Coinbase is a mainstream cryptocurrency exchange designed for beginners and casual UK investors, offering a clean interface, broad coin access, and fast GBP deposits and withdrawals.

Its main strengths sit across usability, asset coverage, and security, with added extras such as staking and Learn & Earn rewards. Its main drawback is a complex and often higher fee structure, which may matter more to active traders or anyone trading larger volumes who prioritises tight pricing over simplicity.

What is Coinbase and how does it work?

Coinbase is a centralised cryptocurrency exchange (CEX) that lets UK users buy, sell, and trade crypto through a custodial account, with an optional “Advanced Trade” interface for more active spot trading. It mainly suits beginners and casual investors, while frequent traders typically use Advanced Trade or a subscription plan to reduce costs.

Is Coinbase a centralised or decentralised exchange?

Coinbase is centralised, meaning trades are executed and recorded through Coinbase’s systems rather than directly on a blockchain via smart contracts.

- Account model: users sign up, complete identity checks (KYC), and trade inside a Coinbase account.

- Custody model: by default, Coinbase holds the crypto on the user’s behalf (custodial). This is why it can offer features such as instant buys and simple cash outs.

- Non custodial option: Coinbase Wallet is separate and self hosted, designed for users who want to hold their own private keys and interact with decentralised apps. It is not required to use the Coinbase exchange.

What is the core trading model on Coinbase?

Coinbase is primarily a spot trading platform, with two main ways to trade.

1) Simple buy, sell, and convert (beginner flow)

This is the standard Coinbase interface aimed at fast purchases.

- Minimum trade size: from £2 (or $2)

- Pricing structure: typically includes a spread of about 0.5%, plus a transaction fee that can vary by payment method and order size

- Typical “simple trade” fees: commonly around 1.5% to 4% shown at checkout, which can make small purchases relatively expensive

2) Coinbase Advanced Trade (active trading flow)

Advanced Trade is closer to an exchange style order book experience for spot markets.

- Order types: supports more trader style execution such as limit orders, rather than only instant buys

- Fee model: a maker taker schedule where fees are described as starting around 0.6% to 1.2%, with reductions for higher volume trading

- Why it matters: this route is generally more cost effective for frequent trading than the simple buy and sell screens

Coinbase One (subscription pricing)

Coinbase One is a paid membership (£19.99 per month) that aims to make costs more predictable by removing standard trading fees for eligible “simple” trades, though spreads and limits can still apply.

What user level is Coinbase designed for?

Coinbase is built to work across three main experience levels.

- Beginner: the core Coinbase app and web platform prioritise simple onboarding, a clear dashboard, and quick buy and sell flows. Many users complete signup and verification quickly, with KYC checks as standard.

- Active trader: Advanced Trade adds charting and more control over execution, with a fee schedule designed to reward higher volume activity.

- Advanced and self custody focused users: Coinbase Wallet is the route for users who want to manage their own keys and interact with decentralised services, but it adds complexity and personal security responsibility.

Practical risk note for UK readers

Crypto is a high risk investment, and losses can be total. UK users should also assume no FSCS protection for crypto holdings, and costs can be harder to predict on the standard interface because spreads and fees are confirmed late in the order flow.

Coinbase overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | UK available. Web + iOS + Android. Supports GBP funding and withdrawals. |

| Exchange type (centralised or decentralised) | Centralised exchange (CEX). |

| Regulator or registration status | UK: Coinbase UK entity used for fiat services and compliance. US: publicly listed company, overseen via bodies such as the SEC (disclosures) and state level licensing regimes (for example NYDFS related approvals). |

| Custody model (custodial or non custodial) | Custodial on the exchange. Optional Coinbase Wallet is non custodial (self hosted keys). |

| Investor protection (usually none) | No FSCS protection for crypto. Crypto is high risk and losses can be total. |

| Supported cryptocurrencies | 250+ cryptocurrencies (examples: BTC, ETH, SOL, ADA, DOGE, LTC). |

| Trading types (spot, derivatives, margin) | Spot trading. Standard buy and sell plus Advanced Trade with order types such as limit orders. |

| Fiat on ramp and off ramp | Bank transfer (including Faster Payments and SEPA routes) and debit or credit card. PayPal and instant card withdrawals available for faster cash outs in supported cases. |

| Trading fees | Standard Coinbase: ~0.5% spread plus ~1.5% to 4% transaction fees (varies by method and size, shown at checkout). Advanced Trade: maker taker with stated starting fees ~0.6% to 1.2% (drops with volume). Coinbase One: subscription ~£19.99 per month for fee free simple trades within limits (spreads may still apply). |

| Deposit and withdrawal fees | Varies by payment method. Card purchases typically higher. Bank transfers often lower. Crypto withdrawals include network fees. |

| Security features | 2FA, device checks, encrypted storage, monitoring. Claims ~97% to 98% of customer crypto held in cold storage. Platform level insurance may apply if Coinbase is breached, but typically does not cover losses from user account compromise. |

| Mobile app and web platform | Beginner friendly standard app and web platform. Advanced Trade adds deeper charts and more control. |

| Ease of use level | Beginner friendly on standard Coinbase. Intermediate on Advanced Trade for frequent traders. |

What assets and markets are available on Coinbase?

Coinbase offers one of the broadest mainstream crypto selections in the UK, with 250 plus cryptocurrencies available and a strong focus on spot markets through simple buy and sell and Advanced Trade. It also supports major stablecoins and fiat pairs (including GBP), with deep liquidity on large cap coins that helps reduce slippage for everyday trades.

Number and range of supported cryptocurrencies

Coinbase’s biggest asset strength is coverage.

- Cryptocurrency count: 250 plus coins and tokens on the exchange.

- Large caps covered: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cardano (ADA), Dogecoin (DOGE), Litecoin (LTC) and many others.

- Breadth: a mix of major networks, newer tokens, and popular themes such as L1s, DeFi, and meme coins, depending on UK availability and Coinbase listing decisions.

This range is well above many beginner first platforms that cap selection closer to a handful of majors, and it makes Coinbase a realistic one stop option for casual investors who want to diversify beyond BTC and ETH.

Spot markets

Coinbase is a spot first exchange.

- Standard Coinbase: simple spot buy, sell, and convert flows built for fast execution.

- Advanced Trade: a more trader style spot experience with limit orders and deeper market views.

- Minimum trade size: from £2 on the standard platform, which makes it accessible for small position sizing and new users.

For most UK users, spot is the main use case, whether that is occasional purchases or more frequent trading via Advanced Trade.

Stablecoin and fiat pairs

Coinbase supports stablecoin activity and fiat pair access that matters for UK users.

- Fiat support: GBP account funding and withdrawals are supported.

- Stablecoins: Coinbase is closely linked to USD Coin (USDC), a widely used stablecoin across the industry.

- Why it matters: stablecoin and fiat pairs help users move between crypto and cash more efficiently, and can reduce the need for extra conversions when entering or exiting positions.

Liquidity depth and market coverage

Liquidity quality varies by asset, but Coinbase is generally strongest where it matters most.

- Deep liquidity on majors: large cap coins like BTC and ETH typically have the tightest effective execution, particularly on Advanced Trade, where users place orders closer to the market.

- Lower depth on smaller tokens: like most exchanges, newer or less traded coins can have thinner order books, which can increase spreads and slippage during volatile periods.

- Coverage benefits for UK users: Coinbase’s scale and mainstream user base supports consistent market access for popular coins, plus reliable conversion routes into GBP when cashing out.

What this means for the score

Coinbase scores highly for supported assets and markets because it combines 250 plus coins, strong spot market access, and mainstream liquidity for major assets, while still offering an upgrade path through Advanced Trade for users who want more control. The main limitation is that derivatives and perpetuals are not clearly positioned as part of the standard UK retail offering.

How good is the trading experience and toolset on Coinbase?

Coinbase delivers one of the smoothest trading experiences for UK retail users, combining a beginner friendly app and website with an Advanced Trade mode for more active spot traders. It supports core order types such as market and limit orders, offers clean charts and pricing screens, and generally performs reliably. The main limitations are fewer pro grade tools than specialist exchanges and no demo mode.

Web and mobile platform usability

Coinbase is built to reduce friction for first time buyers, then scale up as users become more confident.

- Platforms: Web and mobile apps on iOS and Android.

- Onboarding speed: many users complete signup, identity checks, and KYC in under 10 minutes, with approval often instant (but sometimes delayed for extra checks).

- Interface design: the main dashboard is beginner first, with balances, simple buy and sell buttons, and clear price views.

- Upgrade path: users can switch into Advanced Trade for a more trader style layout without needing a separate account, which is useful as trading needs grow.

- Small ticket usability: the ability to start from £2 makes it practical to test small trades without committing meaningful capital.

Overall, Coinbase is stronger on usability than most pro exchanges, especially on mobile.

Order types available

Coinbase supports two broad ways to place trades, which affects the order types available.

- Standard Coinbase (simple buy and sell): optimised for fast execution, typically market style purchases where the price is confirmed at checkout.

- Coinbase Advanced Trade: adds more control, including limit orders, which lets traders set an execution price rather than buying at the current market rate.

- Recurring purchases: supports recurring buys (for example daily, weekly, or monthly) which is useful for pound cost averaging style behaviour.

For many casual users, the standard flow is enough. Active traders typically prefer Advanced Trade because limit orders provide better control and can reduce trading friction.

Charting tools and indicators

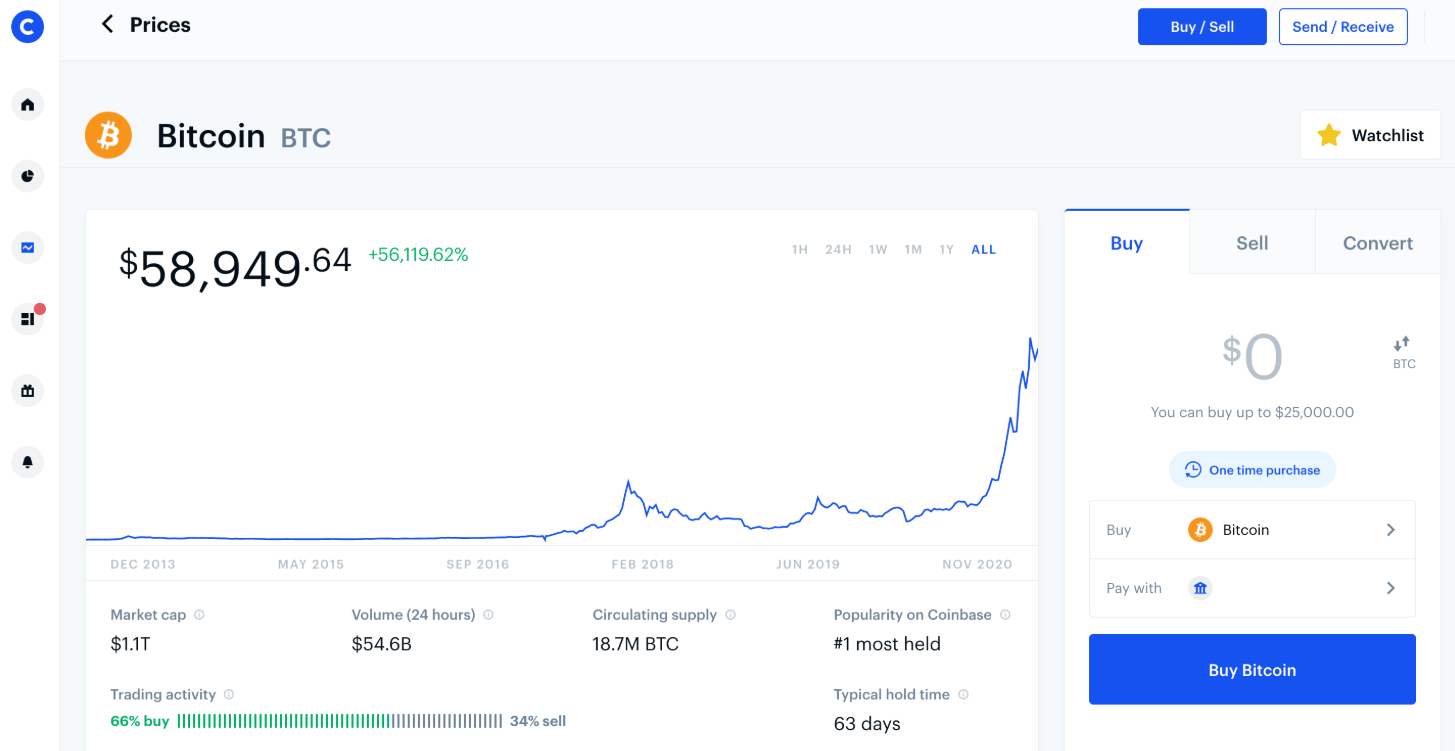

Coinbase’s charting is designed to be readable rather than deeply technical.

- Standard experience: basic price charts and portfolio performance views, aimed at beginners.

- Advanced Trade: more detailed charting and market views, designed for users who want more analysis before placing orders.

- Depth vs specialist platforms: it is usually adequate for spot trading decisions, but high frequency or highly technical traders may find it lighter than dedicated pro platforms that offer deeper indicator libraries and custom layouts.

For most UK retail users trading major coins, the charting is functional and easy to interpret, which matters more than having every indicator.

Advanced tools such as APIs or automation

Coinbase offers a broader ecosystem than a simple retail exchange, but not every advanced feature is equally visible to everyday UK users.

- Advanced Trade: the core toolset upgrade for active traders, combining lower fee pathways with more execution control.

- Coinbase Wallet: separate self hosted wallet option for users who want to move assets off exchange custody and use decentralised apps.

- APIs and institutional tooling: Coinbase runs services such as Prime and Exchange APIs for businesses and higher touch clients, which signals deeper infrastructure. However, day to day retail automation tools are not a core selling point.

- No demo trading: there is no paper trading or simulator, so practice happens with real funds, even if starting sizes can be small.

The practical takeaway is that Coinbase is strong for straightforward spot trading and self custody optionality, but it is not positioned as an automation first platform for retail users.

Performance and reliability

Coinbase generally scores well on reliability for mainstream crypto usage, especially in the areas that matter most to beginners.

- Consistency: navigation is typically intuitive and transactions are clearly shown, with a stable feel across web and mobile.

- Withdrawals: cash outs can be fast, including instant routes such as card or PayPal in supported cases, while bank withdrawals often land in 1 to 3 business days. Crypto transfers to external wallets are often near immediate depending on the network.

- Security driven friction: device verification and 2FA can add extra steps during login and withdrawals, but this usually improves account safety rather than harming usability.

For most casual UK traders, Coinbase’s day to day performance feels dependable. The main downside is that very active traders may still prefer specialist exchanges that prioritise advanced trading workflows over simplicity.

How competitive are Coinbase’s fees and pricing?

Coinbase is usually more expensive than pro focused exchanges, mainly because the standard app includes a spread of about 0.5% plus variable transaction fees that can reach around 1.5% to 4% depending on payment method and order size. Costs improve on Advanced Trade with maker taker pricing (starting around 0.6% to 1.2%) and Coinbase One can reduce headline trading fees, but spreads and limits still apply.

Coinbase fees at a glance

| Cost area | Standard Coinbase (simple buy and sell) | Coinbase Advanced Trade | Coinbase One (subscription) |

|---|---|---|---|

| Trading fee model | Spread + transaction fee shown at checkout | Maker taker (volume based) | Monthly fee plus reduced trading fees on eligible simple trades |

| Typical spread | ~0.5% (can vary with market conditions) | No explicit spread line item, pricing is closer to the order book | Spread can still apply even if trading fees are waived |

| Typical trading fees | ~1.5% to 4% depending on payment method and trade size | Starts around 0.6% to 1.2% and drops with volume | Subscription commonly shown as ~£19.99 per month (UK), with trading fee waivers within limits |

| Minimum trade | From £2 | From small sizes, depends on market and order type | Same trading minimums as standard Coinbase |

| Who it suits | Occasional buyers who value convenience | Active spot traders who want lower fees and more control | Frequent users of simple buy and sell who want more predictable costs |

Trading fees

Coinbase effectively has two pricing experiences, and the difference matters.

Standard Coinbase (simple buy and sell)

This route is the least predictable for fees.

- Spread: typically around 0.5% built into the quoted price.

- Transaction fee: varies by payment method, order size, and market conditions, commonly landing around 1.5% to 4%.

- Why it feels expensive: the spread plus fee stack means smaller trades can lose a meaningful percentage of their value to costs.

Advanced Trade (maker taker pricing)

This is the fee path designed for frequent traders.

- Fee model: maker taker, with stated starting fees around 0.6% to 1.2%.

- Volume discounts: fees decrease as trading volume rises, which is standard for exchange style pricing.

- Trade off: it is more hands on than the simple interface, but the cost structure is typically better for repeated trading.

Spread costs

Spread is the most important hidden style cost on Coinbase because it is not always framed as a separate fee.

- Standard Coinbase typically uses a ~0.5% spread on many simple transactions.

- Spreads can widen during volatile periods or on smaller tokens with thinner liquidity.

- Even when a product advertises reduced trading fees, spreads can still affect the final execution price.

Deposit fees

Deposit costs depend heavily on how funds are added.

- Bank transfer routes are usually the most cost effective for GBP funding.

- Debit or credit card purchases are instant but typically come with higher percentage costs, which is one reason standard Coinbase can reach the 1.5% to 4% fee range on simple buys.

- Coinbase also supports multiple rails such as Faster Payments and SEPA for funding and withdrawals, with timing typically 1 to 3 business days on bank methods.

Withdrawal fees

Withdrawal costs also vary by method and can be easy to miss if only looking at headline trading fees.

- Fiat withdrawals: bank withdrawals commonly land in 1 to 3 business days, while faster cash out routes such as card and PayPal can be near instant in supported cases, but may carry additional charges depending on the method.

- Crypto withdrawals: include network fees (for example blockchain miner or validator fees). These are not Coinbase profit, but they still increase the total cost of moving assets off platform.

- Instant card withdrawals: can carry percentage fees and minimums depending on region and settings.

Any indirect or hidden costs to watch

These are the cost areas that tend to surprise users.

- Fees only confirmed at checkout: on the standard app, the exact cost can be unclear until the final confirmation screen.

- Spread plus fee stacking: a ~0.5% spread plus 1.5% to 4% transaction fees can make simple trades expensive compared with pro exchanges.

- Conversion fees: crypto to crypto conversions can carry an additional charge (commonly shown as ~2% in some breakdowns), which matters for frequent swapping.

- Subscription break even: Coinbase One can make sense for heavy users of simple buy and sell, but the ~£19.99 per month subscription cost can outweigh savings for light users, especially if spreads still apply and there are usage limits.

Bottom line on pricing

Coinbase is rarely the cheapest option, but it offers clearer workflows, fast cash outs, and strong usability. For UK users who care most about price, Advanced Trade is usually the starting point, and anyone trading frequently should compare maker taker fees against alternatives before committing to the standard app flow.

How secure is Coinbase and how are assets held?

Coinbase operates a custodial exchange model with layered security controls, large scale cold storage practices, and formal regulatory oversight in key markets. That structure reduces some operational risks compared with offshore platforms, but it also means users do not control their private keys by default and are not covered by FSCS protection if crypto assets are lost.

Custody model

Coinbase is a custodial exchange.

- Crypto purchased on the main Coinbase platform is held in wallets controlled by Coinbase, not by the user.

- Users do not hold private keys unless assets are withdrawn to an external wallet.

- Coinbase also offers Coinbase Wallet, a non custodial product where users control their own keys, but this is separate from the exchange account and carries different risks.

This model prioritises ease of use and recovery options over full self custody.

Cold storage practices

Coinbase discloses that the vast majority of customer crypto assets are stored offline.

- Around 97% to 98% of customer crypto is held in cold storage, disconnected from the internet.

- Cold storage locations are geographically distributed and use segmented access controls.

- Only a small percentage of assets are kept online to support liquidity and withdrawals.

Cold storage reduces exposure to large scale online breaches, but it does not eliminate all risk.

Account security controls

Coinbase applies multiple account level protections, though effectiveness depends on user configuration.

Standard security features include:

- Mandatory two factor authentication (2FA) using authenticator apps or SMS.

- Device verification and login alerts for new or unrecognised devices.

- Biometric login support on mobile apps.

- Encrypted wallet infrastructure and transaction monitoring.

Additional protections users can enable:

- Withdrawal confirmations and security delays.

- Allowlisting of trusted withdrawal addresses in some configurations.

- Account activity logs and security notifications by email.

Failures at the user level (for example compromised email accounts or weak 2FA choices) remain a common risk vector.

Incident history and disclosures

Coinbase has not reported a full platform wide loss of customer funds, but incidents have occurred.

- In October 2021, approximately 6,000 accounts were accessed through a flaw in the SMS account recovery process combined with phishing of user credentials.

- Coinbase stated that there was no evidence of internal system compromise, and affected users were reimbursed.

- This incident highlighted risks linked to SMS based security and user level account protection rather than cold storage failure.

No crypto exchange can eliminate account takeover risk entirely, especially where users rely on weaker authentication methods.

Insurance and asset protection limits

Coinbase operates with limited insurance coverage, which is often misunderstood.

- Coinbase carries crime insurance that may apply only if Coinbase itself is breached.

- Insurance does not cover losses caused by user error, phishing, malware, or compromised credentials.

- Crypto assets are not protected by the FSCS or any equivalent UK compensation scheme.

- Fiat balances held in custody accounts are structurally separate, but this protection does not extend to crypto holdings.

If crypto is lost due to account compromise, recovery is not guaranteed.

Regulatory context and oversight

Coinbase operates under formal regulatory scrutiny, which affects custody standards but does not remove market risk.

- Coinbase is a publicly listed US company, subject to disclosure and audit requirements.

- It holds state level licences in the US, including oversight linked to New York State Department of Financial Services (NYDFS).

- In the UK, Coinbase operates via an FCA registered entity for crypto asset activities.

- Regulatory supervision focuses on anti money laundering, custody controls, and disclosures, not price protection or compensation.

Regulation improves transparency and operational standards, but crypto losses remain the user’s responsibility.

Clear risk disclosures

- Assets held on Coinbase are custodial, meaning users rely on Coinbase’s operational security.

- Private keys are not controlled by users unless assets are moved to a self custody wallet.

- No statutory compensation scheme applies to crypto losses.

- Account security is partly dependent on user behaviour, including password hygiene and 2FA choices.

- Crypto markets are volatile and losses can be total, regardless of platform security.

Bottom line on security and custody

Coinbase scores strongly on infrastructure security, cold storage discipline, and regulatory transparency, especially compared with lightly regulated exchanges. The main trade offs are custodial control, lack of FSCS protection, and user level account risks, which are common across centralised crypto platforms.

How do deposits and withdrawals work on Coinbase?

Coinbase supports multiple fiat on ramp and off ramp methods alongside standard crypto transfers, with processing times and limits that vary by payment rail and verification level. The system is designed for convenience and speed, but costs and limits are not uniform across methods.

Fiat on ramp and off ramp support

Coinbase provides several ways for UK users to move money in and out.

- Bank transfers:

- Faster Payments (GBP) and SEPA (EUR) are supported.

- Typical processing time is 1 to 3 business days for deposits and withdrawals.

- These routes are usually the lowest cost option for larger amounts.

- Debit and credit cards:

- Card payments allow instant crypto purchases.

- Fees are higher than bank transfers and apply at checkout.

- Cards are typically purchase only, not used for deposits or withdrawals in the traditional sense.

- PayPal and instant card withdrawals:

- Available for fast cash outs, often completing within minutes.

- Convenience comes with higher fees compared with bank transfers.

There is no fixed minimum deposit, and crypto purchases can start from around £2, making entry accessible for new users.

Crypto deposits and withdrawals

Coinbase supports standard blockchain based transfers for supported assets.

- Crypto deposits:

- Funds must be sent to the correct blockchain address and network shown in the account.

- Deposits are credited after the required network confirmations, which vary by asset.

- Crypto withdrawals:

- Withdrawals are sent on chain and usually broadcast within minutes.

- Final settlement speed depends on the blockchain and current network congestion.

- Fees:

- Coinbase charges network fees on crypto withdrawals, which are passed through from the blockchain rather than fixed platform fees.

Incorrect network selection or address errors can result in irreversible loss, which is a standard crypto risk.

Processing times

Processing speed depends heavily on the chosen method.

- Card purchases: usually instant.

- Bank deposits: typically 1 to 3 business days.

- Fiat withdrawals:

- Bank withdrawals often settle in 1 to 3 business days.

- Instant card or PayPal withdrawals can complete within minutes.

- Crypto transfers:

- Often near immediate submission, with confirmation time set by the blockchain.

Delays can occur during periods of high market activity or additional compliance checks.

Limits and minimums

Limits vary by verification level, payment method, and region.

- Minimum crypto trade: typically around £2.

- Deposit and withdrawal limits:

- Visible in the Account Limits section once logged in.

- Higher limits require additional identity verification.

- No stated maximum crypto sale limit, but fiat cash out limits depend on banking method.

These dynamic limits improve fraud control but reduce predictability for very large transfers.

Reliability and transparency

Coinbase generally performs reliably for everyday transfers, but transparency is mixed.

- Strengths:

- Clear confirmation screens before completing deposits and withdrawals.

- Fast access to instant withdrawal options compared with many competitors.

- Limitations:

- Fees and limits can change by method and are sometimes only fully visible at the final confirmation step.

- Network fees fluctuate with blockchain conditions and are outside Coinbase’s control.

Overall, the system prioritises accessibility and speed over absolute cost clarity.

How trustworthy is Coinbase in terms of regulation and support?

Coinbase operates under formal regulatory oversight in multiple jurisdictions and provides extensive disclosures, but customer support quality varies by channel and urgency. Oversight improves transparency, though it does not remove crypto specific risks.

Regulatory or registration status

Coinbase is one of the most visible regulated crypto platforms globally.

- United States:

- Publicly listed company, subject to disclosure requirements and oversight by bodies such as the Securities and Exchange Commission (SEC).

- Licensed at state level, including oversight linked to the New York State Department of Financial Services (NYDFS).

- United Kingdom:

- Operates via an FCA registered crypto asset business, allowing it to provide crypto services to UK residents.

- Scope of regulation:

- Focuses on anti money laundering, custody controls, and disclosures.

- Does not provide investment protection or compensation for crypto losses.

Regulation improves accountability but does not equate to investor protection.

Jurisdictional transparency

Coinbase is relatively transparent compared with many offshore exchanges.

- Publishes financial statements and risk disclosures as a listed company.

- Clearly states which entity serves users in each region.

- Provides public information on custody structure, cold storage practices, and insurance limitations.

This level of disclosure is uncommon among smaller or unregulated exchanges.

Customer support channels and responsiveness

Coinbase offers multiple support channels, though effectiveness can vary.

- Help centre and knowledge base: extensive self service documentation.

- Live chat: available 24/7, but initial contact is often automated.

- Email support: typically responds within 24 to 48 hours, based on testing and user reports.

- Phone support: limited for routine issues, with priority access more likely for higher tier users such as Coinbase One members.

Straightforward issues are usually resolved efficiently, while urgent or complex cases may require repeated follow ups.

Clarity of risk warnings and disclosures

Coinbase presents clear but firm risk messaging.

- Prominent warnings that crypto is high risk and losses can be total.

- Explicit disclosure that crypto assets are not covered by the FSCS or similar schemes.

- Clear distinction between custodial exchange accounts and non custodial wallets.

While disclosures are visible, understanding still depends on user engagement with the documentation.

Bottom line on trust and support

Coinbase scores well for regulatory transparency and disclosure quality, especially compared with lightly regulated platforms. Customer support breadth is solid, but responsiveness can be inconsistent for time sensitive issues. Regulation improves oversight, but crypto market risk and lack of statutory protection remain central considerations for UK users.

What are the pros and cons of using Coinbase?

Pros

- Beginner friendly trading: clean app and web platform with simple buy and sell flows, plus a fast signup process often completed in under 10 minutes.

- Strong crypto coverage: 250 plus cryptocurrencies on the exchange, covering major coins such as BTC, ETH, SOL, ADA, DOGE, LTC.

- Two tier trading setup: standard Coinbase for simplicity and Advanced Trade for limit orders and more control, with lower trading costs than the basic interface.

- Fast cash out options: withdrawals can be routed via bank transfer (often 1 to 3 business days) or faster methods such as PayPal and instant card withdrawals that can land in minutes in supported cases.

- Robust security posture: claims 97% to 98% of customer crypto held in cold storage, with mandatory 2FA, device checks, and security notifications.

Cons

- High and confusing fees on standard trades: typical costs include ~0.5% spread plus ~1.5% to 4% transaction fees, often only fully visible at checkout.

- Custodial by default: users do not control private keys on the exchange, so the account relies on Coinbase’s custody model unless funds are withdrawn.

- No demo trading: no paper trading or simulator, so practice requires real money even if trades can start from £2.

- Support can be inconsistent: live chat often begins with bots and escalating to a human can take persistence; phone support is limited for routine issues.

- No statutory UK protection: crypto holdings are not covered by FSCS, and losses can be total.

Who is Coinbase best for?

- Beginners: wants an intuitive app, clear portfolio view, and small minimum trade sizes from £2.

- Casual UK buyers: prioritises quick purchases, recurring buys, and straightforward cash outs over absolute lowest fees.

- Altcoin focused users: wants a broad menu of tokens, with 250 plus cryptocurrencies available.

- Active spot traders who can use Advanced Trade: wants limit orders and maker taker pricing rather than the higher cost standard flow.

- Users who want optional self custody later: wants to start custodial then move assets to a self hosted wallet when ready.

Who is Coinbase not ideal for?

- Low fee seekers: wants consistently low maker taker fees and minimal spread impact, especially for frequent trading.

- Users who only want self custody: wants full control of private keys by default, without needing a separate wallet setup.

- Advanced traders needing specialist tools: needs deeper charting, more complex order types, or automation first workflows.

- Anyone relying on UK compensation schemes: expects FSCS style protection or regulated investment safeguards for crypto holdings.

- Users who need fast human support every time: wants reliable phone based support for urgent account or transfer issues.

How to get started with Coinbase

- Create an account: Download the iOS or Android app or use the web platform, then sign up with email and a strong password.

- Complete verification: Finish identity checks (KYC) by confirming phone number and uploading a valid photo ID. Many users complete this in under 10 minutes, but additional checks can take longer.

- Deposit funds: Add money using a supported method such as bank transfer (GBP routes like Faster Payments) or debit or credit card for instant purchases. There is no fixed minimum deposit, and trades can start from £2.

- Place a trade: Use standard Coinbase for simple buy and sell, or switch to Advanced Trade if placing limit orders or aiming to reduce trading costs.

- Withdraw or secure assets: Withdraw GBP back to your bank account (often 1 to 3 business days) or use faster cash out routes such as PayPal or instant card withdrawals if available. For custody control, transfer crypto to an external wallet, double checking the correct network to avoid irreversible loss.

How we tested and methodology

Each crypto exchange is evaluated using a standardised six category scoring framework, with every category scored out of 5 and combined to form the overall rating:

- Supported assets and markets

- Trading experience and tools

- Fees and pricing

- Security and custody

- Deposits and withdrawals

- Trust, regulation, and support

Scores are based on hands on testing across the core user journey, including account setup and verification, placing spot trades on both beginner and advanced interfaces, and completing deposits and withdrawals using common fiat and crypto routes.

The review also includes fee analysis across typical trade sizes, a security and custody review covering account controls and cold storage disclosures, and platform usability checks across web and mobile to assess clarity, reliability, and consistency.

FAQs

Is Coinbase safe to use in the UK?

Yes. Coinbase operates as an FCA registered crypto asset business in the UK and uses strong security controls, including two factor authentication and cold storage for most customer crypto. However, crypto assets are high risk and not protected by UK compensation schemes.

Why can’t I cash out on Coinbase UK?

Cash outs can be blocked due to incomplete identity verification, payment method issues, account security checks, or temporary bank restrictions. In some cases, compliance reviews or exceeded withdrawal limits can also delay withdrawals.

What is the downside of Coinbase?

The biggest downside is cost. Standard trades often include a spread of around 0.5% plus transaction fees that can reach 1.5% to 4%, making it more expensive than many competitors.

Do you have to pay tax on Coinbase UK?

Yes. UK users must report crypto gains, income from staking, and some conversions to HMRC, and tax may be due under Capital Gains Tax or Income Tax rules depending on activity.

Which UK banks allow Coinbase?

Most major UK banks support Coinbase transfers, including Barclays, Lloyds, Halifax, NatWest, HSBC, Monzo, and Starling, though policies can change. Some banks may temporarily block or review crypto related payments.

Is my money protected in Coinbase UK?

Crypto assets are not protected by the FSCS. Fiat balances held with Coinbase are safeguarded, but if crypto is lost due to market moves or account compromise, compensation is not guaranteed.

Does Coinbase allow UK withdrawals?

Yes. UK users can withdraw funds via bank transfer, and in some cases via faster options like PayPal or instant card withdrawals, with timing ranging from minutes to a few business days.

Can I trust Coinbase with my money?

Coinbase is one of the most established crypto exchanges globally, publicly listed in the US and used by over 100 million people worldwide. Trustworthiness is high compared with offshore platforms, but crypto risk still applies.

Can HMRC see my Coinbase account?

Yes. Coinbase shares data with tax authorities when legally required, and HMRC can request information on UK users. It is the user’s responsibility to declare taxable activity.

Is it safe to leave crypto on Coinbase?

Coinbase stores around 97% to 98% of customer crypto in cold storage, which reduces hacking risk. Long term holders who want full control often prefer moving funds to a personal wallet.

Can you stake on Coinbase?

Yes. Coinbase supports staking on several major assets, such as Ethereum, Solana, Cardano, and Cosmos, though availability and rewards vary by asset and region. Coinbase takes a commission from staking rewards.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.