs can be material:

- Card deposit fee: 2.99% is steep for regular funding

- GBP withdrawals: £1.90 per payout, with a stated minimum withdrawal amount around £70

- Bank transfer funding is usually the cheapest route for UK users, where supported

Which cryptocurrencies, markets, and features does this exchange support?

Crypto.com offers broad market access, with 400+ cryptocurrencies available and a strong set of GBP pairs, with around 150 coins tradable in GBP. That reduces the chance of being forced into USD conversions just to trade, which can be a real cost issue on some platforms.

Standout features include:

- Crypto baskets, such as curated sets of coins designed for one tap diversification and optional rebalancing

- Visa card integration, with cashback paid in CRO depending on tier

- Crypto.com Onchain, a self custody option for users who want to hold their own keys and access DeFi

- Advanced Exchange tools for users who want order books, limit orders, and more control over execution

UK retail users should not expect crypto derivatives or margin style products, as these are generally restricted for UK retail clients.

How easy is this exchange to use for your experience level?

Crypto.com is generally beginner friendly on mobile, with simple buy and sell flows, watchlists, price alerts, and recurring buys for pound cost averaging. It also scales with experience because the same ecosystem includes more advanced routes, such as the Exchange interface and automation tools.

The trade off is complexity in pricing. Between app spreads, Exchange maker taker fees, and Level Up allowances, it can take a little time to identify the cheapest way to place each trade.

What are the main pros and cons of using this crypto exchange?

Pros

- Strong UK fit with GBP support and FCA registration plus EMI status

- Wide crypto selection and a good range of GBP trading pairs

- Competitive Exchange fees, starting at 0.25% maker and 0.50% taker

- Useful extras such as baskets, Visa card, and a self custody Onchain option

Cons

- Card funding costs are high at 2.99%

- App pricing can include spreads even when the fee line shows 0% on some tiers

- Customer support is often chat first and can feel automated

- Crypto remains high risk and is not protected like traditional investments in the UK

What we think

TLDR: Crypto.com suits UK users who want a single app for buying, holding, staking, and spending crypto, and who are willing to learn the difference between app pricing and Exchange pricing to keep costs down. For fee sensitive traders, the Exchange route and bank transfer funding are usually the most cost effective combination.

Full Crypto.com crypto exchange review and analysis.

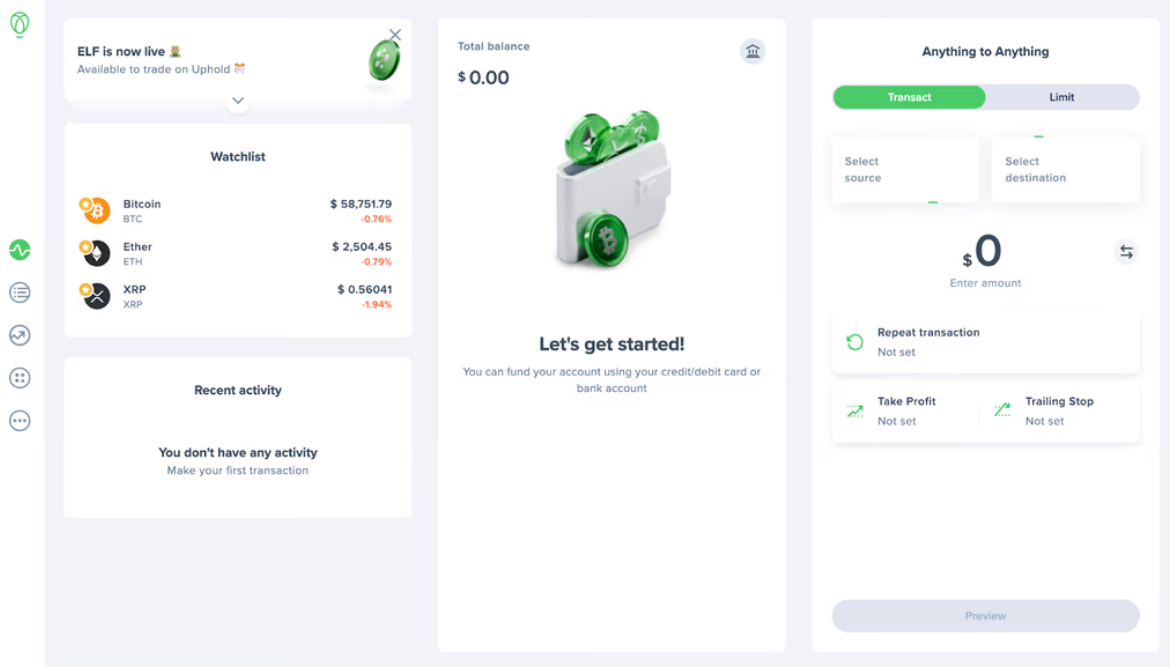

6. Uphold – Best for instant swaps between crypto, fiat, and commodities

Key information at a glance

- Key features: Multi asset wallet, instant swaps, limit orders (up to 50 open orders), Uphold debit card with cashback

- GBP support: Yes, plus 30+ other fiat currencies

- Number of cryptocurrencies: 300+ cryptocurrencies

- Trading fees: Spread based pricing, typically 1.40% to 2.95% depending on the asset and liquidity

- Staking or earn features: On chain staking on 20+ assets

- Other assets available: Multi asset access, including precious metals and selected equities in some regions (availability can vary for UK users)

- Security and custody: 1:1 Proof of Reserves, SOC Type II controls, two factor authentication, bug bounty programme

- UK regulation status: FCA registered cryptoasset business, EMI licence

Is this crypto exchange safe and properly regulated for UK users?

Uphold is a relatively credible option for UK users because it is FCA registered for cryptoasset activities and operates with an EMI licence for fiat services. It also leans into transparency, with a Proof of Reserves model that aims to show customer assets are backed on a one to one basis.

That said, FCA registration for crypto primarily relates to anti money laundering controls rather than full investment style protection. Cryptoassets are high risk and are not covered by FSCS protection, so regulation does not remove the possibility of loss.

How competitive are this exchange’s trading fees and overall costs?

Uphold’s cost structure is simple but can be expensive compared with pro style exchanges.

Instead of maker and taker fees, Uphold mainly charges through the spread, typically:

- 1.40% to 1.60% on major coins like BTC and ETH in normal conditions

- Around 0.25% on some stablecoins and major FX conversions

- 2.50% to 2.95% on less liquid altcoins and smaller markets

Uphold also uses payment method fees that can matter more than trading costs:

- Debit card deposits: around 3.99% in the UK

- Bank transfer funding is usually the lowest cost route when available

- Crypto network fees still apply when withdrawing on chain

The key trade off is convenience and simplicity versus execution price. Heavy traders and fee sensitive users often find a maker taker exchange cheaper, while casual users may prefer Uphold’s predictable, all in spread pricing.

Which cryptocurrencies, markets, and features does this exchange support?

Uphold supports 300+ cryptocurrencies and is built around its “anything to anything” swap model, meaning users can convert between crypto, fiat, and other supported assets without manually stepping back into GBP first.

For UK users, the most practical feature set tends to be:

- Quick conversions between major coins and GBP

- On chain staking on 20+ assets

- Limit orders, including the ability to keep multiple orders open at once without pre funding in the same way as some exchanges

- A debit card that can spend from crypto or fiat balances, with daily spending limits advertised up to £10,000 and cashback rewards

Uphold is better suited to multi asset convenience than advanced market tools. It is not a derivatives platform for UK retail users.

How easy is this exchange to use for your experience level?

Uphold is generally beginner friendly. The app focuses on simple actions like buy, sell, swap, and hold, with a clean interface that avoids the complexity of a full order book by default. Trades can start from as little as £1, which reduces the barrier for first time users.

The main usability downside is that spreads vary by asset, and costs can widen in volatile markets or on low liquidity coins. Users who want maximum price control may need a more advanced exchange style interface.

What are the main pros and cons of using this crypto exchange?

Pros

- FCA registered crypto platform with an EMI structure for fiat services

- Simple pricing model and easy to use app for beginners

- 300+ cryptocurrencies, plus multi asset conversions

- Useful extras like staking and a debit card with cashback

Cons

- Spread based costs can be high, especially on smaller coins

- Debit card deposits are expensive at around 3.99%

- Limited advanced trading tools compared with Kraken Pro style platforms

- Crypto remains high risk and is not protected like traditional investments

What we think

TLDR: Uphold suits UK users who want an easy, regulated on ramp with a broad coin list, staking, and a spendable card. It is less suitable for high frequency traders who want the lowest possible fees and tight order book execution.

Full Uphold crypto exchange review and analysis.

7. Gemini – Best for security-focused investors who prioritise compliance and custody

Key information at a glance

- Key features: Simple buy and sell, ActiveTrader interface, Gemini Wallet and Gemini Custody, Gemini Pay, Cryptopedia learning hub

- GBP support: Yes, plus other supported fiat currencies

- Number of cryptocurrencies: 70+ cryptocurrencies available in the UK

- Trading fees: ActiveTrader maker and taker fees from 0.40% maker and 0.60% taker. Standard purchases can include a 1.49% transaction fee plus a 1% convenience fee

- Staking or earn features: Limited on chain staking support, typically centred on major assets like ETH and SOL

- Other assets available: Crypto focused. No stocks, ETFs, commodities, or ISAs for UK retail users

- Security and custody: 1:1 Proof of Reserves, SOC 1 and SOC 2 controls, two factor authentication, approved withdrawal addresses, bug bounty

- UK regulation status: FCA registered cryptoasset business, EMI licence

Is this crypto exchange safe and properly regulated for UK users?

Gemini’s main strength is security and compliance. It is FCA registered for cryptoasset activities in the UK and is known for a conservative approach to listings and account controls. Users can enable two factor authentication, restrict withdrawals to approved addresses, and choose between standard wallet storage and a separate custody style product aimed at higher security needs.

However, FCA registration for crypto primarily relates to anti money laundering standards, not full investment protection. Cryptoassets are high risk and are not covered by FSCS protection, so regulation does not remove the possibility of loss.

How competitive are this exchange’s trading fees and overall costs?

Gemini’s costs depend heavily on which interface is used.

On the standard Gemini experience, fees can add up:

- Transaction fee: typically 1.49% on orders

- Convenience fee: around 1% built into the quoted price

That can push all in costs above 2% for straightforward buys, which is expensive versus pro exchanges.

Gemini ActiveTrader is the lower cost route:

- Maker fees from 0.40%

- Taker fees from 0.60%

These are more competitive than Gemini standard, but still not as low as the cheapest pro platforms for high volume users.

Funding costs can also matter:

- Debit card deposits: commonly priced around 3.49%

- Bank and crypto deposits are typically free

- Withdrawals are often free up to a monthly allowance, with network or asset specific fees beyond that

Which cryptocurrencies, markets, and features does this exchange support?

Gemini supports 70+ cryptocurrencies in the UK, covering major assets like Bitcoin and Ethereum and a solid mid cap selection. The range is smaller than Coinbase, Kraken, or Crypto.com, but it is usually sufficient for mainstream portfolio building rather than niche token hunting.

Notable features include:

- ActiveTrader for charting, limit orders, and more control over execution

- Gemini Pay for spending crypto where supported

- Gemini Dollar, its US dollar linked stablecoin

- Cryptopedia, a learning hub aimed at beginners

- Gemini Custody and Gemini Wallet, offering different custody and security approaches

Gemini is focused on spot crypto for UK retail users. It is not positioned as a derivatives or margin venue in the UK.

How easy is this exchange to use for your experience level?

Gemini is straightforward for beginners, with a clean app and simple buy and sell flows. ActiveTrader provides a clear upgrade path for users who want better pricing and more advanced order controls without switching platforms.

The main usability drawback is that Gemini’s fee structure can feel layered. Users who stay on the standard interface may pay significantly more than expected compared with ActiveTrader.

Customer support is another potential friction point, as assistance is largely ticket based rather than phone led, which can be frustrating if an account needs urgent attention.

What are the main pros and cons of using this crypto exchange?

Pros

- Strong security reputation with robust account controls

- ActiveTrader offers a more advanced experience with lower fees than the standard interface

- FCA registered operation for UK crypto activity

- Useful add ons such as learning content and custody style options

Cons

- Standard platform fees can exceed 2% when transaction and convenience fees stack

- Smaller coin selection than several major competitors

- Debit card deposits can be expensive at around 3.49%

- Support is mainly ticket based, which can feel slow during account issues

What we think

TLDR: Gemini is best suited to UK users who prioritise security and are happy to trade a smaller coin list for a more conservative, compliance led platform. For costs, ActiveTrader is the preferred route, while the standard interface is better treated as a convenience option rather than a low fee exchange.

Full Gemini crypto exchange review and analysis.

8. Bitstamp – Best for reliable, low-cost crypto trading on a long-established, FCA-registered exchange

Key information at a glance

- Key features: Spot trading with market, limit and stop orders, TradingView chart integration, institutional and pro interfaces, long operating history

- GBP support: Yes, plus EUR and USD

- Number of cryptocurrencies: 110+ cryptocurrencies available

- Trading fees: Maker and taker fees start from 0.30% maker and 0.40% taker, with discounts as 30 day trading volume increases

- Staking or earn features: On chain staking for ETH and ADA

- Other assets available: Crypto focused. No stocks, ETFs, commodities, or ISAs for UK retail users

- Security and custody: Proof of Reserves, SOC Type II controls, cold storage for the majority of assets, insurance coverage, bug bounty

- UK regulation status: FCA registered cryptoasset business

Is this crypto exchange safe and properly regulated for UK users?

Bitstamp is one of the longest standing crypto exchanges operating in the UK, having launched in 2013 and maintained continuous operations through multiple market cycles. It is FCA registered for cryptoasset activities, meaning it meets UK anti money laundering and counter terrorist financing standards.

The platform places a strong emphasis on custody and operational resilience. Around 98% of client assets are held in offline cold storage, and Bitstamp maintains insurance coverage through a third party custodian. While cryptoassets are not covered by FSCS protection, Bitstamp’s longevity and security posture give it a strong credibility profile compared with newer platforms.

How competitive are this exchange’s trading fees and overall costs?

Bitstamp’s pricing is structured and transparent, particularly for spot traders.

For exchange trading:

- Maker fees: from 0.30%

- Taker fees: from 0.40%

- Fees reduce as 30 day trading volume increases, with high volume tiers dropping toward 0%

This makes Bitstamp competitively priced versus many retail focused platforms, especially for users placing limit orders.

Funding and withdrawal costs are worth noting:

- Crypto deposits: free, excluding network fees

- Crypto withdrawals: free, excluding network fees

- GBP and EUR deposits: typically low cost via bank transfer

- Card deposits: can exceed 5%, making bank transfer the preferred option

Overall, Bitstamp is cost efficient for exchange trading, but less attractive for card funded purchases.

Which cryptocurrencies, markets, and features does this exchange support?

Bitstamp supports 110+ cryptocurrencies, including major assets such as Bitcoin, Ethereum, XRP, Litecoin, Cardano, and Stellar. The coin list is smaller than some multi asset platforms, but focuses on higher liquidity and established tokens rather than speculative micro caps.

Key features include:

- Advanced spot trading tools with TradingView charts

- Market, limit, stop loss and trailing stop orders

- On chain staking for selected assets

- Institutional grade infrastructure and APIs

Bitstamp does not offer crypto derivatives, margin trading, or complex earn products for UK retail users. Its focus is squarely on reliable spot trading.

How easy is this exchange to use for your experience level?

Bitstamp is straightforward once set up, but onboarding can feel slower than newer app first platforms. The verification process is more detailed, which can delay first trades by a day or two.

For beginners, the trading interface can feel dense at first glance. For intermediate and advanced users, the layout is logical, stable, and well suited to repeat trading. The mobile app offers a simpler experience for portfolio monitoring and basic trades.

Customer support is a standout area, with email, live chat, and phone support available, which is uncommon among crypto exchanges.

What are the main pros and cons of using this crypto exchange?

Pros

- Long operating history and strong reputation

- Competitive maker and taker fees for spot trading

- FCA registered with robust custody and insurance arrangements

- Reliable platform performance during volatile markets

- Phone support in addition to online channels

Cons

- Smaller cryptocurrency range than many competitors

- Card deposits are expensive

- Verification can feel slow for first time users

- Interface may feel less beginner friendly than app based exchanges

What we think

TLDR: Bitstamp is well suited to UK users who prioritise reliability, transparent fees, and established market infrastructure over flashy features or very broad token coverage. It works best for spot traders using bank transfers and limit orders rather than casual card funded buyers.

Full Bitstamp crypto exchange review and analysis.

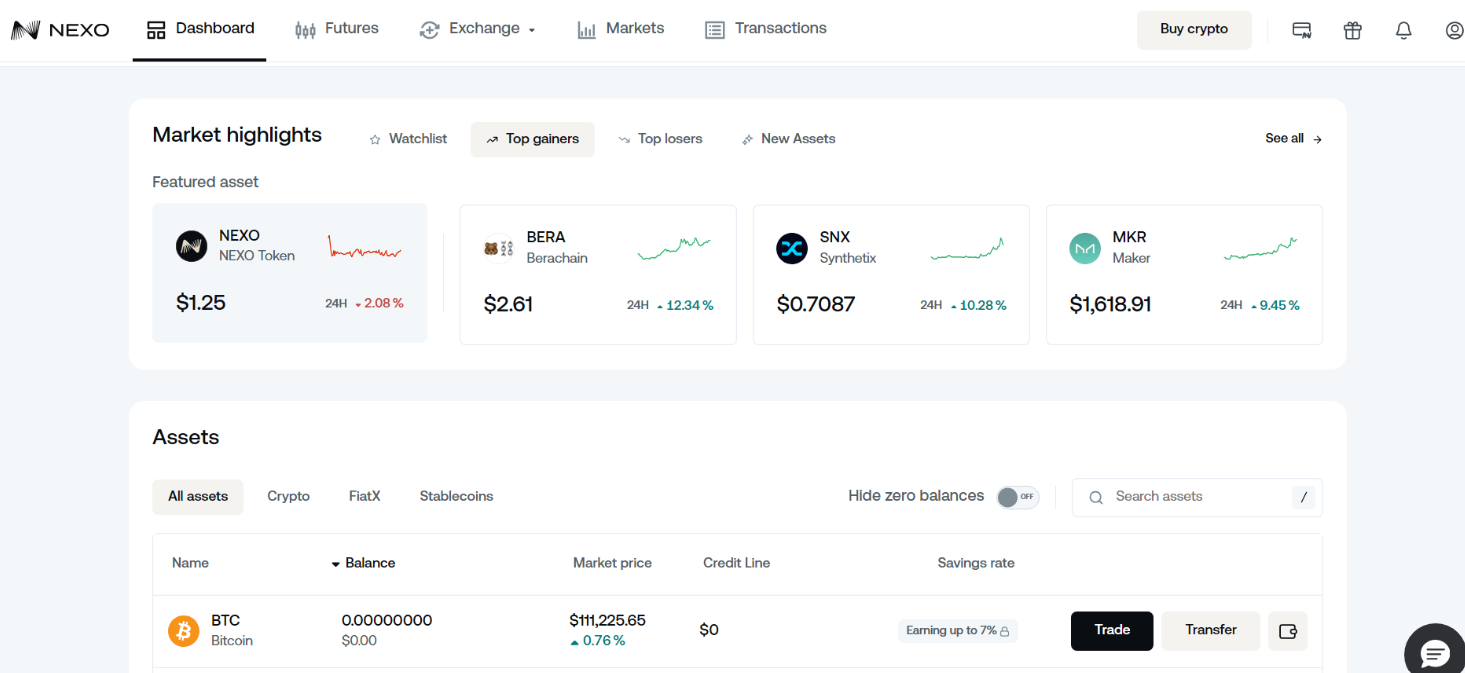

9. Nexo – Best for earning interest or borrowing against crypto holdings

Key information at a glance

- Key features: Crypto backed credit lines, Earn accounts, Nexo Card with debit and credit modes, in app swaps, loyalty tiers (NEXO token)

- GBP support: Yes, plus other supported fiat currencies

- Number of cryptocurrencies: 100+ cryptocurrencies, with 1,500+ trading pairs across the exchange experience

- Trading fees: Maker and taker fees from 0.20% maker and 0.20% taker. Small swap orders can be priced as flat fees such as $0.99 for $10 to $100 and $1.99 for $100.01 to $250

- Staking or earn features: Earn products with rates advertised up to 15%, plus staking style options on major assets such as ETH

- Other assets available: Crypto focused. Lending and card features are the main extras, not stocks, ETFs, or ISAs

- Security and custody: 1:1 Proof of Reserves, SOC 2 and SOC 3 controls, custody partners such as Ledger and Fireblocks, active vulnerability disclosure programme

- UK regulation status: Not currently FCA registered for cryptoasset activity

Is this crypto exchange safe and properly regulated for UK users?

Nexo has built its reputation around security controls and risk management, including Proof of Reserves, institutional custody partners, and multi factor authentication for key actions. However, it is described as no longer FCA registered for cryptoasset activity. UK users should treat it as higher regulatory risk than FCA registered exchanges, even if onboarding has resumed.

How competitive are this exchange’s trading fees and overall costs?

Nexo can be cost effective for active traders on its exchange interface, with maker and taker fees starting at 0.20% each. It can also be competitive for larger swaps if the pricing model applies no fee above $250.01, although spreads and execution price still matter in practice. Costs rise indirectly if users chase better rates through loyalty tiers, which require holding NEXO tokens and adds token price risk.

Borrowing costs are a major part of the total cost picture. Credit line interest is shown as ranging from 2.9% up to 18.9%, depending on loyalty level and loan to value, so borrowing can be cheap or expensive based on how conservatively it is used.

Which cryptocurrencies, markets, and features does this exchange support?

Nexo supports 100+ cryptocurrencies and positions itself as a digital wealth platform rather than a pure exchange. Alongside swapping and trading pairs, it centres the experience on Earn accounts, crypto backed borrowing, and a card that can spend either directly from balances or via borrowing against collateral. The platform is also built around a loyalty system that adjusts benefits such as earn rates, swap perks, and borrowing APR.

UK users should note that availability can vary by jurisdiction and product type. This matters most for earn and borrowing features, which have tighter regulatory constraints than simple spot trading.

How easy is this exchange to use for your experience level?

Nexo is designed to be app first and beginner friendly, with a single dashboard covering balances, earn settings, borrowing capacity, and card controls. It is easier to navigate than many pro exchanges because the main actions are simplified into deposit, earn, borrow, swap, and spend. The complexity comes from understanding loan to value, liquidation risk, and loyalty tier rules, which can materially change costs and risk exposure.

For new users, the safest learning path is usually spot buying and simple custody first, then earn and borrowing only once the mechanics are fully understood.

What are the main pros and cons of using this crypto exchange?

Pros

- Strong all in one product set for earning and borrowing, not just trading

- Competitive entry level exchange fees at 0.20% maker and 0.20% taker

- High advertised earn rates up to 15% for eligible assets and users

- Card features and credit lines can help avoid selling crypto in some scenarios

Cons

- Not currently FCA registered for cryptoasset activity

- Loyalty tiers can push users toward holding NEXO tokens, which adds volatility risk

- Borrowing introduces liquidation risk if crypto prices fall and loan to value rises

- Earn products and rehypothecation style terms can add counterparty risk versus self custody

What we think

TLDR: Nexo suits UK users who want a crypto platform that behaves more like a digital finance hub, combining trading with borrowing and earning. It is less suitable for users who want simple FCA registered spot trading only, or anyone unwilling to take on the extra counterparty and loan to value risks that come with earn and credit features.

Full Nexo crypto exchange review and analysis.

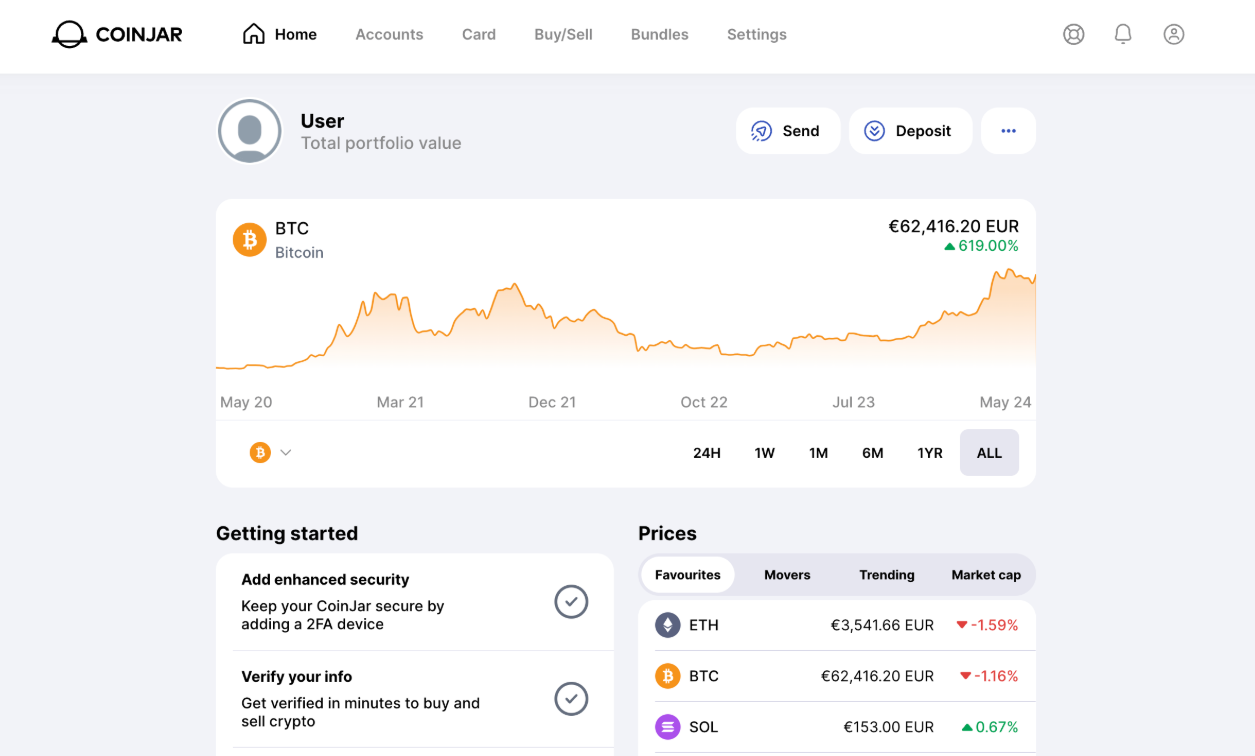

10. CoinJar – Best for beginners and long-term investors seeking low trading fees

Key information at a glance

- Key features: Simple buy and sell, CoinJar Exchange for lower fees, built in wallet, crypto bundles, recurring buys, crypto debit card

- GBP support: Yes, plus EUR, AUD and USD

- Number of cryptocurrencies: 60+ cryptocurrencies

- Trading fees: CoinJar Exchange maker fees from 0.02% and taker fees from 0.06%. Instant Buy by card is typically 2%, with recurring buys reducing card fees to 1% in some cases

- Staking or earn features: No staking is available

- Other assets available: Crypto focused. No stocks, ETFs, commodities, or ISAs

- Security and custody: SOC Type II controls, majority cold storage (around 90%), bug bounty, reserve and matching policy claims

- UK regulation status: FCA registered cryptoasset business

Is this crypto exchange safe and properly regulated for UK users?

CoinJar is FCA registered for cryptoasset activities, which means it meets UK anti money laundering and counter terrorist financing requirements. It also has a long operating history in the UK market, having launched locally in 2014.

On the security side, CoinJar states that around 90% of customer funds are stored offline in cold wallets, with additional protections like encryption, TLS security, and monitoring for suspicious activity. As with all crypto platforms, cryptoassets are high risk and are not covered by FSCS protection.

How competitive are this exchange’s trading fees and overall costs?

CoinJar can be low cost, but only if the right trading route is used.

CoinJar Exchange fees are competitive:

- For GBP trading pairs, entry tier fees are around 0.10% maker and 0.10% taker up to £50,000 in 30 day volume

- Fees step down with volume, reaching 0.02% maker and 0.06% taker at higher tiers

- For crypto trading pairs, fees are around 0.00% maker and 0.06% taker

- For some stablecoin pairs, taker fees can be as low as 0.001%, with 0.00% maker listed

The main cost trap is convenience buying:

- Instant Buy via debit card, Apple Pay or Google Pay is typically 2%

- Recurring buys can reduce the card fee to 1% in some cases

- Bank transfers and Faster Payments are usually the cheapest funding method

Withdrawals are relatively user friendly:

- Bank transfer withdrawals can be free

- Crypto withdrawals are generally free from the platform side, but network fees still apply

Which cryptocurrencies, markets, and features does this exchange support?

CoinJar offers a modest but practical range of 60+ cryptocurrencies, including major assets such as Bitcoin, Ethereum, Solana, Cardano, and XRP. It is not the platform for hunting obscure tokens, but it covers most mainstream coins UK users typically buy.

Feature highlights include:

- CoinJar Exchange, which adds charting and more order control for active traders

- Crypto bundles, designed as one tap diversified baskets, similar in concept to a tracker fund approach

- Recurring buys, supporting a pound cost averaging approach

- A built in wallet, keeping everything in one place

- A crypto debit card for spending where available and eligible

CoinJar does not provide derivatives or margin trading for UK retail users.

How easy is this exchange to use for your experience level?

CoinJar is beginner friendly in its main app experience. Signup and ID verification are guided through the mobile app and most users can start once verification completes, often within a few hours. The buy and sell flows are simple and the wallet experience is designed to feel approachable for first time crypto users.

More advanced users can graduate to CoinJar Exchange, but it does not aim to match the depth of Kraken Pro or similar pro platforms. Some users also report slower withdrawal processing at times, which is worth factoring in if fast cashouts matter.

What are the main pros and cons of using this crypto exchange?

Pros

- FCA registered exchange with long UK operating history

- Very competitive Exchange fees, with maker pricing down to 0.02% on higher tiers

- Beginner friendly app with built in wallet, bundles and recurring buys

- Multiple payment options, including Faster Payments and mobile wallets

Cons

- Coin selection is modest at 60 plus assets

- Instant Buy fees are high at around 2% by card or mobile wallet

- No staking or earn products

- Advanced trading tools are improving but still behind top pro exchanges

What we think

TLDR: CoinJar suits UK users who want a straightforward, FCA registered on ramp with strong low fee exchange pricing and simple long term investing tools like bundles and recurring buys. It is less suitable for users who want staking, the widest possible token list, or a full pro level trading stack.

Full CoinJar crypto exchange review and analysis.

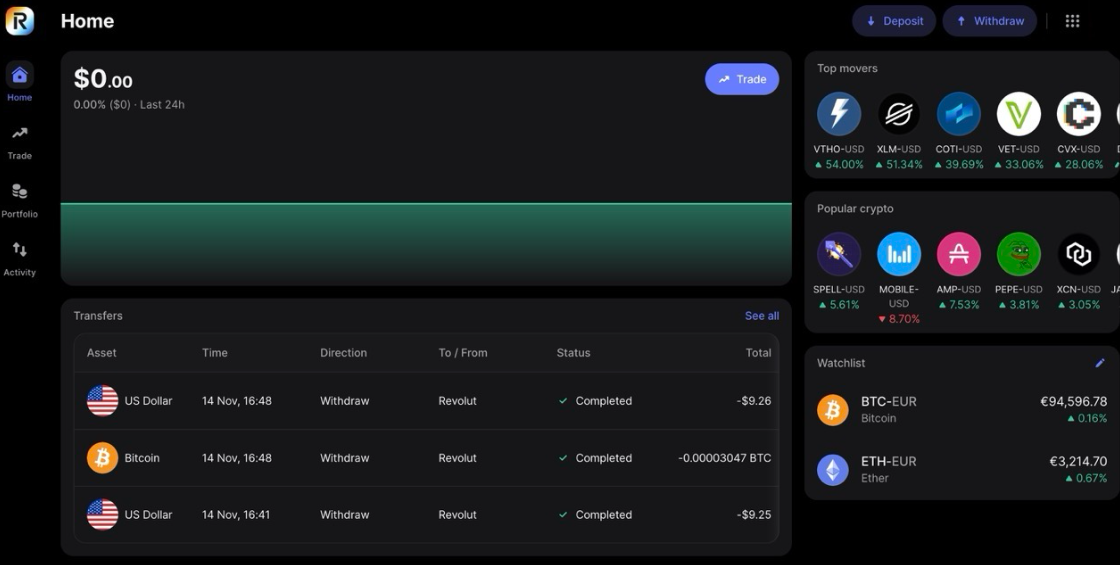

11. Revolut – Best for casual crypto investing alongside everyday banking

Key information at a glance

- Key features: Crypto investing inside the Revolut app, Revolut X pro trading interface, live order books, TradingView charts, crypto debit card, staking, seamless fiat on and off ramps

- GBP support: Yes, plus 30+ other fiat currencies

- Number of cryptocurrencies: 220+ cryptocurrencies available in the UK

- Trading fees: App based trading typically around 1.49%, reduced to 1.29% on larger trades. Revolut X maker and taker fees from 0% maker and 0.09% taker

- Staking or earn features: On chain staking available on 10+ assets, subject to eligibility

- Other assets available: Stocks, ETFs, commodities, FX, ADRs, REITs, and ISAs

- Security and custody: Account level security, biometric login, e money safeguarding, institutional custody partners

- UK regulation status: FCA registered, e money institution licence

Is this crypto exchange safe and properly regulated for UK users?

Revolut is FCA registered and operates as an authorised e money institution in the UK. This means customer fiat balances are safeguarded under e money rules, separate from Revolut’s own funds.

Cryptoassets themselves are not covered by FSCS protection, and Revolut’s crypto service is registered for anti money laundering purposes rather than regulated like traditional investments. Security is a strong point, with features including biometric authentication, in app transaction confirmations, and real time fraud monitoring.

How competitive are this exchange’s trading fees and overall costs?

Fees depend heavily on how crypto is traded.

On the standard Revolut app:

- Typical crypto commission is around 1.49% for smaller trades

- Larger trades above £20,000 benefit from reduced pricing of around 1.29%

- No minimum trade size following recent changes

This makes small purchases relatively expensive compared to dedicated exchanges.

On Revolut X:

- 0% maker fees on many pairs

- 0.09% taker fees, significantly cheaper than app based pricing

- Access to live order books and limit orders

For active or higher volume traders, Revolut X is far more competitive. For casual buys inside the main app, costs are clearly higher.

Which cryptocurrencies, markets, and features does this exchange support?

Revolut supports over 220 cryptocurrencies, covering most major coins and many mid cap tokens. It is not designed for deep altcoin discovery, but it comfortably covers mainstream demand.

Notable features include:

- Revolut X, a standalone pro trading interface with TradingView charts

- Crypto staking on selected assets

- Crypto debit card, spending directly from balances

- Integrated portfolio view, showing crypto alongside stocks, ETFs, and cash

- Instant fiat on and off ramps, using GBP and other currencies

Revolut does not offer derivatives or margin trading to UK retail users.

How easy is this exchange to use for your experience level?

Revolut is extremely beginner friendly for basic crypto exposure. Buying crypto in the main app can take minutes, with clear confirmations and simple interfaces. Everything sits inside the wider Revolut ecosystem, which reduces friction for users already using the app for banking or investing.

More experienced users can switch to Revolut X, which adds proper charts, order books, and tighter spreads. However, Revolut still prioritises simplicity over advanced trading depth, so power users may eventually outgrow it.

One limitation is that the main crypto experience is app first, with desktop access mainly reserved for Revolut X.

What are the main pros and cons of using this crypto exchange?

Pros

- FCA registered UK platform with strong security controls

- 220+ cryptocurrencies supported

- Seamless integration with banking, stocks, ETFs, and ISAs

- Revolut X offers low maker and taker fees for active traders

- Easy entry point for beginners

Cons

- High fees on small trades in the standard app

- Limited crypto research and analytics

- No direct ownership controls comparable to specialist exchanges

- Advanced features require switching to Revolut X

What we think

TLDR: Revolut works best as a convenient, all in one entry point for crypto inside a regulated UK fintech app. It suits beginners and casual investors who want small exposure alongside banking and investing. For frequent trading or fee sensitive users, Revolut X significantly improves value, but dedicated crypto exchanges still offer deeper tools and lower costs at scale.

Full Revolut crypto exchange review and analysis.

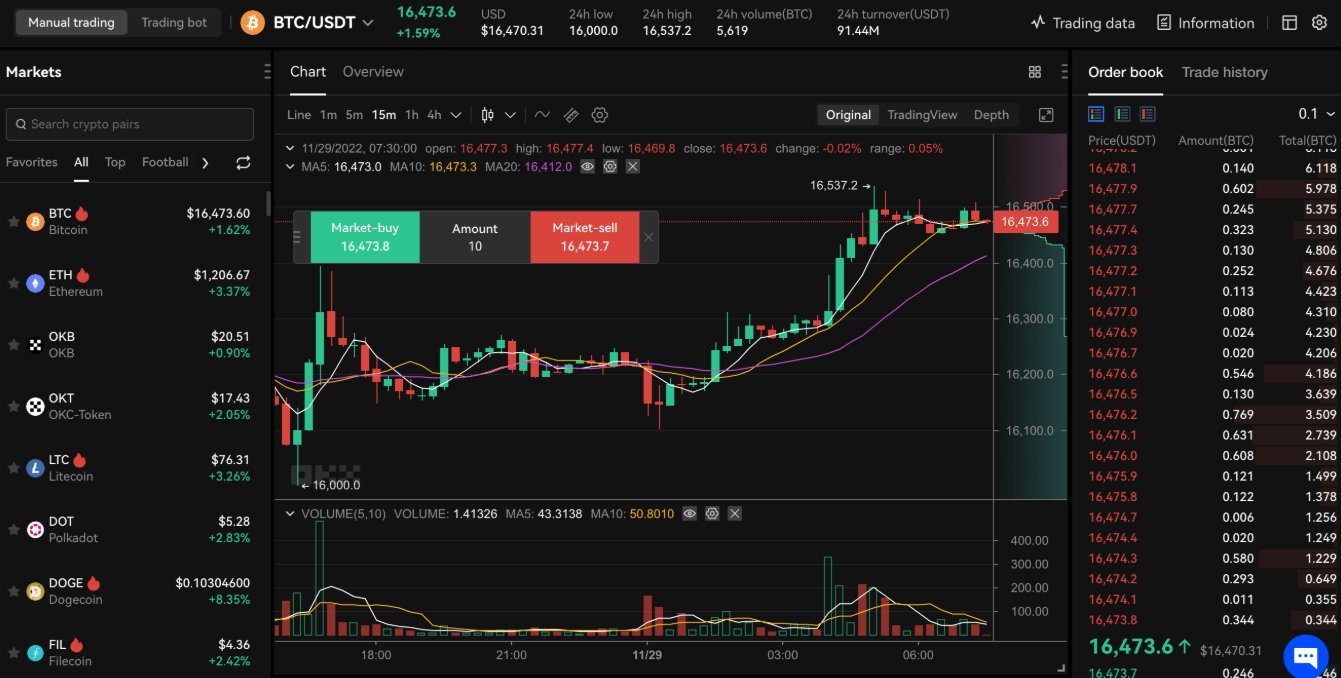

12. OKX – Best for experienced traders who want very low fees and advanced features

Key information at a glance

- Key features: Advanced spot trading, futures and margin markets, TradingView charts, API access, copy trading, staking and DeFi earn tools

- GBP support: Limited. Crypto deposits supported, but full GBP bank on and off ramps are restricted

- Number of cryptocurrencies: 200+ cryptocurrencies

- Trading fees: Spot fees from 0.08% maker and 0.10% taker. Futures fees from 0.02% maker and 0.05% taker, with discounts for high volume traders

- Staking or earn features: On chain staking, DeFi earn, savings products and structured earn tools

- Other assets available: Crypto focused. No stocks, ETFs, commodities, or ISAs

- Security and custody: Cold storage for the majority of assets, proof of reserves, two factor authentication, withdrawal whitelisting

- UK regulation status: Not FCA registered

Is this crypto exchange safe and properly regulated for UK users?

OKX is considered technically secure, but it is not FCA registered, which is an important distinction for UK users. The platform operates offshore and does not appear on the FCA cryptoasset register, meaning it does not meet UK AML registration standards for crypto firms.

From a security perspective, OKX uses industry standard protections such as cold storage for over 95% of customer funds, multi factor authentication, anti phishing codes, and a public proof of reserves system.

However, UK users do not benefit from local regulatory oversight or consumer protections.

How competitive are this exchange’s trading fees and overall costs?

Fees are one of OKX’s strongest selling points.

For spot trading:

- 0.08% maker and 0.10% taker at entry level

- Further reductions for higher volume traders and OKB token holders

For futures trading:

- 0.02% maker and 0.05% taker, placing OKX among the cheapest major exchanges globally

There are no fees for crypto deposits. Withdrawal fees vary by asset and network and can be higher for congested networks like Bitcoin or Ethereum.

The main cost drawback for UK users is not trading fees, but friction around fiat access, as GBP deposits and withdrawals are limited compared to FCA registered exchanges.

Which cryptocurrencies, markets, and features does this exchange support?

OKX supports over 200 cryptocurrencies, including all major coins and a wide range of altcoins. Liquidity is deep on large trading pairs, making it suitable for active and high volume traders.

Supported markets and features include:

- Spot trading with advanced order types

- Futures, margin, and options markets

- Staking, DeFi earn, and structured yield products

- NFT marketplace and Web3 wallet integration

- Copy trading and API based automation

This breadth is far beyond what most UK focused platforms offer, but it also adds complexity.

How easy is this exchange to use for your experience level?

OKX is not beginner friendly. While the interface is modern and fast, it is clearly designed for experienced traders. Charts, derivatives, and advanced order tools are front and centre, which can overwhelm new users.

Experienced traders will appreciate the depth, execution quality, and customisation options. Beginners may struggle to find basic functions or understand the risks associated with advanced products without prior knowledge.

Fiat onboarding is another pain point for UK users, as most will need to fund accounts with crypto rather than GBP.

What are the main pros and cons of using this crypto exchange?

Pros

- Very low spot and futures trading fees

- Deep liquidity across major crypto markets

- Advanced trading tools, APIs, and derivatives

- Strong technical security and proof of reserves

Cons

- Not FCA registered and no UK regulatory oversight

- Limited GBP deposit and withdrawal support

- Complex interface for beginners

- Better suited to traders than long term investors

What we think

TLDR: OKX is a powerful, low cost exchange built for experienced crypto traders who want access to advanced markets and deep liquidity. For UK users, the lack of FCA registration and limited GBP support are significant drawbacks. It is best suited to confident traders who prioritise fees and features over regulatory comfort and simplicity.

Full OKX crypto exchange review and analysis.

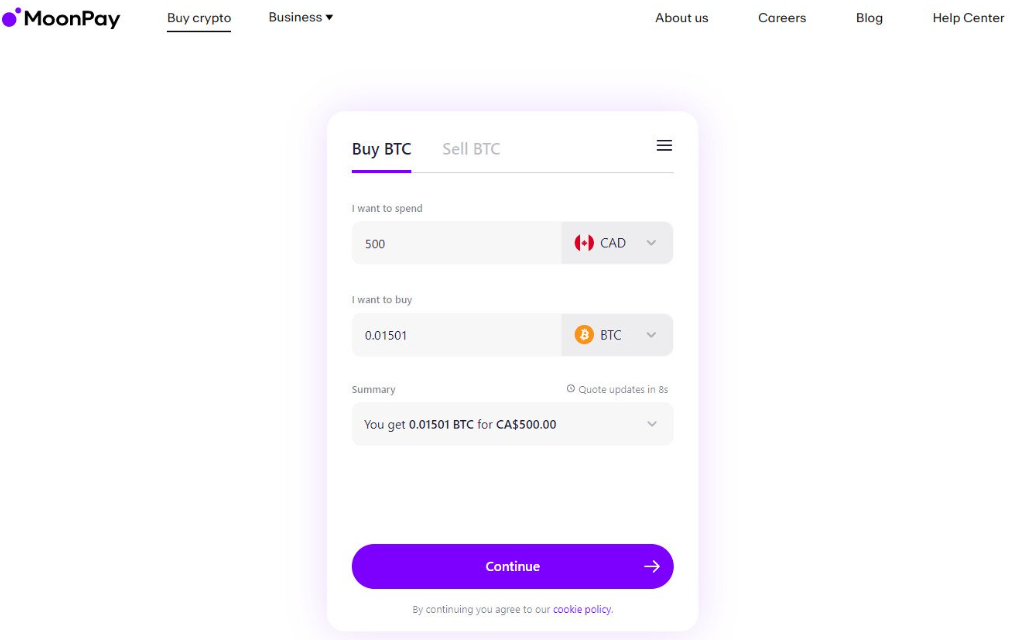

13. MoonPay – Best for fast, card-based crypto purchases

Key information at a glance

- Key features: Fast card and wallet payments for crypto purchases, clean checkout flow, transparent fee preview, simple buy and sell experience

- GBP support: Yes, plus other supported fiat currencies

- Number of cryptocurrencies: Around 80 cryptocurrencies

- Trading fees: Not a maker taker exchange. Card purchases typically cost around 3.5% to 4.5% all in, plus network fees where applicable

- Staking or earn features: None

- Other assets available: Crypto only. No stocks, ETFs, commodities, or ISAs

- Security and custody: Bank grade encryption, two factor authentication, fraud monitoring and KYC checks

- UK regulation status: Not FCA regulated directly in the UK, typically operates via regulated partners

Is this crypto exchange safe and properly regulated for UK users?

MoonPay is generally considered safe for straightforward crypto purchases because it focuses on payment processing rather than running a full trading venue. The platform uses bank grade encryption, two factor authentication, and standard identity checks to reduce fraud risk.

However, MoonPay is not described as FCA regulated directly, which matters if UK users are comparing it to FCA registered exchanges. As with all crypto purchases, FSCS protection does not apply and users remain exposed to market risk and network errors if assets are sent to the wrong wallet.

How competitive are this exchange’s trading fees and overall costs?

MoonPay’s main drawback is cost. It is convenient, but rarely the cheapest way to buy crypto.

Typical costs include:

- Card purchases: commonly around 4.5%

- Crypto to crypto conversions: variable pricing, usually lower than card fees but still not exchange level cheap

- Network fees: charged separately and can vary widely by blockchain and congestion

These costs make MoonPay better suited to occasional purchases, not frequent trading or larger recurring buys. For users buying regularly, a maker taker exchange or a low fee on ramp tends to deliver a better all in price.

Which cryptocurrencies, markets, and features does this exchange support?

MoonPay supports around 80 cryptocurrencies, covering the main coins most UK users buy such as Bitcoin and Ethereum, plus a limited selection of additional assets. It is not built for broad altcoin coverage, advanced order types, or active trading strategies.

Feature coverage is intentionally simple:

- Buy crypto with card or supported payment methods

- Sell crypto in supported regions and cash out where available

- Basic account tools and transaction history

There are no order books, charting tools, or pro interfaces because MoonPay is not designed to be a trading platform.

How easy is this exchange to use for your experience level?

MoonPay is very beginner friendly. Account creation and identity checks are usually quick, and the checkout flow is one of the simplest in the market. Fees are typically shown before confirmation, reducing the chance of unpleasant surprises.

The simplicity comes with trade offs. There are limited tools for monitoring markets, managing a portfolio, or improving execution prices. Support is also commonly ticket or email based, which can feel slow if a payment fails or a refund is needed.

What are the main pros and cons of using this crypto exchange?

Pros

- Very fast and simple way to buy crypto with a card

- Clear checkout flow with fee visibility before purchase

- Suitable for first time buyers who want minimal setup

- Strong baseline security controls for payments

Cons

- High fees on instant buys, often around 3.5% to 4.5%

- Limited coin selection compared with full exchanges

- No trading tools, staking, or advanced features

- Not FCA regulated directly, with limited UK style oversight

What we think

TLDR: MoonPay is best viewed as a convenient on ramp rather than a full UK crypto exchange. It suits UK users making occasional card based purchases who prioritise speed and simplicity. For regular investing or fee sensitive trading, a dedicated FCA registered exchange usually offers a lower all in cost and more control over execution.

Full MoonPay crypto exchange review and analysis.

What is a crypto exchange?

A crypto exchange is an online platform that allows users to buy, sell, and trade cryptocurrencies such as Bitcoin and Ethereum. Most exchanges match buyers and sellers directly, set prices based on market demand, and charge trading fees. Exchanges can be centralised, where the platform holds assets on behalf of users, or decentralised, where trades occur directly between wallets.

Crypto exchanges are typically used for spot trading, but some also offer derivatives, staking, or other advanced features. Unlike traditional investment platforms, crypto exchanges usually do not provide investor protection, which makes fees, security practices, and custody models especially important when choosing where to trade.

What are the different types of cryptocurrency exchanges?

Cryptocurrency exchanges generally fall into three main categories, based on how trades are executed and how user funds are held. Understanding these differences helps users choose a platform that matches their experience level, risk tolerance, and trading needs.

Centralised exchanges (CEXs)

Centralised exchanges act as intermediaries between buyers and sellers and manage the trading infrastructure. Users deposit funds into accounts controlled by the exchange, which handles order matching, custody, and withdrawals. These platforms are usually easier to use and offer higher liquidity, but require trust in the exchange’s security and controls.

Decentralised exchanges (DEXs)

Decentralised exchanges allow users to trade directly from their own wallets using smart contracts, without a central operator holding funds. Trades are settled on the blockchain, giving users full control over their assets. While this reduces custodial risk, DEXs can be more complex to use and may have lower liquidity or higher transaction costs during network congestion.

Hybrid and peer to peer exchanges

Some platforms combine elements of both models, offering non custodial trading with centralised features such as order books or dispute resolution. Peer to peer exchanges connect buyers and sellers directly and often support local payment methods, but trade execution and pricing can be less predictable than on larger exchanges.

Each exchange type involves different trade offs between control, ease of use, liquidity, and risk, so the right choice depends on how and how often someone plans to trade.

What factors matter when picking a cryptocurrency exchange?

Choosing a crypto exchange involves balancing cost, security, and usability with the level of risk a user is willing to accept. Because protections are limited in crypto, the platform’s structure and transparency matter as much as its features.

Fees and pricing

Trading fees, spreads, and withdrawal charges can vary widely and add up over time, especially for frequent traders. Comparing total costs across platforms helps avoid unexpected charges.

Security and custody

It is important to understand whether the exchange holds assets on behalf of users or allows self custody. Security measures such as two factor authentication, cold storage, and withdrawal controls reduce risk but do not eliminate it.

Supported assets and markets

Not all exchanges offer the same range of cryptocurrencies or trading options. Some focus on major coins only, while others support a wider selection, derivatives, or staking products.

Ease of use and tools

The quality of the web and mobile platforms affects how easily trades can be placed and managed. Beginners often benefit from simpler interfaces, while active traders may need advanced order types and charting tools.

Regulation, transparency, and support

Clear information about where the platform operates, how it is overseen, and how customer support works helps set realistic expectations. While regulation does not guarantee safety, greater transparency can improve trust and accountability.

Considering these factors together makes it easier to choose a platform that fits trading goals, experience level, and risk tolerance.

What UK investors should understand about crypto tax and compliance

Crypto taxation in the UK is rules based and increasingly enforced. HMRC has expanded guidance, data sharing with exchanges, and compliance campaigns, which means accurate reporting now matters more than ever. Below is a more detailed breakdown of how crypto tax works in practice, with current thresholds and examples.

How is cryptocurrency regulated in the UK?

In the UK, cryptoassets are regulated mainly for anti money laundering and counter terrorist financing purposes. Crypto exchanges and wallet providers that serve UK users must register with the Financial Conduct Authority under the UK’s AML regime. This registration focuses on controls and reporting, not on protecting investors or approving crypto products.

Crypto investments are not covered by the Financial Services Compensation Scheme. If an exchange collapses or assets are lost, there is usually no statutory compensation. This makes platform choice, custody model, and security controls particularly important for UK users.

Is crypto taxable in the UK?

Yes. HMRC treats cryptocurrency as a capital asset, similar to shares or property, rather than as currency. Tax can apply even if profits are not withdrawn to a bank account.

The two main taxes that apply to crypto activity are:

- Capital Gains Tax (CGT) when crypto is disposed of

- Income Tax when crypto is received as income

The tax treatment depends on the nature of each transaction, not the platform used.

Capital Gains Tax on crypto explained

Capital Gains Tax may apply when cryptoassets are:

- Sold for pounds or another fiat currency

- Swapped for a different cryptocurrency

- Used to pay for goods or services

- Gifted to someone other than a spouse or civil partner

Annual CGT allowance

The annual Capital Gains Tax allowance is currently £3,000. Gains above this threshold are taxable.

CGT rates on crypto

Crypto gains are taxed at the same rates as other capital assets:

- 10% for basic rate taxpayers

- 20% for higher and additional rate taxpayers

The rate depends on total taxable income, not just crypto gains.

Example

If total crypto gains in a tax year are £10,000, the first £3,000 is tax free. The remaining £7,000 is taxed at either 10% or 20%, depending on income level.

When does Income Tax apply to crypto?

Income Tax applies when crypto is earned or received, rather than bought.

Common taxable events include:

- Mining rewards

- Staking rewards

- Airdrops linked to services or activity

- Crypto received as payment for work

HMRC generally taxes the fair market value in pounds at the time the crypto is received.

Income Tax rates

Crypto income is taxed at standard UK Income Tax rates:

- 20% basic rate

- 40% higher rate

- 45% additional rate

If crypto activity is frequent and organised, HMRC may treat it as a trade. In those cases, National Insurance contributions can also apply, typically Class 2 and Class 4 for self employed activity.

What happens if you later sell crypto that was taxed as income?

If crypto that was originally taxed as income is later sold or exchanged, Capital Gains Tax may apply again. The acquisition cost for CGT purposes is the value that was already taxed as income.

This means the same cryptoasset can be subject to Income Tax when received and CGT when disposed of, depending on price movements.

How closely does HMRC monitor crypto activity?

HMRC has confirmed that it receives data from UK and international crypto exchanges. It has also issued large numbers of “nudge letters” to investors it believes may have undeclared crypto gains.

Failure to report crypto correctly can lead to:

- Backdated tax bills

- Interest on unpaid tax

- Penalties for careless or deliberate errors

Penalties increase if HMRC believes information was intentionally withheld.

How can UK investors stay compliant?

HMRC expects investors to keep detailed records of all crypto activity, including:

- Transaction dates

- Amounts in crypto and pounds

- Exchange rates used

- Fees paid

- Wallet and exchange addresses

Records should be kept even if gains fall below the annual allowance. Investors with frequent trades, multiple wallets, or decentralised finance activity may benefit from specialist tax advice to ensure calculations are accurate.

Understanding these rules early helps UK investors manage risk, avoid penalties, and trade crypto within the UK’s legal and tax framework.

FAQs

What’s the best Bitcoin exchange in the UK?

eToro is widely considered one of the best Bitcoin exchanges in the UK due to its FCA-registered UK entity, simple 1% crypto trading fee, and easy GBP deposits. It suits beginners and long-term Bitcoin investors who value clarity and ease of use. More active traders may also consider Kraken for deeper liquidity and advanced trading options.

Who regulates crypto exchanges in the UK?

Crypto exchanges serving UK users must register with the Financial Conduct Authority for anti-money laundering and counter-terrorist financing supervision. This registration does not mean crypto is approved or protected, and cryptoassets are not covered by the FSCS. Regulation focuses on financial crime controls rather than investment safety.

How to choose a UK crypto exchange?