Gemini Exchange is a regulated cryptocurrency exchange designed for security-conscious UK traders, offering strong safeguards, GBP support, and a clear trading experience across spot markets and advanced tools.

Its main strengths sit in security, compliance, and professional-grade custody, alongside a solid web and mobile platform. Its main drawback is pricing on instant trades and limited UK-only features, which may matter for frequent traders or users seeking low-cost, incentive-driven trading.

What is Gemini Exchange and how does it work?

Gemini is a centralised cryptocurrency exchange that allows UK users to buy, sell, trade, and store digital assets through a regulated, account-based platform. It operates primarily as a spot trading exchange, with optional advanced tools for active traders, and is designed to suit beginners through to experienced market participants.

At its core, Gemini uses a traditional order-book trading model, where buyers and sellers place market, limit, or advanced orders and trades are matched by the exchange. UK users can trade over 150 cryptocurrencies, including Bitcoin, Ethereum, and Solana, using GBP-funded accounts via bank transfer or debit card.

For casual and beginner users, Gemini offers a simplified web and mobile interface that supports instant and limit trades, portfolio tracking, and basic market data. For more experienced traders, the ActiveTrader platform provides deeper functionality, including candlestick charts, multiple order types, API access, and volume-based fee tiers. This dual-interface approach allows users to scale up without changing platforms.

Gemini is not a decentralised exchange. All trades are executed within Gemini’s custodial infrastructure, meaning the platform holds client assets on users’ behalf. To support this model, Gemini places strong emphasis on custody and compliance, using cold storage for the majority of client funds, insurance coverage for hot wallet assets, and strict access controls such as two-factor authentication and device approval.

In the UK, Gemini operates under Financial Conduct Authority (FCA) oversight as an Electronic Money Institution (EMI). This means users must complete identity verification before trading, deposits and withdrawals are monitored under UK financial rules, and certain features such as referral rewards and trading competitions are restricted to comply with UK financial promotions regulations.

Overall, Gemini is best described as a security-first, regulation-led crypto exchange that prioritises transparency, custody standards, and structured trading over aggressive incentives or speculative features.

Gemini Exchange overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | Available to UK users since 2020 and accessible in 60+ countries |

| Exchange type (centralised or decentralised) | Centralised crypto exchange |

| Regulator or registration status | FCA registered as an Electronic Money Institution (EMI) in the UK |

| Custody model (custodial or non custodial) | Custodial. Gemini holds client assets on users’ behalf |

| Investor protection (usually none) | No statutory investor protection for crypto assets. EMI status applies to fiat funds only |

| Supported cryptocurrencies | 150+ cryptocurrencies including Bitcoin, Ethereum, Solana, Avalanche, Polygon, Chainlink, and Uniswap |

| Trading types (spot, derivatives, margin) | Spot trading for all users. Derivatives available via ActiveTrader. No margin trading for UK retail users |

| Fiat on ramp and off ramp | GBP bank transfers via Faster Payments, CHAPS, SWIFT. Debit card deposits supported |

| Trading fees | Maker fees 0.00% to 0.20%. Taker fees 0.03% to 0.40% based on 30 day volume. Instant orders incur additional transaction and convenience fees |

| Deposit and withdrawal fees | GBP bank transfers free. Debit card deposits 3.49%. Crypto withdrawals subject to network fees |

| Security features | Cold storage for most assets, two factor authentication, device and IP whitelisting, insurance on hot wallet funds |

| Mobile app and web platform | Full featured web platform and iOS and Android mobile apps |

| Ease of use level | Beginner friendly interface with an optional advanced ActiveTrader mode for experienced users |

What assets and markets are available on Gemini Exchange?

Gemini offers UK users access to 150+ cryptocurrencies across well regulated spot markets, with selected derivatives available via ActiveTrader. Trading focuses on major assets and liquid pairs, supported by GBP and USD markets, making Gemini better suited to mainstream crypto exposure than high risk or niche tokens.

Supported cryptocurrencies

Gemini supports over 150 digital assets, covering most large cap and established cryptocurrencies. This includes Bitcoin, Ethereum, Solana, Avalanche, Polygon, Chainlink, Litecoin, and Uniswap, alongside a range of ERC 20 and Layer 1 tokens. Asset listings are conservative and compliance led, with fewer experimental or newly launched tokens than some global competitors.

Spot markets

Spot trading is the core offering for UK users. Assets can be traded directly against GBP, USD, and major stablecoins, using market, limit, and advanced order types. Spot markets are available through both the standard interface and the ActiveTrader platform, with deeper tools reserved for experienced users.

Derivatives and advanced markets

Gemini offers derivatives trading through ActiveTrader, including perpetual style contracts in supported regions. Access for UK retail users is more limited due to regulatory restrictions, and derivatives are primarily aimed at experienced traders who meet eligibility requirements.

Stablecoins and fiat pairs

Gemini supports major stablecoins such as USDC, alongside multiple GBP and USD trading pairs. Direct GBP pairs reduce conversion costs for UK users and improve execution efficiency when moving between fiat and crypto.

Liquidity and market coverage

Liquidity on Gemini is strongest in major pairs such as BTC GBP, ETH GBP, BTC USD, and ETH USD, supported by institutional participation and market makers. While depth is competitive for large cap assets, liquidity can be thinner on smaller altcoins compared with high volume global exchanges.

How good is the trading experience and toolset on Gemini Exchange?

Gemini delivers a clean, reliable trading experience that works well for beginners while still offering advanced tools through ActiveTrader. UK users get stable web and mobile platforms, multiple order types, solid charting, and API access, though automation and derivatives access are more limited than on high frequency global exchanges.

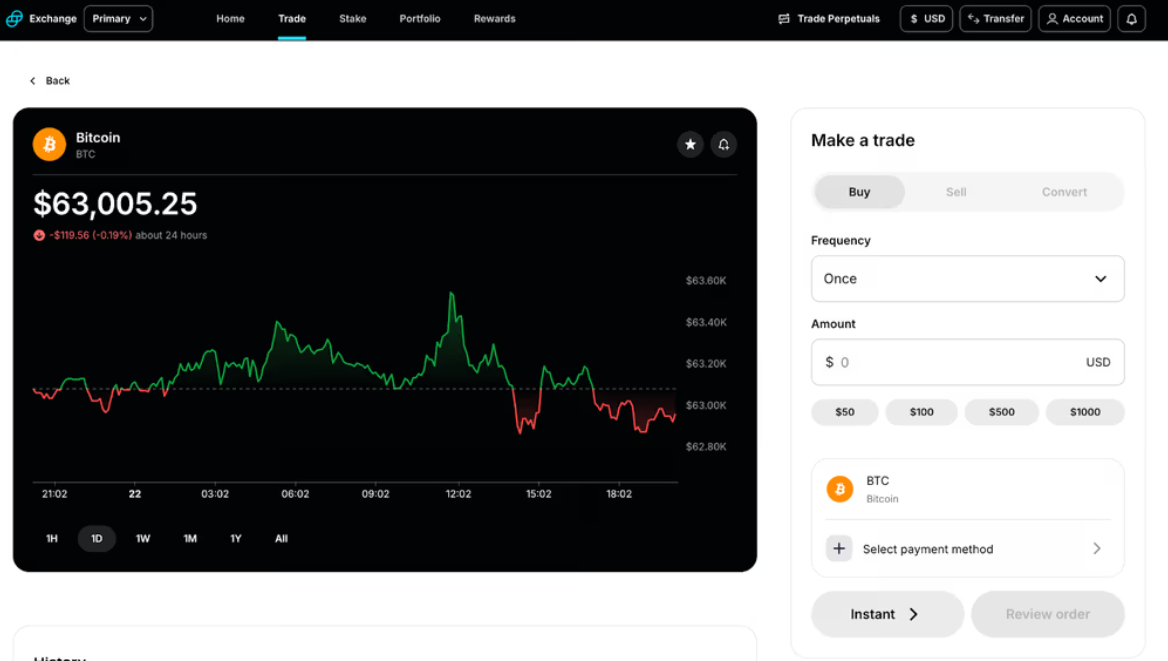

Web and mobile platform usability

Gemini uses a dual interface model. The standard web and mobile platforms are designed for simplicity, with clear buy and sell flows, portfolio tracking, and straightforward funding in GBP. The mobile apps for iOS and Android closely mirror the web experience, allowing deposits, withdrawals, and spot trades without reduced functionality.

For more experienced users, ActiveTrader unlocks a professional style layout with order books, depth charts, and advanced trade controls. Switching between modes is seamless, allowing users to progress without opening a new account.

Order types available

Gemini supports a strong range of order types for spot trading, including:

- Market orders

- Limit orders

- Stop limit orders

- Immediate or cancel orders on ActiveTrader

These cover most retail and active trading strategies, though complex conditional orders and advanced automation triggers are more limited compared with specialist derivatives platforms.

Charting tools and indicators

ActiveTrader provides candlestick charts, depth charts, and real time order books, with standard indicators such as moving averages and volume. Charting is functional and reliable but not as extensive as platforms that integrate full TradingView indicator libraries. For most spot traders, the available tools are sufficient for technical analysis on major pairs.

Advanced tools and APIs

Gemini offers a well documented API for developers and algorithmic traders. This supports automated trading, market data access, and account management. API fees follow the same volume based maker and taker structure as ActiveTrader. While automation is supported, Gemini does not focus on built in trading bots or strategy marketplaces.

Performance and reliability

Gemini has a strong reputation for platform stability and uptime, particularly during periods of high market volatility. Order execution is consistent on major pairs such as BTC GBP and ETH GBP, supported by institutional liquidity providers. While smaller altcoins may show thinner depth, execution reliability remains solid for typical UK retail trade sizes.

TLDR: Gemini scores well for usability, reliability, and progression from beginner to active trader, but power users seeking advanced automation or deep derivatives functionality may find the toolset more conservative than competitors.

How competitive are Gemini Exchange’s fees and pricing?

Gemini’s pricing is competitive for active and higher volume traders using ActiveTrader, but relatively expensive for casual users placing instant trades. Maker taker fees scale with volume, deposits are mostly free via bank transfer, and crypto withdrawals carry network costs. The main drawback is added convenience fees on simple buy and sell orders.

Trading fees (maker taker model)

Gemini uses a volume based maker taker fee structure across its web platform, mobile app, API, and ActiveTrader interface. Fees decrease as 30 day trading volume increases.

| Asset type | Maker fee | Taker fee |

|---|---|---|

| Stablecoins | 0.00% | 0.01% |

| Other cryptocurrencies | 0.00% to 0.20% | 0.03% to 0.40% |

| Derivatives via ActiveTrader | -0.01% to 0.02% | 0.03% to 0.07% |

This structure benefits users who place limit orders and trade frequently, while market order users pay the higher end of the taker range.

Spread costs and instant order fees

Gemini does not explicitly publish spread markups on spot markets. However, instant orders placed through the simplified interface carry additional costs:

- Transaction fee: 1.49%

- Convenience fee: 1.00%

These charges apply on top of underlying market pricing, making instant buys and sells significantly more expensive than placing limit orders on ActiveTrader.

Deposit fees

GBP deposits are competitively priced, especially for bank transfers.

| Deposit method | Fee |

|---|---|

| GBP bank transfer (Faster Payments, CHAPS, SWIFT) | Free |

| Crypto deposits | Free |

| Debit card | 3.49% |

| PayPal | 2.50% |

Bank transfers are the most cost effective option for UK users.

Withdrawal fees

- GBP withdrawals: Free from Gemini’s side via bank transfer, though local banks may charge processing fees

- Crypto withdrawals: Variable network fees based on blockchain congestion and asset type

There are no fixed crypto withdrawal charges, but ERC 20 tokens require standard gas fees at the time of withdrawal.

Indirect and hidden costs to consider

Gemini’s pricing is transparent, but users should be aware of:

- Higher costs when using instant orders instead of ActiveTrader

- Network fees on crypto withdrawals, which can rise during congestion

- Gemini Custody fees for institutional or high net worth users, set at 0.4% per month per asset, plus a $125 (£96.58) administrative withdrawal fee

TLDR: Gemini offers fair pricing for experienced traders who use limit orders and higher volumes, but casual users may find fees less competitive compared with platforms that bundle spreads into simpler pricing models.

How secure is Gemini Exchange and how are assets held?

Gemini uses a custodial security model with most client crypto held in cold storage and layered account controls for access and withdrawals. UK users’ assets are stored and managed by Gemini, not self held, with security practices focused on custody controls, segregation, and regulatory oversight rather than decentralised self custody.

Custody model

Gemini is a centralised, custodial exchange, meaning it holds users’ crypto assets on their behalf. Private keys are managed by Gemini, not the end user. This model simplifies trading and recovery but introduces counterparty risk, as access to funds depends on the platform’s operational integrity.

For larger holders and institutions, Gemini Custody offers a separate, institutional grade custody service with dedicated cold storage and additional governance controls.

Cold storage practices

Gemini states that the majority of customer crypto assets are stored offline in cold storage, isolated from internet connected systems. Hot wallets are used only for operational liquidity, and assets held in hot wallets are covered by insurance against certain types of security breaches.

Cold storage systems are geographically distributed and designed to reduce single point of failure risk.

Account security controls

Gemini provides multiple account level protections, including:

- Two factor authentication (2FA) for login and withdrawals

- Device approval and IP address whitelisting

- Withdrawal address whitelists, limiting where funds can be sent

- Session monitoring and login alerts

These controls reduce the risk of unauthorised access but rely on users correctly enabling and maintaining them.

Incident history and track record

Since launching in 2014, Gemini has not publicly disclosed any major platform level hacks resulting in loss of customer funds. However, past performance does not eliminate future risk, and no exchange is immune to operational, technical, or governance failures.

Risk disclosures and limitations

Crypto assets held on Gemini are not protected by the UK Financial Services Compensation Scheme (FSCS). FCA Electronic Money Institution status applies to certain fiat arrangements only, not crypto balances. If Gemini were to face insolvency or operational disruption, recovery of crypto assets could be delayed or incomplete depending on circumstances.

TLDR: Gemini’s security and custody framework is among the more conservative and institutionally oriented in the crypto market, but users remain exposed to custodial and platform risk inherent to centralised exchanges.

How do deposits and withdrawals work on Gemini Exchange?

Gemini offers UK users reliable GBP on and off ramps, clear crypto transfer workflows, and transparent fee disclosure. Bank transfers are the most cost effective option, while card deposits are faster but expensive. Processing times are generally predictable, though crypto withdrawals depend on blockchain conditions.

Fiat on ramp and off ramp support

Gemini supports GBP deposits and withdrawals, allowing UK users to move funds without currency conversion. Fiat transfers are available through established banking rails, with most users relying on Faster Payments for routine funding.

| Fiat method | Direction | Typical fee |

|---|---|---|

| GBP bank transfer (Faster Payments, CHAPS, SWIFT) | Deposit and withdrawal | Free from Gemini |

| Debit card | Deposit only | 3.49% |

| PayPal | Deposit only | 2.50% |

GBP withdrawals are processed back to verified bank accounts. While Gemini does not charge for fiat withdrawals, banks may apply their own processing fees.

Crypto deposits and withdrawals

Crypto deposits are supported for all listed assets and are free from Gemini’s side. Each asset has a dedicated deposit address, and funds become available after the required number of blockchain confirmations.

Crypto withdrawals follow a standard custodial process:

- Users submit a withdrawal request

- Address whitelisting and security checks apply

- Gemini broadcasts the transaction to the relevant blockchain

Withdrawal fees are variable network fees, determined by real time blockchain congestion. ERC 20 token withdrawals require standard Ethereum gas fees.

Processing times

- GBP deposits: Often same day via Faster Payments, depending on bank cut off times

- GBP withdrawals: Typically processed within one to three business days

- Crypto deposits: Credited after network confirmations

- Crypto withdrawals: Processed promptly by Gemini, with final settlement dependent on blockchain speed

During periods of high network activity, crypto withdrawals may take longer or cost more due to increased fees.

Limits and minimums

- Minimum GBP deposit: £10

- Deposit and withdrawal limits: Tiered by account verification level and security settings

- Custody withdrawals: Subject to additional administrative fees and approval processes for institutional users

Limits are clearly displayed in account settings, improving transparency for planning transfers.

Reliability and transparency

Gemini provides clear transaction status updates, confirmation emails, and detailed transaction histories for both fiat and crypto movements. While delays can occur due to banking cut offs or blockchain congestion, the deposit and withdrawal process is generally consistent and predictable for UK users.

TLDR: Gemini scores well for transparency and reliability on fiat transfers, with crypto movements behaving as expected for a regulated custodial exchange.

How trustworthy is Gemini Exchange in terms of regulation and support?

Gemini operates with a strong compliance focus, combining FCA registration in the UK with clear jurisdictional disclosures and structured customer support. Regulation applies to fiat services rather than crypto assets, but transparency around oversight, restrictions, and risk warnings is clearer than on many global exchanges.

Regulatory and registration status

In the UK, Gemini is registered with the Financial Conduct Authority (FCA) as an Electronic Money Institution (EMI). This status allows Gemini to provide GBP payment services, including deposits and withdrawals, under UK financial regulations.

It is important to note:

- FCA EMI registration does not regulate crypto trading itself

- Crypto assets are not covered by the Financial Services Compensation Scheme (FSCS)

- Regulatory oversight applies to money handling, controls, and financial promotions

Outside the UK, Gemini operates through regulated entities in jurisdictions such as the United States, where it is licensed as a trust company by the New York State Department of Financial Services (NYDFS).

Jurisdictional transparency

Gemini provides clear information about:

- Which entity serves UK customers

- Which services fall under FCA oversight

- Which features are restricted due to UK financial promotions rules

This transparency is reflected in the removal of referral incentives and trading competitions for UK users following FCA rule changes in January 2024. These restrictions are disclosed upfront rather than hidden in terms.

Customer support channels and responsiveness

Gemini offers 24/7 customer support, primarily through:

- An online support request form

- Email based ticketing

- A comprehensive help centre covering funding, trading, security, and account issues

There is no live chat or phone support for most retail users. Response times can vary during periods of high market activity, but issue tracking and follow up communication are generally clear and documented.

Risk warnings and disclosures

Gemini includes clear risk disclosures across its UK platform, explaining that:

- Crypto prices are volatile and losses are possible

- Assets are held custodially and exposed to platform risk

- Regulatory protections differ from traditional financial products

Risk warnings are displayed during onboarding, funding, and trading flows, aligning with FCA expectations on financial promotions and consumer protection.

TLDR: Gemini scores well for regulatory transparency and disclosure clarity, with structured but limited support channels. It stands out for compliance alignment, though users must understand the boundaries of crypto regulation in the UK.

What are the pros and cons of using Gemini Exchange?

Pros

- Strong regulatory positioning for UK users: Registered with the Financial Conduct Authority as an Electronic Money Institution, with clear disclosures on what is and is not regulated.

- High security and custody standards: Majority of assets held in cold storage, insurance on hot wallet funds, and optional institutional grade Gemini Custody.

- Clean GBP on and off ramps: Supports GBP deposits and withdrawals via Faster Payments, CHAPS, and SWIFT, with no platform fees on bank transfers.

- Dual interface for different skill levels: Simple app and web experience for beginners, plus ActiveTrader with order books, APIs, and lower fees for active users.

- Reliable execution on major pairs: Strong liquidity on BTC and ETH GBP and USD pairs, supported by institutional market makers.

Cons

- High costs on instant trades: Instant buy and sell orders carry a 1.49% transaction fee plus a 1.00% convenience fee.

- Limited advanced features for UK retail users: Restricted access to derivatives, promotions, and referral rewards due to FCA rules.

- Smaller altcoin coverage than some competitors: Around 150 assets, with fewer newly launched or speculative tokens.

- No FSCS protection for crypto assets: FCA oversight applies to fiat services only, not crypto balances.

- Support channels are limited: No live chat or phone support for most retail users, only ticket based assistance.

Who is Gemini Exchange best for?

- Security focused users who prioritise custody controls, cold storage, and regulatory transparency.

- Active traders using limit orders and volume based pricing on ActiveTrader.

- UK users funding in GBP who want predictable bank transfers without conversion fees.

- Institutional or high net worth holders needing segregated custody through Gemini Custody.

Who is Gemini Exchange not ideal for?

- Low fee casual traders who rely on instant buy and sell orders.

- Altcoin focused users seeking early stage or highly speculative tokens.

- Users expecting full regulatory protection similar to stocks or savings accounts.

- Traders who want incentives or promotions, such as referrals, competitions, or rewards programs in the UK.

How to get started with Gemini Exchange

- Create an account: Visit the Gemini website or download the mobile app and register with an email address. Set a strong password and enable basic security settings during setup.

- Complete verification if required: Verify identity through standard KYC checks. UK users are asked for a government issued ID and proof of address to unlock deposits, trading, and withdrawals.

- Deposit funds: Add funds using GBP bank transfer via Faster Payments, CHAPS, or SWIFT for low cost funding. Debit card deposits are available for faster access but incur higher fees.

- Place a trade: Use the standard interface for simple buys and sells, or switch to ActiveTrader for limit orders, order books, and lower maker taker fees. Trades can be placed on web or mobile.

- Withdraw or secure assets: Withdraw GBP back to a verified bank account or transfer crypto to an external wallet. Long term holders can keep assets on Gemini, understanding custodial and platform risk.

How we tested and methodology

Each crypto exchange is evaluated using a standardised six-category scoring framework, with every category scored out of 5 points to ensure consistency, comparability, and transparency across reviews.

The six scoring categories are:

- Supported assets and markets: Breadth and quality of cryptocurrencies, spot markets, fiat and stablecoin pairs, and liquidity on major trading pairs.

- Trading experience and tools: Web and mobile usability, order types, charting quality, APIs, and overall platform reliability.

- Fees and pricing: Trading fees, spreads where applicable, deposit and withdrawal costs, and any indirect or convenience charges.

- Security and custody: Custody model, cold storage practices, account level security controls, and disclosed incident history.

- Deposits and withdrawals: Fiat on and off ramps, crypto transfer processes, processing times, limits, and transparency of fees.

- Trust, regulation, and support: Regulatory or registration status, jurisdictional clarity, customer support access, and quality of risk disclosures.

Scores are based on hands on testing, including account setup, identity verification, deposits, trading, and withdrawals. This is combined with fee analysis, a review of published pricing schedules, security and custody assessment, and platform usability checks across web and mobile environments. Regulatory claims and disclosures are verified against official sources where applicable.

This methodology is designed to reflect real user experience rather than marketing claims, while highlighting trade offs that matter to UK crypto users.

FAQs

Is Gemini crypto safe?

Gemini Exchange uses a custodial security model with most customer assets held in cold storage, alongside controls such as two factor authentication and withdrawal whitelisting. While no crypto platform is risk free, Gemini has a long operating history and a security first approach compared with many global exchanges.

Is Gemini good for crypto in the UK?

Gemini is a solid option for UK users who value GBP support, clear disclosures, and a regulated operating structure for fiat services. It suits users focused on major cryptocurrencies rather than speculative or newly launched tokens.

Is Gemini better than Coinbase?

Gemini and Coinbase serve similar audiences, but the better choice depends on priorities. Gemini typically appeals to security focused and active traders using limit orders, while Coinbase is often simpler for beginners but can be more expensive on instant trades.

Should I buy crypto on Gemini?

Buying crypto on Gemini makes sense if you plan to use bank transfers, place limit orders, and focus on established assets like Bitcoin and Ethereum. Users relying on instant buys or seeking aggressive promotions may find better value elsewhere.

Can I trust the Gemini app?

The Gemini mobile app offers the same security controls and account protections as the web platform, including device approval and login alerts. Trust ultimately depends on understanding that assets are held custodially and are not protected by UK compensation schemes.

Is Gemini regulated in the UK?

Gemini is registered with the Financial Conduct Authority as an Electronic Money Institution. This regulation covers fiat payment services, not crypto trading or crypto asset protection.

Can I use British pounds to trade crypto on Gemini?

Yes, Gemini supports GBP deposits and withdrawals for UK users. This allows direct trading against GBP pairs without needing to convert to another currency.

What is the minimum deposit on the Gemini crypto platform?

The minimum deposit for UK users is £10. This applies to GBP funding via supported bank transfer methods.

Is Gemini legal in the UK?

Yes, Gemini operates legally in the UK and is authorised to provide fiat related services under FCA registration. Crypto trading itself remains unregulated, but Gemini complies with UK financial promotions and consumer protection rules.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.