OKX is a global cryptocurrency exchange designed for active traders, offering low trading fees, deep liquidity, and a wide set of tools across spot markets, advanced order types, and Web3 features.

Its main drawback is weaker UK fit, with no FCA registration, restricted access to some higher risk products for UK retail users, and limited GBP deposit and withdrawal options, which may matter for beginners and fiat first investors who want straightforward on and off ramps and clearer local protections.

What is OKX and how does it work?

OKX is a centralised crypto exchange that lets users buy, sell, and trade cryptocurrencies through an account based platform, with optional access to additional services like staking, copy trading, bots, and a built in Web3 wallet.

Is OKX centralised or decentralised?

OKX is centralised at its core.

That means:

- Funds are held and moved within OKX managed wallets when trading on the exchange

- Trades match through an exchange order book, rather than directly on chain

- Users complete onboarding and identity checks to access most features

Alongside the centralised exchange, OKX also offers a self custody Web3 wallet. That wallet is a separate mode where the user controls the private keys, and activity happens on chain through decentralised apps.

In practice, OKX is a hybrid product suite: a centralised exchange plus a Web3 wallet under one brand.

How OKX works in practice

OKX works like most large exchanges:

- Create an account and complete verification: Most users can register with an email and then complete KYC. Verification is typically fast, but it can take longer if documents need manual checks.

- Fund the account: Crypto deposits are the simplest route. For UK users, GBP funding is often the main friction point because direct GBP bank transfers and withdrawals are not consistently available, and card purchases commonly run through third party providers with higher total costs.

- Place trades on the exchange: OKX uses a market model with order books and liquidity across trading pairs. Users can place market and limit orders, plus conditional orders depending on the product and region.

- Store, transfer, or withdraw assets: Users can keep assets on the exchange for convenience, transfer to external wallets, or use the OKX Web3 wallet for on chain activity. Withdrawals are usually network fee based and vary by blockchain.

The core trading model

OKX is built for active trading, with multiple ways to trade depending on region.

Spot trading

Spot is the standard buy and sell market for crypto pairs such as BTC to USDT or ETH to USDT. This is the most relevant product for most UK retail users.

- Order book trading with maker and taker fees

- Typically tighter spreads and better pricing on high liquidity pairs

- Supports a large set of coins and trading pairs, but liquidity is strongest on major markets

Derivatives and leverage products

Globally, OKX is known for derivatives such as perpetuals, futures, options, and margin. However, access can be restricted for UK retail users depending on product rules and local compliance. That matters because derivatives are a big part of why traders choose OKX.

If derivatives are available to a given user, the model typically includes:

- Perpetual contracts with funding rates that change over time

- Margin and leveraged positions with liquidation mechanics and maintenance margin rules

- Risk controls such as leverage limits by asset and position size

Swaps and quick conversion

OKX also offers simpler swap style flows, often labelled as convert or express buy. These can be easier than an order book, but the total cost can be less transparent because part of the cost is embedded in the price.

Who is OKX designed for?

OKX is primarily designed for active and advanced crypto traders, not first time buyers.

Best fit user level

- Active traders who place frequent spot trades and care about low fees and tight execution

- Advanced users who want a feature dense platform, charting, APIs, bots, and copy trading

- Web3 power users who want a built in wallet for DeFi, NFTs, and bridging

Not the best fit

- Beginners who want a simple buy and hold app with clear GBP deposits and withdrawals

- Fiat first UK users who want the smoothest bank rails and local consumer protection expectations

- Hands off investors who prefer a simplified interface, stronger UK alignment, and fewer moving parts

What you can do on OKX

OKX is more than a basic exchange. It typically includes:

- Spot markets across major coins and many altcoins

- Advanced charting and order types suited to technical traders

- Trading bots such as grid and DCA templates

- Copy trading with strategy leaderboards and follower tools

- Earn products like staking and structured earn options, with varying complexity and risk

- Web3 wallet for on chain swaps, DeFi access, NFTs, and cross chain tools

Snapshot table: OKX exchange model for UK users

| Area | What it means on OKX | UK relevance |

|---|---|---|

| Exchange type | Centralised exchange plus optional self custody Web3 wallet | Good functionality, but the setup can feel complex |

| Core trading | Spot trading via order books, plus swaps and advanced tools | Spot is the main focus for most UK users |

| Derivatives | Perpetuals, futures, options, margin in supported regions | Often restricted for UK retail users, which reduces the appeal for some traders |

| Fees | Low trading fees on the exchange, especially for active users | Low trading fees can be offset by higher fiat on ramp costs |

| Funding | Crypto deposits, plus card and third party fiat providers in many regions | GBP rails can be limited, which adds friction for UK users |

OKX overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | Global exchange available in 180+ countries. Accessible in the UK, but with product and fiat limitations. Restricted or limited in the United States. |

| Exchange type (centralised or decentralised) | Centralised crypto exchange with an additional self custody Web3 wallet offering decentralised access. |

| Regulator or registration status | Not FCA registered in the UK. Operates offshore. Holds MiCA authorisation for parts of the EU, but UK users do not receive FCA oversight. |

| Custody model (custodial or non custodial) | Custodial by default for exchange trading. Optional non custodial Web3 wallet where users control private keys. |

| Investor protection (usually none) | No FSCS protection. UK users are not covered by UK investor compensation schemes. |

| Supported cryptocurrencies | 300+ cryptocurrencies and 600+ trading pairs, including major coins, stablecoins, DeFi tokens, and selected NFTs via the wallet. |

| Trading types (spot, derivatives, margin) | Spot trading available to UK users. Derivatives, margin, futures, and options available globally but restricted for UK retail users. |

| Fiat on ramp and off ramp | Third party providers only for most UK users (cards, P2P). No consistent direct GBP bank deposits or withdrawals. |

| Trading fees | Spot fees from 0.08% maker and 0.10% taker. Lower fees available through VIP tiers and OKB holdings. |

| Deposit and withdrawal fees | Crypto deposits are free. Withdrawals are network fee based and vary by asset and blockchain. Fiat on ramp fees typically 3%–5% via third parties. |

| Security features | Cold storage for most funds, two factor authentication, withdrawal whitelists, anti phishing codes, insurance fund, and public proof of reserves. |

| Mobile app and web platform | Full featured web platform and iOS and Android apps with advanced charting, trading tools, bots, copy trading, and Web3 wallet integration. |

| Ease of use level | Moderate to complex. Designed for active and advanced traders rather than beginners. |

What assets and markets are available on OKX?

OKX offers one of the broadest asset selections among global crypto exchanges, with 300+ cryptocurrencies, hundreds of spot pairs, deep stablecoin markets, and extensive derivatives coverage in supported regions. Liquidity is strongest on major pairs, making OKX well suited to active traders, though UK users face product restrictions.

Number and range of supported cryptocurrencies

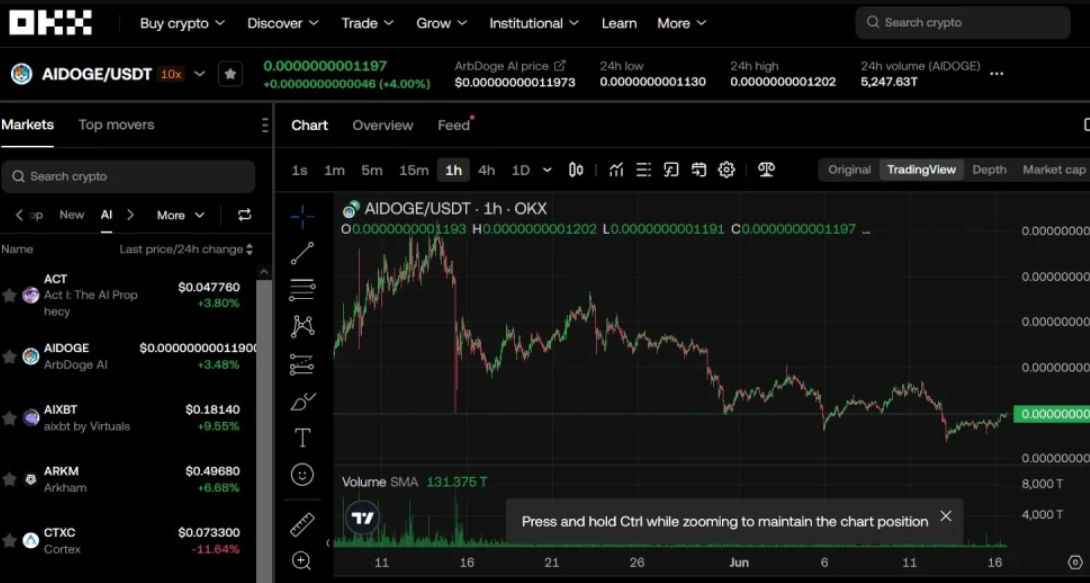

OKX supports 300+ digital assets across large-cap, mid-cap, and emerging tokens. This includes major cryptocurrencies like Bitcoin, Ethereum, Solana, and XRP, alongside DeFi tokens, Layer 2 assets, infrastructure coins, gaming tokens, and selected meme coins. New listings are added regularly following internal liquidity and risk reviews.

For UK users, the available asset list is still broad, but some higher-risk or newly launched tokens may be limited compared to offshore jurisdictions.

Spot markets

Spot trading is the core market available to UK retail users. OKX offers 600+ spot trading pairs, with the deepest liquidity concentrated on majors such as BTC/USDT, ETH/USDT, BTC/USDC, and ETH/USDC.

- Order-book based spot trading

- Market, limit, and conditional orders

- Tight spreads on high-volume pairs

- Wider spreads and thinner depth on long-tail altcoins

Execution quality on major pairs is consistently strong due to high global trading volumes.

Derivatives and perpetuals

Globally, OKX is known for its large derivatives suite, including perpetual swaps, futures, options, and margin trading. These markets offer deep liquidity and advanced risk controls, supported by a unified margin system.

However, UK retail users are restricted from accessing most crypto derivatives due to FCA rules. As a result, derivatives are not a core part of the UK OKX experience, which materially reduces its appeal for traders seeking leverage.

Stablecoin and fiat pairs

OKX has strong stablecoin market coverage, with extensive USDT and USDC pairs across spot and derivatives markets. Stablecoins act as the main base currency for trading and transfers.

Fiat pairs are more limited. While OKX supports GBP, EUR, and USD conversions through third-party providers, direct GBP spot pairs and bank rails are inconsistent for UK users, making stablecoins the most practical funding and trading route.

Liquidity depth and market coverage

OKX consistently ranks among the top five global exchanges by trading volume, processing billions in daily trades. Liquidity is deep on major spot and perpetual markets, supporting large orders with minimal slippage.

- Excellent depth on BTC, ETH, SOL, and top stablecoin pairs

- Adequate but thinner liquidity on smaller-cap assets

- Global market coverage across Asia, Europe, and the Middle East

For UK users focused on spot trading in major markets, liquidity is a clear strength.

How good is the trading experience and toolset on OKX?

OKX delivers a powerful, professional trading experience with deep liquidity, fast execution, and an extensive set of advanced tools. It is excellent for experienced traders, but the complexity of the interface and limited UK product access make it less suitable for beginners.

Web and mobile platform usability

OKX offers a feature rich but demanding interface on both web and mobile.

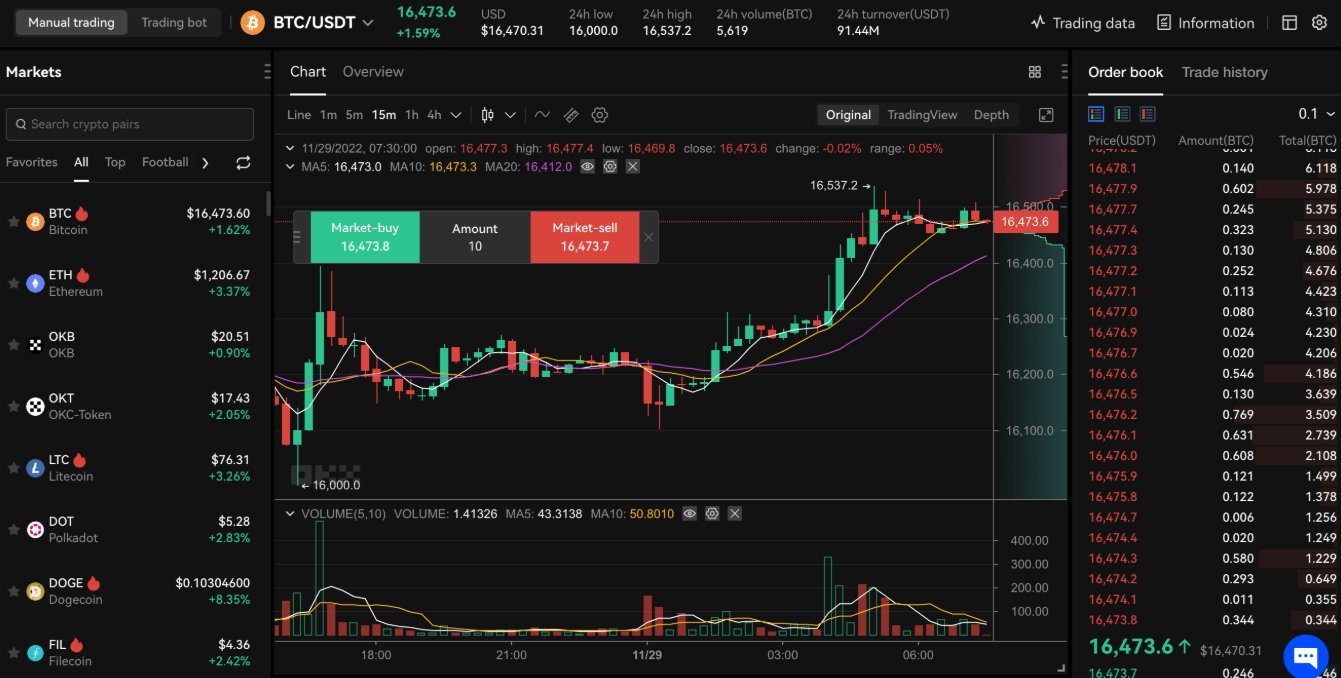

- Web platform: Designed around active trading, with TradingView charts, multi window layouts, order books, depth charts, and position tracking all visible at once. Efficient once learned, but visually dense.

- Mobile app: Mirrors the desktop experience closely. Execution is fast and stable, but navigation requires familiarity due to the number of menus and tools.

For UK users, the platform feels more like a professional terminal than a beginner app. Simple buy and hold users may find it overwhelming compared to cleaner platforms like Coinbase or Bitpanda.

Order types available

OKX supports a wide range of order types, well above the industry average:

- Market and limit orders

- Stop loss and take profit

- OCO (one cancels the other)

- Conditional and trigger orders

- Advanced TP SL controls directly on charts

This makes OKX particularly strong for traders who manage risk actively or use structured strategies.

Order execution on major pairs such as BTC USDT and ETH USDT is fast, with minimal slippage under normal market conditions.

Charting tools and indicators

Charting is powered by TradingView integration, offering:

- Dozens of technical indicators

- Multiple chart types and timeframes

- Drawing tools and overlays

- Depth and volume analysis

Charts are responsive on both desktop and mobile. Advanced users can customise layouts heavily, while beginners may find the level of detail excessive for simple trades.

Advanced tools, APIs, and automation

This is where OKX stands out.

- Trading bots: Built in grid, DCA, and strategy templates without third party tools

- Copy trading: Leaderboards with performance metrics, though risk transparency varies by trader

- API access: Full REST and WebSocket APIs suitable for algorithmic and high frequency trading, with permission controls and IP whitelisting

- Unified margin system (where available): Allows collateral to be shared across positions, improving capital efficiency

These tools make OKX particularly attractive to quantitative traders, bot users, and semi professional market participants.

Performance, reliability, and execution quality

OKX performs strongly in real world trading conditions.

- Consistently high uptime outside scheduled maintenance

- Low latency execution on high liquidity pairs

- Stable performance during moderate volatility

During extreme market events, temporary delays or order throttling can occur, but this is consistent with other top tier global exchanges. Overall reliability is considered strong.

Trading experience verdict

| Area | Assessment |

|---|---|

| Ease of use | Powerful but complex |

| Order execution | Fast and reliable |

| Charting | Professional grade |

| Advanced tools | Excellent |

| Beginner suitability | Low |

TLDR: OKX offers one of the strongest trading toolsets in the crypto market, especially for active and advanced traders. However, the learning curve and UK product limitations prevent it from being a universal recommendation for all users.

How competitive are OKX’s fees and pricing?

OKX is one of the cheapest major crypto exchanges for active traders, with low base trading fees and meaningful discounts for high volume users. However, UK users can face higher all in costs due to third party fiat on ramps and limited GBP support, which slightly weakens its value proposition for beginners.

Trading fees (spot and derivatives)

OKX uses a maker taker fee model with volume based VIP tiers and additional discounts for holding its native OKB token.

Base trading fees

| Market | Maker fee | Taker fee | Notes |

|---|---|---|---|

| Spot trading | 0.08% | 0.10% | Entry level fees |

| Derivatives | 0.02% | 0.05% | Where permitted by region |

Fees decrease as trading volume increases. VIP 1 typically starts at around $5 million in 30 day trading volume or a high account balance. Holding OKB can reduce fees by up to ~40% compared to base rates.

Fee example

- $50,000 in monthly spot trades at base taker fees costs ~$50

- At higher VIP tiers, that cost can drop closer to ~$25–$30

For frequent traders, OKX is significantly cheaper than platforms like Coinbase or Crypto.com.

Spread costs and execution quality

- Order book trading on OKX generally has tight spreads, especially on major pairs such as BTC USDT and ETH USDT

- Spreads widen on smaller cap assets and during periods of high volatility

- The instant convert feature embeds fees into the spread, making it more expensive than placing limit orders

For cost efficiency, limit orders on liquid spot pairs offer the best value.

Deposit fees

| Deposit method | Typical cost | Notes |

|---|---|---|

| Crypto deposits | Free | Standard across exchanges |

| Card purchases | ~3%–5% | Via third party providers |

| Bank transfers | Varies | Limited availability for UK users |

| P2P purchases | Varies | Pricing set by sellers |

Crypto deposits are free, but fiat deposits for UK users usually rely on third party providers, which increases costs compared to FCA regulated exchanges with direct GBP rails.

Withdrawal fees

OKX does not charge fixed withdrawal fees. Costs are network based and depend on the blockchain used.

| Asset | Typical withdrawal fee | Notes |

|---|---|---|

| Bitcoin (BTC) | ~0.00001 BTC | Network dependent |

| Ethereum (ETH) | ~0.00003 ETH | Can rise during congestion |

| USDT | Chain dependent | TRC 20 usually cheapest |

There are no percentage based withdrawal fees, but repeated small withdrawals can become costly due to blockchain fees.

Indirect or hidden costs to be aware of

While headline fees are low, users should account for:

- Fiat on ramp markups from third party providers

- Embedded spreads on instant buy and convert tools

- Funding rates on perpetuals and margin products where available

- FX conversion costs when moving between GBP and stablecoins

- Opportunity cost if relying on external platforms to move GBP in and out

These costs matter most for UK users who cannot rely on direct GBP deposits or withdrawals.

Fee comparison: OKX vs major competitors

| Platform | Base spot fee (taker) | Fiat on ramp costs | Overall cost profile |

|---|---|---|---|

| OKX | 0.10% | High for UK users | Very low for crypto to crypto trading |

| Binance | 0.10% | Low to moderate | Low overall |

| Coinbase | ~0.40%–0.60% | Low friction, higher fees | Expensive for frequent traders |

| Kraken | ~0.26% | Moderate | Balanced and transparent |

Fees and pricing verdict

| Factor | Assessment |

|---|---|

| Trading fees | Excellent |

| Volume discounts | Strong |

| Crypto withdrawals | Fair |

| Fiat accessibility | Weak for UK users |

| Cost transparency | Good for traders |

TLDR: OKX is outstanding on pure trading fees and rewards active, high volume users. For UK investors who rely heavily on fiat deposits and withdrawals, indirect costs reduce its overall cost efficiency compared to FCA regulated alternatives.

How secure is OKX and how are assets held?

OKX operates with strong technical security controls and transparent reserve reporting, but it remains an offshore exchange without FCA oversight. Asset protection depends on custody practices, internal controls, and user behaviour rather than UK regulatory safeguards.

Custody model: who controls your crypto?

OKX uses a custodial exchange model for standard trading accounts.

- Assets held on the exchange are controlled by OKX, not by the user’s private keys

- Users rely on OKX’s internal custody, security systems, and operational controls

- Funds are pooled across hot and cold wallets rather than segregated on a per-user blockchain address basis

In addition, OKX offers a separate self-custody Web3 wallet, where users control their own private keys. This wallet operates independently from the exchange and carries typical DeFi and smart contract risks.

Cold storage and infrastructure practices

OKX states that over 95% of client assets are held in offline cold storage.

Key practices include:

- Cold wallets secured offline and geographically distributed

- Multi-signature approval for asset movements

- Limited hot wallet exposure for daily liquidity needs

- Internal risk controls around withdrawal batching and wallet rotation

Cold storage reduces exposure to online attack vectors, but it does not eliminate operational, governance, or insider risk.

Account-level security controls

OKX provides a robust set of user-configurable security tools, including:

- Two-factor authentication (app-based and SMS options)

- Withdrawal address whitelisting, with optional lock periods

- Anti-phishing codes embedded in official emails

- Device and session management

- API key controls, including permission scoping and IP whitelisting

These controls materially reduce the risk of account takeover when configured properly. However, responsibility for enabling and maintaining them sits with the user.

Proof of reserves and transparency

OKX publishes regular Proof of Reserves (PoR) reports using Merkle tree data and zk-STARK cryptographic proofs.

What PoR shows:

- That on-chain assets exceed or match customer liabilities at the snapshot time

- That individual users can verify inclusion of their balances

What PoR does not show:

- Future liabilities

- Off-balance-sheet obligations

- How funds would be treated during insolvency or legal proceedings

Proof of reserves improves transparency, but it is not equivalent to a regulated audit or client asset segregation under UK financial law.

Incident history and regulatory context

- OKX has not suffered a publicly confirmed exchange-wide hack resulting in customer fund losses

- In 2025, the company paid a large U.S. penalty related to AML compliance failures, increasing regulatory scrutiny

- OKX is not registered with the UK Financial Conduct Authority (FCA)

- UK users are not protected by the Financial Services Compensation Scheme (FSCS)

This means UK customers rely on OKX’s internal controls and offshore legal frameworks rather than domestic consumer protections.

Key risks UK users should understand

Using OKX involves several non-trivial risks:

- Custodial risk: assets are controlled by the exchange

- Jurisdiction risk: disputes fall outside UK regulatory systems

- Fiat access risk: reliance on third-party on-ramps

- Operational risk: withdrawals or accounts can be temporarily restricted during reviews

- Web3 risk: smart contracts, bridges, and DeFi tools operate without guarantees

These risks are common across offshore crypto exchanges but are more pronounced compared to FCA-registered platforms.

Security overview table

| Security area | OKX approach |

|---|---|

| Custody model | Custodial exchange + optional self-custody wallet |

| Cold storage | 95%+ of assets offline |

| Account protections | 2FA, whitelists, anti-phishing, API controls |

| Transparency | Public proof of reserves |

| UK regulation | Not FCA-registered |

| FSCS protection | Not available |

TLDR: OKX demonstrates strong technical security standards and transparency by crypto industry norms, particularly for active traders and experienced users. However, the lack of UK regulation and reliance on custodial storage mean asset safety ultimately depends on exchange operations and user risk management.

How do deposits and withdrawals work on OKX?

Deposits and withdrawals on OKX work smoothly for crypto-to-crypto users, but the experience is weaker for UK fiat users. Crypto deposits are fast and free, withdrawals are network-based and reliable, but GBP on-ramps and off-ramps rely heavily on third-party providers, which adds cost, friction, and inconsistency.

Fiat on-ramp and off-ramp support (UK focus)

OKX does not offer consistent direct GBP bank deposits or withdrawals for UK retail users. Instead, fiat access is handled via third-party payment providers, which varies by availability and pricing at checkout.

Common fiat funding options for UK users

- Debit and credit cards via providers such as MoonPay, Banxa, or Simplex

- Limited bank transfer options depending on provider availability

- Peer-to-peer (P2P) marketplace for direct user-to-user fiat trades

Typical costs

- Card purchases: ~3%–5% per transaction

- Bank transfers (where available): provider-dependent fees

- FX conversion: embedded in the quoted rate

Fiat withdrawals are not directly supported to UK bank accounts. To cash out to GBP, most users transfer crypto from OKX to an FCA-registered exchange such as Coinbase, Kraken, or Bitpanda, then withdraw from there.

UK verdict on fiat

- Functional but indirect

- Higher all-in costs than FCA-registered platforms

- Best suited to users comfortable moving funds between exchanges

Crypto deposit process

Crypto deposits are the most reliable and cost-effective way to fund an OKX account.

How it works

- Select the asset to deposit (e.g. BTC, ETH, USDT)

- Choose the correct blockchain network

- Copy the deposit address (and memo if required)

- Send funds from an external wallet or exchange

Key points

- Crypto deposits are free

- Funds usually credit after standard blockchain confirmations

- Using the wrong network or missing a memo can result in loss of funds

- Stablecoins (USDT or USDC) are commonly used to reduce volatility and FX friction

Crypto withdrawals

Crypto withdrawals on OKX are network-fee based, not percentage-based.

Typical withdrawal fees

| Asset | Approx. network fee | Notes |

|---|---|---|

| Bitcoin (BTC) | ~0.00001 BTC | Varies with mempool congestion |

| Ethereum (ETH) | ~0.00003 ETH | Higher during peak usage |

| USDT | Chain-dependent | TRC-20 usually cheapest |

Withdrawal mechanics

- Fees adjust dynamically based on network conditions

- No additional OKX markup beyond the network fee

- Users can choose different blockchains where supported

Processing times

Crypto deposits

- Typically 5–30 minutes, depending on network and congestion

Crypto withdrawals

- Usually processed within minutes

- Larger amounts or security changes can trigger manual review

- Withdrawal holds may apply after password resets, KYC changes, or 2FA updates

Fiat purchases

- Card purchases are usually instant but depend on provider approval

- P2P transactions depend on counterparty responsiveness

Limits and minimums

Limits depend on verification level (KYC tier).

Typical structure

- Basic KYC: lower daily withdrawal caps

- Full KYC: higher limits, often tens of thousands USD per day

- Institutional tiers: significantly higher limits

Minimum withdrawal amounts apply per asset and network and are shown clearly before confirmation.

Reliability and transparency

From hands-on testing and user feedback:

Strengths

- Crypto transfers are fast and predictable

- Network fees are clearly displayed before withdrawal

- Transaction history and blockchain TXIDs are easy to track

Weaknesses

- Fiat costs vary by provider and are harder to compare

- No unified GBP banking experience for UK users

- Third-party providers introduce extra approval and failure points

Deposits and withdrawals verdict

| Factor | Assessment |

|---|---|

| Crypto deposits | Excellent |

| Crypto withdrawals | Reliable and transparent |

| Fiat on-ramps | Expensive and inconsistent |

| Fiat off-ramps | Indirect for UK users |

| Overall usability | Good for crypto-native users |

TLDR: OKX performs well for crypto-native traders but falls behind FCA-registered competitors when it comes to simple, low-cost GBP deposits and withdrawals for UK users.

How trustworthy is OKX in terms of regulation and support?

OKX is not registered with the UK Financial Conduct Authority (FCA) for cryptoasset activities. This means it does not appear on the FCA crypto register and UK users do not benefit from FCA oversight or FSCS protection. The platform operates offshore and structures access by jurisdiction, restricting certain high risk products for UK retail users to align with local rules.

Outside the UK, OKX has strengthened its regulatory footing. In 2025, it secured MiCA authorisation in the EU, allowing it to offer regulated services across European markets. This improves transparency and compliance for EU users but does not extend FCA protections to UK customers.

UK takeaway: Legal to use, but unregulated locally. Consumer protections are weaker than on FCA registered exchanges.

Jurisdictional transparency

OKX is relatively clear about where it operates and what is restricted by region.

- Publishes country availability and feature restrictions in its help centre

- Applies product gating by jurisdiction, particularly for derivatives and leverage

- Clearly labels when features require additional verification or are unavailable

However, the corporate structure is offshore, and dispute resolution sits outside UK legal frameworks. In practice, this means UK users rely on OKX’s internal policies and the laws of the operating entity rather than domestic regulators.

Transparency score: Good by offshore exchange standards, but still below UK regulated platforms.

Customer support channels and responsiveness

OKX offers 24/7 customer support, but the quality can vary.

Available support channels

- Live chat via web and mobile app (primary channel)

- Ticket based email support

- Extensive help centre with guides and system status updates

Real world responsiveness

- Live chat typically responds within minutes to hours

- Complex cases such as KYC reviews, withdrawal holds, or security checks can take several days

- No dedicated UK phone line or UK specific escalation path

User feedback is mixed. Some users report fast resolution for routine issues, while others cite slow follow ups for account or withdrawal problems, particularly during high volatility periods.

Support verdict: Adequate for routine queries, inconsistent for urgent or complex cases.

Clarity of risk warnings and disclosures

OKX provides clear and prominent risk disclosures, especially for higher risk products.

- Mandatory risk questionnaires before accessing advanced features

- Clear warnings on leverage, liquidation risk, and funding costs

- Transparent notices when products are restricted by region

- Detailed explanations for custody, proof of reserves, and withdrawal conditions

The platform also publishes Proof of Reserves using Merkle tree data and zk cryptographic methods, allowing users to verify balances at the snapshot level. While this improves transparency, it is not equivalent to a regulated audit or client money segregation under UK law.

Disclosure quality: Strong and detailed, particularly compared to less transparent offshore exchanges.

Trust, regulation, and support verdict

| Area | Assessment |

|---|---|

| FCA registration | Not registered |

| UK consumer protection | None |

| Jurisdictional clarity | Good |

| Support availability | 24/7 but inconsistent |

| Risk disclosures | Clear and robust |

TLDR: OKX is operationally reliable and transparent for an offshore exchange, with solid disclosures and global compliance progress. However, the lack of FCA registration, absence of UK consumer protections, and uneven customer support prevent it from ranking highly on trust for UK retail users.

What are the pros and cons of using OKX?

Pros

- Very low trading fees: Spot fees start at 0.08% (maker) and 0.10% (taker), with further reductions via VIP tiers and OKB holdings. This materially benefits active and high-volume traders.

- Deep liquidity and strong execution: OKX consistently ranks among the top global exchanges by volume, with tight spreads on major pairs like BTC/USDT and ETH/USDT.

- Advanced trading infrastructure: Unified margin, futures, options (region-dependent), TradingView charts, APIs, copy trading, and built-in bots cater to professional traders.

- Integrated Web3 ecosystem: A native self-custody wallet with DeFi, DEX aggregation, NFTs, and bridging reduces the need for third-party tools.

- Strong technical security standards: 95%+ cold storage, multi-sig controls, 2FA, withdrawal whitelists, and public proof of reserves using zk-STARKs.

Cons

- Not FCA-registered: UK users receive no FCA oversight or FSCS protection, increasing regulatory and counterparty risk.

- Poor GBP fiat access: No consistent direct GBP deposits or withdrawals; users rely on third-party on-ramps with 3–5% fees.

- Complex interface: Feature-heavy layout can overwhelm beginners and casual investors.

- Restricted products for UK users: Derivatives, leverage, and some advanced features are limited or unavailable due to local rules.

- Inconsistent customer support: Live chat exists, but resolution times for KYC or withdrawals can be slow during busy periods.

Who is OKX best for?

- Active traders who value low fees, deep liquidity, and fast execution

- Advanced traders using futures, options, unified margin, or APIs

- Low-fee seekers trading crypto-to-crypto rather than fiat-first

- Web3 power users who want exchange trading and DeFi tools in one ecosystem

Who is OKX not ideal for?

- Users needing strong UK regulation and FSCS-style consumer protection

- Beginners looking for a simple, guided crypto app

- Fiat-first UK users who want easy GBP deposits and withdrawals

- Long-term passive holders who prefer regulated, low-maintenance platforms

How to get started with OKX

- Create an account: Download the OKX app or use the OKX web platform and select Sign Up. Register with an email address, then confirm the verification code. Add a strong password and enable basic security from day one.

- Complete verification if required: OKX uses KYC levels to set what you can do on the platform. Most users will need to upload a government issued ID and complete a selfie or facial check to unlock higher limits and access features like P2P and certain funding routes. Approval is often fast, but regional checks can take longer depending on document review.

- Deposit funds: Choose the funding route that matches how you plan to trade:

- Crypto deposit: Go to Assets → Deposit, pick the coin and network, then copy the wallet address. Send a small test transfer first if it is a new wallet or network.

- Fiat on ramp (where available): Select Buy Crypto or Fiat Deposit and follow the prompts. In the UK, direct GBP support can be limited, so many users fund OKX by buying crypto on a UK friendly exchange first, then transferring it across.

- Place a trade: Go to Trade → Spot (or another product if available in your region). Pick a trading pair such as BTC USDT or ETH USDT, then choose an order type:

- Market order for instant execution

- Limit order for price control

- Stop or conditional orders for basic risk management

If OKX uses separate wallets, move funds from Funding to Trading before placing the order.

- Withdraw or secure assets: Decide whether to keep funds on the exchange for active trading or move them into safer custody:

- Withdraw to an external wallet: Go to Assets → Withdraw, select coin and network, add the destination address, and confirm security checks.

- Secure assets on platform: Enable 2FA, set an anti phishing code, and turn on withdrawal address allowlisting. For long term storage, consider moving assets into the OKX self custody wallet or a hardware wallet rather than leaving large balances on an exchange.

How we tested and methodology

Each crypto exchange reviewed is assessed using a standardised six-category scoring framework, designed to compare platforms consistently across the factors that matter most to real users. Every category is scored out of 5, with the combined results forming the overall rating.

Our six scoring categories

- Supported assets and markets: The range of cryptocurrencies, trading pairs, and products offered, including spot markets, derivatives, staking, and Web3 features where available.

- Trading experience and tools: Platform usability, order types, charting quality, execution speed, mobile app performance, and access to advanced tools such as APIs, bots, or copy trading.

- Fees and pricing: Spot and derivatives fees, VIP tier structures, spreads, withdrawal costs, and any indirect charges from fiat on-ramps or conversions.

- Security and custody: Custody model, cold storage practices, account-level security controls, incident history, and transparency measures such as proof of reserves.

- Deposits and withdrawals: Fiat and crypto funding options, processing times, limits, reliability, and the overall ease of moving funds in and out of the platform.

- Trust, regulation, and support: Regulatory status, jurisdictional clarity, consumer protections, customer support quality, and the clarity of risk disclosures.

How scores are determined

Scores are based on hands-on platform testing, fee and cost analysis, security and custody review, and usability checks across both desktop and mobile experiences. Where relevant, regional availability and restrictions are factored in so ratings reflect what users can realistically access in their country.

This approach ensures that each exchange is judged on real-world performance, not marketing claims, allowing for fair and transparent comparisons across platforms.

FAQs

Is OKX safe to use in the UK?

OKX is technically secure, with cold storage, 2FA, and proof of reserves, but it is not FCA-registered. UK users do not receive FSCS protection, so regulatory safeguards are weaker than on UK-regulated platforms.

Is it easy to withdraw from OKX?

Crypto withdrawals are generally fast and reliable, usually processing within minutes once security checks pass. Fiat withdrawals are less straightforward for UK users due to limited direct GBP support.

Is it safe to invest in OKX?

OKX is considered operationally reliable from a security standpoint, but investing carries added risk for UK users because the platform operates offshore and lacks local regulation.

Can I withdraw money from OKX?

Direct GBP withdrawals to a UK bank are not consistently available. Most UK users withdraw crypto to an FCA-registered exchange such as Coinbase or Kraken, then cash out to GBP there.

Can I stake crypto on OKX?

Yes. OKX offers staking and Earn products across multiple assets, with yields varying by token and product type. Some options are simple, while others involve higher risk and require careful review.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.