MoonPay is a crypto on ramp and payment gateway designed for beginners and casual buyers, offering a simple checkout flow and fast purchases across convenient payment methods like bank transfer and cards, plus Apple Pay on supported devices.

Its main drawback is higher overall costs on instant payment methods and a light feature set, which may matter for frequent buyers, active traders, or anyone trying to minimise fees while needing stronger real time support.

What is MoonPay and how does it work?

MoonPay is a centralised crypto on ramp that lets UK users buy and sell cryptocurrency using familiar payment methods such as debit cards, credit cards, bank transfers, and Apple Pay. It is not a full crypto exchange, there is no order book, no advanced charting, and no derivatives trading.

Is MoonPay centralised or decentralised?

MoonPay is centralised. It operates as a regulated payments style service that sits between a fiat payment method and a crypto purchase, handling identity checks, fraud controls, and settlement before delivering crypto to a wallet address.

This differs from a decentralised exchange where trades happen directly on chain via smart contracts and users connect a wallet to swap tokens.

What is the core trading model?

MoonPay’s model is instant buy and sell, plus simple swaps, rather than traditional exchange trading.

It mainly supports:

- Instant purchases: buy BTC, ETH, USDC and other supported assets using card, bank transfer, and Apple Pay where available

- Sell to fiat: sell supported assets and withdraw to a bank account, availability can vary by asset and region

- Swaps: crypto to crypto conversion in a simplified flow, typically with network costs and any embedded spread shown at checkout

- Recurring buys: automated purchases for users who want a set schedule, this is closer to a savings plan than active trading

- NFT checkout and integrations: MoonPay is used inside many wallets and apps as a checkout layer

What MoonPay does not offer:

- Spot trading via an order book, limit orders, advanced order types

- Derivatives such as futures, options, or leveraged products

- Pro grade tools like depth charts, advanced analytics, or trading APIs aimed at active traders

Who is MoonPay designed for?

MoonPay is aimed at beginners and casual buyers who value speed and convenience over getting the lowest possible price.

It tends to work best for:

- First time buyers who want a straightforward checkout experience

- Users topping up a wallet quickly for a one off purchase

- People happy to pay more for card or Apple Pay convenience

- Users who prefer a simple interface instead of trading screens

It is usually not a first choice for:

- Active traders who need tight pricing, deep liquidity, and pro tools

- Frequent buyers who want to minimise fees over time

- Altcoin hunters who want the widest possible list of tokens in every region

- Anyone who needs fast human support during payment issues

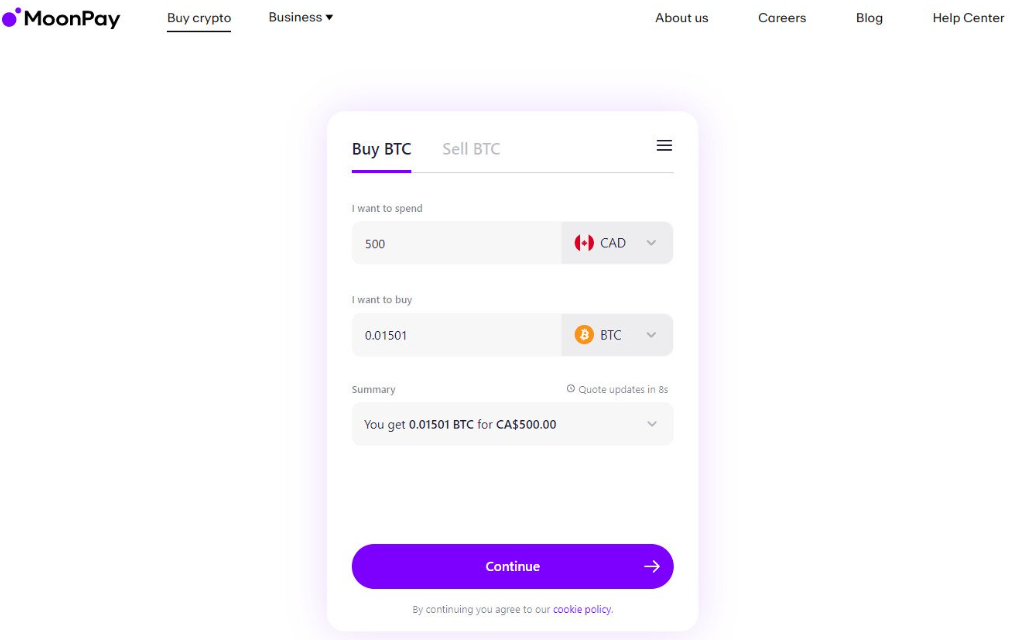

How MoonPay works in practice

| Step | What happens | What to watch for |

|---|---|---|

| Choose asset and amount | Select the crypto and enter a GBP amount | Supported coins can vary by region |

| Identity checks | Complete KYC, typically a photo ID and selfie | Extra checks can apply at higher limits |

| Pick payment method | Card, bank transfer, Apple Pay, and other methods depending on device and region | Fees differ a lot by method |

| Confirm full cost | MoonPay shows total cost before you pay | Instant methods can be expensive, small buys get hit by minimum fees |

| Receive crypto | Crypto is delivered to a wallet address, either one provided by the user or created in app | Double check address and network selection |

What MoonPay is, and what it is not

| Topic | MoonPay | A full crypto exchange |

|---|---|---|

| Primary job | Fast fiat to crypto checkout | Trading venue for spot markets |

| Pricing | Convenience first, fees can be higher on instant payments | Often lower for repeat trading, clearer maker taker models |

| Tools | Simple buy, sell, swap, recurring buys | Advanced charts, order books, multiple order types |

| Best user level | Beginner, casual | Beginner through advanced |

| Typical use case | Buy crypto in minutes, fund a wallet | Trade frequently, manage a portfolio, access more markets |

MoonPay overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | Available in 180 plus countries, including the UK, EU, US, Canada, and Australia. Some US states are excluded. |

| Exchange type (centralised or decentralised) | Centralised crypto on ramp and off ramp. Not a full crypto exchange. |

| Regulator or registration status | FCA registered in the UK for cryptoasset activities. Licensed or registered across multiple US states. Not FCA regulated as an investment firm. |

| Custody model (custodial or non custodial) | Primarily non custodial. Crypto can be sent directly to an external wallet. In app balances may temporarily hold funds during processing. |

| Investor protection (usually none) | No FSCS or SIPC protection. Crypto purchases are not covered by UK investor compensation schemes. |

| Supported cryptocurrencies | 80 to 170 plus cryptocurrencies depending on region. Major assets include BTC, ETH, SOL, USDC, and leading altcoins. |

| Trading types (spot, derivatives, margin) | Instant buy and sell, simple crypto to crypto swaps, recurring buys. No spot order books, margin, or derivatives. |

| Fiat on ramp and off ramp | Yes. Supports debit cards, credit cards, bank transfers, Apple Pay, Google Pay, and selected local methods. |

| Trading fees | No maker taker fees. Card and instant payments typically 3.5 to 4.5 percent. Bank transfers around 1 percent. MoonPay Balance purchases can be fee free. |

| Deposit and withdrawal fees | Fiat deposits via bank transfer usually free or low cost. Crypto sales to GBP typically around 1 percent. Network fees apply to crypto transfers. |

| Security features | Mandatory KYC and AML checks, TLS encryption, AES 256 data encryption, SOC 2 Type 2, ISO 27001 and ISO 27018 certifications, PCI DSS compliance, fraud monitoring, optional 2FA. |

| Mobile app and web platform | iOS and Android mobile apps plus web based checkout. No advanced trading interface. |

| Ease of use level | Very beginner friendly. Designed for fast checkout and simple crypto purchases rather than active trading. |

What assets and markets are available on MoonPay?

MoonPay supports a moderate range of cryptocurrencies focused on major assets rather than deep markets. It offers instant buy and sell access to popular coins and stablecoins but does not provide spot order books, derivatives, or advanced trading markets. Asset availability varies by region, with the UK seeing a narrower selection than full exchanges.

Number and range of supported cryptocurrencies

MoonPay typically supports 80 to 170+ cryptocurrencies, depending on jurisdiction, compliance rules, and partner integrations. In the UK and EU, coverage focuses on large cap and high demand assets rather than long tail tokens.

Commonly available assets include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Litecoin (LTC)

- XRP

- Cardano (ADA)

- Polygon (MATIC)

- Avalanche (AVAX)

Smaller DeFi and emerging tokens may be available through swaps or specific integrations but are not consistently supported across all regions.

Spot markets

MoonPay does not offer spot markets in the traditional exchange sense.

There is:

- No order book

- No limit or market orders

- No price depth or bid ask spread visibility

All purchases are executed via instant pricing, where MoonPay sources liquidity behind the scenes and presents a final quoted price at checkout.

Derivatives or perpetuals

MoonPay does not support derivatives, including:

- Futures

- Perpetual contracts

- Options

- Margin or leveraged trading

The platform is strictly designed for fiat to crypto access rather than speculative trading.

Stablecoin and fiat pairs

MoonPay supports several major stablecoins, most commonly:

- USDC

- USDT

- DAI in limited regions

Fiat on ramp and off ramp support includes GBP, EUR, USD, and other local currencies, with GBP bank transfers and card payments available for UK users. Stablecoins are usually paired indirectly via fiat purchases rather than traded against one another.

Liquidity depth and market coverage

Liquidity on MoonPay is aggregated, not native. Prices are sourced from external market makers and exchanges, meaning:

- Liquidity is generally reliable for major coins

- Large orders may see wider effective spreads

- Pricing can be less competitive during volatile periods

MoonPay’s coverage is strong for mainstream assets but limited for users seeking deep liquidity, tight pricing, or broad altcoin exposure.

TLDR: MoonPay delivers solid access to core cryptocurrencies and stablecoins but lacks true trading markets, derivatives, and broad altcoin coverage. It is suitable for simple purchases, not for users who want market depth or advanced asset access.

How good is the trading experience and toolset on MoonPay?

MoonPay delivers a smooth and beginner friendly purchase flow but offers very limited trading functionality. It is designed as a fiat to crypto on ramp, not a full exchange, which explains its strengths in usability and speed and its weaknesses in tools, order control, and analytics.

Web and mobile platform usability

MoonPay performs well on usability across both web and mobile. The interface is clean, modern, and focused on a single task: buying, selling, or swapping crypto quickly.

Key usability highlights:

- Web checkout loads quickly and works consistently across browsers

- Mobile apps on iOS and Android are highly optimised for one tap purchases

- Fees and final pricing are shown before confirmation, improving transparency

- Wallet address checks and network warnings reduce user error

From hands on testing, card and Apple Pay purchases typically completed within minutes, and the transaction status tracker reduced uncertainty during processing.

Order types available

MoonPay does not support traditional trading orders.

Available actions:

- Instant buy

- Instant sell

- Simple crypto to crypto swaps

- Recurring buys funded via MoonPay Balance

Unavailable features:

- Market or limit orders

- Stop loss or take profit orders

- Conditional or advanced order routing

All pricing is quoted upfront and executed instantly, meaning users have no control over entry price beyond accepting or rejecting the quoted rate.

Charting tools and indicators

MoonPay provides no native charting or technical analysis tools.

What is included:

- Basic price view at checkout

- Simple asset overview screens in app

What is missing:

- Candlestick charts

- Timeframe selection

- Indicators such as RSI, MACD, or moving averages

- Portfolio performance analytics

Users who want to analyse price action or track performance over time must rely on external tools or exchanges.

Advanced tools such as APIs or automation

MoonPay offers no advanced trading tools for retail users.

Not supported:

- Trading APIs

- Bots or automated strategies

- Algorithmic execution

- Advanced portfolio management

While MoonPay does provide developer APIs for business integrations and on ramp services, these are not relevant for individual traders.

Performance and reliability

In testing, MoonPay was generally reliable for small to medium sized transactions, particularly when using cards, Apple Pay, or MoonPay Balance.

Observed performance characteristics:

- High approval rates for supported payment methods

- Stable checkout flow even during volatile market periods

- Occasional delays during enhanced fraud or compliance checks

- Refunds and failed payments can take several days to resolve

Performance is acceptable for occasional use, but the lack of real time support increases friction when issues occur.

Trading experience summary

| Component | Assessment |

|---|---|

| Ease of execution | Very strong for instant buys and sells |

| Trading control | Extremely limited |

| Analytical tools | Essentially none |

| Advanced features | Not supported |

| Overall depth | Shallow compared with exchanges |

TLDR: MoonPay offers a frictionless buying experience, not a trading platform. It excels at speed, simplicity, and payment flexibility but falls short in every area that matters to active or cost conscious traders. For users who want charts, order control, and lower long term costs, platforms like eToro or Coinbase provide a far more complete trading experience. MoonPay is best viewed as a convenience layer rather than a place to actively trade crypto.

How competitive are MoonPay’s fees and pricing?

MoonPay’s pricing is built around speed and convenience, not cost efficiency. There are no traditional trading fees because MoonPay is not an exchange, but users pay via percentage based transaction fees, embedded spreads, and minimum charges, which can add up quickly, especially on small or frequent purchases.

Trading fees structure

MoonPay does not use a maker taker model. Instead, it applies flat percentage based fees that vary by payment method and transaction type.

| Transaction type | Typical fee range | Notes |

|---|---|---|

| Debit and credit cards | ~3.5% to 4.5% | Minimum fee usually applies on small orders |

| Apple Pay and Google Pay | ~3.5% to 4.5% | Treated as instant card based payments |

| Bank transfer (UK Faster Payments) | ~1% to 1.5% | Slower but significantly cheaper |

| MoonPay Balance purchases | 0% MoonPay fee | Requires pre funding via bank transfer |

| Crypto to crypto swaps | 0% MoonPay fee | Network fees and spread still apply |

There are no discounts for volume and no loyalty pricing, which makes MoonPay less attractive for repeat buyers.

Spread costs

MoonPay applies an embedded spread in its quoted price. This spread is not itemised separately and can widen during periods of high volatility or low liquidity.

Key points:

- The final price is shown before confirmation, improving transparency

- Users cannot see the underlying market rate versus execution price

- Larger orders can experience a wider effective spread

In practice, this means the true cost is often higher than the headline percentage fee alone.

Deposit fees

| Deposit method | Fee |

|---|---|

| UK bank transfer | Usually free |

| Open Banking | Free |

| Card deposits | Included in transaction fee |

| Apple Pay and Google Pay | Included in transaction fee |

MoonPay does not charge a separate deposit fee, but card and instant methods bundle deposit and purchase costs together.

Withdrawal fees

| Withdrawal type | Fee |

|---|---|

| Crypto sale to GBP | ~1% |

| Crypto withdrawal to wallet | Network fee only |

| MoonPay Balance withdrawal | Free to original funding account |

Withdrawal costs are reasonable compared with other on ramps, though the sale fee still reduces overall value.

Minimum fees and indirect costs

MoonPay applies minimum transaction fees, typically around the equivalent of $3.99 to $4.50, depending on region and referral source. This disproportionately impacts small purchases.

Additional indirect costs include:

- Currency conversion markups on non GBP transactions

- Wider spreads during volatile market conditions

- Opportunity cost versus lower fee exchanges

Fee competitiveness summary

| Cost area | Assessment |

|---|---|

| Small purchases | Expensive due to minimum fees |

| Card and instant payments | High cost compared with rivals |

| Bank transfers | Reasonable but not market leading |

| Transparency | Clear checkout pricing, but hidden spread |

| Overall value | Below average for frequent users |

TLDR:

MoonPay is convenient but not cost competitive in 2026. It works well for one off purchases where speed matters, but frequent buyers will pay noticeably more than on platforms such as eToro or Coinbase, which offer lower effective fees, tighter pricing, and broader functionality.

For UK users focused on value rather than speed, MoonPay’s fees are acceptable only when using bank transfers or MoonPay Balance. For most other use cases, cheaper alternatives exist.

How secure is MoonPay and how are assets held?

MoonPay operates with a security model closer to a regulated payments provider than a traditional crypto exchange. It focuses on compliance, transaction security, and non custodial delivery, rather than holding large user balances long term.

Custody model

MoonPay is primarily non custodial.

- Crypto purchases are typically delivered directly to a user specified external wallet

- MoonPay does not operate a full custodial exchange wallet model like Coinbase or Binance

- Temporary in app balances can exist during processing or when using MoonPay Balance, but MoonPay does not act as a long term custodian of user crypto assets

This structure reduces exposure to large scale exchange custody risk but places more responsibility on users to manage their own wallets securely.

Cold storage and asset handling

MoonPay does not publicly disclose cold storage ratios because it is not designed to hold user crypto in pooled exchange wallets.

Key points:

- Assets are routed to external wallets rather than stored centrally

- MoonPay Balance represents fiat or tokenised balances, not traditional exchange custody

- For supported in app features such as swaps or staking products, custody mechanics depend on the underlying blockchain and partner infrastructure

Because MoonPay is an on ramp rather than a trading venue, cold storage disclosures are more limited than at full exchanges.

Account security controls

MoonPay applies standard fintech level account security controls rather than advanced exchange level protections.

Available protections include:

- Mandatory KYC and AML checks before transactions

- Two factor authentication (2FA) on supported accounts

- Encrypted sessions using TLS 1.2 or higher

- AES 256 encryption for stored personal data

- Device and transaction level fraud monitoring

Limitations:

- No withdrawal whitelists, as assets are usually sent out immediately

- No advanced account permissions or sub account controls

- Limited user side security customisation compared with pro exchanges

Compliance, audits, and certifications

MoonPay is FCA registered in the UK for cryptoasset activities, but it is not FCA regulated as an investment firm and does not offer FSCS protection.

Notable compliance and security standards include:

- SOC 2 Type II certification

- ISO 27001 and ISO 27018 certifications

- PCI DSS Level 1 compliance for card payments

- GDPR compliant data handling

These standards indicate strong internal controls around data security and payment processing, rather than guarantees around asset protection.

Incident history

As of 2026, MoonPay has not reported any major public hacks involving loss of customer crypto.

However:

- Payment delays, frozen transactions, and refund disputes are commonly cited by users

- Issues are usually linked to compliance checks, chargeback risk, or third party payment processors rather than security breaches

There is no public evidence of systemic wallet compromise, but operational friction during reviews remains a known risk.

Risk disclosures and limitations

Key risks users should understand:

- Crypto purchases are not protected by FSCS or SIPC

- MoonPay does not control the security of external wallets

- Errors in wallet address or network selection can result in irreversible loss

- Transactions may be delayed or reversed during enhanced fraud or compliance checks

- Support resolution can be slow if funds are temporarily locked

MoonPay clearly positions itself as a payments intermediary, not a crypto custodian or broker.

Security and custody summary

| Area | Assessment |

|---|---|

| Custody model | Non custodial delivery reduces platform risk |

| Account security | Solid but basic |

| Regulatory posture | FCA registered, not FCA regulated |

| Incident history | No major hacks reported |

| User responsibility | High |

TLDR:

MoonPay offers strong payment and data security, backed by recognised certifications and compliance standards. Its non custodial model reduces exposure to large scale exchange failures, but also shifts responsibility to the user.

It is suitable for occasional buyers who value compliance and simplicity, but it lacks the advanced account controls and explicit custody transparency expected by high value or institutional users.

How do deposits and withdrawals work on MoonPay?

MoonPay is built as a fiat on-ramp and off-ramp rather than a traditional exchange. Deposits and withdrawals are tightly integrated into the buy and sell flow, with clear pricing shown upfront, but flexibility depends heavily on payment method, region, and asset.

Fiat deposits (on-ramp support)

MoonPay supports a wide range of fiat payment methods, making it easy to fund crypto purchases without using a separate exchange account.

Common UK and EU deposit methods

- Debit and credit cards (Visa and Mastercard)

- Apple Pay and Google Pay

- Bank transfers (Faster Payments in the UK, SEPA in the EU)

- Open Banking where supported

Card and instant payments are processed immediately, while bank transfers typically take longer but cost less. MoonPay Balance allows users in the UK, EU, and US to pre-fund a fiat balance via bank transfer and then buy crypto with zero MoonPay fees, though funding the balance itself is slower.

Typical deposit processing times

- Cards and Apple Pay: near instant

- Open Banking and Faster Payments UK: minutes to 1 hour

- SEPA bank transfer: same day to 1 business day

Minimum purchase amounts are usually low, often around £20 or equivalent, but card payments are subject to a minimum fee, which makes very small transactions poor value.

Crypto deposits and delivery

MoonPay does not function like a standard exchange wallet. Instead, crypto is usually delivered directly to a user-specified external wallet at the time of purchase.

How crypto delivery works

- Users select the crypto asset and enter a destination wallet address

- MoonPay executes the purchase and sends crypto on-chain

- Network fees are included in the quoted price at checkout

Because MoonPay is primarily non-custodial, it does not encourage long-term storage on the platform itself. This reduces counterparty risk but places responsibility on the user to enter correct wallet details. Incorrect addresses or unsupported networks can result in permanent loss of funds.

Delivery times depend on blockchain congestion rather than MoonPay alone. In testing, major assets like BTC and ETH typically arrived within 5–15 minutes after payment confirmation.

Fiat withdrawals (off-ramp support)

MoonPay allows users to sell selected cryptocurrencies and withdraw proceeds back to a bank account.

Key withdrawal details

- Supported mainly for major assets such as BTC, ETH, and USDC

- Withdrawals go back to a verified bank account

- GBP withdrawals usually incur around a 1 percent fee

Processing times for fiat withdrawals are typically:

- 1 to 2 business days for UK bank accounts

- Longer during periods of high demand or enhanced compliance checks

Not all supported cryptocurrencies can be sold directly. In some cases, assets must be swapped into a supported coin before withdrawal, adding extra steps and potential costs.

Limits, reliability, and transparency

MoonPay applies rolling limits based on verification level, payment method, and region. Card purchases generally have lower maximums than bank transfers, while MoonPay Balance increases approval rates and consistency for frequent users.

From a reliability standpoint, MoonPay performs well on execution and speed, especially for instant purchases. Fee transparency is a strength, as total costs are shown before confirmation. However, higher card fees, minimum charges, and occasional compliance-related delays reduce its appeal for repeat or high-value transactions.

MoonPay is fast, accessible, and transparent, but it is not optimised for cost efficiency or advanced fund management. For users who prioritise low fees, broader withdrawal support, or frequent fiat movements, platforms like eToro or Coinbase offer a more flexible overall experience.

How trustworthy is MoonPay in terms of regulation and support?

MoonPay operates with a strong compliance and payments background, but it stops short of full financial regulation in the UK. Its trust profile is solid for a crypto on-ramp, though customer support limitations and regulatory nuance reduce its overall score compared with fully regulated platforms.

Regulatory and registration status

MoonPay is FCA-registered in the UK under the Money Laundering Regulations, meaning it is authorised to carry out cryptoasset activities such as fiat-to-crypto transactions and compliance checks.

Key points to understand:

- FCA registration is not the same as FCA regulation

- MoonPay is not authorised as an investment firm

- Crypto purchases via MoonPay are not covered by FSCS protection

- The FCA does not oversee pricing, execution quality, or customer outcomes

Outside the UK, MoonPay holds money services or crypto licences across 40+ US states and operates legally in 180+ countries, adapting its services based on local regulatory rules.

Jurisdictional transparency

MoonPay is generally transparent about where and how it operates.

Notable disclosures include:

- Clear explanation of its role as a payments intermediary, not an exchange or broker

- Region-specific availability and restrictions clearly outlined

- Upfront display of total transaction cost before confirmation

- Publicly listed leadership team and funding history

However, some aspects remain less clear:

- Limited visibility into how pricing spreads are calculated

- No detailed public reporting on complaint resolution metrics

- Regulatory language can be confusing for users unfamiliar with FCA registration vs regulation

Overall, MoonPay provides above-average transparency for an on-ramp, but it does not reach the clarity level of fully regulated investment platforms.

Customer support channels and responsiveness

MoonPay’s biggest trust weakness is customer support.

Available channels:

- Email-based ticket system

- Online help centre with searchable articles

What is missing:

- No live chat for most regions

- No phone support in the UK

- No guaranteed response time

From hands-on testing and user feedback:

- Typical response times range from 12 to 24 hours, sometimes longer during peak demand

- Payment or refund issues can take several days to resolve

- Responses are usually accurate and professional, but slow

For a platform handling real-time payments, the lack of fast support is a clear drawback.

Risk warnings and disclosures

MoonPay provides clear and prominent crypto risk disclosures, especially during onboarding and checkout.

Disclosures typically cover:

- Crypto price volatility and risk of loss

- Lack of investor protection schemes

- Irreversibility of blockchain transactions

- Responsibility for correct wallet address and network selection

Risk warnings are displayed before account creation and again at the point of purchase, aligning well with FCA expectations for consumer transparency.

Trust, regulation, and support summary

| Area | Assessment |

|---|---|

| UK regulatory status | FCA registered, not FCA regulated |

| Global compliance | Strong multi-jurisdiction presence |

| Transparency | Generally clear, some pricing opacity |

| Customer support | Email only, slow during issues |

| Risk disclosures | Clear and well positioned |

TLDR:

MoonPay is legitimate, compliant, and broadly trustworthy for its intended role as a crypto on-ramp. It meets UK AML standards, operates transparently across jurisdictions, and communicates crypto risks clearly.

However, the lack of full FCA regulation, absence of investor protection, and slow customer support prevent it from matching the trust profile of platforms like eToro or Coinbase. It is suitable for occasional use, but less reassuring for users making frequent or high-value transactions.

What are the pros and cons of using MoonPay?

Pros

- Fast, low friction buying: Card and Apple Pay style checkouts let users buy crypto in minutes without learning an exchange interface.

- Wide payment method coverage: Supports multiple on ramp options including cards, bank transfer and wallet based payments, which improves approval chances and convenience.

- Broad geographic availability: Works across 180 plus countries, so it is useful for travellers and users outside major exchange supported regions.

- Non custodial by design: Purchases can be sent directly to an external wallet, keeping custody with the user rather than the platform.

- Strong compliance and security posture: Uses KYC and AML checks and references security credentials and payment security standards, reducing fraud risk on card purchases.

Cons

- High total cost on instant payments: Card purchases can run around 3.5 to 4.5 percent plus minimum fees, and the exchange rate spread can further reduce the amount of crypto received.

- Not a full trading platform: No order book trading, no advanced order types, no serious charting, no derivatives, no margin.

- Weak support for payment problems: Email based support only in many cases, with slow response times during peak periods, which is a major issue when funds are stuck mid transaction.

- Asset availability varies by region: The headline token count does not always match what UK users can actually buy or sell, which limits choice versus major exchanges.

- Limited consumer protection: FCA registration does not equal FCA regulation, and crypto purchases have no FSCS cover, so users take full platform and asset risk.

Who is MoonPay best for?

- Beginners who want a simple checkout flow to buy BTC, ETH or stablecoins without learning an exchange interface

- Casual buyers making occasional purchases where speed matters more than fees

- Wallet first users who already use MetaMask, Trust Wallet, Ledger, or an NFT marketplace and want a built in on ramp

- International users who need a widely available provider with many local payment options

Who is MoonPay not ideal for?

- Low fee seekers who want tight spreads and predictable trading fees

- Active traders who need limit orders, charting, advanced order types, APIs, or derivatives

- Users who need strong regulation and protections and want FCA regulated investment style safeguards or FSCS eligibility

- High value buyers making large or frequent purchases where percentage fees and spreads compound quickly

How to get started with MoonPay

- Create an account

- Go to MoonPay on web or download the MoonPay app.

- Sign up with an email address, or use a supported single sign in option (for example Apple or Google).

- Add basic personal details and set up account security from day one (strong password, device lock, and any available account security settings).

- Complete verification if required

- MoonPay uses KYC checks before most purchases and cash outs.

- Typical flow:

- Provide name, date of birth, nationality, and address

- Upload a government issued ID (passport or driving licence)

- Complete a selfie or liveness check

- For higher limits or certain payment methods, MoonPay may request extra information such as proof of address or an additional risk or source of funds questionnaire.

- Deposit funds

- MoonPay is an on ramp, so “deposit” usually means funding a purchase at checkout.

- Choose the funding method that fits the trade off between speed and cost:

- Card payments and Apple Pay or Google Pay: usually fastest, typically the most expensive route

- Bank transfer options: slower than card, typically lower fees

- MoonPay Balance (where available): fund a fiat balance first, then buy from that balance, which can reduce or remove MoonPay fees on some transactions

- Before confirming, check the full breakdown shown at checkout: purchase amount, fees, any minimum fee, and the final crypto amount expected.

- Place a trade

- MoonPay is not an exchange with an order book, so the action is a buy, sell, or swap, depending on what is available in the user’s region.

- Steps usually look like this:

- Select the crypto asset (for example BTC, ETH, USDC) and the amount in GBP

- Pick where the crypto should go:

- Send to an external wallet address (non custodial route)

- Or hold in app if the app wallet flow is enabled for the selected asset in that region

- Confirm network details carefully for withdrawals to external wallets (chain selection and address accuracy matter more than any other step).

- Withdraw or secure assets

- If buying for long term holding, move funds off any app wallet and into self custody:

- Send to a hardware wallet (Ledger style) or another wallet the user controls

- Use whitelists if supported by the receiving platform and always test with a small amount first

- If selling back to fiat:

- Use MoonPay’s sell flow (where supported) and withdraw to the same bank account used to fund in many cases

- Expect bank processing time rather than instant cash out in most scenarios

- Keep records of every transaction (dates, amounts, fees, wallet addresses) for portfolio tracking and tax reporting.

- If buying for long term holding, move funds off any app wallet and into self custody:

Practical tip for UK users: MoonPay tends to be most useful for occasional, convenience first purchases. For regular buying, compare the total cost versus a full exchange before committing, especially when using cards.

How we tested and methodology

Each crypto exchange is evaluated using a standardised six category scoring framework. Every category is scored out of 5, then combined to form the overall rating.

Scoring framework (each out of 5):

- Supported assets and markets: breadth of cryptocurrencies, fiat and stablecoin pairs, and whether spot and derivatives markets are available.

- Trading experience and tools: quality of the web and mobile experience, order functionality, charting depth, and advanced features such as APIs where relevant.

- Fees and pricing: trading fees, spreads, deposit and withdrawal charges, and any indirect costs that affect the real total cost of use.

- Security and custody: custody model, account security controls, operational security practices, and any relevant incident history.

- Deposits and withdrawals: supported funding methods, processing times, limits, reliability, and transparency during the transfer process.

- Trust, regulation, and support: regulatory or registration status, jurisdictional clarity, support channels, response expectations, and the quality of risk disclosures.

How scores are determined

Scores are based on hands on testing across key user journeys, structured fee analysis using real checkout and trade scenarios, a security review focused on custody and account controls, and platform usability checks across web and mobile flows.

FAQs

Is MoonPay legal in the UK?

Yes. MoonPay is legal in the UK and is FCA registered under the Money Laundering Regulations for cryptoasset activities. This means it can operate as a crypto on ramp, but it is not FCA regulated as an investment firm.

Is MoonPay a safe site?

MoonPay is generally considered safe, using KYC checks, encrypted transactions, and recognised security standards such as PCI DSS and SOC 2. However, crypto purchases are not covered by FSCS protection, so users still carry asset risk.

What are the risks of MoonPay?

The main risks are high fees on card payments, delayed transactions during compliance checks, and limited customer support if something goes wrong. There is also standard crypto risk, including price volatility and irreversible blockchain transactions.

Can I use MoonPay to buy crypto in the UK?

Yes. UK users can buy crypto on MoonPay using debit cards, bank transfers, and supported digital wallets. Availability of specific coins and payment methods can vary by region.

Can I withdraw from MoonPay to my bank?

Yes, MoonPay allows users to sell supported cryptocurrencies and withdraw GBP to a linked UK bank account. Withdrawals typically take 1–2 business days and usually incur a fee of around 1%.

How much does MoonPay charge per transaction?

Fees depend on the payment method. Card and instant payments are typically around 3.5%–4.5% with minimum fees, while UK bank transfers are usually closer to 1%.

Is MoonPay legit?

Yes. MoonPay is a legitimate crypto payments company used by millions of users worldwide and integrated into major wallets and apps. It is well funded, publicly known, and compliant with UK AML rules.

Is MoonPay available in the UK?

Yes. MoonPay is fully available to UK residents, with support for GBP payments and UK bank withdrawals, subject to standard verification requirements.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.