Buying cryptocurrency in the UK is more straightforward than ever, thanks to FCA-registered platforms that support GBP deposits and secure account features.

However, crypto remains a high-risk asset class with no FSCS protection and significant price volatility.

This guide explains how to buy cryptocurrency UK safely, minimise fees, and understand the key legal and tax considerations before getting started.

Quick steps: How to buy crypto in UK

- Choose an FCA registered crypto platform such as eToro and sign up with your email and a secure password.

- Complete the required identity checks and fund your account using GBP via bank transfer or debit card.

- Select the cryptocurrency you want to buy, reviewing price, volatility, and purpose before proceeding.

- Confirm your purchase through the platform’s web interface or mobile app using a simple buy order or a price limit.

- Store your crypto on the platform for ease of access or transfer it to a personal wallet for greater long term control and security.

How to Invest in Cryptocurrency UK? Step by step

Buying cryptocurrency in the UK is a regulated, structured process that typically takes less than an hour to complete on most UK crypto exchanges. The steps below reflect how FCA registered exchanges and brokers operate in 2026 and what UK investors should expect at each stage.

Step 1. Choose a UK compliant crypto platform

The first step is selecting a platform that is registered with the Financial Conduct Authority for cryptoasset activities. FCA registration does not remove investment risk, but it confirms that the platform complies with UK anti money laundering and counter terrorist financing rules.

When comparing platforms, UK investors should focus on:

- FCA registration status

- Supported cryptocurrencies and markets

- GBP deposit and withdrawal options

- Transparent trading fees and spreads

- Custody and security standards

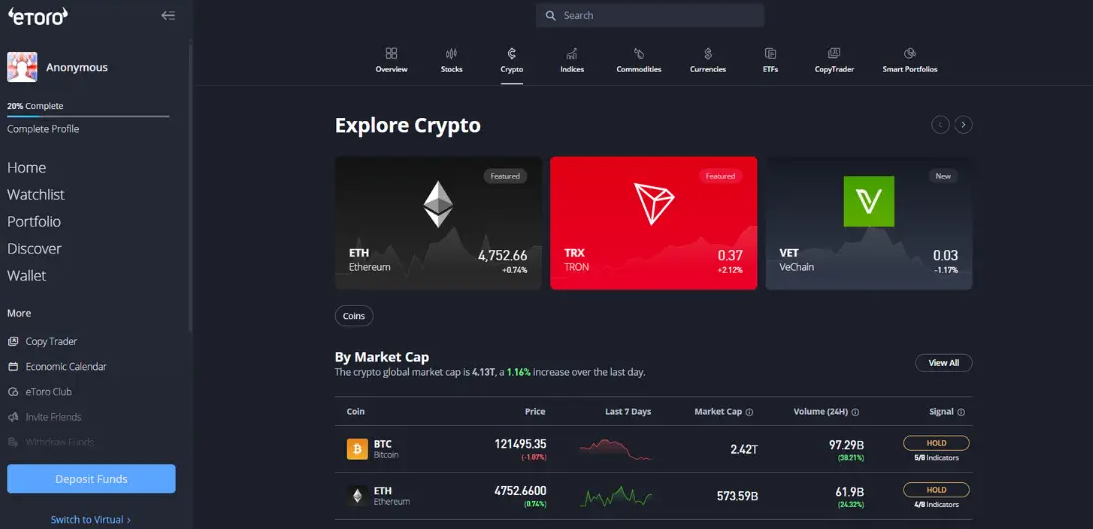

Popular FCA registered platforms used by UK buyers include Bitpanda, eToro, Coinbase, IG, and Kraken.

Exchanges allow you to buy and sell crypto directly at market prices, while brokers simplify the process by offering instant buys at quoted prices. Exchanges generally offer lower fees and more coins, while brokers prioritise ease of use.

Step 2. Create an account and verify your identity

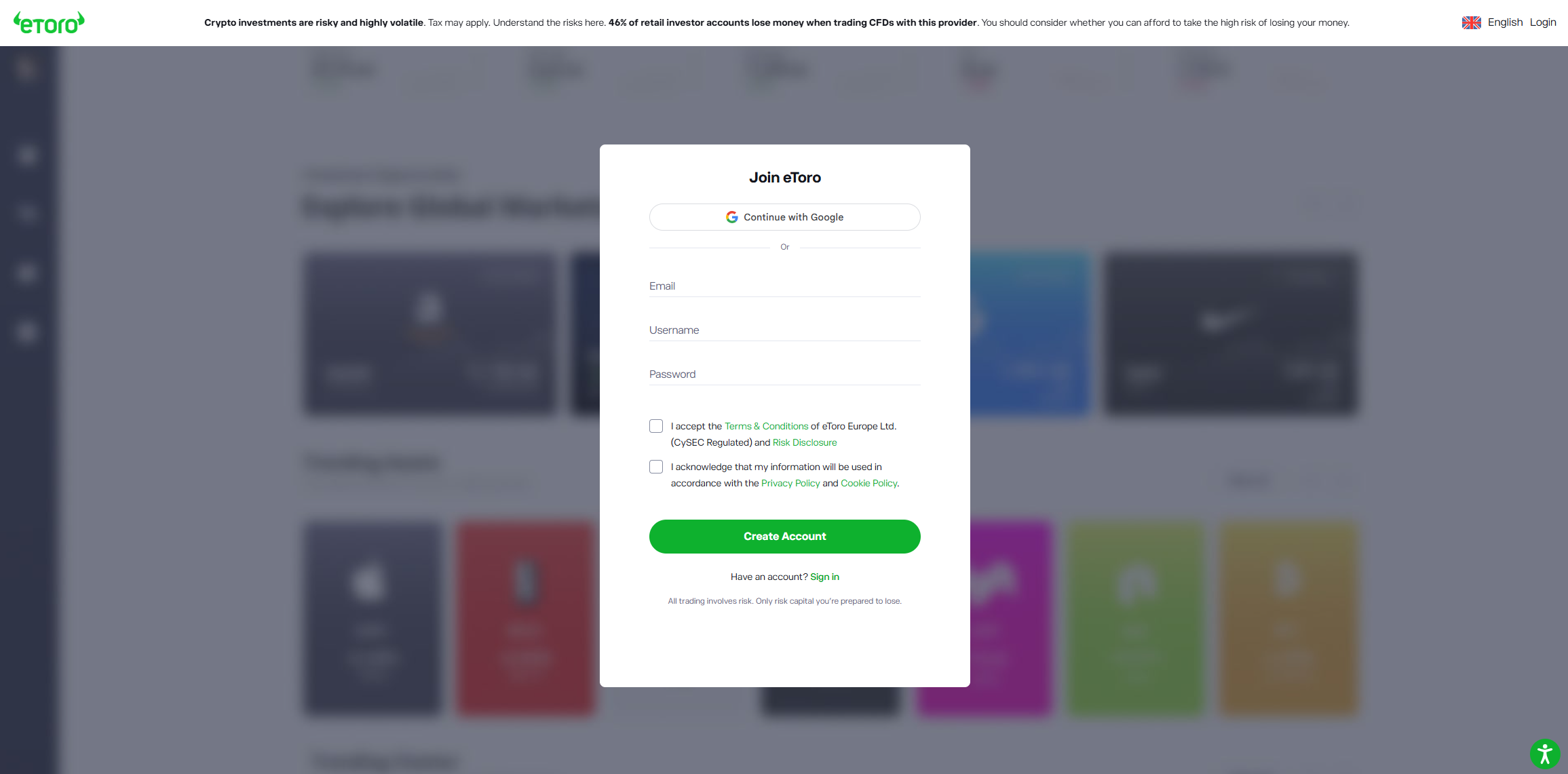

After choosing a platform, you will need to open an account using your email address and a strong password. All UK crypto platforms are required to complete Know Your Customer checks.

This usually involves:

- Uploading a valid passport or UK driving licence

- Providing proof of address such as a utility bill or bank statement

- Completing a selfie or facial recognition check

Most platforms complete verification within minutes, although manual checks can take up to 24 hours during busy periods. Two factor authentication is strongly recommended and is now standard across major UK platforms.

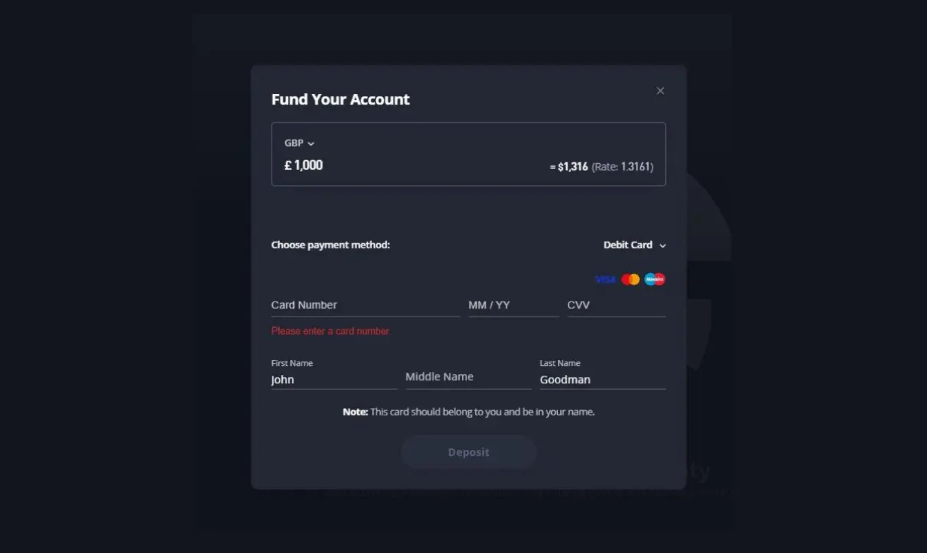

Step 3. Deposit funds in GBP

Once verified, you can fund your account in pounds sterling. Common UK deposit methods include:

- Bank transfer via Faster Payments

- Debit card

- E wallets such as PayPal on supported platforms

Bank transfers are usually free and settle within minutes. Debit card deposits are instant but often carry fees of around 2 percent to 3 percent. Credit cards are increasingly restricted and may be blocked or treated as cash advances by UK banks.

Most platforms allow fractional purchases, meaning you can buy small amounts of crypto. For example, you do not need to buy a full Bitcoin. Many UK platforms allow minimum purchases as low as £1.

Step 4. Buy cryptocurrency

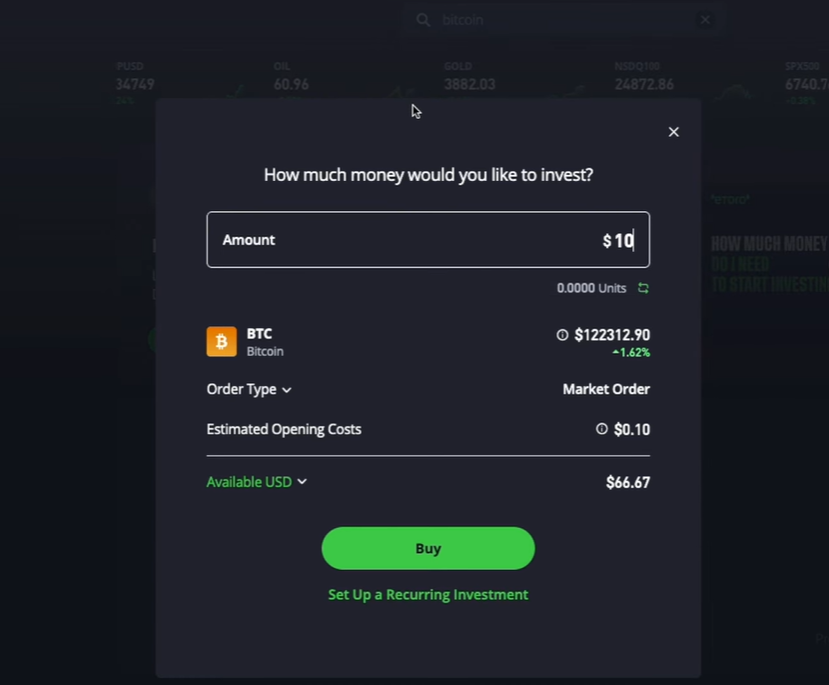

With funds available, navigate to the platform’s buy or trade section and select the cryptocurrency you want to purchase, such as Bitcoin or Ethereum.

You will usually have two options:

- Market order. Buys instantly at the current price

- Limit order. Buys only if the price reaches your chosen level

Before confirming, the platform will show a full trade breakdown including fees, exchange rates, and the amount of crypto you will receive. Once confirmed, the crypto is credited to your account immediately and recorded on the relevant blockchain.

Step 5. Decide how to store your crypto

After purchasing, you need to decide where to hold your crypto. There are two main options.

| Storage option | Key benefits | Main trade offs |

|---|---|---|

| Exchange custody | Convenient and easy to trade | Higher exposure if the platform is hacked |

| Private wallet | Full control and higher security | Less convenient for frequent trading |

For small amounts or active trading, leaving crypto on a reputable platform with two factor authentication is common. For larger balances or long term holding, many UK investors move assets to a private wallet, particularly hardware wallets that remain offline.

Step 6. Understand tax and reporting obligations

In the UK, cryptocurrency is subject to capital gains tax and income tax depending on how it is used. Selling crypto, swapping one token for another, or using crypto for purchases can all create a taxable event.

From January 2026, UK crypto platforms are required to collect National Insurance numbers or Unique Taxpayer References and share transaction data with HMRC under the Crypto Asset Reporting Framework.

UK investors are responsible for keeping records and reporting gains via self assessment. Portfolio tracking tools are commonly used to calculate tax liabilities accurately.

TLDR: In practical terms, buying crypto in the UK involves choosing an FCA registered platform, completing identity checks, depositing GBP, placing a trade, and securing your assets appropriately. The process is now faster and more regulated than in previous years, but the risks remain the same. Prices are volatile, losses are possible, and crypto is not covered by the Financial Services Compensation Scheme.

What is the best place to buy Bitcoin UK & other cryptocurrencies?

The best place to buy Bitcoin in the UK depends on what matters most: low fees, the widest coin selection, beginner friendly design, or an all in one investing app. For most people, the safest starting point is an FCA registered cryptoasset business that supports GBP deposits, clear pricing, and strong security controls.

| Platform | Best for | FCA status in the UK | Crypto available to UK users | Typical trading cost | GBP deposits | Staking or earn | Security and custody highlights |

|---|---|---|---|---|---|---|---|

| eToro | All in one investing plus crypto, stocks, ETFs | FCA registered cryptoasset business plus EMI licence | Around 100 | Spread pricing, typically around 1% on major coins | Yes, but GBP is converted to USD | Not available for UK users | Segregated client funds, cold storage, two factor authentication, integrated wallet |

| Coinbase | Beginners who want a trusted exchange with a clean app | FCA registered cryptoasset business plus UK EMI | Around 150 to 200 | Standard: spread around 0.5% plus fees about 1.49% to 3.99%. Advanced Trade: maker from 0.40%, taker from 0.60% | Yes, bank transfer and card | Available on around 8 to 10 assets. Commission roughly 15% to 35% of rewards | Around 98% held in cold storage, strong account security, optional self custody via Coinbase Wallet |

| Kraken | Low fees and advanced tools using Kraken Pro | FCA registered cryptoasset business plus UK EMI | 300 plus | Standard instant trades around 1% plus spread. Kraken Pro: maker from 0.25%, taker from 0.40% | Yes, bank transfer | On chain staking on 20 plus assets | Proof of Reserves audits, majority cold storage, ISO certified controls, strong track record since 2011 |

| Bitpanda | Widest crypto selection for buy and hold | FCA registered cryptoasset business for AML | 600 plus | Spread pricing from 0.99% on Bitcoin up to about 2.49% on some altcoins | Yes | On chain staking on 50 plus assets, weekly rewards, no lockups for most | Cold storage, two factor authentication, withdrawal confirmations, ISO certified data protection |

How to choose the best place to buy Bitcoin in the UK

For most UK buyers, the right platform comes down to a few essentials:

- FCA registration to meet UK compliance standards, even though Bitcoin is not FSCS protected

- Clear fees, with exchanges usually cheaper than simple buy and sell apps

- GBP bank transfers to keep costs low

- Strong security, including two factor authentication and cold storage

- Withdrawal options if you want to move Bitcoin to a private wallet later

A simple, regulated platform suits beginners, while lower fee exchanges are better for active or long term investors.

What should you know before buying cryptocurrency?

Cryptocurrency can offer diversification and high growth potential, but it also carries materially higher risk than most traditional investments. Before investing, UK investors should understand how crypto works, what drives prices, and the specific legal and tax obligations that apply in 2026.

What is cryptocurrency and how does it work?

Cryptocurrency is a digital asset recorded on a blockchain, which is a decentralised ledger maintained by a distributed network of computers rather than a central authority. Assets such as Bitcoin and Ethereum are secured using cryptography and validated through consensus mechanisms like proof of work or proof of stake.

Crypto ownership is controlled through private keys held in a wallet. There is no bank or institution guaranteeing access. If private keys are lost, stolen, or compromised, the crypto is usually unrecoverable. This makes security and custody decisions far more important than with traditional investments.

Cryptocurrencies can be used for peer to peer transfers, trading, payments in limited contexts, or held as speculative or long term investments. Prices are set entirely by market supply and demand.

What drives cryptocurrency prices?

Crypto markets are known for sharp and unpredictable price movements. Several factors influence valuations.

- Volatility: Bitcoin and Ethereum routinely experience daily price swings of 3% to 10%. Smaller tokens can move 20% or more in a single day. Large drawdowns are common, including declines of over 70% during market downturns.

- Market sentiment: Prices react quickly to news, social media narratives, and investor positioning. Sentiment shifts often matter more than fundamentals in the short term.

- Adoption and utility: Tokens with real usage, developer activity, and network growth tend to be more resilient than purely speculative assets.

- Liquidity: Assets with low trading volume can suffer from extreme price gaps and poor execution during volatile periods.

- Regulatory signals: Announcements from major regulators frequently trigger rapid repricing across the entire market.

Is cryptocurrency legal in the UK?

Yes. Buying, holding, and selling cryptocurrency is legal in the UK. Firms offering crypto services to UK users must be registered with the Financial Conduct Authority as cryptoasset businesses for anti money laundering supervision.

However, cryptoassets are not classed as legal tender and are not protected by the Financial Services Compensation Scheme. If a platform collapses or markets fall, losses are not covered in the way bank deposits or regulated investments are.

Using an FCA registered platform reduces compliance and financial crime risk, but it does not reduce market risk.

How is cryptocurrency taxed in the UK?

Cryptocurrency is fully taxable in the UK, and HMRC has significantly tightened reporting rules from 2026.

Capital gains tax on crypto

Most retail investors fall under capital gains tax rules. A taxable event occurs when you:

- Sell crypto for GBP or another fiat currency

- Swap one cryptocurrency for another

- Use crypto to pay for goods or services

- Gift crypto to someone other than a spouse or civil partner

For the 2025 to 2026 tax year:

- Annual CGT allowance: £3,000

- Basic rate taxpayers: 10% on capital gains

- Higher and additional rate taxpayers: 20% on capital gains

Example: If a higher rate taxpayer makes £15,000 in total crypto gains in a tax year, £3,000 is tax free and £12,000 is taxable at 20%, resulting in a £2,400 CGT bill.

HMRC applies the share pooling method to crypto, meaning you must calculate an average acquisition cost rather than tracking individual coins.

Income tax on crypto

Income tax may apply instead of CGT in certain situations, including:

- Staking rewards

- Mining income

- Crypto received as payment or salary

- Airdrops received in return for services

These are taxed at your marginal income tax rate:

- Basic rate: 20%

- Higher rate: 40%

- Additional rate: 45%

National Insurance contributions may also apply in employment or business contexts.

New reporting rules from 2026

From January 2026, UK crypto platforms must collect National Insurance numbers or Unique Taxpayer References and report transaction data directly to HMRC under the Crypto Asset Reporting Framework.

Reported data can include:

- Identity details

- Transaction history

- Asset balances

- Crypto to crypto trades

- Transfers between wallets

This significantly reduces the ability to under report crypto activity. Investors are expected to maintain accurate records and declare gains via self assessment.

Many UK investors now use crypto tax software to consolidate data across exchanges and wallets and calculate liabilities accurately.

What are the main risks to understand before investing?

| Risk | Why it matters |

|---|---|

| Market risk | Prices can fall sharply and remain depressed for years |

| Regulatory risk | Rule changes can restrict access or liquidity |

| Security risk | Hacks, phishing, and key loss can lead to permanent loss |

| Platform risk | Exchange outages or insolvency can delay withdrawals |

| Tax risk | Poor record keeping can lead to penalties and backdated tax |

TLDR: Cryptocurrency is a high risk asset class with no capital protection, extreme volatility, and increasing tax scrutiny in the UK. Investors should understand the technology, accept large price swings, use FCA registered platforms, plan for capital gains and income tax, and only invest money they can afford to lose.

How to trade Bitcoin UK – beginners guide

Trading Bitcoin in the UK involves buying and selling the asset over shorter timeframes to profit from price movements, rather than holding it long term.

While the mechanics are straightforward, Bitcoin trading carries high risk due to volatility, fees, and tax obligations. UK traders should understand the full process before placing their first trade.

Step 1. Choose a UK compliant Bitcoin trading platform

The first step is selecting a platform that supports active Bitcoin trading and is registered with the Financial Conduct Authority as a cryptoasset business. FCA registration confirms compliance with UK anti money laundering rules, although it does not provide FSCS protection for crypto holdings.

UK traders typically choose between:

- Crypto exchanges such as Kraken or Coinbase Advanced Trade, which offer order books, lower fees, and more control

- Broker style platforms such as eToro, which simplify trading but usually charge higher spread based costs

Key factors to compare include:

- Trading fees and spreads

- Available order types

- GBP deposit and withdrawal options

- Platform stability during volatile markets

Step 2. Fund your account in GBP

Most UK platforms support GBP deposits via Faster Payments bank transfer, which is usually free and settles within minutes. Debit cards are also supported on many platforms but often incur fees of 2% to 3%.

Credit cards are generally blocked or treated as cash advances by UK banks and are not recommended for trading Bitcoin.

Bitcoin can be traded fractionally, so you do not need large capital. Many UK platforms allow trades from as little as £1 to £10.

Step 3. Understand Bitcoin trading order types

Successful trading depends on using the right order types. The most common options are:

| Order type | What it does | When it is used |

|---|---|---|

| Market order | Buys or sells instantly at the best available price | Fast execution in liquid markets |

| Limit order | Executes only at your chosen price or better | Better price control and lower fees |

| Stop loss | Sells automatically if price falls to a set level | Risk management |

| Take profit | Locks in gains at a target price | Discipline and exit planning |

Exchanges often charge lower fees for limit orders that add liquidity. For example, maker fees on advanced UK exchanges typically range from 0.20% to 0.40%, while taker fees range from 0.40% to 0.60%, depending on volume.

Step 4. Choose a Bitcoin trading strategy

There is no single correct way to trade Bitcoin, but most UK traders fall into a few broad approaches.

- Day trading: Multiple trades per day aiming to profit from small price moves. High risk and fee sensitive.

- Swing trading: Holding positions for days or weeks to capture larger trends. Lower stress than day trading but still volatile.

- Breakout trading: Entering trades when Bitcoin moves above resistance or below support levels, often during high volume periods.

- Trend following: Trading in the direction of the prevailing market trend using indicators such as moving averages.

Bitcoin frequently moves 3% to 10% in a single day, meaning losses can accumulate quickly without strict risk controls.

Step 5. Manage risk carefully

Risk management is critical when trading Bitcoin.

- Never risk more than 1% to 2% of account capital per trade

- Always use stop losses to limit downside

- Avoid trading during illiquid hours when spreads widen

- Do not trade with borrowed money

Bitcoin has experienced drawdowns of over 70% in previous market cycles. Even short term traders must be prepared for sharp adverse moves.

Step 6. Decide how to store Bitcoin while trading

Active traders usually keep Bitcoin on the exchange for speed and liquidity. Long term storage in private wallets is safer, but impractical for frequent trading.

| Storage option | Best for | Risk level |

|---|---|---|

| Exchange wallet | Active trading | Moderate with two factor authentication |

| Private wallet | Long term holding | Lower platform risk but higher user responsibility |

Two factor authentication, withdrawal whitelists, and strong passwords should always be enabled.

Step 7. Understand tax on Bitcoin trading in the UK

Bitcoin trading is taxable in the UK. Most retail traders fall under capital gains tax rules.

For the 2025 to 2026 tax year:

- Capital gains allowance: £3,000

- Basic rate CGT: 10%

- Higher and additional rate CGT: 20%

Each disposal is taxable, including selling Bitcoin or swapping it for another cryptocurrency. Frequent trading does not automatically mean income tax, but in rare cases HMRC may classify activity as trading income.

From January 2026, UK platforms must report user activity to HMRC under the Crypto Asset Reporting Framework, including transaction histories and balances. Accurate record keeping is essential.

Step 8. Be aware of common Bitcoin trading risks

| Risk | Impact on traders |

|---|---|

| Volatility | Rapid losses if positions move against you |

| Slippage | Poor execution during fast markets |

| Fees | High frequency trading increases costs |

| Platform outages | Inability to exit during extreme moves |

| Emotional trading | Overtrading and revenge trades |

TLDR: Trading Bitcoin in the UK is accessible, but it is not simple or low risk. It requires a compliant platform, low fees, clear strategies, disciplined risk management, and careful tax reporting. For most UK investors, Bitcoin trading should only represent a small part of a broader investment approach, using money they can afford to lose.

Other ways to invest in crypto UK

Buying and holding cryptocurrency directly is not the only way UK investors can gain exposure to the sector. There are several indirect routes that reduce the need to manage wallets, private keys, or on-chain transactions, while still linking returns to the growth of the crypto market.

Crypto related shares and listed companies

One indirect approach is investing in publicly listed companies that benefit from crypto adoption. These businesses generate revenue from crypto trading, infrastructure, or blockchain services rather than from holding coins themselves.

Examples include:

- Nvidia, whose high performance GPUs are widely used in crypto mining and data centres

- Publicly listed crypto exchanges and brokers that earn fees from trading activity

- Blockchain infrastructure firms providing custody, payments, or security services

The advantage of this route is that shares are held within a standard investment account and benefit from established market regulation. However, share prices are influenced by broader equity market conditions, not just crypto prices.

Crypto exchange traded notes ETNs

UK retail investors can also access crypto price exposure through exchange traded notes, following regulatory changes introduced in late 2025.

On 8 October 2025, the Financial Conduct Authority lifted its ban on retail access to crypto ETNs. This allows investors to gain exposure to assets such as Bitcoin or Ethereum through traditional investment platforms without directly owning crypto.

Key points to understand about crypto ETNs:

- ETNs are debt instruments, not funds

- The ETN issuer holds the underlying cryptocurrency

- Investors are exposed to both crypto price risk and issuer credit risk

- ETNs trade on regulated exchanges like shares

Crypto ETNs offer a simpler route for investors who prefer using familiar brokerage accounts, but they do not remove volatility or market risk.

Using ISAs and investment accounts

Under current rules, crypto ETNs can be held in a stocks and shares ISA until 5 April 2026, allowing gains to be sheltered from capital gains tax during that period. After this date, existing holdings must be transferred to a general investment account unless regulations change.

Direct cryptocurrency holdings cannot be placed in an ISA, making ETNs one of the few tax efficient ways to gain crypto exposure within an ISA structure.

Comparing direct and indirect crypto exposure

| Approach | Direct crypto ownership | Platform and custody risk | ISA eligible |

|---|---|---|---|

| Buying crypto on an exchange | Yes | Yes | No |

| Crypto related shares | No | Lower | Yes |

| Crypto ETNs | No | Issuer risk | Yes until April 2026 |

TLDR: Indirect crypto investments can suit UK investors who want exposure without managing wallets or private keys. Shares and ETNs offer convenience and regulatory familiarity, but they still carry significant risk and may not track crypto prices perfectly. As with all crypto related investments, returns are uncertain and losses are possible, so exposure should remain proportionate to overall portfolio risk.

Common questions about buying crypto in the UK

ggggg

Where to buy cryptocurrency UK?

Cryptocurrency can be bought in the UK through online platforms registered with the Financial Conduct Authority as cryptoasset businesses, which meet UK anti money laundering and financial promotion rules.

Popular options include dedicated crypto exchanges such as Coinbase and Kraken, as well as multi-asset platforms like eToro that combine crypto with stocks and ETFs. Most UK platforms support GBP deposits via Faster Payments bank transfer, with minimum purchases often starting from £1 to £10.

How to buy Bitcoin safely?

To buy Bitcoin safely in the UK, use a platform registered with the Financial Conduct Authority and fund your account via GBP bank transfer rather than credit card to reduce fees and risk. Secure your account with two factor authentication and a strong, unique password before trading. For long term holdings, transfer Bitcoin to a private wallet where you control the private keys, ideally a hardware wallet kept offline. Avoid unsolicited offers or social media tips, and only invest money you can afford to lose, as Bitcoin is volatile and not protected by the FSCS.

How to buy cryptocurrency for beginners?

For beginners in the UK, the safest way to buy cryptocurrency is to start with a simple, FCA registered platform that supports GBP deposits and has clear, upfront fees. After creating an account and completing identity checks, you can deposit pounds via bank transfer, which is usually free, and buy a small amount of a major cryptocurrency such as Bitcoin or Ethereum, with minimum purchases often starting from £1 to £10.

Beginners should enable two factor authentication immediately and avoid complex features like leverage or frequent trading. Because crypto prices can move by more than 5% in a single day and are not protected by the FSCS, it is best to start small and only invest money you can afford to lose.

What is the cheapest way to buy Bitcoin?

In the UK, the lowest cost way to buy Bitcoin is usually through an exchange with an order book such as Kraken Pro or Coinbase Advanced Trade, where fees typically range from 0.25% to 0.60% per trade depending on volume. This is significantly cheaper than beginner focused buy and sell apps, where spread based pricing can exceed 1% to 3% per transaction. Using a GBP bank transfer via Faster Payments is also essential, as it is usually free, while debit card purchases often add 2% to 3% in extra fees.

Final thoughts

Buying cryptocurrency in the UK is now straightforward, but it remains high risk and unsuitable for money you cannot afford to lose. Using an FCA registered platform, understanding fees and taxes, and securing your assets properly are more important than trying to time the market.

Starting small, sticking to well known cryptocurrencies, and avoiding unnecessary complexity can help reduce early mistakes. Crypto can have a place in a diversified portfolio, but it should be approached with caution, discipline, and realistic expectations.

FAQs

Is it legal to buy cryptocurrency in the UK?

Yes, buying and owning cryptocurrency is legal in the UK. Firms offering crypto services must be registered with the Financial Conduct Authority for anti money laundering supervision, but crypto is not legal tender and is not protected by the Financial Services Compensation Scheme. This means prices can fall sharply and losses are not compensated if a platform fails.

What is the safest way to buy crypto in the UK?

The safest route is to use an FCA registered platform such as Coinbase, Kraken, eToro, or Bitpanda, and fund your account via GBP bank transfer. Enabling two factor authentication and moving long term holdings to a private wallet where you control the keys further reduces risk.

Can you withdraw crypto to a UK bank?

Yes, you can sell cryptocurrency on most UK platforms and withdraw GBP to a UK bank account. Withdrawals are typically processed via Faster Payments and often arrive the same day or within one working day, depending on the platform and verification status.

Can I buy crypto with my bank account?

Yes, buying crypto with a UK bank account is widely supported and usually the cheapest option. Platforms typically accept GBP bank transfers with no deposit fees, making this method more cost effective than card payments.

How to buy cryptocurrency in the UK with a debit card

Debit cards can be used on many UK platforms and allow instant purchases, which suits beginners who want quick access. However, card fees are usually around 2% to 3% per transaction, making this one of the more expensive ways to buy crypto compared with bank transfers.

What is the best way to buy crypto in the UK?

For most users, the best approach is to use an FCA registered platform, deposit GBP via bank transfer, and start with established assets like Bitcoin or Ethereum. This method balances regulatory compliance, lower fees, and ease of use, particularly for first time buyers.

What is the cheapest way to buy crypto?

The cheapest option is typically using an exchange with an order book such as Kraken Pro or Coinbase Advanced Trade, where fees usually range from 0.25% to 0.60% per trade. Spread based buy and sell apps are simpler but often cost 1% to 3% or more per transaction.

What is the safest way to buy Bitcoin?

Bitcoin is safest to buy through an FCA registered platform using GBP bank transfer, combined with strong account security like two factor authentication. For long term storage, transferring Bitcoin to a private or hardware wallet provides better protection than leaving it on an exchange.

How to trade cryptocurrency in the UK?

Trading crypto in the UK involves buying and selling assets on FCA registered platforms using market, limit, and stop orders. Because crypto prices can move 5% to 10% in a single day, traders should manage risk carefully and keep accurate records for capital gains tax reporting to HMRC.

References

- https://www.fca.org.uk/publication/research/research-note-cryptoasset-consumer-research-2023.pdf

- https://www.bankofengland.co.uk/explainers/what-are-cryptocurrencies

- https://www.gov.uk/government/collections/cryptoassets

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.