Kraken is a centralised UK cryptocurrency exchange designed for investors who prioritise security, regulation awareness, and deep crypto market access, offering a wide range of assets, robust trading tools, and competitive fees through Kraken Pro.

Its main drawback is that costs are higher and the interface more complex when using the standard instant buy features, which may matter for beginners or occasional traders who want a simpler, low-effort buying experience.

How do we rate Kraken?

Kraken scores 4.3/5 overall, standing out for security, compliance, and platform stability. Fees are competitive for active traders using Kraken Pro, while the standard interface trades simplicity for higher costs. For UK users seeking a long-established, FCA-registered exchange with strong safeguards, Kraken remains one of the most credible options available.

What is Kraken and how does it work?

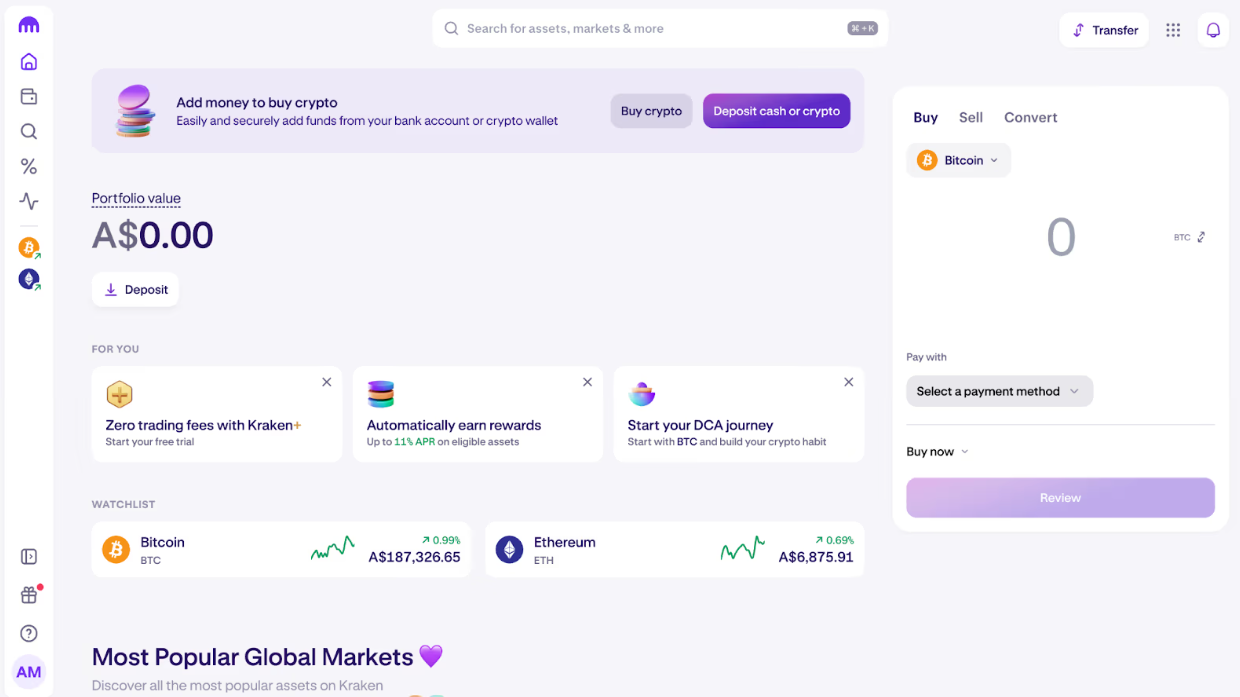

Kraken is a centralised cryptocurrency exchange that lets UK users buy, sell, trade, and hold crypto through a regulated onboarding process, using either a simple instant buy screen or an advanced order book. In the UK, most retail activity is focused on spot trading, with beginner friendly conversion tools on Kraken and lower cost, more technical trading on Kraken Pro.

Is Kraken centralised or decentralised?

Kraken is centralised, meaning trades happen through Kraken’s platform rather than directly on a blockchain via smart contracts.

That centralised model usually involves:

- Custody through the exchange, where crypto can be held in a Kraken account (rather than solely in a self custody wallet)

- Identity checks and verification, including UK specific appropriateness questions and a 24 hour cooling off period before trading begins

- Fiat rails, such as GBP deposits via UK bank transfer, plus card and wallet payments depending on availability

In the UK, Kraken operates through Payward Ltd and appears on the Financial Conduct Authority cryptoasset register for AML and counter terrorism controls, which is not the same as full FCA regulation of crypto trading. It is also worth stating plainly that crypto holdings are not covered by the FSCS.

What is Kraken’s core trading model?

For most UK retail users, Kraken is primarily a spot exchange, meaning users trade crypto at current market prices, either:

- via instant buy, sell, or convert on the standard interface, typically shown as around 1% per transaction plus a spread, with extra payment method fees shown at checkout

- via Kraken Pro, which uses an order book and maker taker pricing, starting around 0.25% maker and 0.40% taker on the entry tier, with lower fees at higher 30 day volumes

Kraken lists 490 plus cryptocurrencies overall, though some tokens may not be available to UK retail clients. Supported fiat currencies shown in the product details include GBP, EUR, and USD, among others.

Important UK limitation: Kraken may offer margin, futures, or other derivatives in some regions; UK customers are not eligible for futures and margin trading due to FCA restrictions. That makes Kraken, in practical terms for UK retail users, a spot and instant buy platform first, with Kraken Pro as the main upgrade path for active traders who want lower fees and more order control.

Who is Kraken intended for?

Kraken is built to serve two user levels through two interfaces that share the same underlying account, security, and custody setup.

Beginner and occasional users

- Best fit is the standard Kraken app or web view, where users can buy and sell in a few steps

- Typical use cases include first crypto purchases, converting between coins, and moving back to GBP

- Trade off is higher all in costs versus Pro, due to the instant buy style pricing and spreads

Active traders and advanced users

- Best fit is Kraken Pro, with an order book, advanced charts, and order types such as market, limit, and stop

- Pricing is typically lower for frequent trading due to maker taker fees and volume tiers

- This interface can feel complex if a user is new to charting and order entry

A simple way to think about it is this: Kraken is the on ramp and portfolio hub, while Kraken Pro is the lower fee trading terminal for people who want tighter control over execution and costs.

Kraken overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | Available in the UK, with GBP support. |

| Exchange type (centralised or decentralised) | Centralised exchange (CEX). |

| Regulator or registration status | Listed on the FCA cryptoasset register (AML and counter terrorism checks). |

| Custody model (custodial or non custodial) | Mainly custodial on exchange, with option to withdraw to self custody wallets. |

| Investor protection (usually none) | No FSCS protection for crypto holdings. |

| Supported cryptocurrencies | 490 plus cryptocurrencies listed overall (UK availability can vary by asset). |

| Trading types (spot, derivatives, margin) | UK focus is spot plus instant buy and convert. Derivatives and margin not available for UK users. |

| Fiat on ramp and off ramp | £1 minimum via UK bank transfer for GBP deposits. Also supports SEPA and other methods such as debit card and PayPal (availability varies). |

| Trading fees | Standard instant buy is around 1% plus spread. Kraken Pro starts at 0.25% maker and 0.40% taker (lower at higher volumes). |

| Deposit and withdrawal fees | GBP deposit can be free via FPS or BACS. Other deposit methods can be up to £21. Fiat withdrawals are roughly £1.95 to £35 depending on method. Crypto withdrawals have asset specific flat fees and minimums. |

| Security features | 2FA, withdrawal confirmations, and mostly cold storage (95% offline). Proof of Reserves checks. |

| Mobile app and web platform | Web, iOS, Android. Two interfaces: Kraken and Kraken Pro. |

| Ease of use level | Beginner friendly on standard Kraken. Intermediate to advanced on Kraken Pro. |

What assets and markets are available on Kraken?

Kraken offers a broad crypto lineup with 490 plus cryptocurrencies and a strong set of spot markets that UK users can access through the standard app or the Kraken Pro order book. UK users get GBP, EUR, and USD funding options and common stablecoin pairs, while derivatives and margin features are restricted for UK retail.

Number and range of supported cryptocurrencies

Kraken’s coverage is designed to suit both mainstream and long tail demand:

- 490 plus cryptocurrencies listed overall

- Major assets such as Bitcoin (BTC) and Ethereum (ETH) plus large caps like XRP, ADA, DOT, SOL, LINK

- A wide selection of smaller tokens, including gaming and niche projects such as AXS and GLMR

- Asset availability can differ by country, so some tokens may not be available to UK retail users

Spot markets

Kraken’s core market for UK users is spot trading:

- Spot trading is available via the Kraken Pro order book, which is where tighter spreads and more precise execution typically show up compared with instant buy

- The standard Kraken interface focuses on buy, sell, and convert, which is simpler but usually less cost efficient than trading directly on the order book

Derivatives, perpetuals, and margin

Kraken is known globally for offering advanced products in some regions, but the UK experience is narrower:

- Futures and margin are not available to UK customers due to FCA restrictions

- For UK retail, Kraken is best assessed as a spot exchange first, with instant buy and conversion tools as the beginner route

Stablecoin and fiat pairs

Kraken supports multiple fiat currencies and commonly traded stablecoins:

- Fiat currencies listed include GBP, EUR, USD, JPY, CAD, CHF, AUD

- Common stablecoins referenced include USDT and USD Coin (USDC)

- UK users can fund accounts from £1 via UK bank transfer on supported rails, with other methods such as card and PayPal mentioned as available depending on payment provider and eligibility

Liquidity depth and market coverage

Kraken positions itself as a high liquidity venue built for reliable execution:

- Founded in 2011, Kraken is one of the longer running exchanges and is often described as having deep liquidity and fast order processing

- Kraken Pro is structured around an order book market, which generally improves pricing for active traders compared with instant buy conversions

- Platform coverage includes availability across 176 countries and a user base referenced at around 10 million globally, which supports broad market participation and typically helps liquidity in popular pairs

How this affects the “Supported assets and markets” score: Kraken’s large asset list, strong spot market setup, and stablecoin plus fiat coverage are positives for UK users, while the lack of UK access to derivatives and margin reduces the market range for advanced strategies.

How good is the trading experience and toolset on Kraken?

Kraken delivers a strong trading experience through two interfaces: a simple buy and sell app for beginners, and Kraken Pro for active traders who want an order book, advanced charts, and lower fees.

Order types cover the essentials for spot trading, and Kraken Pro adds API access for more technical workflows. Reliability is a key strength for a platform founded in 2011.

Web and mobile platform usability

Kraken splits the experience into two layers that suit different user levels:

- Kraken standard (web and app): built for fast buying, selling, and converting, with guided steps and a clean dashboard. It is easier to navigate, but it is usually more expensive than Pro because pricing includes a spread and higher instant buy style fees.

- Kraken Pro (web and app): designed for active traders, with an order book layout, depth charts, and more controls for execution. It can feel technical if you are new to charting or trading terminology.

Both interfaces connect to the same Kraken account and share the same custody and security setup, so switching between Kraken and Kraken Pro does not change how assets are held.

Order types available

For UK users focused on spot markets, Kraken Pro supports the order types most traders expect:

- Market orders for immediate execution

- Limit orders to target a specific price

- Stop orders for basic risk management and breakout style entries

The standard Kraken interface is more about instant buys, sells, and conversions, rather than manual order entry on an order book.

Charting tools and indicators

Kraken Pro is where most of the analytical tooling lives:

- Advanced charts aimed at active trading

- Order book and depth charts for reading liquidity and short term price levels

- Trade ticket design that makes it easier to place and manage limit and stop orders without leaving the charting view

The standard Kraken app is more portfolio and transaction focused, with market information such as price changes and key market stats, but it is not positioned as a full trading terminal.

Advanced tools such as APIs or automation

Kraken Pro includes tools that matter for advanced workflows:

- API access on Kraken Pro (useful for algorithmic trading, custom dashboards, and connecting third party portfolio tools)

- A more professional interface for managing frequent trades, tracking orders, and working directly from the order book

If automation is a priority, Kraken Pro is the realistic starting point. The standard Kraken interface is not built for API driven trading.

Performance and reliability

Kraken is positioned as a mature exchange:

- Founded in 2011, which makes it one of the longer running crypto exchanges

- Known for high liquidity and low processing times, which generally improves the trading experience for popular spot pairs

- Support coverage is strong for an exchange, with live chat often referenced at 2 plus minutes, ticket requests at 15 plus minutes, and a contact form that can run 6 plus hours in busy periods

- Phone support is referenced as available Monday to Friday, 24 hours a day, with weekend phone support temporarily paused, while chat support is described as available around the clock

One practical friction point for new UK users is onboarding requirements, an appropriateness assessment and a 24 hour cooling off period before trading, which can delay first trades but is designed to ensure users understand crypto risks.

How this affects the “Trading experience and tools” score: Kraken is strong for active traders using Kraken Pro, thanks to the order book, charting, and API access. Beginners can use the standard interface, but the Pro toolset and layout is where Kraken’s trading depth is most obvious.

How competitive are Kraken’s fees and pricing?

Kraken’s pricing is competitive for active traders using Kraken Pro, where spot trading uses a maker taker model starting around 0.25% maker and 0.40% taker and falling as 30 day volume increases.

Costs are higher on the standard instant buy flow, where fees are roughly 1% plus a spread, and card based purchases can materially raise the all in cost.

Kraken fees at a glance

| Cost type | Kraken standard (instant buy and convert) | Kraken Pro (order book trading) |

|---|---|---|

| Trading fee | Around 1% per trade | From 0.25% maker and 0.40% taker (entry tier), lower at higher volumes |

| Spread | Yes, spread is built into the quoted price | Lower spreads typically, priced from the order book |

| Best for | Beginners and one off trades | Active traders and higher volume |

Trading fees

Kraken’s fee structure depends on which interface you use.

Kraken standard (instant buy and convert)

- Trading fee is described as around 1% per transaction

- A spread is built into the quoted price, so the effective cost can be higher than the headline fee

- Payment method charges can apply, such as card or PayPal, and are shown at checkout

Kraken Pro (maker taker)

- Entry level maker taker fees start at 0.25% maker and 0.40% taker

- Fees step down as your 30 day trading volume increases

- Maker fees as low as 0.00% and taker fees down to 0.10% at higher tiers

Practical takeaway: Kraken Pro is usually the cheapest way to trade spot on Kraken, but it requires comfort with order books and manual order entry.

Spread costs and when they matter

Spreads are the main hidden cost on many crypto platforms, and Kraken is no exception.

- On Kraken standard, the spread is built into the displayed price, which can make the cost meaningfully higher than the simple fee line suggests

- On Kraken Pro, pricing comes from the order book, where spreads are usually tighter on highly traded pairs, especially major coins and stablecoin pairs

If the goal is to minimise total costs, Kraken Pro plus limit orders generally offers better control than instant buy.

Deposit fees

Kraken supports multiple fiat funding methods, and deposit fees vary by rail.

- UK bank transfer methods can be free, with a minimum deposit as low as £1

- Some deposit routes can cost up to around £21, depending on method

- Crypto deposits are generally described as mostly free, but may require a minimum balance to deposit depending on the asset

Withdrawal fees

Withdrawals split into fiat and crypto, with different fee mechanics.

Fiat withdrawals

- Fees are method dependent, commonly referenced in a range around £1.95 to £35

- A £1 minimum withdrawal

Crypto withdrawals

- Fees are typically a flat network style fee that varies by coin or token

- Minimum withdrawal thresholds can apply per asset

Indirect or hidden costs to watch

Even when the headline fees look low, there are a few cost traps that change the real world total.

- Using instant buy instead of Pro: standard trading is simpler, but higher cost due to spread plus fee

- Payment method charges: card and some alternative payment methods can add extra fees at checkout

- FX conversion: if funding in a non base currency, conversion costs can appear in the final price

- Minimums and fixed crypto withdrawal fees: small withdrawals can be expensive in percentage terms when an asset has a fixed fee

TLDR: Kraken is priced well for active traders who use Kraken Pro and trade on the order book. Beginners can start easily on the standard interface, but the total cost is usually higher once spread and payment fees are included.

How secure is Kraken and how are assets held?

Kraken is a centralised exchange that holds customer crypto in a custodial model when assets remain on platform, with most funds stored in cold storage and a smaller portion kept online to process withdrawals and trading. Security is built around strict verification, strong account controls such as 2FA, and operational checks like Proof of Reserves, but crypto remains high risk and is not protected by the FSCS.

Custody model and how assets are held

Kraken is a centralised crypto exchange, so custody works differently from a self custody wallet:

- When you keep crypto on Kraken, it is held in a custodial account controlled by the exchange’s infrastructure.

- You can move assets off platform by withdrawing to an external wallet, which shifts custody to self custody.

- Kraken operates in the UK under Payward Ltd and uses verification and compliance screening as part of custody and withdrawal controls.

This custody structure matters because it creates counterparty risk. If an exchange experiences operational failure, legal issues, or cyber incidents, user access to funds can be disrupted even if the blockchain itself is functioning normally.

Cold storage practices

Kraken’s storage approach is designed to reduce online attack surface:

- Around 95% of deposits are kept in offline cold storage, described as “air gapped” and geographically distributed.

- A smaller portion remains in hot wallets to support day to day liquidity and withdrawals.

Cold storage does not remove risk, but it changes the risk profile. Most exchange thefts involve online systems, so keeping the majority of reserves offline is a common industry control.

Account security controls

Kraken includes several user level security features and operational checks:

- Two factor authentication (2FA) for login and account actions

- Email confirmations for withdrawals, which add a second approval step before funds leave the account

- Additional confirmation steps such as SMS style checks

- Strong identity verification, including KYC steps and a UK specific appropriateness assessment and 24 hour cooling off period before first trading, which is designed to ensure risk understanding rather than to protect account security directly

These controls reduce certain risks like unauthorised access from password reuse, phishing, or device compromise, but they depend on the user’s own device security and email account protection. If an attacker controls your email or phone number, withdrawal confirmations can be bypassed.

Proof of Reserves, audits, and compliance signals

- Proof of Reserves checks are mentioned as a transparency measure. These are designed to show that an exchange holds certain assets in reserve relative to customer balances, though the scope and methodology can vary by audit cycle.

- ISO or IEC 27001 certification is referenced. ISO 27001 is a recognised information security management standard that focuses on governance, controls, and security processes rather than guaranteeing outcomes.

- Kraken is described as being audited by independent firms, which can support operational discipline, but audits do not eliminate risks tied to market shocks, liquidity events, or cyber threats.

Incident history and operational track record

Kraken has operated since 2011 with no confirmed customer fund losses from hacks, and it developed its security posture in response to early industry failures such as Mt. Gox. That history supports Kraken’s positioning as a mature platform, but it should not be treated as a guarantee of future outcomes.

Clear risk disclosures for UK users

Kraken is not a bank and crypto holdings are not treated like regulated investments such as shares or funds in the UK.

Key points to state clearly in a UK review:

- No FSCS protection applies to crypto holdings on Kraken.

- Crypto is a high risk investment, and losses can result from price volatility, fraud, user error, or platform issues.

- Custodial exchanges introduce counterparty risk, including the possibility of withdrawal delays or account access restrictions during operational incidents.

- Users remain responsible for account hygiene, including strong passwords, secure email access, and enabling 2FA.

How this affects the “Security and custody” score: Kraken’s reported cold storage ratio of 95%, strong user security controls, and transparency steps like Proof of Reserves support a high score, while the core risks of custodial crypto custody and the lack of UK investor protection mean it cannot be treated as low risk.

How do deposits and withdrawals work on Kraken?

Kraken supports GBP deposits and withdrawals through UK bank transfer rails and also allows crypto deposits and withdrawals to external wallets.

Minimums can be low, including £1 for some GBP bank transfers, while processing times vary by method, from near instant crypto transfers after network confirmation to 0 to 5 business days for certain fiat routes. Fees and limits depend on the payment provider and verification level.

Fiat on ramp and off ramp support

Kraken supports multiple fiat currencies, including GBP, EUR, and USD, and UK users typically fund accounts using bank transfers for the lowest fees.

Common UK deposit routes mentioned

- FPS or BACS via Clear Junction: £1 minimum, often free

- CHAPS via Clear Junction: £22 minimum, around £21 fee

- SWIFT via Bank Frick: £4 minimum, around £3 fee

- SWIFT via Etana Custody: £150 minimum, free

Other supported deposit methods referenced include debit card, PayPal, Apple Pay, Google Pay, and SWIFT, but availability and fees can differ by provider and user eligibility.

Fiat withdrawals

- Fiat withdrawals are supported, with fees varying by method

- Typical fee range of around £1.95 to £35

- A £1 minimum withdrawal is referenced

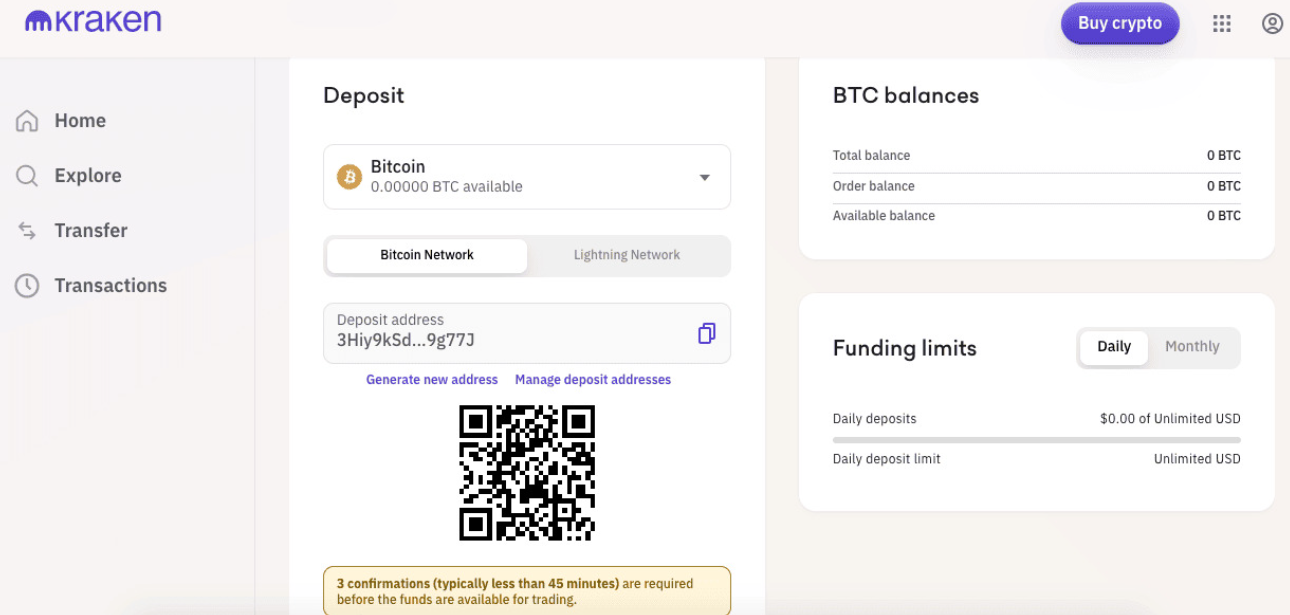

Crypto deposit and withdrawal process

Crypto transfers on Kraken follow the standard exchange workflow:

Crypto deposits

- Select the asset and generate a Kraken deposit address

- Send crypto from an external wallet or another exchange to that address

- Funds credit after required blockchain confirmations complete

Crypto deposits as mostly free, though some assets may require a minimum balance to deposit.

Crypto withdrawals

- Add a withdrawal address for the asset you want to send

- Enter the amount and confirm the withdrawal

- Kraken processes the transaction and broadcasts it to the network

Withdrawals generally require additional approvals such as email confirmations, and 2FA is recommended before moving funds off platform.

Crypto withdrawals typically include:

- An asset specific flat withdrawal fee

- A minimum withdrawal amount, which can make very small withdrawals expensive in percentage terms

Processing times

Processing times depend on whether the transaction is fiat or crypto.

Fiat

- Processing windows of 0 to 5 business days depending on the deposit or withdrawal method

- Bank transfers often settle faster than international wires, but timing can still vary by bank cut off times and weekends

Crypto

- Crypto transfers are typically processed quickly by the platform, but the real variable is network congestion and confirmation requirements

- Crypto deposits and withdrawals as being processed instantly by Kraken, but the blockchain still determines when the funds are fully confirmed and spendable

Limits and minimums

Kraken applies limits based on funding method, account level, and asset type.

Minimums

- GBP deposits can start from £1 on certain UK bank transfer routes

- Crypto deposits can be free but may require minimums depending on the asset

- Fiat withdrawals reference a minimum of £1

Limits

- Account level limits can scale significantly for higher tiers, such as crypto withdrawal limits up to $10,000,000 per 24 hours for Pro, versus lower limits like $500,000 per 24 hours

Because limits can vary by region and verification tier, the main practical point for UK users is that higher verification levels generally support larger cash and crypto transfer limits.

Reliability and transparency

Kraken’s deposit and withdrawal system is relatively transparent by exchange standards because:

- Fee schedules differ by method, but charges are generally displayed before confirmation

- Bank transfer routes list minimums and fees clearly, such as £1 minimum for FPS or BACS and fee ranges up to £21 for CHAPS deposits

- Crypto withdrawals show asset specific fees and minimums rather than using a single flat policy across all coins

Where issues can still arise:

- Fiat transfers can be delayed by banking cut offs, compliance checks, or intermediary bank processes on SWIFT routes

- Crypto transfers can be delayed by network congestion, incorrect wallet addresses, or selecting the wrong chain for an asset

Practical takeaway for UK users: For the lowest cost and simplest funding, GBP bank transfer rails such as FPS or BACS are usually the default choice, while card and alternative methods trade speed and convenience for higher fees.

How trustworthy is Kraken in terms of regulation and support?

Kraken is a long running centralised crypto exchange that operates in the UK through Payward Ltd and appears on the FCA cryptoasset register for anti money laundering and counter terrorism checks. It combines structured onboarding, clear risk warnings, and multiple support channels, but UK users should note crypto is not covered by FSCS and service access can vary by region.

Regulatory or registration status

Kraken’s UK status is best understood as registration for financial crime controls, not full regulation of crypto trading.

- UK entity: Kraken operates in the UK under Payward Ltd

- FCA status: Kraken is listed on the Financial Conduct Authority cryptoasset register, which relates to AML and counter terrorism compliance

- What this does not mean: Crypto trading itself is not regulated in the UK like shares or funds, and this registration does not create FSCS coverage for crypto holdings

A practical implication is that Kraken’s onboarding and monitoring tends to be strict, with more emphasis on identity verification and transaction controls than platforms operating in looser regimes.

Jurisdictional transparency

Kraken is relatively transparent about who runs the platform and where it operates.

- Founded: 2011

- Founder: Jesse Powell

- Origin: launched in San Francisco

- Scale: around 10 million users, operating across 176 countries

- Market credibility milestone: one of the earlier exchanges to provide crypto price data to the Bloomberg Terminal

For UK users, jurisdiction also affects product availability. Advanced products such as futures and margin are not available to UK customers due to local restrictions, which reduces regulatory complexity but also limits functionality for derivatives focused traders.

Customer support channels and responsiveness

Support is a meaningful differentiator for crypto platforms, because account access and transfer issues often need real time help.

Channels mentioned

- Live chat: available 24/7

- Phone support: available Monday to Friday, 24 hours a day

- Weekend phone support: referenced as temporarily paused

- Ticketing and contact forms are also used for less urgent cases

Indicative response times

- Live chat: around 2 plus minutes

- Ticket request: around 15 plus minutes

- Contact us form: 6 plus hours in some cases

These are not guarantees, but they give a realistic picture of the support stack. Users should still expect slower responses during market volatility or major platform incidents.

Clarity of risk warnings and disclosures

Kraken’s disclosures are direct and consistent with UK expectations for high risk products.

- Risk warning: crypto is described as a high risk investment, and users should not expect protection if something goes wrong

- Investor protection: crypto holdings are not covered by the FSCS

- Onboarding safeguards: Appropriateness assessment and a 24 hour cooling off period before trading, aimed at confirming the user understands crypto risks

- Fee transparency: deposit, withdrawal, and trading fees vary by method and platform, but the flow typically shows charges at checkout, especially for instant buy purchases

One additional trust signal is that Kraken uses transparency tools such as Proof of Reserves. It is still important to treat those as partial evidence of reserves at a point in time, rather than a complete view of all risks, liabilities, or operational exposure.

How this affects the “Trust, regulation, and support” score: Kraken benefits from clear UK registration status, long operating history since 2011, and unusually broad support options for a crypto exchange.

The main limitation is structural: crypto remains outside traditional investor protection frameworks, and user experience and product access can differ by jurisdiction.

What are the pros and cons of using Kraken?

Pros

- Low trading fees on Kraken Pro: maker taker pricing starts around 0.25% maker and 0.40% taker, with lower tiers for higher 30 day volume, which reduces costs for active spot traders.

- Large crypto selection: supports 490 plus cryptocurrencies, covering majors like BTC and ETH plus a wide range of altcoins, which helps users diversify beyond the top coins.

- Strong security posture for a centralised exchange: around 95% of assets are held in cold storage, with 2FA and withdrawal confirmations, which reduces exposure to common account takeover risks.

- Solid GBP banking support: UK bank transfers can start from £1 with free FPS or BACS routes, making it accessible for smaller deposits and regular top ups.

- Above average customer support coverage: 24/7 live chat plus phone support Monday to Friday, 24 hours a day, which is more support infrastructure than many exchanges provide.

Cons

- High all in costs on instant buy: standard buy and convert pricing is around 1% plus spread, and card based purchases can push the effective cost much higher, which penalises low frequency users who do not use Pro.

- No FSCS protection: crypto held on Kraken is not covered by UK investor protection schemes, and the custodial model adds counterparty risk.

- Advanced features restricted for UK users: futures and margin are not available to UK customers, which removes entire strategy types for derivatives focused traders.

- Interface complexity for beginners: Kraken Pro uses an order book and trading ticket workflow that can overwhelm users unfamiliar with charts and order types.

- Fiat transfer timing is not instant: some GBP deposit and withdrawal methods can take 0 to 5 business days, which matters if cash is needed quickly.

Who is Kraken best for?

- Beginners who want a known exchange with GBP deposits and the option to start from £1 via bank transfer.

- Active spot traders who will use Kraken Pro for lower maker taker fees and order book execution.

- Altcoin focused users who want access to a broad list of 490 plus cryptocurrencies.

- Low fee seekers willing to place trades via Pro instead of paying instant buy spreads.

- Users who value customer support access and want 24/7 chat plus weekday phone support.

Who is Kraken not ideal for?

- Beginners who only want one click buying and do not want to learn Pro, because instant buy costs are materially higher once spread and payment fees are included.

- Derivatives traders in the UK who need futures, perpetuals, or margin, because those products are restricted in the UK.

- Long term holders who want investor protection: there is no FSCS cover for crypto, and keeping assets on an exchange adds custodial risk.

- Users who require guaranteed fast fiat withdrawals: bank transfer withdrawals can take up to 5 business days depending on method and banking cut offs.

How to get started with Kraken

1. Create an account

Go to Kraken’s website or mobile app and select Sign up. Enter an email address, create a username, and set a strong password. Kraken then sends an email link to confirm the address and activate the account.

2. Complete verification if required

Kraken uses identity checks to meet compliance requirements. UK users should expect to provide personal details such as full name, date of birth, country of residence, and a phone number, then upload a government issued ID and proof of address if prompted.

UK onboarding can also include an appropriateness assessment covering experience with high risk investments and crypto specific risk questions. If the assessment is passed, a 24-hour cooling-off period before trading is enabled.

3. Deposit funds

Choose whether to fund with fiat or crypto.

- GBP bank transfer: deposits can start from £1 on certain UK bank transfer rails, often with low or zero fees depending on route.

- Other fiat methods: options such as debit card or PayPal may be available depending on eligibility and provider, but typically cost more than bank transfer.

- Crypto deposit: select the asset, generate a deposit address, and send from an external wallet or another exchange. Crypto deposits are typically free on the platform side, but network rules still apply.

4. Place a trade

Pick the interface that matches the user’s experience level.

- Kraken standard: use the Buy, Sell, Convert flow for simple trades. This is usually the fastest route for a first trade but tends to cost more, because pricing includes a spread and higher instant buy style fees.

- Kraken Pro: use the order book for lower cost trading. Choose an order type such as market, limit, or stop and submit the order. Pro fees are typically lower than standard instant buys, especially for frequent trading.

5. Withdraw or secure assets

Decide whether to keep assets on the exchange or move them off platform.

- Secure the account first: enable two factor authentication (2FA) and keep withdrawal confirmations active before moving funds.

- Withdraw fiat: choose a supported withdrawal route for GBP. Fees and processing times vary by method, with some routes taking 0 to 5 business days.

- Withdraw crypto: add the destination wallet address carefully, select the correct network for that asset, confirm the withdrawal, and account for asset specific minimums and flat withdrawal fees.

FAQs

Is Kraken good in the UK?

Yes. Kraken is well suited to UK users thanks to GBP bank transfers from £1, a long operating history since 2011, and FCA AML registration via Payward Ltd. It is strongest for users who want a reliable exchange with good security and access to Kraken Pro for lower fees.

Is Kraken trustworthy?

Kraken is generally considered trustworthy for a crypto exchange. It has no confirmed customer fund losses, keeps around 95% of assets in cold storage, uses 2FA, and publishes Proof of Reserves checks. That said, crypto assets are not protected by the FSCS, so platform trust does not remove market or custody risk.

Why is it so hard to withdraw from Kraken?

It can feel difficult because Kraken applies strict security and compliance checks. Withdrawals often require address whitelisting, email confirmations, 2FA, and correct network selection. These steps reduce fraud risk but add friction compared with less controlled platforms.

Is it safe to keep my money in Kraken?

Kraken is among the safer centralised exchanges due to cold storage and security controls, but keeping funds on any exchange carries custodial risk. Long term holders often reduce exposure by withdrawing crypto to a self custody wallet, since there is no FSCS protection for exchange held crypto.

Is Kraken safe for beginners?

Kraken can be safe for beginners from a security standpoint, but the Kraken Pro interface is complex. Beginners who stick to the standard Buy and Sell flow will find it easier, though fees are higher. Using 2FA and starting with small amounts is essential.

Is Kraken legal in the UK?

Yes. Kraken operates legally in the UK and is listed on the FCA cryptoasset register for AML and counter terrorism compliance. This does not mean crypto trading is fully regulated like shares, but Kraken is allowed to operate.

What are the downsides of Kraken?

Kraken can be expensive for instant buys due to spreads and payment fees, and crypto holdings are not covered by the FSCS. UK users cannot access futures or margin trading, and Kraken Pro has a learning curve for beginners. Fiat withdrawals are also not instant and may take several business days.

How long does Kraken withdrawal take in the UK?

GBP withdrawals usually take from the same day up to five business days, depending on the method and bank cut off times. Crypto withdrawals are processed quickly, but final timing depends on blockchain confirmations and network congestion.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.