CoinJar is a UK cryptocurrency exchange designed for beginners and long term investors, offering low exchange style trading fees, a simple app based buy and sell flow, and a built in wallet with offline storage for most customer funds.

Its main drawback is limited depth for active trading, which may matter for frequent traders who want advanced tools, broader markets, and faster support channels.

What is CoinJar and how does it work?

CoinJar is a centralised cryptocurrency exchange that lets users buy, sell, and hold digital assets using traditional money or crypto, through a simple app and web platform.

Centralised or decentralised?

CoinJar is a centralised exchange (CEX). This means the platform acts as an intermediary, holding custody of user funds and executing trades on users’ behalf. Accounts are subject to full identity verification (KYC), and assets are stored using a combination of hot wallets and offline cold storage, with around 90 percent of customer funds held offline to reduce security risk.

Core trading model

CoinJar focuses exclusively on spot trading, rather than complex or leveraged products. There is no derivatives trading, futures, options, or perpetual swaps available.

Users can trade in three main ways:

- Instant Buy and Sell: Buy or sell cryptocurrencies instantly using GBP balances, debit cards, or Apple Pay and Google Pay. Instant purchases typically carry a 2 percent fee, reduced to 1 percent for recurring buys.

- Standard buy and sell (wallet trading): Convert between fiat and crypto or crypto to crypto at a flat 1 percent conversion fee, designed for simplicity rather than active trading.

- CoinJar Exchange (advanced spot trading): A separate exchange interface offering lower maker and taker fees based on 30 day trading volume.

- GBP pairs: 0.10 percent taker, 0.02 to 0.10 percent maker

- Crypto to crypto pairs: 0.06 percent taker, 0.00 percent maker

- Stablecoin pairs: as low as 0.001 percent taker

All trading is done at spot prices, meaning users are buying and selling real cryptocurrencies rather than contracts.

Intended user level

CoinJar is designed primarily for beginners and long term investors, with limited but growing support for more active traders.

- Best suited for

- First time crypto buyers

- Long term holders using pound cost averaging

- Users who value low fees and simple execution

- Investors using features like Recurring Buy and CoinJar Bundles for diversification

- Less suited for

- High frequency traders

- Users looking for leverage, derivatives, or advanced automation

- Traders who rely on advanced charting, indicators, or trading bots

Overall, CoinJar prioritises ease of use, transparent pricing, and basic spot trading, making it a practical entry point into cryptocurrency, but not a full featured trading platform for advanced strategies.

CoinJar overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | United Kingdom, Australia, United States, Ireland |

| Exchange type (centralised or decentralised) | Centralised exchange (CEX) |

| Regulator or registration status | FCA registered in the UK (cryptoasset registration); regulated locally in Australia |

| Custody model (custodial or non custodial) | Custodial |

| Investor protection (usually none) | No statutory investor protection; crypto assets are not FSCS protected |

| Supported cryptocurrencies | 65+ cryptocurrencies including BTC, ETH, LTC, XRP, SOL, ADA, XLM, ALGO, EOS, XTZ |

| Trading types (spot, derivatives, margin) | Spot trading only |

| Fiat on ramp and off ramp | GBP, EUR, AUD, USD via bank transfer, FPS, SEPA, debit card, Apple Pay, Google Pay |

| Trading fees | Maker: 0.02% to 0.10% • Taker: 0.06% to 0.10% (CoinJar Exchange); flat 1% on standard buy sell |

| Deposit and withdrawal fees | Bank transfers and crypto deposits free; card and wallet instant buys up to 2% |

| Security features | 90%+ funds held in cold storage, encryption, TLS, machine learning fraud detection, 2FA |

| Mobile app and web platform | iOS and Android apps plus full web platform |

| Ease of use level | Beginner to intermediate |

What assets and markets are available on CoinJar?

CoinJar offers access to around 65 cryptocurrencies through spot-only markets, with strong coverage of major coins, stablecoins, and fiat pairs, but no derivatives or leveraged products. Asset breadth is solid for beginners and long term investors, though market depth and product range remain limited compared to global trading platforms.

Number and range of supported cryptocurrencies

CoinJar supports 65+ cryptocurrencies, focusing on established, high-liquidity assets rather than speculative micro-cap tokens. The range prioritises market leaders and widely traded networks, which helps reduce volatility and execution risk for newer users.

Supported assets include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Solana (SOL)

- Cardano (ADA)

- Stellar (XLM)

- Algorand (ALGO)

- EOS

- Tezos (XTZ)

Plus around 57 additional assets, including selected DeFi tokens and stablecoins.

While this coverage is sufficient for core portfolio construction, it is smaller than exchanges like Kraken or Binance, which list several hundred assets.

Spot markets only

CoinJar is a spot-only exchange. All trades involve buying and selling real cryptocurrencies, either against fiat currencies or other crypto assets.

There is no access to:

- Futures

- Perpetual contracts

- Options

- Margin or leveraged trading

This limits flexibility for advanced trading strategies but aligns with CoinJar’s focus on simplicity and risk control.

Derivatives and perpetuals

Not offered. CoinJar does not support derivatives, perpetual futures, or leveraged instruments in any supported region. This materially reduces complexity and liquidation risk but also excludes hedging and short-selling strategies used by professional traders.

Stablecoin and fiat pairs

CoinJar provides strong fiat on-ramp coverage, particularly for UK and Australian users.

Supported fiat currencies:

- GBP

- EUR

- AUD

- USD

Stablecoin support includes assets such as USDC and DAI, with ultra-low trading fees on stablecoin pairs on CoinJar Exchange (as low as 0.001% taker).

This makes CoinJar efficient for:

- Fiat-to-crypto entry

- Stablecoin parking

- Low-cost conversions between cash-equivalent assets

Liquidity depth and market coverage

Liquidity on CoinJar is strongest on major pairs, particularly:

- BTC/GBP

- ETH/GBP

- BTC/AUD

- ETH/AUD

- Core crypto-to-crypto pairs

CoinJar Exchange uses an order book model with maker–taker pricing, offering:

- Maker fees from 0.00% to 0.02% on higher volumes

- Taker fees from 0.06% to 0.10%

Liquidity is adequate for retail and moderate-volume traders, but thinner on smaller altcoins, where spreads can widen during volatile periods.

TLDR: CoinJar scores well for core crypto coverage, fiat access, and spot market execution, but loses points for its limited asset count and lack of derivatives, which restrict its appeal for advanced and high-frequency traders.

How good is the trading experience and toolset on CoinJar?

CoinJar delivers a clean, reliable trading experience focused on simplicity rather than power trading, with intuitive web and mobile platforms, basic order types, and solid performance for spot markets. While advanced tools like automation and derivatives are absent, execution quality and ease of use are strong for beginners and long term investors.

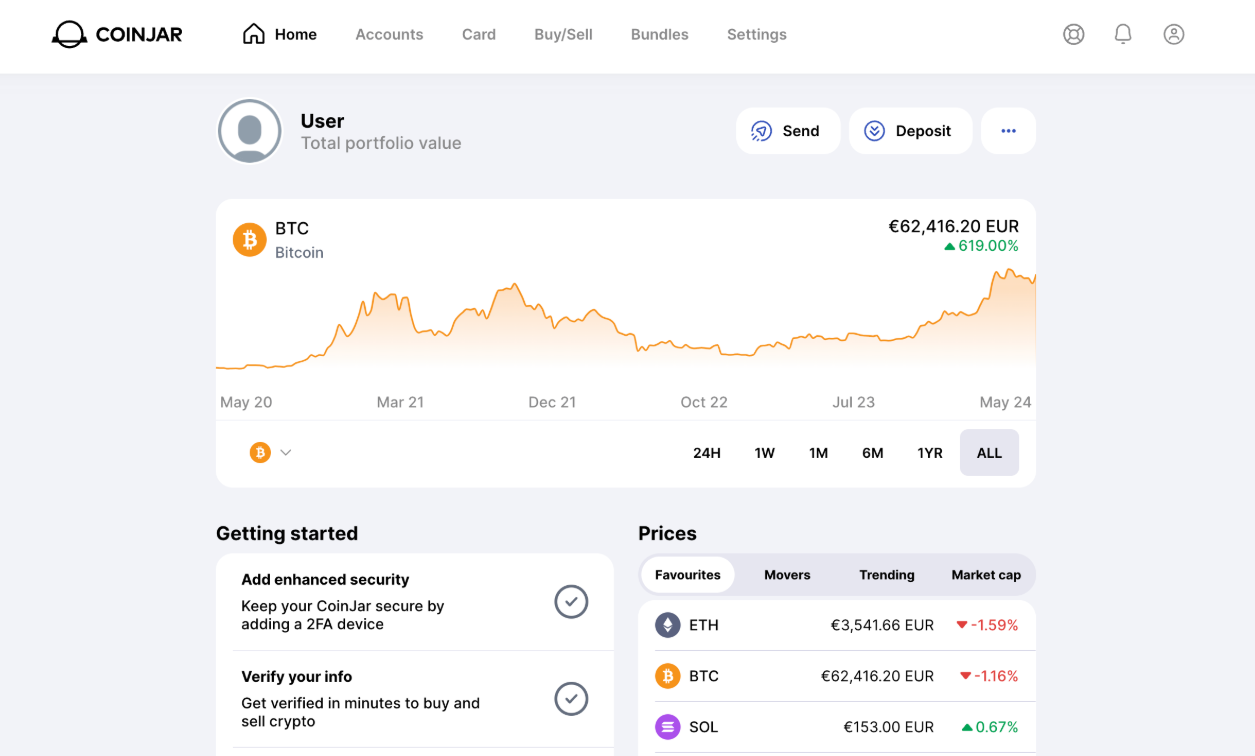

Web and mobile platform usability

CoinJar offers two clearly separated interfaces:

- Standard CoinJar platform: Designed for ease of use, this interface allows instant buy and sell, portfolio tracking, recurring buys, and bundle investing. Navigation is simple, onboarding is fast, and pricing is clearly shown before execution.

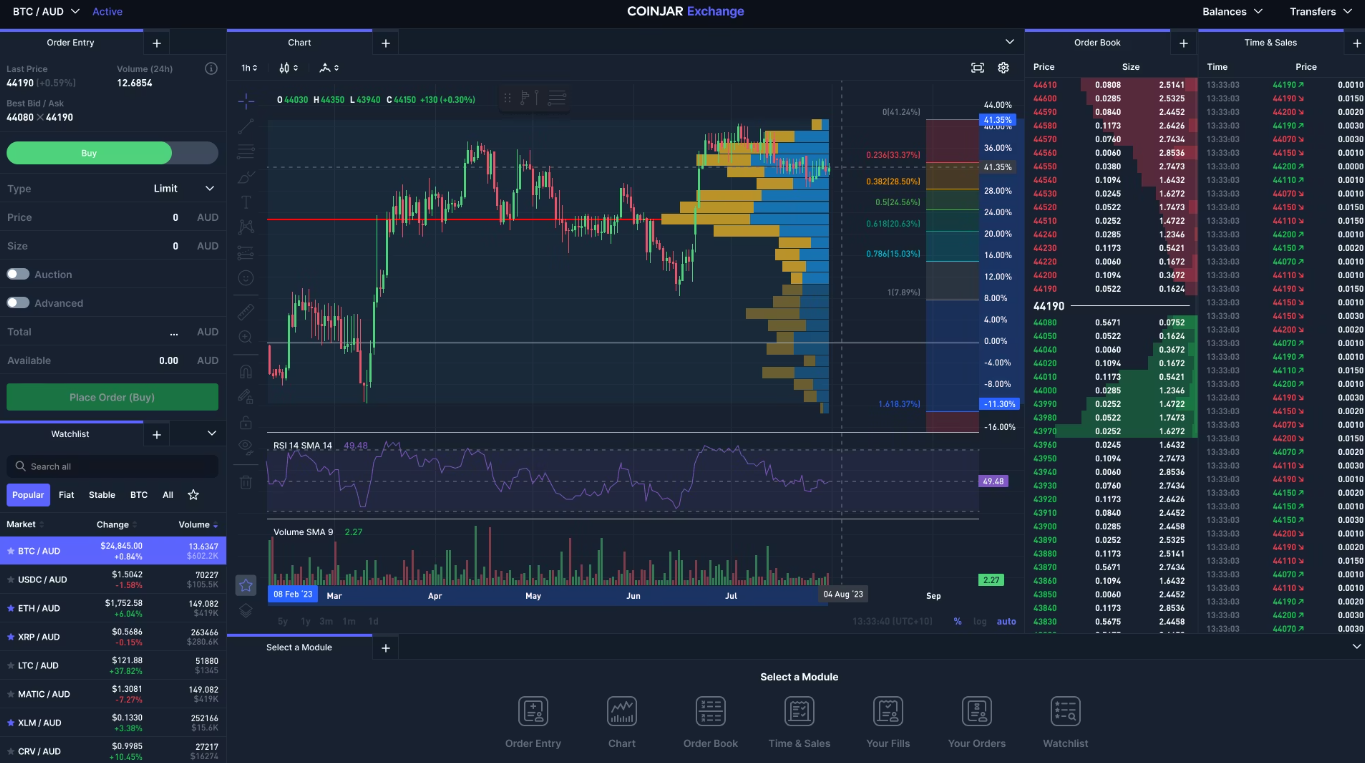

- CoinJar Exchange: A more advanced web based interface with an order book, depth view, and trading panel. This is aimed at users who want lower fees and manual control without overwhelming complexity.

The mobile app on iOS and Android mirrors most core features of the main platform, including buying, selling, wallet management, and identity verification. Advanced exchange trading is primarily desktop focused, which may limit active traders who rely on mobile execution.

Usability score is high due to:

- Clean layouts

- Minimal clutter

- Fast onboarding via app based KYC

- Seamless movement between wallet and exchange balances

Order types available

CoinJar supports a limited but functional range of order types, depending on the interface used.

On CoinJar Exchange, users can place:

- Market orders

- Limit orders

- Stop orders

There is no support for:

- Trailing stops

- Conditional orders

- OCO orders

- Bracket orders

For most retail traders, these order types cover basic execution needs, but strategy driven users may find the selection restrictive.

Charting tools and indicators

Charting on CoinJar Exchange is serviceable rather than advanced.

Available tools include:

- Real time price charts

- Basic timeframe selection

- Order book depth

- Trade history and recent fills

However, the platform does not offer:

- TradingView integration

- Custom indicators

- Drawing tools

- Multi chart layouts

Charts are suitable for confirming price levels and short term trend direction, but not for deep technical analysis. Many users pair CoinJar with external charting platforms for analysis before executing trades.

Advanced tools such as APIs or automation

CoinJar provides API access for CoinJar Exchange, supporting:

- Market data retrieval

- Order placement

- Account balance queries

This allows technically confident users to build basic trading tools or connect third party systems.

However, there is no native support for:

- Trading bots

- Strategy automation

- Copy trading

- Signal integration

There are also no derivatives, margin, or leverage tools, which simplifies risk but limits advanced use cases.

Performance and reliability

CoinJar has operated since 2013 and has built a reputation for platform stability rather than aggressive feature expansion.

Performance highlights:

- Consistent uptime during normal market conditions

- Reliable execution on major pairs such as BTC and ETH

- No reported major exchange outages in recent years

- No history of platform wide security breaches

Execution quality is strongest on high liquidity pairs, while smaller altcoins may experience wider spreads during volatile periods.

Withdrawal processing is generally reliable, though some users report occasional delays during peak demand, particularly for manual reviews.

Trading experience and tools score

TLDR: CoinJar scores well for clarity, reliability, and beginner friendliness, but loses points for its limited charting, basic order set, and lack of automation or derivatives, which place it behind full service trading platforms like Kraken or Binance for advanced users.

How competitive are CoinJar’s fees and pricing?

CoinJar is one of the lowest cost crypto exchanges for spot trading, particularly on its exchange interface, with maker fees as low as 0.02 percent and no fees on most deposits or withdrawals. Pricing is transparent, with clear differences between instant buys and exchange trading.

Trading fees

CoinJar uses two distinct pricing models, depending on how trades are placed.

Standard buy and sell pricing (simple interface)

This is the default option for beginners using the main CoinJar app or web dashboard.

- Fiat to crypto: 1 percent

- Crypto to fiat: 1 percent

- Crypto to crypto: 1 percent

These fees are built into the quoted price and prioritise simplicity over tight spreads.

CoinJar Exchange maker taker fees

Active users can reduce costs significantly by using CoinJar Exchange, which operates on an order book model with volume based pricing.

GBP trading pairs

| 30 day trading volume | Taker fee | Maker fee |

|---|---|---|

| £0 to £50,000 | 0.10% | 0.10% |

| £50,000 to £500,000 | 0.10% | 0.08% |

| £500,000 to £5 million | 0.08% | 0.04% |

| £5 million plus | 0.06% | 0.02% |

Crypto to crypto pairs

| Pair type | Taker fee | Maker fee |

|---|---|---|

| All crypto pairs | 0.06% | 0.00% |

Stablecoin pairs

| Pair type | Taker fee | Maker fee |

|---|---|---|

| Stablecoin pairs | 0.001% | 0.00% |

These rates place CoinJar among the cheapest spot exchanges available, particularly for market makers and high volume traders.

Spread costs

- Instant Buy and Sell: spreads are wider and embedded into the quoted price, which increases total cost beyond the headline fee.

- CoinJar Exchange: spreads depend on market liquidity and are typically tight on major pairs such as BTC GBP and ETH GBP.

Users focused on minimising execution cost will generally achieve better pricing on the exchange interface.

Deposit fees

Most deposit methods are free, including local bank transfers.

| Deposit method | Fee |

|---|---|

| Faster Payments (GBP) | Free |

| SEPA transfers (EUR) | Free |

| Bank transfer (AUD USD) | Free |

| Cryptocurrency deposits | Free |

| Debit card Instant Buy | 2% |

| Apple Pay and Google Pay | 2% |

| Recurring Buy via card | 1% |

Card based deposits trade speed for cost, while bank transfers remain the most economical option.

Withdrawal fees

CoinJar does not charge platform fees for most withdrawals.

| Withdrawal type | Fee |

|---|---|

| Bank transfer | Free |

| Cryptocurrency withdrawal | Free |

Network fees may still apply to on chain crypto withdrawals depending on blockchain conditions, but CoinJar does not add an extra markup.

Indirect or hidden costs

There are no inactivity fees, custody fees, or account maintenance charges. The main indirect costs to be aware of are:

- Wider spreads on instant buys

- Card processing fees on debit card and wallet payments

- Blockchain network fees on external crypto transfers

All fees are clearly disclosed before transactions are confirmed.

TLDR: CoinJar scores exceptionally well for low exchange fees, zero cost bank transfers, and transparent pricing, losing only minor points for higher instant buy costs and limited incentives for advanced trading strategies compared with larger global platforms.

How secure is CoinJar and how are assets held?

CoinJar operates a custodial exchange model, meaning customer assets are held and managed by the platform rather than by users through private keys. This approach prioritises usability and recovery support, but it also introduces counterparty risk, which users should understand clearly before depositing funds.

Custody model

CoinJar is a fully custodial platform. When crypto is deposited or purchased, assets are held in wallets controlled by CoinJar rather than in user-managed wallets.

Key implications of this model:

- Users do not control private keys

- CoinJar is responsible for safeguarding assets

- Withdrawals and transfers are subject to platform controls and reviews

- Assets remain exposed to platform-level operational and insolvency risk

As with all custodial crypto exchanges, funds are not protected by the FSCS or any equivalent investor compensation scheme.

Cold storage and asset segregation

CoinJar states that over 90 percent of customer crypto assets are held in offline cold storage. These wallets are not connected to the internet, reducing exposure to remote hacking and automated exploits.

Additional custody practices disclosed by CoinJar include:

- Use of segregated wallets for operational and customer funds

- Offline key storage with restricted access controls

- Hot wallets used only for day-to-day liquidity and withdrawals

- Internal policies designed to maintain sufficient reserves to meet customer balances

While CoinJar discloses cold storage usage, it does not publish real-time proof-of-reserves or third-party attestations, which limits independent verification.

Account-level security controls

CoinJar provides a standard but solid set of user security tools, including:

- Two-factor authentication (2FA) using authenticator apps

- Email confirmations for sensitive actions

- Device and session monitoring

- Automatic fraud detection, using behavioural and machine-learning based systems

- TLS encryption across platform communications

At present, CoinJar does not publicly document support for advanced controls such as:

- Withdrawal address whitelisting

- Custom withdrawal limits

- Hardware security key support

These omissions may be relevant for higher-balance or security-conscious users.

Incident history and operational track record

CoinJar was founded in 2013, making it one of the longer-operating cryptocurrency exchanges still active.

Notable security record points:

- No publicly reported major hacks or customer fund losses

- No known platform-wide breaches disclosed to date

- Continued operation through multiple high-volatility market cycles

However, the absence of past incidents does not guarantee future security, and CoinJar does not offer explicit insurance coverage against exchange-level failure or theft.

Infrastructure and internal controls

CoinJar states that it applies:

- Encrypted data storage

- Isolated internal networks

- Continuous monitoring for suspicious activity

- Regular internal security reviews

Some sources reference the use of third-party custody and infrastructure partners, but specific providers and audit results are not comprehensively disclosed, which limits transparency compared to some institutional-focused platforms.

Regulatory and risk disclosures

In the United Kingdom, CoinJar is registered with the Financial Conduct Authority (FCA) under the cryptoasset registration regime for anti-money laundering supervision.

Important limitations to note:

- FCA registration does not mean FCA regulation of crypto trading

- Customer crypto holdings are not protected if CoinJar fails

- Crypto assets can lose value rapidly or become illiquid

- Withdrawal delays may occur during compliance checks or periods of market stress

CoinJar clearly displays standard UK crypto risk warnings, including the possibility of losing all invested capital.

Security and custody assessment

CoinJar offers a competent and conservative security setup for a retail-focused exchange, with strong cold storage practices and a clean incident history. However, limited transparency around audits, reserves, and advanced user controls prevents it from ranking among the most robust custody providers in the market.

It is best suited to:

- Beginners and long-term holders prioritising simplicity

- Users making smaller to medium-sized allocations

- Investors comfortable with custodial risk in exchange for ease of use

Users holding significant balances or requiring institutional-grade controls may prefer platforms with published proof-of-reserves, insured custody, and more granular withdrawal security.

How do deposits and withdrawals work on CoinJar?

CoinJar offers a strong fiat on ramp and off ramp, particularly for UK and Australian users, with free bank transfers, clear fee disclosures, and generally reliable processing. Card based options add convenience at a higher cost, while crypto transfers follow standard on chain processes.

Fiat on ramp and off ramp support

CoinJar supports four major fiat currencies and multiple local banking rails, making it accessible for users in its core markets.

Supported fiat currencies

- GBP

- EUR

- AUD

- USD

Fiat deposit methods by region

- United Kingdom: Faster Payments Service (FPS), debit card, Apple Pay, Google Pay

- Europe: SEPA bank transfer

- Australia: Bank transfer, PayID, Osko, NPP

- United States: Bank transfer (availability varies by state)

Fiat withdrawals

- Withdrawals are processed via local bank transfer in supported regions

- CoinJar does not charge a platform fee for fiat withdrawals

- Funds are returned to a linked bank account in the same name as the CoinJar account

Fiat deposits and withdrawals are only available once identity verification is complete, in line with AML requirements.

Fiat processing times

| Method | Typical processing time |

|---|---|

| Faster Payments (UK) | Near-instant to a few hours |

| SEPA transfer (EU) | 1 to 3 business days |

| Australian bank transfer / PayID | Minutes to same day |

| Debit card / Apple Pay / Google Pay | Instant |

| Fiat withdrawal (bank transfer) | Same day to 1 business day |

Processing times can extend during weekends, public holidays, or manual compliance reviews.

Deposit and withdrawal fees (fiat)

| Method | Fee |

|---|---|

| Bank transfer (FPS, SEPA, AUD transfer) | Free |

| Debit card purchase (Instant Buy) | 2% |

| Apple Pay / Google Pay (Instant Buy) | 2% |

| Recurring Buy via card | 1% |

| Fiat withdrawal | Free |

There are no inactivity or account maintenance fees. All fiat fees are shown clearly before confirmation.

Crypto deposits and withdrawals

CoinJar supports deposits and withdrawals for 65+ cryptocurrencies, including BTC, ETH, SOL, ADA, XRP, and major stablecoins.

Crypto deposits

- Free to deposit on all supported networks

- Each asset has a dedicated deposit address

- Funds are credited after the required number of blockchain confirmations

- Incorrect networks or unsupported tokens may result in permanent loss

Crypto withdrawals

- CoinJar does not charge a platform withdrawal fee

- Standard blockchain network fees still apply

- Withdrawal requests may be subject to automated or manual review

Typical crypto processing times

- Deposit crediting: dependent on network confirmations

- Withdrawals: usually processed within minutes, but can take longer during high network congestion or compliance checks

Limits and minimums

Limits vary by account verification level, region, and payment method.

Common examples:

- UK Faster Payments minimum deposit: typically around £5

- Card purchases are subject to daily and monthly limits

- Crypto withdrawals may be capped per transaction or per day for risk control

- New or recently changed withdrawal details may trigger temporary limits

CoinJar publishes limits inside the user dashboard rather than as fixed public thresholds, which improves flexibility but reduces upfront transparency.

Reliability and transparency

CoinJar has operated since 2013 and has a generally consistent record for payment reliability.

Strengths:

- Clear disclosure of fees before execution

- Free bank transfers in core regions

- Reliable local payment rails for GBP and AUD users

- Transparent distinction between instant buys and bank funded trades

Limitations:

- Occasional withdrawal delays, particularly during peak demand or account reviews

- Card based deposits are materially more expensive

- Limits are not always clearly published outside the account interface

Deposits and withdrawals assessment

CoinJar performs well for everyday fiat to crypto movement, especially for UK and Australian users who rely on fast local bank transfers. The platform balances convenience and cost effectively, provided users avoid high fee instant buys and understand the role of compliance checks.

It is best suited to:

- Beginners funding accounts via bank transfer

- Long term investors using recurring buys

- Users prioritising simple, low cost cash movement

Active traders moving large balances or requiring predictable high withdrawal limits may find more transparency on platforms with published tiered limits and institutional grade rails.

How trustworthy is CoinJar in terms of regulation and support?

CoinJar benefits from a long operating history, clear jurisdictional structure, and formal regulatory registrations in key markets. While crypto assets remain largely unregulated, CoinJar’s compliance posture, transparency, and consistent customer support place it above many retail-focused exchanges.

Regulatory and registration status

CoinJar is not a fully regulated financial services provider for crypto trading, but it is formally registered and supervised for anti money laundering purposes in the jurisdictions where it operates.

Key regulatory positions include:

- United Kingdom: CoinJar UK Limited is registered with the Financial Conduct Authority (FCA) under the UK cryptoasset registration regime, approved on 27 September 2021.

This registration covers AML and counter terrorist financing compliance, not investor protection or conduct regulation. - Australia: CoinJar operates under Australian AML laws and is registered with AUSTRAC, the country’s financial intelligence agency.

- Ireland and United States: CoinJar operates under local AML and registration requirements, with services limited based on regional rules.

Important context for users:

- FCA registration does not mean crypto trading is regulated like stocks or CFDs

- Customer crypto assets are not covered by the FSCS or any compensation scheme

- Protections apply to compliance and reporting, not losses or insolvency

Jurisdictional transparency and company structure

CoinJar is one of the oldest continuously operating crypto exchanges, founded in 2013 and headquartered in Melbourne, Australia.

Key transparency points:

- Clearly defined legal entities by region, including CoinJar UK Limited

- Public disclosure of supported countries and service limitations

- Explicit separation between fiat payment rails and crypto services

- Consistent disclosure of custodial risk across jurisdictions

CoinJar has processed over $1.5 billion in cumulative crypto transactions and serves hundreds of thousands of users, contributing to its credibility as a long-standing market participant.

However, as with most retail exchanges, CoinJar does not publish audited proof of reserves, which limits independent verification of on-chain asset backing.

Customer support channels and responsiveness

CoinJar’s customer support model prioritises ticket-based assistance and self-service resources rather than real-time channels.

Available support options

| Channel | Availability | Typical response time |

|---|---|---|

| Help centre and FAQs | Yes | Immediate |

| Online support ticket | Yes | Usually within 2 hours |

| Live chat | No | Not available |

| Phone support | Limited | VIP customers only |

User feedback across review platforms, including Trustpilot, generally highlights:

- Fast initial responses

- Clear explanations for account or transaction issues

- Slower resolution during periods of high market volatility

The absence of live chat or general phone support may be a drawback for users who expect instant assistance during time-sensitive issues.

Clarity of risk warnings and disclosures

CoinJar provides clear and consistent crypto risk disclosures, particularly for UK users.

Key disclosures include:

- Prominent warnings that crypto is high risk and volatile

- Clear statements that users may lose all invested capital

- Explicit confirmation that crypto assets are not protected by UK consumer compensation schemes

- Transparent fee disclosures shown before trade execution

CoinJar aligns with UK regulatory guidance by displaying standard warnings such as:

“Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.”

Disclosures are visible during onboarding, funding, and trading, rather than buried solely in legal documents.

Trust and support assessment

CoinJar stands out for longevity, regulatory registration, and operational transparency, particularly compared with newer or offshore exchanges. Its trust profile is strongest for users who value compliance, simplicity, and a conservative platform design.

Strengths:

- FCA registered in the UK for AML supervision

- Over a decade of operating history

- Clear risk warnings and fee transparency

- Generally responsive ticket-based support

Limitations:

- No FSCS or investor protection

- Limited real-time customer support channels

- No publicly verifiable proof of reserves

Overall, CoinJar is best suited to beginners and long-term investors who want a compliant, clearly structured exchange and understand the limits of crypto regulation.

What are the pros and cons of using CoinJar?

Pros

- Exceptionally low spot trading fees: CoinJar Exchange offers maker fees as low as 0.02% and taker fees from 0.06%, placing it among the cheapest spot exchanges available for GBP, AUD, and crypto to crypto pairs. This materially reduces long-term trading costs compared with flat fee platforms.

- Simple, beginner-friendly platform with built-in custody: The core CoinJar app is easy to navigate, with clear pricing, instant buy and sell, recurring buys, and a built-in custodial wallet, reducing setup friction for first-time users.

- Strong fiat on-ramps for UK and Australia: Free Faster Payments (UK), SEPA (EUR), and Australian local bank rails make deposits and withdrawals straightforward and low cost for users in supported regions.

- Long operating history with no major public security breaches: Founded in 2013, CoinJar is one of the longest-running crypto exchanges still active, with 90%+ of customer assets held in cold storage and no disclosed platform-wide hacks.

- Useful long-term investing features: Tools like Recurring Buy and CoinJar Bundles support dollar cost averaging and basic diversification without requiring active portfolio management.

Cons

- Limited advanced trading capabilities: No futures, options, margin trading, copy trading, or native automation tools. Order types are basic, which restricts strategy-driven or professional trading use cases.

- Smaller asset selection than major global exchanges: With around 65 cryptocurrencies, CoinJar’s listings are conservative and exclude many newer or higher-risk altcoins available on platforms like Binance or Kraken.

- Higher costs for convenience-based purchases: Instant Buy via debit card, Apple Pay, or Google Pay carries a 2% fee (1% for recurring buys), which is expensive compared with bank-funded exchange trades.

- Limited real-time customer support: Support is primarily ticket-based, with no live chat and phone support restricted to VIP users. This can be frustrating during time-sensitive account or withdrawal issues.

- Custodial risk with no investor protection: Assets are held by CoinJar, not the user. Crypto holdings are not protected by the FSCS or any statutory compensation scheme in the UK.

Who is CoinJar best for?

- Beginners: Simple interface, clear pricing, built-in wallet, and straightforward onboarding make CoinJar suitable for first-time crypto users.

- Low-fee seekers: Traders focused on minimising spot trading costs benefit from CoinJar Exchange’s very competitive maker and taker fees.

- Long-term investors: Features like recurring buys and bundles suit users building positions gradually rather than trading frequently.

- UK and Australian users: Strong local banking integration and free bank transfers give CoinJar an edge in these regions.

Who is CoinJar not ideal for?

- Advanced or professional traders: No derivatives, leverage, advanced order types, or deep technical analysis tools limit its usefulness for complex strategies.

- Altcoin-focused investors: Users seeking exposure to hundreds of emerging or niche tokens will find the asset range restrictive.

- Users needing strong regulatory protection: CoinJar is FCA registered for AML purposes only. There is no investor compensation or regulatory protection if the platform fails.

- Traders who require instant, live support: The absence of live chat or general phone support may be a drawback during urgent account or transaction issues.

How to get started with CoinJar

- Create an account: Visit CoinJar and select Join CoinJar. Enter an email address, create a password, and confirm the verification link sent to the inbox. Set a username and choose the country of residence to finish the initial setup.

- Complete verification if required: To access full features, complete identity checks in the CoinJar mobile app. Provide personal details, upload a government issued ID, complete the in app face scan, and submit proof of address (such as a bank statement, utility bill, or council tax statement). Approval can take a few hours depending on review volume.

- Deposit funds: Fund the account using a supported method:

- Bank transfer (UK Faster Payments, SEPA for EUR, or local transfer where available)

- Debit card

- Apple Pay or Google Pay

- Crypto deposit from an external wallet

Bank transfers are typically the lowest cost option. Card and mobile wallet purchases may carry higher Instant Buy fees.

- Place a trade: Choose the asset to buy or sell and select the trade method:

- Use the main CoinJar app for simple buy and sell with fiat balances

- Use CoinJar Exchange for maker taker pricing and more control over execution

Confirm the amount, review fees, and place the order. Market and limit style order options may be available depending on the interface being used.

- Withdraw or secure assets: After trading, choose how to store or move assets:

- Keep crypto in CoinJar’s built in custodial wallet for convenience

- Withdraw crypto to an external wallet address for self custody

- Withdraw fiat back to a linked bank account using bank transfer

Always double check wallet addresses and networks before sending crypto, and consider enabling account security features like two factor authentication before holding larger balances.

How we tested and methodology

Each crypto exchange is assessed using a standardised six category scoring framework, designed to reflect how platforms perform in real-world use rather than how they are marketed. Every category is scored out of 5, with results combined to form an overall rating.

The six evaluation categories are:

- Supported assets and markets: The number and quality of cryptocurrencies available, coverage of fiat and crypto trading pairs, and access to spot or advanced markets.

- Trading experience and tools: Platform usability across web and mobile, order types, charting functionality, execution quality, and the availability of advanced features.

- Fees and pricing: Trading fees, spreads, deposit and withdrawal costs, and overall cost transparency for both casual and active users.

- Security and custody: Custody model, cold storage practices, account-level security controls, incident history, and transparency around asset safeguarding.

- Deposits and withdrawals: Supported funding methods, processing times, limits, reliability, and clarity of fee disclosures.

- Trust, regulation, and support: Regulatory registration, operating history, risk disclosures, customer support quality, and responsiveness.

Scores are based on hands-on testing of each platform, including live account setup, identity verification, funding, trading, and withdrawals where possible. This is supported by detailed fee analysis, a review of publicly disclosed security and custody practices, and structured usability checks across both desktop and mobile environments.

FAQs

Is CoinJar safe to use?

CoinJar is generally considered safe for retail users. It has operated since 2013 with no publicly reported major security breaches and states that over 90 percent of customer crypto assets are held in offline cold storage, alongside standard protections such as two factor authentication.

Is CoinJar regulated in the UK?

CoinJar is registered with the UK Financial Conduct Authority (FCA) under the cryptoasset registration regime for anti money laundering supervision. This registration does not provide investor protection, and crypto assets held on the platform are not covered by the FSCS.

How long does CoinJar withdrawal take?

Fiat withdrawals via UK Faster Payments are usually processed the same day or within one business day once approved. Crypto withdrawals are often processed within minutes, but timing ultimately depends on blockchain network conditions and any compliance checks.

Is CoinJar good for beginners?

Yes. CoinJar is well suited to beginners due to its simple interface, clear pricing, built in wallet, and features like instant buy, recurring purchases, and crypto bundles, which reduce complexity for first time users.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.