Nexo is a centralized crypto wealth platform designed for long-term crypto holders and yield-focused investors, offering borrowing, earning, trading, and card spending within a single ecosystem.

Its main strengths sit across asset coverage, flexible earn products, and integrated tools such as crypto-backed credit lines and the Nexo Card.

Its primary drawback is the loyalty-tier structure tied to holding NEXO tokens, which may matter for advanced users seeking predictable rates without token exposure.

What is Nexo and how does it work?

Nexo is a centralized, custodial crypto wealth platform that lets UK users buy, sell, borrow, and earn on digital assets in one app. It works like a combined cryptocurrency exchange and lending service: users deposit crypto or fiat, then trade (spot or futures), earn yield via savings products, or borrow against collateral using Nexo credit lines.

Is Nexo centralized or decentralized?

Nexo is centralized finance (CeFi), not DeFi. That means:

- Nexo holds custody of client assets within the platform, rather than users self custodying via a personal wallet.

- Access is account based, with KYC identity checks and platform controls.

- Products such as earn interest and credit lines are provided through Nexo’s internal systems and counterparties, not on chain smart contracts controlled solely by the user.

This structure can feel more familiar to people who want an all-in-one service, but it also creates centralization risk because users rely on Nexo’s operational and financial resilience.

What is the core trading model?

Nexo combines an exchange style trading layer with wealth and lending features:

Spot trading and swaps

- Trading is available across 100 plus cryptocurrencies and 1,500 plus trading pairs.

- Fees follow a tiered structure.

- Spot maker fees: about 0.20% down to 0.04%

- Spot taker fees: about 0.20% down to 0.07%

- Some swap orders show flat fees such as $0.99 for $10 to $100, $1.99 for $100.01 to $250, and no fee above $250.01 (with other costs like spreads still relevant).

Derivatives

- Nexo also supports futures trading, with fees shown as:

- Futures taker: about 0.06% down to 0.03%

- The platform includes high risk leverage features in some jurisdictions, with futures leverage up to 100x on perpetual contracts. This is not beginner territory and can amplify losses quickly.

How trading connects to the rest of the platform

- Nexo is built around an integrated model where trading, borrowing, and earning can interact.

- Example: users can trade, then move assets into earn products, or use assets as collateral for a credit line.

Who is Nexo designed for?

Nexo is built for a wide range of users, but it fits best when someone wants more than basic buy and sell.

Beginner friendly

- The mobile app is designed to make common actions simple, like adding funds, viewing a portfolio, and moving between trade, earn, and borrow features.

- Onboarding is straightforward for users who mainly want to buy major coins and hold.

Active users

- The platform offers 1,500 plus pairs, tiered trading fees, and extra tools like demo trading in some areas.

- Users who regularly swap assets or want to manage a portfolio from one dashboard tend to get more value.

More advanced users

- Nexo’s borrowing tools, booster style leverage products, and futures features can suit experienced users who understand collateral, loan to value, and liquidation risk.

- The loyalty tier structure can also appeal to higher balance users, but it adds complexity and introduces NEXO token exposure.

Quick snapshot of how Nexo works

| What you want to do | How it works on Nexo | Numbers to know |

|---|---|---|

| Trade crypto | Spot trading and swaps inside the platform | 100 plus cryptos, 1,500 plus pairs, spot fees roughly 0.20% down to 0.04% maker and 0.20% down to 0.07% taker |

| Trade derivatives | Futures in supported regions | Futures fees are roughly 0.06% down to 0.03% taker, leverage up to 100x |

| Earn on holdings | Flexible and fixed term savings | Earn rates up to 14% flexible and up to 16% fixed term, with some assets higher depending on terms and tier |

| Borrow without selling | Crypto collateralised credit lines | Borrowing APR from 18.9% down to 2.9%, affected by loan to value and loyalty tier |

| Spend crypto or fiat | Nexo Card with debit mode and credit mode | Cashback up to 2% in NEXO in credit mode, free ATM withdrawals up to €2,000 per month for Platinum tier, then 2% |

Nexo overview – crypto exchange key facts

| Category | Our assessment |

|---|---|

| Availability | Available to UK users and operates across 150+ jurisdictions globally. Product access varies by location, and some features are restricted in major markets such as the US, reflecting a compliance-first rollout rather than full global parity. |

| Exchange type | Centralised (CeFi) platform combining an exchange, crypto-backed lending, earn products, leverage tools, and a payment card within a single ecosystem. |

| Regulatory and registration status | Operates under a multi-jurisdictional licensing and registration model, including DFPI (California), ASIC (Australia), OAM (Italy), FNTT (Lithuania), and FSA (Seychelles), with additional registrations in Poland and Hong Kong. Not FCA-authorised in the UK, so this should be viewed as global compliance rather than UK regulation. |

| Custody model | Fully custodial. Client assets are held on platform rather than in user-controlled wallets. Nexo has confirmed it is discontinuing its self-custody wallet after 2026, reinforcing a long-term managed custody model. |

| Investor protection | No statutory investor protection. Crypto assets are not covered by UK schemes such as the FSCS. Asset protection is positioned through institutional custody and insurance partnerships, not government-backed guarantees. |

| Supported cryptocurrencies | 100+ cryptocurrencies available for trading and 1,500+ trading pairs. Borrowing and collateral support spans 90+ cryptocurrencies. |

| Trading types | Spot trading, swap-based trading, and futures. Futures markets cover 100+ perpetual contracts with leverage available in supported regions. Instant swaps prioritise convenience over execution control. |

| Fiat on- and off-ramps | Supports GBP, EUR, and USD for deposits, withdrawals, earning, and card spending. Fiat balances are held internally as GBPx, EURx, and USDx at a 1:1 value. |

| Trading fees | Spot trading uses a maker–taker model ranging from 0.20% to 0.04% (maker) and 0.20% to 0.07% (taker) based on volume and tier. Swap transactions follow flat fees ($0.99 to $1.99 on smaller trades), but spreads still apply and can be the main cost. |

| Deposit and withdrawal fees | Crypto withdrawals are typically blockchain fee only, with free withdrawals on networks like Solana, Polygon, and Arbitrum, and higher allowances at upper loyalty tiers. Fiat withdrawals are fixed-fee and comparatively expensive: £5 FPS or £25 SWIFT (GBP), €5 SEPA or €25 SWIFT (EUR), $10 ACH or $25 SWIFT (USD). Minimum crypto withdrawals apply, including 0.0002 BTC and 0.006 ETH. |

| Security features | Strong account-level security including email and SMS verification, authenticator app support, and biometric login on mobile. Credit products use strict over-collateralisation, up to 6.6x collateral coverage. Infrastructure runs on AWS with Cloudflare protection. Custody partners include Fireblocks and Ledger Vault, with transaction monitoring supported by Chainalysis. |

| Mobile app and web platform | Full-featured web and mobile platforms (iOS, Android, Huawei). The mobile app is polished and portfolio-centric, with app store ratings around 4.2 on Google Play and 4.0 on Apple App Store. |

| Ease of use | Beginner-friendly for buying, earning, and basic borrowing, but intermediate to advanced for credit lines, loyalty tier optimisation, fixed-term earn products, futures, and leverage tools such as Booster. |

What assets and markets are available on Nexo?

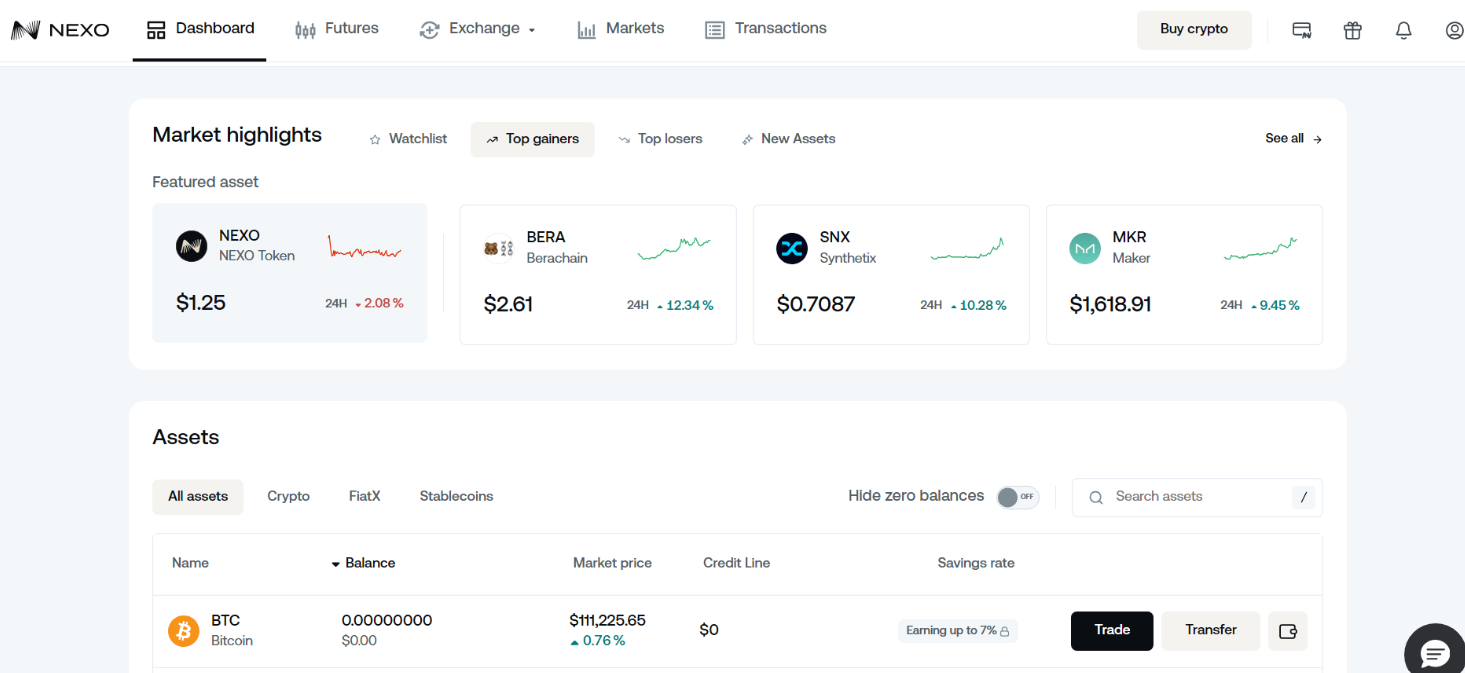

Nexo offers access to 100 plus cryptocurrencies and 1,500 plus trading pairs, covering major coins, large cap altcoins, and key stablecoins, with spot trading and perpetual futures available in supported regions.

It also supports GBP, EUR, and USD pairs for core services, with market access and leverage features varying by jurisdiction.

Number and range of supported cryptocurrencies

For UK users, Nexo’s market coverage is broad for a multi product CeFi platform:

- 100 plus cryptocurrencies for trading

- 1,500 plus crypto trading pairs on the exchange

- Support across major networks and assets, including BTC, ETH, BNB, SOL, plus stablecoins such as USDT and USDC, and popular large cap altcoins like ADA, DOT, LINK, DOGE, TON

Nexo’s asset depth tends to favour established coins and high demand tokens, rather than being a pure long tail altcoin venue.

Spot markets

Nexo supports spot trading through its exchange and in app swap functionality:

- Spot trading is available across 100 plus assets and 1,500 plus pairs

- 0.20% to 0.04% maker

- 0.20% to 0.07% taker

- The platform also shows swap style fees in some contexts:

- Orders $10 to $100: $0.99

- Orders $100.01 to $250: $1.99

- Orders above $250.01: no fee

- This is not the same as a traditional spot fee schedule, so UK users should treat it as an additional trading path where spreads still matter.

Derivatives and perpetuals

Nexo offers derivatives in the form of futures in supported locations:

- Futures trading alongside spot trading

- Fee range shown for futures includes:

- 0.06% to 0.03% taker

- 100 plus perpetual contracts and leverage up to 100x in supported regions

For most UK readers, the key point is that futures are available, but they are higher risk and may be subject to local eligibility rules and product restrictions.

Stablecoin and fiat pairs

Nexo supports both stablecoin markets and fiat linked balances:

- Stablecoins include USDT and USDC

- Fiat support for core services includes GBP, EUR, and USD

- Nexo uses internal fiat representations such as GBPx, EURx, USDx, shown as 1:1 with the underlying fiat amount

- This matters for market coverage because it supports a clearer on ramp and off ramp workflow and makes it easier to move between fiat style balances and crypto positions inside the platform.

Liquidity depth and market coverage

Nexo positions its exchange as a high liquidity venue by aggregating liquidity:

- The exchange is described as using an aggregation approach that can support swaps up to $3 million in value

- Market depth and execution quality can still vary by pair, with the most consistent liquidity typically found in:

- BTC and ETH pairs

- High volume stablecoin pairs such as USDT and USDC

- Large cap altcoins that trade actively on most major venues

Supported assets beyond trading

Nexo’s “assets and markets” coverage also includes eligibility for other products, which can matter for users choosing it as an all in one platform:

- Borrowing collateral accepted across 90 plus cryptocurrencies, the ability to borrow against 900 plus assets (product dependent)

- Earn products support for 38 plus interest-bearing cryptocurrencies in one section, and “over 60 earning assets” in another, with the broad programme described as 40 crypto and fiat currencies available for earning interest

Because these numbers vary by product type and jurisdiction, the most accurate way to frame it is that Nexo has large market coverage across trading, earn, and borrowing, but exact availability depends on where the user is based and which product they are using.

How good is the trading experience and toolset on Nexo?

Nexo offers a smooth, mobile first trading experience that makes it easy to move between buying and selling crypto, earning yield, and borrowing against collateral in one app. The toolset is strong for beginners and everyday users, but it is less specialised than a pro exchange, with fewer confirmed advanced execution and API style features.

Web and mobile platform usability

Nexo’s biggest strength is how it bundles multiple crypto actions into a single, clean interface.

- Mobile app first design: the app is intuitive, with real time portfolio insights and quick access to core services in a few taps.

- App availability: iOS, Android, and Huawei are supported.

- App ratings: 4.2 on Google Play and 4.0 on the Apple App Store.

- Navigation and flows: funding and account actions are surfaced prominently, and most features sit one or two taps from the main dashboard. This matters because Nexo is not just a trading app. Users regularly switch between exchange, earn, card, and credit line features.

Web access is also available and mirrors the same integrated layout, but the mobile experience is the more polished entry point.

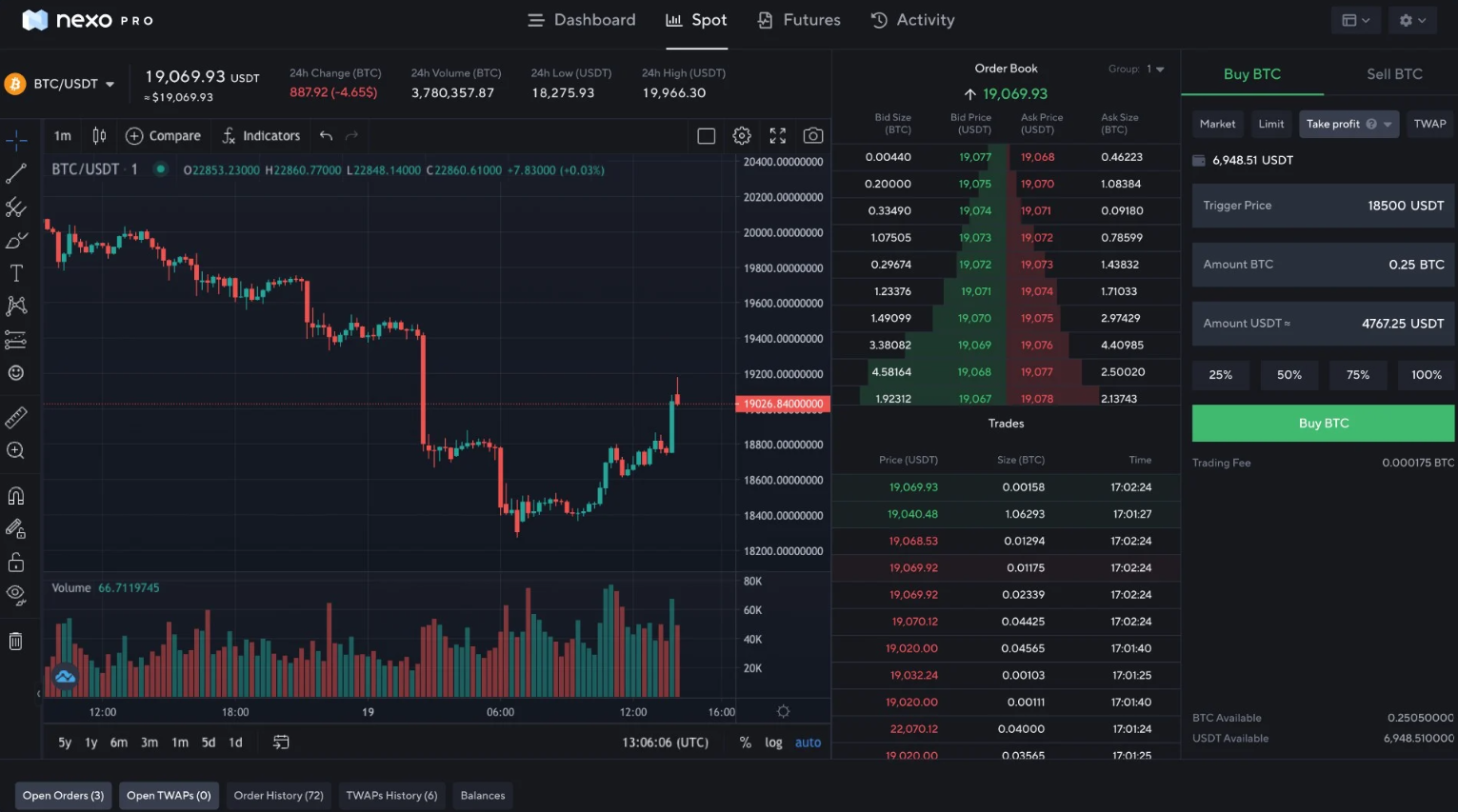

Order types available

- Nexo offers spot trading and futures trading in supported regions.

- It also supports swap style trading, where the user selects an asset and exchanges it instantly without needing an order book interface.

- A maker taker fee model, which typically implies an order book style exchange environment for at least some trading routes.

Charting tools and indicators

- Nexo focuses on an easy to understand portfolio view, with real time insights surfaced within the app.

- It offers a demo trading mode for strategy testing in supported areas, which suggests a more advanced trading interface exists for eligible users.

If charting quality is a top priority, a dedicated pro exchange or a TradingView integrated platform is usually a stronger fit. Nexo’s advantage is the integrated wealth view rather than technical analysis depth.

Advanced tools such as APIs or automation

Nexo has several advanced trading adjacent tools, but they are more product driven than developer driven.

Advanced tools

- Demo trading: lets users test strategies without using real funds, where available.

- Collateral swap: allows users to swap the crypto used as collateral for an existing credit line. This is a practical risk management tool for borrowers because it can help users reposition collateral when market conditions change.

- Nexo Booster: a leverage style product that lets users increase exposure using borrowing mechanics, with leverage up to 3x and a fee schedule tied to loan to value.

- Dual Investment: a yield and execution style product where users commit to buying or selling at a pre set price, while earning enhanced yield until settlement.

So, Nexo has advanced features, but they are packaged as in app products rather than open tooling for systematic trading.

Performance and reliability

Nexo positions itself as a premium and resilient platform:

- Operating history dating back to 2018 and surviving multiple market cycles is a positive signal in a sector where many yield focused platforms failed.

- Infrastructure and security partners include Amazon Web Services and Cloudflare for platform resilience, plus custody and security providers such as Fireblocks and Ledger Vault.

- The exchange model is described as aggregating liquidity and supporting large swaps, with transaction sizing up to $3 million in some contexts.

- User protections within the platform include multi step verification and layered authentication, which reduces account takeover risk but can add friction to fast trading.

Where reliability can be affected

- Some features vary by jurisdiction, so UK users may see a different toolset than users elsewhere.

- The platform’s most complex features, such as futures and leverage products, naturally increase risk and require more active monitoring regardless of platform stability.

Trading tools summary

| Area | What Nexo does well | Where it is weaker |

|---|---|---|

| Usability | Clean mobile experience, integrated trading plus earn and borrow | More complex products add learning curve |

| Trading access | Spot, swaps, and futures in supported regions | Not positioned as a pure pro execution venue |

| Trading tools | Demo mode, collateral swap, Dual Investment, Booster | No confirmed API or advanced automation tooling |

| Analysis | Portfolio first visibility | Charting and indicators not clearly detailed |

| Reliability | Mature platform history, major infrastructure and custody partners | Tool availability depends on jurisdiction |

TLDR: Nexo delivers a polished, integrated trading experience that is easy to use and feature rich for everyday crypto management. The toolset becomes less compelling for highly active traders who need deep charting, advanced order controls, or API based execution.

How competitive are Nexo’s fees and pricing?

Nexo’s pricing is competitive when the platform is used as an integrated ecosystem rather than a simple buy-and-sell exchange.

Trading fees are in line with major centralised exchanges, crypto withdrawals can be inexpensive when using supported networks, and borrowing rates are attractive at low loan-to-value for higher loyalty tiers.

The main downside is complexity: costs are spread across trading fees, swap pricing, spreads, fiat transfer charges, card FX markups, and loyalty tier conditions.

Nexo fees at a glance

| Fee area | What Nexo charges | What it means in practice |

|---|---|---|

| Spot trading fees | 0.20% to 0.04% maker and 0.20% to 0.07% taker (volume based) | Competitive for a mainstream exchange, especially at higher volumes or higher loyalty tiers. Not always the cheapest option for pure spot trading compared with pro-only platforms. |

| Swap transaction fees | $0.99 ($10–$100), $1.99 ($100.01–$250), $0 above $250.01 | Simple pricing for quick conversions, but the spread often represents the real cost on instant swaps. |

| Futures trading fees | 0.06% to 0.03% taker | In line with large exchanges for derivatives trading, where available. |

| Spread costs | Embedded in quoted prices | Most noticeable on small trades, low-liquidity pairs, and instant swaps. |

| Crypto withdrawals | Blockchain fee only, with free withdrawals on selected networks (e.g. Solana, Polygon, Arbitrum) | Very cost-effective if you stay within monthly free limits and use supported networks. |

| Fiat withdrawals | £5 FPS / £25 SWIFT (GBP) €5 SEPA / €25 SWIFT (EUR) $10 ACH / $25 SWIFT (USD) | Transparent but expensive for frequent cash-outs, especially via SWIFT. |

| Card FX & ATM withdrawals | FX: 0.2% (EEA/UK/CH), 2% elsewhere + 0.5% weekends ATM: free up to €2,000/month (Platinum), then 2% (min €1.99) | Reasonable for occasional spending, less attractive for heavy travel or cash use. |

| Borrowing costs | 2.9% to 18.9% APR, based on loyalty tier and LTV | Very competitive at low LTV for Platinum users, expensive at higher LTVs or lower tiers. |

| Booster fees | 1% (<50% LTV), 2% (50–60%), 3% (60%+) + loan interest | Leverage product pricing includes both a one-off fee and ongoing interest. |

Trading fees

Nexo uses two pricing paths depending on how a trade is executed.

Exchange (maker–taker) pricing

- Maker: 0.20% to 0.04%

- Taker: 0.20% to 0.07%

This structure rewards higher trading volumes and liquidity-adding orders, making it suitable for active traders who use the order book rather than instant swaps.

Swap pricing

- $0.99 for trades between $10–$100

- $1.99 for trades between $100.01–$250

- No explicit fee above $250.01

Swap pricing is convenient but not always the cheapest route, as execution prices include a spread that can outweigh the fixed fee.

Spread costs and pricing transparency

Nexo clearly discloses that spreads are embedded in pricing, particularly on instant conversions. In practice, spreads are most noticeable on:

- Smaller trade sizes

- Less liquid trading pairs

- Fast swap routes rather than order-book trades

Comparing the quoted price against a live market benchmark before confirming a swap gives a realistic view of the total cost.

Deposit fees

- Crypto deposits: Free from Nexo’s side, with standard network fees paid when sending from an external wallet or exchange.

- Fiat deposits: Supported through bank transfers and card purchases. Any applicable costs are shown in-app at the time of deposit, with card fees dependent on the issuing bank.

Withdrawal fees

Crypto withdrawals

- Charged at blockchain fee level

- Free withdrawals on selected networks, including Solana, Polygon, and Arbitrum

- Platinum tier users receive additional free withdrawal allowances

Minimum withdrawals

- 0.0002 BTC

- 0.006 ETH

These minimums are typical for custodial platforms but limit flexibility for small balances.

Fiat withdrawals

- GBP: £5 (FPS), £25 (SWIFT)

- EUR: €5 (SEPA), €25 (SWIFT)

- USD: $10 (ACH), $25 (SWIFT)

This is where Nexo is least competitive for UK users compared with exchanges that prioritise low-cost domestic bank transfers.

Indirect costs to watch

Nexo’s true cost profile depends on how the platform is used.

Key considerations include:

- Loyalty tier dependence: Best rates and withdrawal perks require holding NEXO tokens, adding price volatility risk.

- Swap spreads: Fixed swap fees do not guarantee cheap execution.

- Card FX markups: 0.2% within EEA/UK/CH, 2% elsewhere, plus a 0.5% weekend premium.

- Leverage costs: Booster fees plus interest and liquidation risk.

- Fiat transfer fees: Especially high when SWIFT is used.

TLDR: Nexo’s fees are competitive for users who trade at scale, manage withdrawals strategically, and take advantage of supported networks and loyalty benefits. Costs rise for frequent fiat withdrawals, small instant swaps, or users who prefer simple, low-fee cash-outs without tier conditions.

How secure is Nexo and how are assets held?

Nexo operates a fully custodial, centralised security model built around institutional-grade custody, layered account protection, and enterprise infrastructure partners. Assets are held on platform rather than in user-controlled wallets, which enables seamless trading, earning, borrowing, and card spending, but also means users rely on Nexo’s operational controls, counterparty management, and risk framework.

Custody model

Nexo uses a custodial custody structure designed for scale and integration across its products:

- Client assets are held on platform and managed through Nexo’s custody architecture.

- Custody is provided in partnership with Fireblocks and Ledger Vault, two of the most widely used institutional custody providers in the crypto industry.

- Nexo has confirmed plans to discontinue its self-custody wallet after 2026, reinforcing that its long-term model is focused on managed custody rather than user-held private keys.

For UK users, this approach prioritises convenience and capital efficiency. Funds can move instantly between trading, savings, credit lines, and the Nexo Card without external transfers. The trade-off is clear: users trust Nexo to safeguard assets, manage liquidity, and remain solvent.

Cold storage and asset segregation

Nexo does not publish a fixed hot-to-cold storage ratio. Instead, it positions its asset protection around institutional custody workflows rather than self-managed cold wallets.

What is clear from how the platform operates:

- Custody is handled through Ledger Vault and Fireblocks, which use secure key management, MPC technology, and controlled access policies.

- Asset protection is framed through custody and insurance partnerships rather than a single, platform-owned cold storage guarantee.

This model aligns with how large CeFi platforms typically operate, but it means security assurances come from third-party custodians rather than a published internal cold storage percentage.

Account-level security controls

Nexo applies multiple layers of user security across web and mobile access.

Authentication and access

- Mandatory email confirmations and SMS verification

- Authenticator app support for two-factor authentication

- Biometric authentication on supported mobile devices

These controls significantly reduce the risk of unauthorised access. The trade-off is added friction for frequent withdrawals or rapid account actions, which active users may notice.

Transaction controls

- Withdrawal behaviour is influenced by loyalty tier, free withdrawal allowances, and minimum withdrawal thresholds such as 0.0002 BTC and 0.006 ETH.

- Advanced features such as withdrawal address whitelisting or time-locked withdrawals are not positioned as core selling points, so users who require those controls should verify availability inside their account settings.

Infrastructure and operational security

Nexo’s security stack extends beyond custody into infrastructure resilience and transaction monitoring.

Infrastructure

- Platform infrastructure runs on Amazon Web Services

- Network protection and traffic security are supported by Cloudflare

Monitoring and compliance tooling

- Nexo works with Chainalysis, supporting transaction monitoring, risk analysis, and compliance-related controls.

This combination is standard among large financial and crypto platforms and supports uptime, scalability, and abuse detection.

Insurance structure and coverage limits

Nexo does not provide direct, user-level insurance comparable to bank deposit protection.

Instead:

- Asset protection is through custody and insurance partnerships involving Lloyd’s of London and Arch Insurance, alongside custodians such as Fireblocks and Ledger Vault.

- Coverage terms, exclusions, and event-specific protections are not presented as blanket guarantees.

For UK users, it is important to understand that crypto assets held on Nexo are not protected by statutory schemes such as the FSCS.

Track record and operating history

Nexo has operated continuously since 2018, navigating multiple market cycles including the 2022–2023 crypto credit collapse that saw competitors like Celsius and BlockFi fail.

While longevity alone is not a guarantee of safety, surviving prolonged stress periods is a meaningful trust signal in the CeFi lending sector.

Business model risks to understand

Nexo’s security must be assessed alongside how the platform generates returns and manages risk.

Key considerations include:

- Centralisation risk: users do not control private keys and depend on Nexo’s custody and governance.

- Rehypothecation: deposited assets may be reused for lending, collateralisation, or other business activities, similar to traditional banking models.

- Lending and liquidation risk: earn products and credit lines rely on over-collateralisation and automated liquidation mechanisms, which can be stressed during sharp market moves.

- Leverage exposure: products such as Credit Mode card spending and Nexo Booster amplify both gains and losses through loan-to-value mechanics.

Security summary

| Area | What Nexo provides | What to consider |

|---|---|---|

| Custody | Institutional custody via Fireblocks and Ledger Vault | Assets are not self-custodied |

| Account security | 2FA, email and SMS checks, biometric login | Extra friction for frequent actions |

| Infrastructure | AWS hosting and Cloudflare protection | Extreme volatility can still impact services |

| Insurance | Partner-based coverage through custodians and insurers | No direct user insurance or FSCS protection |

| Risk management | Over-collateralisation and monitoring | Rehypothecation and CeFi risks remain |

TLDR: Nexo’s security framework is robust for a custodial crypto wealth platform, combining institutional custody, enterprise infrastructure, and layered account protection. The primary risks are structural rather than technical, centred on centralisation, rehypothecation, and reliance on Nexo’s risk management during periods of market stress.

How do deposits and withdrawals work on Nexo?

Nexo offers a smooth, app-led funding experience for UK users, with support for fiat and crypto deposits, multiple banking rails, and network-based crypto withdrawals. The process is clearly structured inside the platform, though costs and limits vary by withdrawal method and loyalty tier.

Fiat on-ramp and off-ramp support

Nexo supports three core fiat currencies across deposits, withdrawals, and in-app services:

- GBP

- EUR

- USD

Fiat balances appear on the platform as GBPx, EURx, and USDx, each tracked at a 1:1 value against the underlying currency. These balances can be used across trading, earn products, borrowing, and card spending.

Fiat withdrawals

Fiat withdrawals are clearly priced by transfer rail:

GBP

- £5 via Faster Payments (FPS)

- £25 via SWIFT

EUR

- €5 via SEPA

- €25 via SWIFT

USD

- $10 via ACH

- $25 via SWIFT

This fee structure is transparent and predictable, but it favours users who withdraw less frequently.

Regular cash-outs, especially via SWIFT, can become expensive over time.

Fiat deposits

UK users can fund accounts directly from the app using supported on-ramp methods, including bank transfers and card-based purchases. Available methods and any card processing costs are shown at the point of deposit inside the funding screen, which acts as the source of truth for each account.

Crypto deposits and withdrawals

Crypto transfers follow a standard custodial exchange workflow and are well integrated into the Nexo dashboard.

Depositing crypto

- Select the asset in the app

- Generate a unique deposit address

- Send funds from an external wallet or another exchange

Nexo supports 70+ cryptocurrencies for deposits and withdrawals, covering major networks and widely used assets.

Withdrawing crypto

- Choose the asset

- Select the preferred network where applicable

- Enter the destination wallet address and confirm

Crypto withdrawals are generally charged at blockchain fee level only, with added benefits:

- Free withdrawals on selected networks, including Solana, Polygon, and Arbitrum

- Additional free withdrawals for higher loyalty tiers, including Platinum

Minimum withdrawal amounts

Nexo enforces minimum crypto withdrawal thresholds, including:

- 0.0002 BTC

- 0.006 ETH

These minimums are standard for custodial platforms but can limit flexibility for very small balances.

Processing times

Crypto transfers

- Processing time depends on the blockchain network and confirmation speed

- Faster, low-fee networks are supported and encouraged through free withdrawal allowances

Fiat withdrawals

- FPS is typically the fastest option for GBP

- SEPA is used for EUR transfers

- SWIFT is slower and carries higher fees

Transaction status and progress are shown in-app, with confirmation notifications once processing is complete.

Limits and thresholds

Several limits affect how deposits and withdrawals work in practice:

- A $5,000 portfolio balance is a key threshold for certain features and loyalty tier benefits

- Minimum crypto withdrawals apply, as listed above

- Loyalty tier influences:

- Number of free crypto withdrawals

- ATM withdrawal allowances

- Overall cost efficiency for frequent users

Nexo Card cash access

- Free ATM withdrawals up to €2,000 per month for Platinum tier

- After the limit: 2% fee, minimum €1.99

Reliability and transparency

Nexo is clear about withdrawal pricing, minimums, and tier-based benefits, which makes costs predictable once users understand how the loyalty system works.

What works well

- Clearly listed fiat withdrawal fees across FPS, SEPA, ACH, and SWIFT

- Network-specific crypto withdrawal rules, including free options

- Visible minimum withdrawal amounts for major assets

What to watch

- Free withdrawals reset monthly and depend on loyalty tier

- Fiat withdrawals, especially via SWIFT, are costly if used often

- Swap-based funding and conversions can include spread costs even when transfer fees are low

Quick summary

| Flow | What UK users can do | Key details |

|---|---|---|

| Deposit fiat | Fund via in-app GBP on-ramps | Methods shown at deposit stage |

| Withdraw fiat | Bank transfer cash-outs | £5 FPS, £25 SWIFT (GBP) |

| Deposit crypto | Send from external wallet | 70+ supported assets |

| Withdraw crypto | Choose asset and network | Free withdrawals on selected networks, tier-based |

| Card cash access | ATM withdrawals | €2,000 free monthly for Platinum |

TLDR: Nexo’s deposit and withdrawal system is flexible, well integrated, and transparent on costs. It works best for users who plan withdrawals carefully and take advantage of supported networks and loyalty benefits. The main trade-offs are tier-dependent limits and higher fiat withdrawal costs for frequent cash-outs.

How trustworthy is Nexo in terms of regulation and support?

Nexo operates as a globally distributed crypto wealth platform with a compliance-first structure built around regional registrations, jurisdiction-specific restrictions, and always-on customer support. Trust here comes less from a single headline licence and more from how Nexo adapts its product set to local rules, maintains transparency around risk, and supports users in real time.

Regulatory and registration status

Nexo does not operate under one universal crypto licence. Instead, it follows a multi-jurisdictional registration and compliance model, aligning its services with local regulatory requirements in the markets it serves.

Based on disclosed information, Nexo holds registrations or licences with regulators including:

- California Department of Financial Protection and Innovation (United States)

- Australian Securities and Investments Commission (Australia)

- Financial Services Authority of Seychelles

- Registrations in parts of Europe, including Italy, Lithuania, and Poland through local financial or registry authorities

Rather than forcing a single global product, Nexo restricts or disables specific features in jurisdictions where rules are tighter. Interest-bearing products and leverage tools, for example, are not universally available, and access varies by country.

For UK users, this approach signals a platform that prioritises regulatory alignment over aggressive expansion. At the same time, it is important to understand that Nexo is not a UK-authorised bank or investment firm, and crypto assets held on the platform are not protected by the FSCS.

Jurisdictional transparency

Nexo is clear that availability depends on location and regulatory context.

Key transparency points:

- The platform publicly states it operates in 150+ jurisdictions

- Product availability can differ even within supported countries

- Certain services are blocked entirely in major markets such as the United States

In practice, this is reflected directly in the app. Features that are not permitted in a user’s region are not shown or are disabled, reducing the risk of users accidentally accessing non-compliant products.

This jurisdiction-first design is a positive signal for trust, even if it results in a less uniform global offering.

Customer support channels and responsiveness

Nexo places noticeable emphasis on live support and accessibility, which stands out compared with many crypto platforms that rely heavily on ticket-only systems.

Support channels available

- 24/7 in-app live chat

- AI-powered support assistant for instant queries

- Escalation to human agents when needed

- Email-based support for account and compliance issues

- Comprehensive online Help Centre with detailed product documentation

In live use, support responses are typically quick, particularly via chat, and account-level issues such as verification errors or duplicate account problems are handled directly rather than pushed into long ticket queues.

For higher loyalty tiers, Nexo also offers prioritised or personalised client care, reinforcing its positioning as a premium crypto wealth platform rather than a low-touch exchange.

Clarity of risk warnings and disclosures

Nexo is explicit about the structural risks of its platform and products, especially compared with how crypto lenders operated prior to the 2022 CeFi collapses.

Key disclosures include:

- Assets are held on a custodial basis, not in user-controlled wallets

- Interest and yield products rely on lending and rehypothecation

- Borrowing, card credit mode, and leverage tools depend on loan-to-value thresholds and may trigger liquidation during sharp market moves

- Crypto holdings are not covered by statutory protection schemes such as FSCS

These risks are presented in platform documentation and terms rather than buried in marketing copy. While that does not eliminate risk, it does allow users to make informed decisions about how and whether to use features like Earn, Credit Lines, or Booster.

Trust summary

| Area | Assessment |

|---|---|

| Regulatory posture | Multi-jurisdictional registrations with location-based restrictions |

| UK suitability | Available, but not FCA-authorised and not FSCS-protected |

| Transparency | Clear about jurisdictional limits and product availability |

| Customer support | 24/7 live chat, fast escalation, strong Help Centre |

| Risk disclosures | Explicit about custody, rehypothecation, and liquidation risk |

TLDR: Nexo earns a strong trust score by combining regulatory adaptability, visible compliance boundaries, and responsive customer support. It does not offer the regulatory certainty of a UK-authorised financial institution, but within the crypto wealth category, it demonstrates above-average transparency, operational maturity, and user-facing support.

What are the pros and cons of using Nexo?

Pros

- All in one crypto wealth platform: Trading, earning, borrowing, card spending, and leverage tools sit inside a single account, reducing the need to move funds between multiple platforms.

- Strong earning and borrowing mechanics: Flexible and fixed term earn products can reach up to 15 to 16 percent APY depending on asset and loyalty tier, while crypto backed credit lines can drop as low as 2.9 percent APR at low loan to value for Platinum users.

- Institutional grade custody and infrastructure: Assets are held using established custody and security partners, with layered account protection and enterprise level infrastructure supporting platform stability.

- Competitive trading fees for higher tiers and active users: Maker and taker fees become more attractive with volume and loyalty tier benefits, and free crypto withdrawals on selected networks can materially reduce costs.

- High quality mobile app and live support: The app is fast, intuitive, and feature complete, with 24 7 live chat support that resolves most account level issues without long ticket queues.

Cons

- Custodial model with rehypothecation risk: Users do not control private keys, and deposited assets can be reused for lending or collateral purposes, increasing counterparty and platform risk.

- Complex fee structure: Costs can come from multiple sources including trading fees, swap spreads, fiat transfer charges, card FX markups, and tier dependent withdrawal limits.

- Loyalty tier dependency: Many of the best rates and perks require holding NEXO tokens, introducing token price volatility into what would otherwise be a neutral platform decision.

- Fiat withdrawals can be expensive: GBP, EUR, and USD cash outs via bank transfer carry fixed fees that are higher than many UK first exchanges, especially when SWIFT is required.

- Not fully available in all major markets: Certain products are restricted or unavailable in regions such as the United States, limiting global consistency for international users.

Who is Nexo best for?

- Crypto holders who want to earn and borrow without selling: Users looking to generate yield or unlock liquidity while keeping long term exposure to assets like BTC and ETH.

- Active users who value an integrated ecosystem: Traders and investors who prefer trading, earning, borrowing, and spending from one platform rather than managing multiple accounts.

- Higher balance users willing to engage with loyalty tiers: Portfolios large enough for Platinum tier benefits where lower borrowing rates and extra free withdrawals meaningfully improve value.

- Users comfortable with CeFi risk: Those who understand and accept custodial, lending, and liquidation risks in exchange for convenience and yield.

Who is Nexo not ideal for?

- Users who require strong UK style regulation or FSCS protection: Nexo is not a UK authorised bank or investment firm, and crypto assets are not covered by statutory protection schemes.

- Self custody focused long term holders: Investors who want full control of private keys and zero rehypothecation exposure will prefer hardware wallets or DeFi solutions.

- Cost sensitive users making frequent fiat withdrawals: Fixed bank transfer fees can add up quickly for users who cash out regularly.

- Beginners seeking simplicity above all else: The breadth of products, tier mechanics, and fee variables can feel overwhelming for first time crypto users.

- Users unwilling to hold platform tokens: Those who do not want exposure to NEXO tokens will miss out on many of the platform’s best rates and benefits.

How to get started with Nexo

Getting started on Nexo is straightforward, with most users able to move from signup to funding within a short session. The platform is fully custodial, so all actions take place inside the app or web dashboard.

1. Create an account

Begin by registering on Nexo using an email address or a supported single sign on option. During signup, users set login credentials and accept the platform terms, which outline custody, lending, and risk mechanics. Once the account is created, the main dashboard becomes accessible, showing wallets, balances, and available products.

2. Complete verification if required

Identity verification is mandatory before accessing full platform features.

- Verification is handled through a third party provider and typically involves:

- Uploading a government issued photo ID

- Completing a live selfie check

- Most verifications are completed within minutes, although additional checks can apply depending on jurisdiction and account activity.

Verification unlocks deposits, withdrawals, trading, and access to earning and borrowing features where permitted.

3. Deposit funds

Nexo supports both crypto and fiat funding.

Crypto deposits

- Select the asset in the wallet section

- Generate a deposit address

- Send funds from an external wallet or another exchange

- Supported assets include major cryptocurrencies such as BTC, ETH, and stablecoins, with dozens of deposit and withdrawal options available

Fiat deposits

- Supported core currencies include GBP, EUR, and USD

- Funding options vary by region and may include bank transfer and card based top ups

- Available methods and any applicable fees are shown directly in the in app funding screen for the user’s account

Once funds arrive, balances are reflected instantly for internal use, even if blockchain confirmations are still pending.

4. Place a trade or activate products

With funds available, users can immediately put capital to work.

Common next steps include:

- Trading crypto via spot or swap routes using the built in exchange

- Activating flexible or fixed term earn products on supported assets

- Opening a crypto backed credit line without a credit check

- Applying for the Nexo Card to enable spending or credit mode purchases

All actions are initiated from the dashboard, with clear previews showing fees, rates, and loan to value thresholds before confirmation.

5. Withdraw or secure assets

Users can exit or rebalance at any time, subject to minimums and tier limits.

Crypto withdrawals

- Select the asset and network

- Enter an external wallet address

- Confirm the transaction using multi factor authentication

- Some networks offer free withdrawals, while others incur standard blockchain fees

Fiat withdrawals

- Withdraw to a linked bank account in GBP, EUR, or USD

- Fixed fees apply depending on the transfer rail used

Assets that remain on the platform are secured under Nexo’s custodial model with account level security controls and institutional custody partners.

TLDR: Nexo’s onboarding flow is fast and intuitive, with verification, funding, trading, and withdrawals all handled inside a single interface. The main decision for new users is not how to get started, but which combination of trading, earning, borrowing, or spending features best fits their risk tolerance and usage style.

How we tested and methodology

Each crypto exchange reviewed on this site is assessed using a standardised six category scoring framework, with every category scored out of 5 to ensure consistent, side by side comparisons across platforms.

The six scoring categories are:

- Supported assets and markets: Breadth of cryptocurrencies, trading pairs, fiat support, and availability of products such as spot, derivatives, earn, and borrowing.

- Trading experience and tools: Platform usability, order types, execution quality, mobile and web performance, and access to advanced features where relevant.

- Fees and pricing: Trading fees, spreads, withdrawal costs, card charges, borrowing rates, and any indirect or tier based pricing mechanics.

- Security and custody: Custody model, account level protections, infrastructure resilience, custody partners, and disclosed risk controls.

- Deposits and withdrawals: Fiat and crypto funding options, processing reliability, transparency of fees, limits, and minimums.

- Trust, regulation, and support: Regulatory registrations, jurisdictional transparency, customer support availability, responsiveness, and clarity of risk disclosures.

Scores are based on hands on platform testing, real world fee analysis, review of published security and custody information, and direct usability checks across core user flows such as onboarding, funding, trading, and withdrawals.

This methodology is designed to reflect how each platform performs in practice, not just how it markets itself, with a focus on accuracy, consistency, and real user impact.

FAQs

Is Nexo safe and legit?

Nexo is a legitimate, long-running crypto wealth platform founded in 2018 and used by millions of users globally. It operates a custodial model with institutional custody partners and layered account security, but as with any CeFi platform, users remain exposed to centralisation and lending risk.

Is Nexo regulated in the UK?

Nexo is not authorised or regulated by the UK Financial Conduct Authority (FCA). It operates in the UK under a cross-border, jurisdiction-based compliance model, and crypto assets held on the platform are not protected by the FSCS.

Can I withdraw GBP from Nexo?

Yes, UK users can withdraw GBP from Nexo to a bank account. GBP withdrawals are available via Faster Payments (FPS) or SWIFT, with fixed fees depending on the transfer method.

How long does a Nexo withdrawal take?

GBP withdrawals via Faster Payments are typically processed faster than SWIFT transfers, which can take longer due to banking intermediaries. Crypto withdrawal times depend on the blockchain network used and current network conditions rather than Nexo alone.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.