Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro is a regulated social trading platform designed for beginner and casual crypto investors, offering simple access to cryptocurrencies alongside copy trading, an intuitive interface, and strong educational tools.

Its main strengths are usability, community driven features, and regulatory oversight, which help reduce complexity for new users.

The main drawback is its spread based pricing and limited advanced trading controls, which may matter for experienced traders seeking lower costs or full self custody control.

What is eToro and how does it work?

eToro is a centralised, regulated online trading platform that lets users buy, sell, and hold cryptocurrencies through a simple, broker style interface, rather than a decentralised blockchain based exchange. Trades are executed and custody is handled by eToro itself, which means users interact with prices and balances inside the platform instead of managing private keys or on chain wallets.

Centralised or decentralised?

eToro is a fully centralised platform.

This means:

- eToro acts as the intermediary between buyers and sellers

- Crypto assets are held in custodial wallets managed by eToro or its affiliated wallet service

- Users do not control private keys by default unless assets are transferred out to the eToro Money crypto wallet and then onward to an external wallet

This model prioritises ease of use, regulatory oversight, and account recovery over full self custody, which appeals strongly to newer investors.

Core trading model

For crypto users, eToro primarily operates a spot trading model:

- You buy and sell cryptocurrencies at market prices

- There is no order book visible to users

- Pricing is spread based, with a typical 1% buy and sell fee built into the spread

In the UK and EU, eToro also offers crypto CFDs for eligible users, allowing leveraged exposure without owning the underlying asset. These are higher risk products and are not available to retail users in all regions, including the United States.

eToro does not operate as a derivatives only exchange like Binance Futures, nor does it support decentralised swaps or on chain liquidity pools.

Intended user level

eToro is designed primarily for:

- Beginners who want a regulated and simple way to start investing in crypto

- Casual and long term investors who prefer buy and hold strategies

- Users who want to learn by following other traders through CopyTrader and Smart Portfolios

It is less suitable for:

- Advanced traders who need deep order books, advanced charting, or custom trading bots

- Users seeking full decentralised finance access such as staking via validators, yield farming, or on chain swaps

With over 35 million registered users globally and regulation through bodies such as the Financial Conduct Authority (FCA) in the UK and CySEC in the EU, eToro positions itself as a bridge between traditional investing platforms and cryptocurrency markets, prioritising accessibility, compliance, and guided investing over technical complexity.

eToro overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | UK, EU, Australia, and many global markets. Crypto availability varies by jurisdiction. |

| Exchange type (centralised or decentralised) | Centralised platform operated by eToro |

| Regulator or registration status | FCA registered in the UK, CySEC in the EU, ASIC in Australia. Crypto trading is regulated differently by region and may not carry full investor protections. |

| Custody model (custodial or non custodial) | Custodial by default. Assets are held by eToro. Users can transfer supported crypto to the eToro Money Wallet and then to an external wallet if eligible. |

| Investor protection (usually none) | No FSCS protection for crypto assets. Crypto is not covered by UK or EU investor compensation schemes. |

| Supported cryptocurrencies | Around 100 cryptocurrencies globally, including Bitcoin, Ethereum, Solana, XRP, Cardano, and major altcoins. |

| Trading types (spot, derivatives, margin) | Spot crypto trading. Crypto CFDs available to eligible UK and EU users. No crypto futures exchange. |

| Fiat on ramp and off ramp | Bank transfer, debit card, PayPal in supported regions. Fiat balances held in USD with currency conversion for GBP and EUR. |

| Trading fees | Spread based pricing. Around 1% per crypto trade, built into the buy and sell price. |

| Deposit and withdrawal fees | No deposit fees. $5 withdrawal fee. Currency conversion fee applies for non USD deposits. |

| Security features | Cold storage for most assets, SSL encryption, mandatory two factor authentication, fraud monitoring, regulated operational controls. |

| Mobile app and web platform | Full featured iOS, Android, and web trading platforms with social trading and portfolio tools. |

| Ease of use level | Beginner friendly. Designed for new and casual investors rather than advanced traders. |

Quick answer: Should you use eToro for cryptocurrency investing?

Yes. eToro is a beginner friendly, regulated platform for investors who want a simple and guided way to invest in crypto. Fees are higher than some specialist UK crypto exchanges, but strong usability, copy trading, and regulatory oversight make it well suited to learning and lower complexity investing.

Key highlights

- Minimum deposit: $50 via UK bank transfer

- Copy top performing traders across crypto and other assets

- FCA registered and compliant with UK crypto marketing rules

- Clean interface with social trading and mobile app support

- Best suited to beginners and casual investors looking for guidance rather than advanced trading tools

What assets and markets are available on eToro?

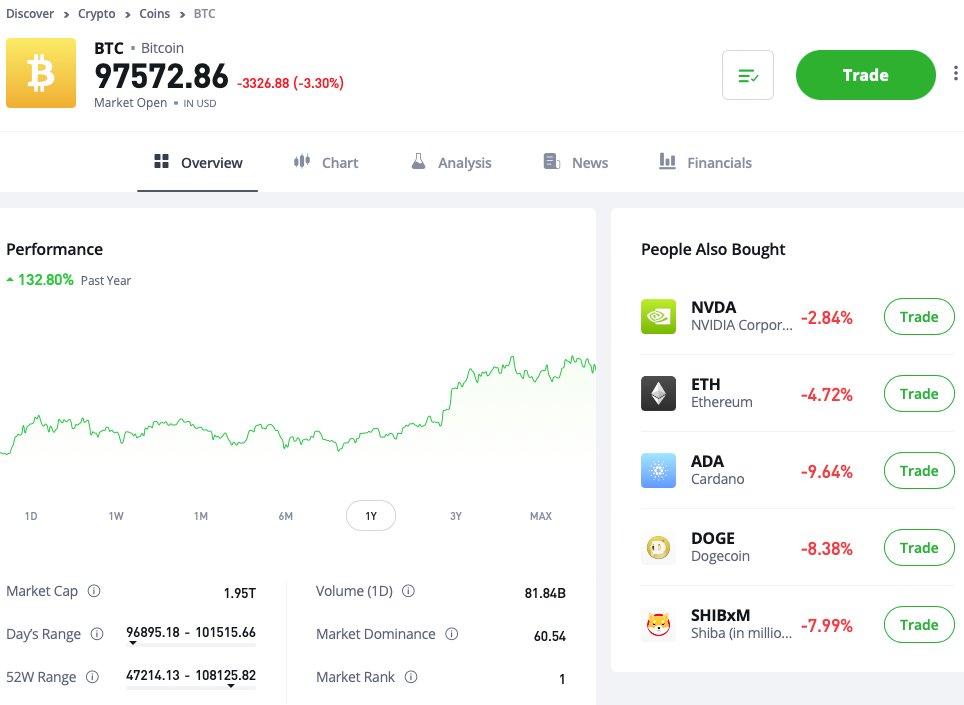

eToro offers a broad but region dependent crypto lineup, with roughly 100 cryptocurrencies available globally and a simpler spot style trading experience priced via spreads rather than an order book. It focuses on major coins and large cap tokens rather than deep altcoin coverage, and it does not run a perpetual futures exchange.

Number and range of supported cryptocurrencies

eToro’s crypto range is strongest in the large cap and mainstream part of the market. Depending on the user’s country, it typically includes:

- Major networks like Bitcoin (BTC) and Ethereum (ETH)

- Popular layer 1s and large caps such as Solana (SOL), Cardano (ADA), XRP, and Polkadot (DOT)

- A selection of DeFi and utility tokens such as Chainlink (LINK), Uniswap (UNI), Aave (AAVE), and others

Availability is not uniform across countries. In the United States, eToro’s retail crypto offering was reduced after a September 2024 SEC settlement, with the platform limiting supported assets for US retail customers to Bitcoin, Bitcoin Cash, and Ether. That is a meaningful reminder that eToro’s crypto menu is driven by local rules, not just demand.

Spot markets

eToro’s crypto trading is primarily spot exposure delivered through a broker style interface:

- Users buy and sell crypto at quoted prices inside the platform

- Trading is designed around simple actions like buy, sell, and convert

- Pricing is based on the spread, rather than matching orders in a visible order book

This structure suits beginners because it removes order book complexity, but it also means eToro does not provide the same market microstructure tools as specialist exchanges.

Derivatives or perpetuals

eToro does not operate a crypto perpetuals or futures exchange.

For derivatives, the position depends on location:

- In some regions, eToro offers CFDs for eligible users, which are leveraged products and higher risk

- In the UK, leverage and shorting restrictions apply, and CFD availability depends on product rules and user eligibility

For crypto investors, the practical takeaway is that eToro is built around straightforward spot style investing, not advanced derivatives trading.

Stablecoin and fiat pairs

eToro generally supports major stablecoins such as USDT and USDC in regions where they are permitted, alongside other widely used tokens.

However, eToro is not a classic pairs based exchange:

- Trading is typically quoted in USD, with local currency funding converted when needed

- For UK users, GBP deposits commonly convert into USD balances, which can create an additional cost layer through conversion fees depending on account setup

So while many cryptoassets are available, users should not expect the same range of fiat to crypto or stablecoin to crypto pairs seen on a high liquidity order book exchange.

Liquidity depth and market coverage

Liquidity is one of the biggest differences between eToro and specialist exchanges:

- eToro does not publish a full public order book for most retail crypto trading flows

- The platform typically sources pricing from underlying liquidity providers and market venues, then quotes a tradeable price to the user, with costs reflected through the spread

This model usually provides enough coverage for mainstream retail sized orders in major coins, but it is not designed for:

- Very high frequency strategies

- Large size execution requiring visible depth and granular limit order control

- Altcoin hunting where market depth varies sharply between venues

Scoring note for supported assets and markets

eToro scores well for beginners because it covers the most widely traded cryptocurrencies and keeps market access simple. It scores lower than specialist exchanges for active traders because it lacks perpetual futures, does not focus on deep pair coverage, and offers less transparency around order book depth and execution routing.

How good is the trading experience and toolset on eToro?

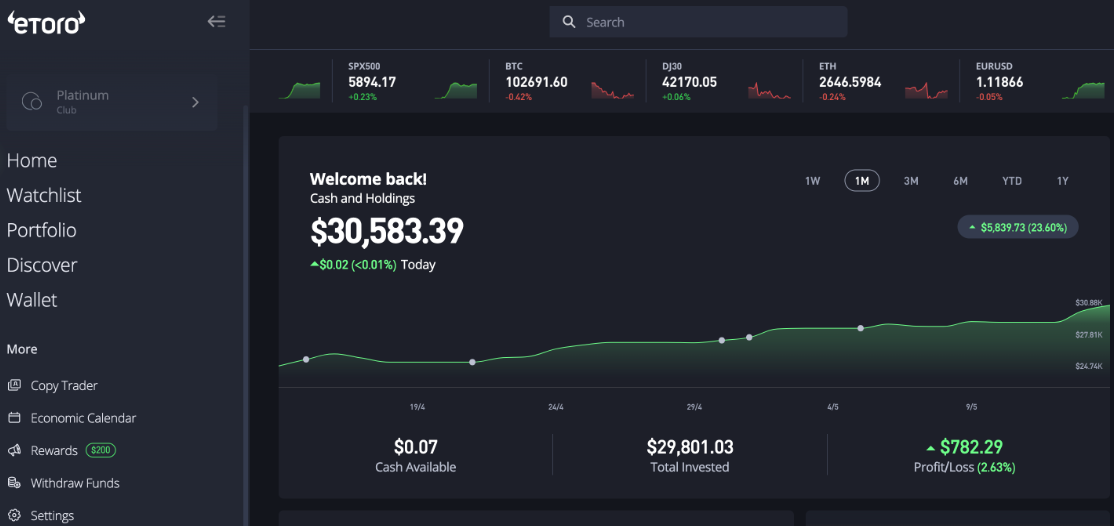

eToro delivers a polished, beginner focused trading experience on web and mobile, with simple crypto dealing, clear portfolios, and standout social features like CopyTrader and a social feed. It supports basic order types and solid charts for everyday use, but it is not built for advanced execution, automation, or professional grade crypto trading workflows.

Web and mobile platform usability

eToro’s biggest strength is usability. The web platform and mobile app are designed for quick actions like buying, selling, and tracking performance, without the complexity of an order book style exchange.

Key usability features include:

- Clean dashboard and navigation that makes it easy to find major coins like BTC, ETH, SOL, and others

- One click trading to place a trade quickly without building a multi step order ticket

- Price alerts so users can monitor levels without constantly checking the app

- Social layer with a feed where users discuss market moves and share ideas

- CopyTrader to automatically copy other traders’ portfolios and trades

- Virtual portfolio demo mode with $100,000 in paper funds to practise without risking real money

For new users, this matters because the platform reduces decision friction. The trade off is that the interface is optimised for simplicity, not for deep trading controls.

Order types available

For crypto, eToro focuses on core retail order functionality:

- Market orders for instant execution at the quoted price

- Limit orders for buying or selling at a chosen level

Compared with specialist crypto exchanges, eToro is more limited on advanced conditional orders. It lacks some advanced order features that active traders expect, particularly for fast moving crypto markets.

Practical impact:

- Fine for buy and hold investors placing occasional trades

- Less suitable for traders who rely on layered conditional orders for risk management and entries

Charting tools and indicators

Charting is suitable for mainstream users rather than technical analysts:

- Charts and price views are easy to access on both mobile and web

- The platform supports common trading workflows like watching price changes, using alerts, and checking performance

- eToro also integrates research style tooling in some regions, including ProCharts and a TipRanks research tab, which can add context for multi asset investors

Limitations:

- Charting and technical tooling are not positioned as best in class versus advanced platforms

- The experience is designed to support decision making, not to replicate a professional trading terminal

Advanced tools such as APIs or automation

This is not eToro’s core positioning.

- eToro’s advanced edge is social trading, not automation

- CopyTrader and portfolio style products such as CopyPortfolios or Smart Portfolios act as guided, semi automated ways to follow strategies, without the user needing bots or custom scripts

There is no clear emphasis on:

- Public trading APIs for retail users

- Algorithmic order routing

- Bot marketplaces or advanced automation tools typical of exchange first crypto platforms

So eToro suits users who want a managed, guided workflow rather than building or running automated strategies.

Performance and reliability

eToro is an established platform with a long operating history and a large user base, cited as 35 million users globally, which usually indicates mature infrastructure and established processes.

That said, reliability is not only about uptime.

- Withdrawal speed complaints and reports of delays in some cases

- Concerns from some users around fees feeling higher than expected, often linked to spread pricing and conversion costs

Best way to frame this for readers:

- The trading interface itself is generally smooth and accessible for day to day use

- The main friction points tend to show up around money movement and cost transparency, rather than the basic act of placing a trade

How this affects the score for trading experience and tools

eToro scores strongly for beginners due to usability, social features, and the demo account. It scores lower for advanced traders because order types, charting depth, and automation style tooling are more limited than what a dedicated crypto exchange typically provides.

How competitive are eToro’s fees and pricing?

eToro’s crypto pricing is simple but not the cheapest. Crypto trades are charged via a spread based model, with a headline 1% fee on buys and sells built into the quoted price, plus potential currency conversion costs if funding in GBP or EUR. Deposits are usually free, but $5 withdrawals and inactivity fees can apply.

eToro crypto fees at a glance

| Fee type | What eToro charges | What it means in practice |

|---|---|---|

| Trading fee model | Spread based, not maker taker | Users trade at a quoted buy and sell price rather than an order book |

| Crypto buy and sell fee | 1% per trade (added to the bid ask spread) | Costs are easiest to see as the difference between the buy and sell price |

| Spread costs | Variable | Spreads can widen in fast markets or on less liquid coins, increasing total cost |

| Deposit fees | Often $0 | Funding the account is usually free, but payment method and provider fees can still apply |

| Withdrawal fees (fiat) | $5 per withdrawal and $30 minimum withdrawal | Small withdrawals are less cost effective |

| Withdrawal fees (crypto transfers) | eToro does not charge a separate send fee, but blockchain network fees apply | You still pay on chain fees when moving crypto to an external wallet |

| Currency conversion | 0.75% for non USD transactions | UK users funding in GBP may pay conversion because trading balances are typically in USD |

| Inactivity fee | $10 per month after 12 months of inactivity | Relevant for buy and hold users who stop logging in and do not trade |

Trading fees and spread costs

eToro does not run a traditional crypto exchange fee schedule with maker and taker tiers. Instead, it uses a broker style model where pricing is embedded in the spread. The platform also applies a clear headline crypto fee of 1% on buys and sells, which is added to the spread, so the true cost is the combination of both.

This structure is usually competitive for beginners who value simplicity, but it can be more expensive than order book exchanges for frequent traders, especially when spreads widen during volatile periods.

Deposit fees

Deposits are commonly advertised as fee free, which helps keep funding costs predictable. However, indirect costs can still show up if a payment provider charges its own fee, or if the deposit currency triggers conversion into USD.

Withdrawal fees

Fiat withdrawals carry a $5 fee and a $30 minimum, which can be a drawback for users who withdraw frequently or in smaller amounts. Some higher tier account levels may have the withdrawal fee waived, but for most users it should be assumed to apply.

Crypto transfers do not typically include a separate platform send fee, but users still pay blockchain network fees when moving assets on chain.

Indirect or hidden costs to watch

These are the main extra costs that can catch users out:

- Currency conversion when depositing or withdrawing in non USD currencies

- Wider spreads on smaller coins or during high volatility

- Inactivity fee if the account is left unused for over a year

- Withdrawal minimums that make small withdrawals less efficient

Scoring view for fees and pricing

eToro is transparent and easy to understand, but it is not a low cost crypto exchange. The pricing structure suits occasional investors and beginners, while high frequency traders often find better value on platforms with tight spreads and maker taker fee tiers.

How secure is eToro and how are assets held?

eToro is a custodial crypto platform, meaning the firm controls the wallets and safekeeping process rather than the user holding private keys by default. It uses standard exchange style protections such as cold storage for most crypto assets and two factor authentication (2FA) at account level, but crypto holdings still carry insolvency and platform risk and are typically not covered by FSCS.

Custody model

eToro’s default custody model is centralised and custodial:

- When a user buys crypto on the platform, assets are held within eToro’s custody framework rather than being delivered directly to a personal on chain wallet.

- eToro also offers the eToro Money crypto wallet, which can be used to hold supported assets and, in some cases, move crypto on chain, but the core trading platform remains custodial.

Why this matters:

- Custodial platforms can simplify account recovery and onboarding.

- Users are exposed to platform level risks, including operational issues and, in a worst case scenario, insolvency processes.

In the United States, risk disclosures often highlight that crypto held on a custodial exchange can become part of an insolvency claim process, where customers may be treated as unsecured creditors.

Cold storage practices

eToro describes an institutional custody setup that includes:

- Most crypto assets held in cold storage, meaning private keys are stored offline to reduce exposure to online attacks.

- Assets held inside the eToro Money wallet are described as being held on chain, while platform custody uses cold storage for a large share of balances.

Cold storage is a standard control used by major custodial platforms. It reduces one class of risk, but it does not remove counterparty risk or operational risk.

Account security controls

Account level controls:

- Two factor authentication (2FA), with 2FA required after the first deposit in the described onboarding flow.

- SSL encryption for data transmission and secure logins.

- Security guidance and fraud prevention resources, including phishing and scam reporting workflows.

Incident history and regulatory signals

- eToro has operated since 2007 and has supported crypto trading since 2013, which indicates a long operating history compared with many crypto only exchanges.

- In the United States, eToro reached a September 2024 settlement with the SEC linked to how crypto assets were offered, after which its retail crypto lineup was reduced. This is not a security incident, but it is a regulatory event that can affect product availability and user access to assets over time.

Clear risk disclosures to include

A security section should state the risks plainly:

- Crypto is high risk and volatile, and losses can exceed expectations if positions move quickly.

- Crypto holdings are usually not protected by FSCS in the UK, and UK or EU consumer protections that apply to some regulated investments generally do not apply in the same way to crypto.

- Custodial crypto exposes users to platform and counterparty risk. If a platform fails, access to assets can be delayed and outcomes can depend on insolvency processes.

- Transfers to external wallets can involve blockchain fees and irreversible transactions if sent to the wrong address.

Scoring view for security and custody

eToro scores strongly for mainstream users because it combines regulated business operations in multiple jurisdictions with common security controls like cold storage and mandatory 2FA. It scores lower than specialist exchanges for users who want maximum self custody control or advanced withdrawal security tooling as standard.

How do deposits and withdrawals work on eToro?

eToro supports mainstream fiat funding methods such as bank transfer, debit card, and PayPal in many regions, then converts balances into USD for trading. Crypto can be bought and sold inside the platform, and eligible users can transfer supported coins to the eToro Money Wallet for on chain withdrawals. Deposits are usually free, while fiat withdrawals typically cost $5 and have a $30 minimum.

Fiat on ramp and off ramp support

Funding the account (fiat deposits)

eToro is designed around fiat on ramp convenience, so most users start by depositing cash and then buying crypto inside the platform.

Common supported methods:

- Bank transfer

- Debit card

- PayPal

- Wire transfer in some cases

Minimum deposit

The minimum deposit is $50 via UK bank transfer.

Base currency and conversion

Even for UK users depositing GBP, eToro commonly operates with balances in USD, which means:

- Deposits and withdrawals are processed in USD

- GBP and EUR deposits may trigger a currency conversion fee (0.75%)

This conversion layer is one of the most important practical costs in the deposit and withdrawal flow, especially for users funding from GBP accounts.

Withdrawing fiat (off ramp)

Fiat withdrawals typically involve:

- A $5 withdrawal fee

- A $30 minimum withdrawal amount

- Withdrawal fee waivers for some higher tier membership levels, depending on account status

These rules make eToro better suited to fewer, larger withdrawals rather than frequent small withdrawals.

Crypto deposit and withdrawal process

eToro’s crypto workflow is more controlled than on a pure exchange, because the platform is custodial by default.

Buying crypto

Most users do not deposit crypto to begin. Instead, they:

- Deposit fiat

- Buy crypto on eToro using the app or web platform

- Hold it within the platform or move it to the eToro Money Wallet if supported

Depositing crypto

In general, eToro supports crypto wallet functionality via eToro Money, but eligibility and supported assets can vary by region and token.

Withdrawing crypto

Crypto withdrawals typically follow a two step structure:

- Move supported crypto from the trading account into the eToro Money Wallet

- Send from the wallet to an external address on chain

Costs and friction points:

- eToro is described as not charging a separate fee for sending or withdrawing crypto, but users still pay blockchain network fees (for example, Ethereum gas fees) when transferring on chain

- Not every token or region is eligible for transfer out, so it is not always equivalent to a full self custody exchange experience

Processing times

Deposits

- Card and PayPal deposits are typically fast, often close to instant for funding

- Bank transfers depend on banking rails and cut off times

Withdrawals

- Withdrawals can take a few business days and that slow withdrawals are one of the recurring complaints in external user feedback summaries

- Processing time can be affected by verification status, internal checks, and withdrawal method

For readers, the key expectation to set is:

- Deposits feel quick in most cases

- Withdrawals can be slower than some dedicated crypto exchanges, particularly for fiat cash outs

Limits and minimums

- Minimum deposit: $50 via UK bank transfer (with other contexts referencing $100 minimums)

- Withdrawal fee: $5

- Minimum withdrawal: $30

In practice, users should expect additional limits based on:

- Account verification level

- Payment method risk checks

- Jurisdictional requirements tied to FCA and other regulator standards

Reliability and transparency

eToro’s deposits and withdrawals are generally easy to follow inside the app, but transparency is not only about the on screen flow. The biggest reliability and clarity factors for users are:

- USD as the base currency, which can create conversion costs and make it harder to predict the net amount received in GBP

- Fee structure spread across steps, where users see trading spreads, withdrawal fees, and conversion fees as separate components

- Withdrawal timing variability, with user feedback often focusing on delays and friction during cash out

Scoring view for deposits and withdrawals

eToro scores well for beginners due to common payment options and straightforward funding. It scores lower for active crypto traders because withdrawals can be slower, fiat withdrawals have fixed fees and minimums, and the USD base currency can add conversion costs for UK and EU users.

How trustworthy is eToro in terms of regulation and support?

eToro is a multi jurisdiction trading platform with named regulated entities and oversight that varies by country. In the UK, the brand operates through an FCA regulated firm and follows UK crypto marketing rules, while other regions are covered via regulators like CySEC and ASIC. Support is mainly digital first via help centres and tickets, with limited phone access.

Regulatory or registration status

eToro’s trust profile starts with jurisdiction level structure rather than a single global licence.

Key regulators:

- Financial Conduct Authority (FCA) in the UK

- Cyprus Securities and Exchange Commission (CySEC) for parts of Europe

- Australian Securities and Investments Commission (ASIC) in Australia

In the United States, the product set is split by entity and rules:

- Stock and ETF trading is offered through eToro USA Securities, which is a member of the Securities Investor Protection Corporation (SIPC). SIPC protection relates to brokerage custody failures for eligible securities and does not protect crypto price losses.

- Crypto trading is offered by eToro USA, which is described as not FDIC or SIPC insured for crypto holdings.

A key regulatory event worth noting for transparency is the September 2024 settlement with the US Securities and Exchange Commission (SEC), after which eToro agreed to restrict its US retail crypto offering. That is not a customer support issue, but it is a clear example of regulation changing what a user can trade.

Jurisdictional transparency

eToro is relatively clear that:

- Availability and features differ by country, including which cryptocurrencies can be traded

- Some products such as CFDs are jurisdiction dependent, with CFDs not available in the United States

- Crypto is treated differently from regulated investments, even when the platform itself is regulated

For crypto users in the UK and EU, the most important transparency point is that consumer protection is limited. Crypto is typically not covered by FSCS or equivalent investor compensation schemes, and protections that apply to certain regulated investments do not apply in the same way to crypto assets.

Customer support channels and responsiveness

eToro’s support model is primarily online:

- Help centre resources and FAQs

- Support tickets and, in some cases, live chat

- Phone support is described as limited. For the US arm, the phone number listed is 888 271 8365, but users are generally directed toward tickets or chat first

- The platform also references account managers for more active clients, cited as those with $5,000 or more in equity on the platform

User feedback flags recurring complaints around withdrawal speed and fund access, which is relevant because support experience is often judged most harshly during withdrawals, verification checks, or disputes.

Clarity of risk warnings and disclosures

eToro’s disclosures on crypto are typically direct and should be repeated clearly in any review:

- Crypto is high risk and volatile, and losses are possible

- Crypto holdings usually have no UK or EU consumer protection protections

- In the US, crypto trading via eToro USA is described as not SIPC or FDIC insured

- Where crypto assets are held on a custodial platform, insolvency risk exists. If crypto assets are commingled on a custodial crypto exchange, customers could become unsecured creditors in insolvency scenarios

Scoring view for trust, regulation, and support

eToro scores strongly on jurisdictional credibility because it operates through regulated entities and publishes clear risk language. It scores lower on support compared with providers that offer consistently fast, human first service, because channels are ticket led and withdrawal related complaints appear in user feedback summaries.

What are the pros and cons of using eToro?

Pros

- Beginner friendly interface that makes it easy to buy and sell crypto without learning order books, fee tiers, or complex trading screens

- Social and copy trading through CopyTrader, letting users mirror other traders’ portfolios and use the platform as a learning tool

- Strong multi jurisdiction oversight compared with many crypto only exchanges, with regulation referenced across the UK (FCA), EU (CySEC), and Australia (ASIC)

- Demo account with $100,000 virtual funds, useful for practising trades and testing the platform before funding with real money

- Broad mainstream crypto coverage outside the US, with around 100 supported cryptocurrencies globally and a focus on large cap names

Cons

- Higher ongoing trading costs than many exchanges due to spread based pricing and a headline 1% crypto fee added to the bid ask spread

- Custodial model by default, meaning users do not control private keys unless they move eligible assets to the eToro Money Wallet and then withdraw on chain

- Fiat withdrawals cost $5 with a $30 minimum, and user feedback summaries frequently highlight slow or frustrating withdrawal experiences

- USD base currency can trigger conversion fees for UK and EU users depositing in GBP or EUR, increasing total cost beyond the headline trading fee

- Restricted crypto availability in some jurisdictions, including the US retail crypto lineup being limited after the September 2024 SEC settlement

Who is eToro best for?

- Beginners who want a simple way to buy and sell major cryptocurrencies

- Casual investors who prefer a guided experience with a clean app and clear portfolio view

- Copy trading users who want to follow other traders through CopyTrader rather than building strategies from scratch

- Multi asset investors who also want access to stocks, ETFs, and other markets in the same account, depending on region

- Safety focused users who prioritise regulated entities and clear risk disclosures over the lowest possible crypto fees

Who is eToro not ideal for?

- Low fee seekers who want maker taker pricing, tight spreads, and predictable order book execution

- Advanced traders who need deep order types, advanced charting, APIs, and automation tooling

- Self custody first users who want full control of private keys and on chain wallet workflows as standard

- Users who withdraw frequently because fixed withdrawal fees, minimums, and processing delays can be a recurring friction point

- US users wanting broad altcoin access, since the retail crypto lineup is constrained relative to global availability

How to get started with eToro

Getting started with eToro is designed to be quick and structured, with clear steps that meet regulatory requirements in the UK, EU, and other supported regions. Most users can go from sign up to placing their first crypto trade in the same day, depending on verification speed.

1. Create an account

Visit eToro’s website or download the mobile app and register with:

- An email address and password, or

- A linked Google or Apple account (where available)

At this stage, no funds are required. Users can immediately access the platform in demo mode, which comes with $100,000 in virtual funds to practise trading without real money.

2. Complete verification if required

Before depositing or withdrawing, eToro requires identity verification to comply with KYC and AML regulations enforced by bodies such as the FCA (UK), CySEC (EU), and ASIC (Australia).

Verification typically involves:

- Personal details such as full name, date of birth, and address

- A government issued photo ID (passport or driving licence)

- Proof of address in some cases (utility bill or bank statement)

- A short suitability questionnaire covering trading experience and risk tolerance

Verification can take from a few minutes to several business days, depending on document checks and region.

3. Deposit funds

Once verified, users can fund their account using supported fiat on ramp methods, which commonly include:

- Bank transfer

- Debit card

- PayPal

- Wire transfer in some regions

Key funding details:

- Minimum deposit: often $50 via UK bank transfer, though some payment methods or regions reference $100 minimums

- Accounts typically operate in USD, so GBP or EUR deposits may incur a currency conversion fee

- Deposits are usually fee free from eToro’s side, but payment providers may charge separately

Funds appear in the trading balance once processed, with card and PayPal deposits often being the fastest.

4. Place a trade

After funding, users can place a crypto trade in a few steps:

- Search for a cryptocurrency such as Bitcoin (BTC) or Ethereum (ETH)

- Select Buy or Sell

- Enter the trade amount in USD

- Review the quoted price, including the spread and 1% crypto trading fee

- Confirm the trade

eToro supports basic order types such as market and limit orders, depending on asset and region. For beginners, trades are executed at a clear quoted price rather than through a complex order book.

Users can also:

- Copy other traders using CopyTrader

- Invest via managed Smart Portfolios (where available)

5. Withdraw or secure assets

After trading, users have two main options for managing assets:

Withdraw fiat

- Convert crypto back to cash

- Request a withdrawal to the original payment method

- Typical withdrawal terms include a $5 fee and a $30 minimum

- Processing can take a few business days, especially after compliance checks

Secure crypto assets

- Eligible users can transfer supported cryptocurrencies to the eToro Money Wallet

- From the wallet, crypto can be sent on chain to an external wallet

- eToro does not usually charge a separate crypto withdrawal fee, but blockchain network fees apply

- Not all assets or regions support on chain withdrawals

Key risk reminder

Crypto held on a custodial platform can be subject to platform and insolvency risk, and crypto assets are typically not protected by FSCS or similar schemes. Users who want full self custody must complete an on chain withdrawal where supported.

This structured onboarding process is one of the reasons eToro appeals to beginners, while more advanced traders may find the flow restrictive compared with full exchange style platforms.

How we tested and methodology

Each cryptocurrency platform is assessed using a standardised six category scoring framework, designed to ensure consistency, transparency, and fair comparison across all reviews. Every category is scored out of 5, with the combined results used to form the overall platform rating.

The six scoring categories are:

- Supported assets and markets: breadth of cryptocurrencies available, regional restrictions, and access to major and emerging assets

- Trading experience and tools: platform usability, order types, charting, mobile app quality, and additional features such as copy trading or demo accounts

- Fees and pricing: trading fees, spreads, withdrawal costs, currency conversion charges, and any indirect or hidden costs

- Security and custody: custody model, cold storage practices, account security controls, and historical security considerations

- Deposits and withdrawals: fiat on ramp and off ramp options, crypto transfer support, processing times, minimums, and reliability

- Trust, regulation, and support: regulatory status, jurisdictional transparency, quality of disclosures, and customer support access

Scores are based on hands on platform testing, detailed fee and pricing analysis, a security and custody review, and structured usability checks across both desktop and mobile environments. Regulatory registrations and public disclosures are reviewed to assess trust and operational transparency, with user experience and practical limitations reflected in the final scoring.

FAQs

Is eToro good for crypto?

Yes. eToro is well suited to beginners and casual investors who want a simple way to buy and sell major cryptocurrencies within a regulated platform. It prioritises ease of use and learning tools over advanced trading features.

Does eToro support crypto?

Yes. eToro supports cryptocurrency trading alongside stocks and other assets, with around 100 cryptoassets available globally, although availability varies by country.

Can I buy crypto on eToro UK?

Yes. UK users can buy and sell cryptocurrencies on eToro, subject to FCA compliant crypto marketing rules and local product restrictions.

Do I actually own my crypto on eToro?

Crypto on eToro is held under a custodial model by default, meaning private keys are controlled by the platform. Ownership exposure exists, but full self custody only applies if supported assets are transferred out via the eToro Money Wallet.

Is it safe to leave crypto on eToro?

eToro uses cold storage, two factor authentication, and operates regulated entities, which reduces some operational risks. However, crypto held on custodial platforms is not protected by FSCS and remains exposed to platform and insolvency risk.

Which is better, Coinbase or eToro?

Coinbase is generally better for users who want a pure crypto exchange with clearer custody options, while eToro suits beginners who value simplicity and social trading features. The better option depends on whether ease of use or crypto native tools matter more.

Can I take my crypto out of eToro?

Yes, but with limits. Supported cryptocurrencies can be moved to the eToro Money Wallet and then withdrawn on chain, although not all assets or regions support external transfers.

Is eToro safe in the UK?

eToro operates through an FCA regulated UK entity and follows UK crypto promotion rules. That improves transparency and oversight, but crypto assets themselves are still high risk and not covered by FSCS.

Are eToro crypto fees high?

Fees are higher than many exchanges. Crypto trades include a 1 percent buy and sell fee built into the spread, plus potential currency conversion costs for GBP users.

Is eToro good for crypto trading?

It is suitable for basic crypto trading and portfolio building. It is less suitable for active or professional traders who need tight spreads, advanced order types, or APIs.

Can you trade crypto on eToro in the UK?

Yes. UK users can trade supported cryptocurrencies on eToro, with access dependent on local rules and asset eligibility.

Is eToro good for beginners?

Yes. The platform is widely considered beginner friendly due to its clean interface, demo account, and copy trading features that reduce complexity for first time crypto investors.

eToro is a multi-asset platform that offers both investing in stocks and crypto assets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. The trading history presented is less than 5 complete years and may not suffice as a basis for investment decisions.

Copy Trading does not amount to investment advice. Your crypto investment value may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilising publicly available non-entity-specific information about eToro.

This content has been prepared by Payward Limited.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.