Revolut is a multi purpose digital banking app designed for everyday users who want a simple way to buy and hold cryptocurrency alongside their money. It offers broad access to major cryptocurrencies, strong mobile usability, and integrated fiat on and off ramps, with optional advanced trading through Revolut X.

Its main drawback is relatively high crypto fees on standard plans and a custodial wallet model, which may matter for frequent traders or users seeking full self custody and advanced exchange level tools.

What is Revolut and how does it work?

Revolut is a centralised, custodial crypto investing service built into a regulated digital banking app, designed for beginners and casual investors who want to buy, sell, and hold major cryptocurrencies using GBP, EUR, or USD without using a standalone crypto exchange.

Is Revolut a centralised or decentralised exchange?

Revolut is not a decentralised exchange (DEX). It operates as a centralised platform, where crypto trades are executed on your behalf and assets are held with third party custodians. Users do not control private keys directly, and custody risk sits with the provider rather than the user.

This model is similar to traditional centralised crypto exchanges, but with crypto layered on top of a banking app rather than a trading first exchange.

What is the core crypto trading model?

Revolut supports spot crypto trading only.

There are no derivatives, futures, options, leverage, or perpetual contracts available.

Users can:

- Buy and sell cryptocurrencies at market prices

- Hold crypto in a custodial wallet

- Send supported cryptocurrencies to external wallets

- Trade fiat to crypto directly using GBP, EUR, or USD

Crypto trading is available through two interfaces:

- Revolut app: Simple buy and sell execution across 228+ cryptocurrencies

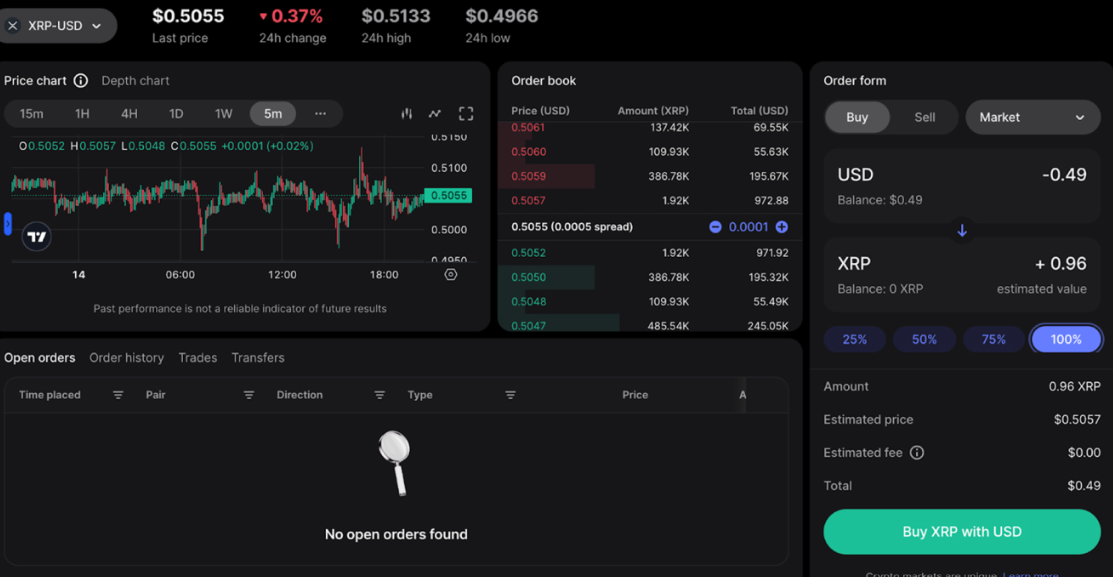

- Revolut X: A separate, more advanced crypto trading app offering 400+ trading pairs, live order books, and TradingView charts

Revolut X introduces a more exchange like experience but remains limited to spot markets.

Who is Revolut crypto investing designed for?

Revolut’s crypto offering is designed primarily for:

- Beginners buying crypto for the first time

- Casual investors making small or infrequent trades

- Banking app users who want crypto alongside cards, savings, and payments

It is not designed for advanced or professional traders. There is no direct market access, limited order types, minimal research tools, and relatively high percentage based fees on standard plans.

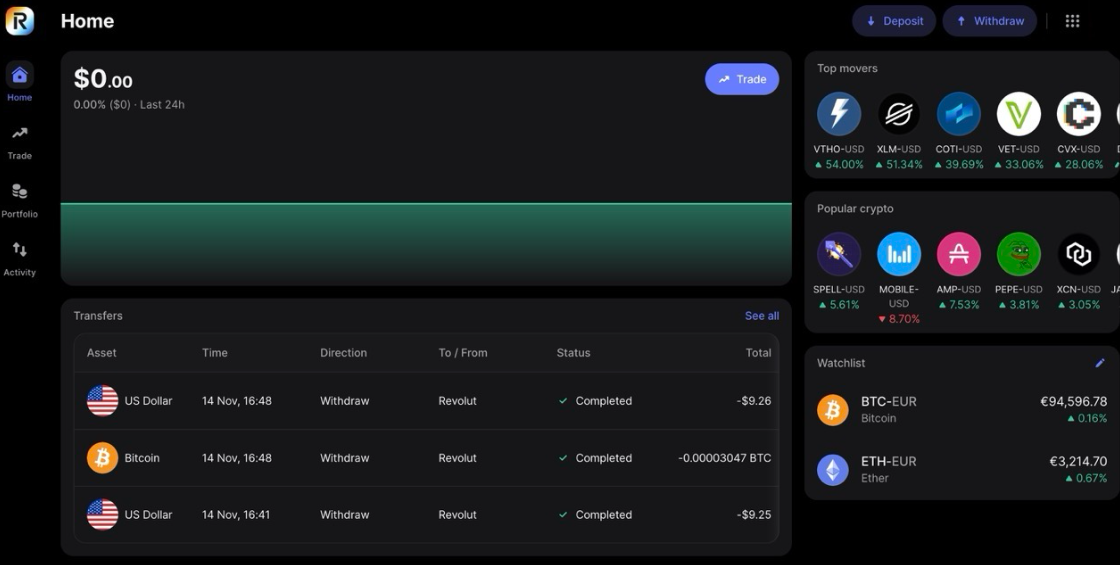

How crypto investing works in practice

Crypto investing on Revolut follows a simple flow:

- Users top up their Revolut account using a bank transfer or debit card

- Crypto is purchased directly within the app at quoted prices

- Fees are shown upfront before confirmation

- Assets appear instantly in the user’s crypto portfolio

Trades can be as small as under £1.49, following the removal of minimum trade sizes in March 2025.

Important limitations to understand

- Crypto investing on Revolut is not regulated by the FCA in the same way as stocks or funds

- Assets are held in a custodial wallet, meaning users do not control private keys

- Fees of 1.49% to 1.99% apply on standard plans, which can be expensive for small trades

- Research tools are basic and mainly link to whitepapers and official project sites

TLDR: Revolut is best viewed as a crypto on ramp within a banking app, not a full crypto exchange. It prioritises simplicity, speed, and convenience over advanced trading features, making it suitable for beginners and light users but limiting for anyone seeking deeper market access or full self custody.

Revolut overview crypto exchange key facts

| Category | Details |

|---|---|

| Availability | UK and EEA supported. Crypto services available to UK residents. Not available to US residents. |

| Exchange type (centralised or decentralised) | Centralised crypto investing service built into a digital banking platform. |

| Regulator or registration status | Revolut operates as a regulated bank in Europe. Crypto trading itself is not FCA regulated in the same way as stocks or funds in the UK. |

| Custody model (custodial or non custodial) | Custodial. Crypto is held with third party custodians. Users do not control private keys directly. |

| Investor protection (usually none) | No investor protection for crypto. Crypto holdings are not covered by FSCS protection. Capital at risk. |

| Supported cryptocurrencies | 228+ cryptocurrencies available in the main app. Includes major assets such as Bitcoin, Ethereum, Solana, XRP, Cardano, and USDT and USDC. |

| Trading types (spot, derivatives, margin) | Spot trading only. No derivatives, futures, options, margin, or leverage. |

| Fiat on ramp and off ramp | Yes. Direct GBP, EUR, and USD deposits and withdrawals via bank transfer or debit card. |

| Trading fees | Main app: 1.99% (Basic and Plus), 1.49% (Premium and above). Revolut X: 0% taker (sell) and 0.09% maker (buy) fees. |

| Deposit and withdrawal fees | Fiat deposits usually free. Crypto withdrawals incur network fees plus a Revolut service fee, shown in app before confirmation. |

| Security features | Banking grade security, two factor authentication, biometric login, transaction monitoring, and fraud detection. No major platform breaches reported. |

| Mobile app and web platform | Mobile app only for standard crypto investing. Revolut X available on mobile and desktop with TradingView charts and live order books. |

| Ease of use level | Beginner friendly. Simple buy and sell flow designed for casual and first time crypto investors. |

What assets and markets are available on Revolut?

Revolut offers access to 228+ cryptocurrencies for simple spot buying and selling, with 400+ crypto trading pairs available on Revolut X. Markets are limited to spot only, with no derivatives or leverage, making coverage suitable for mainstream assets rather than advanced or speculative trading.

Number and range of supported cryptocurrencies

Revolut supports over 228 digital assets in its main banking app. The list focuses on well known and higher liquidity cryptocurrencies rather than long tail or experimental tokens.

Commonly available assets include:

- Bitcoin and Ethereum

- Solana, Cardano, Polkadot, and Avalanche

- XRP, Dogecoin, Shiba Inu, and Polygon

- Layer 2 and infrastructure tokens such as Arbitrum, Chainlink, NEAR, and Hedera

This is a small subset of the thousands of tokens listed on major data aggregators, but it covers most large cap and widely traded assets that beginners typically start with.

Spot markets

All crypto trading on Revolut is spot based.

Users buy and sell crypto at current market prices, with assets either held in a custodial wallet or sent to an external wallet where supported. There are no advanced order types beyond basic execution in the main app.

On Revolut X, users can view:

- Live order books

- Token level price data

- TradingView powered charts

- Top traded, top gaining, and highest market cap assets

Derivatives or perpetuals

Revolut does not offer:

- Futures

- Perpetual contracts

- Options

- Margin or leveraged trading

This significantly reduces risk for new users but limits functionality for experienced traders.

Stablecoin and fiat pairs

Revolut supports both stablecoins and fiat trading pairs.

- Stablecoins include USDT and USDC

- Fiat currencies include GBP, EUR, and USD

- Revolut X offers 400+ fiat to crypto and crypto to crypto pairs

This makes Revolut effective as a fiat on ramp and off ramp rather than a full multi currency exchange.

Liquidity depth and market coverage

Liquidity is strongest on major cryptocurrencies such as Bitcoin, Ethereum, and Solana, where spreads and execution are generally smoother.

However:

- Revolut does not provide direct market access in the main app

- Liquidity is aggregated through partner venues and custodians

- Smaller or less traded tokens may have wider spreads

Revolut X improves transparency with visible order books, but overall market depth remains more limited than on large global exchanges.

TLDR: Revolut delivers strong coverage of mainstream crypto assets and fiat pairs for everyday investors, but the lack of derivatives, limited token breadth, and reduced liquidity on smaller coins prevent it from matching full scale crypto exchanges.

How good is the trading experience and toolset on Revolut?

Revolut delivers a simple, beginner focused trading experience through its mobile app, with an optional step up via Revolut X for users who want charts and order books. Tools are solid for spot trading and portfolio tracking, but limited compared with dedicated crypto exchanges built for active or automated trading.

Web and mobile platform usability

The core Revolut crypto experience is mobile first and integrated directly into the banking app. Buying crypto is fast and intuitive, typically taking only a few minutes from login to execution.

Key usability points:

- Clean interface consistent with Revolut’s banking features

- Clear fee breakdown shown before confirming a trade

- Simple navigation between fiat balances and crypto holdings

- App only for standard crypto investing, with no web platform

For users who want more visibility, Revolut X is available as a standalone app and on desktop. This offers a more traditional exchange style layout, making it easier to analyse prices and market activity.

Order types available

Order functionality is basic.

- Main Revolut app supports simple buy and sell orders at quoted prices

- No advanced order types such as stop loss, take profit, trailing stops, or conditional orders

- Revolut X adds limit style execution via an order book, but still focuses on spot trading only

There is no support for margin, leverage, futures, or options.

Charting tools and indicators

Charting depends on which Revolut product is used.

- Main app: Basic price charts, percentage changes, and portfolio performance views

- Revolut X: TradingView powered charts with technical indicators and time frame selection

Revolut X also highlights:

- Top traded cryptocurrencies

- Top gainers and losers

- Largest market cap assets

This is sufficient for casual analysis, but not on par with professional charting platforms.

Advanced tools such as APIs or automation

Revolut does not offer advanced trading infrastructure.

Not available:

- Trading APIs

- Algorithmic or automated trading

- Bot integrations

- Third party trading terminals

This reinforces Revolut’s positioning as a manual, user driven investing app rather than an active trading platform.

Performance and reliability

Revolut benefits from operating on banking grade infrastructure with a large global user base exceeding 30 million customers.

Performance highlights:

- Fast execution for mainstream cryptocurrencies

- Stable app performance during normal market conditions

- Transparent pricing and execution confirmation

However:

- Liquidity is aggregated rather than directly accessed in the main app

- Smaller tokens may experience wider spreads during volatile periods

TLDR: Revolut scores well for ease of use and reliability, especially for beginners, but loses points for limited order types, lack of automation, and a toolset that falls short of full featured crypto exchanges.

How competitive are Revolut’s fees and pricing?

Revolut’s crypto fees are simple but relatively expensive for small trades, with flat percentage pricing in the main app and more competitive maker taker fees on Revolut X. Costs are transparent and shown upfront, but frequent or active traders will usually find cheaper pricing on dedicated crypto exchanges.

Trading fees explained

Revolut uses two different pricing models, depending on how you trade crypto.

Main Revolut app (standard crypto investing)

Crypto trades in the banking app use a flat commission model, which varies by plan:

- 1.99% on Basic and Plus plans

- 1.49% on Premium, Metal, and Ultra plans

- Reduced to 1.29% for trades above £20,000

There is no longer a minimum trade size. Since March 2025, users can place crypto trades below £1.49, making Revolut accessible for very small purchases.

Revolut X (advanced trading)

Revolut X uses a maker taker fee structure, closer to a traditional exchange:

- 0% taker fee when selling into existing liquidity

- 0.09% maker fee when placing buy orders that add liquidity

This pricing is significantly cheaper than the main app, but only applies if you actively use Revolut X rather than the standard buy and sell flow.

Spread costs

Revolut does not explicitly list spreads, but spreads are embedded in quoted prices, particularly in the main app where there is no visible order book.

Important points:

- Spreads are typically tighter on major assets like Bitcoin and Ethereum

- Smaller or less liquid tokens may carry wider effective spreads

- Revolut X improves transparency by showing a live order book

For casual users, spreads are usually less noticeable than the headline commission.

Deposit and withdrawal fees

Fiat funding is one of Revolut’s strengths.

- Fiat deposits via bank transfer are usually free

- Fiat withdrawals to UK bank accounts are typically free or low cost

Crypto withdrawals incur additional charges.

- Network fee paid to blockchain validators

- Revolut service fee for processing the transfer

- Total cost is displayed in app before confirmation

The amount shown will never exceed the final charge.

Indirect or hidden costs

Revolut is generally transparent, but users should be aware of indirect costs:

- Percentage based fees make small trades disproportionately expensive

- Embedded spreads may increase total trading costs

- Holding crypto in a custodial wallet introduces no custody fee, but limits control

There are no inactivity fees or crypto custody charges.

Revolut crypto fees at a glance

| Fee type | Cost |

|---|---|

| Trading fee (Basic and Plus) | 1.99% per trade |

| Trading fee (Premium and above) | 1.49% per trade |

| High value trades | 1.29% above £20,000 |

| Revolut X maker fee | 0.09% |

| Revolut X taker fee | 0% |

| Fiat deposits | Usually free |

| Fiat withdrawals | Usually free |

| Crypto withdrawals | Network fee plus Revolut service fee |

TLDR: Revolut scores well for transparency and accessibility, but percentage based fees in the main app are high compared with specialist exchanges. Revolut X improves competitiveness, though pricing still favours casual investors over frequent traders.

How secure is Revolut and how are assets held?

Revolut uses a centralised, custodial security model for crypto, with assets held by third party custodians and protected by banking grade account controls. Security practices are strong at the account level, but users do not control private keys and crypto holdings are not covered by statutory investor protection.

Custody model

Revolut operates a custodial crypto wallet.

- Crypto assets are held on the user’s behalf by third party custody providers

- Users own the crypto economically, but do not control private keys

- Access to assets depends on Revolut and its custody partners remaining operational

This model mirrors how centralised exchanges hold assets, rather than a self custody or on chain wallet setup.

Cold storage practices

Revolut does not publicly disclose full custody architecture, but crypto assets are typically held using a combination of cold and hot storage via its custodial partners.

Key points to understand:

- Cold storage reduces exposure to online attacks

- Hot wallets are used to facilitate withdrawals and transfers

- Custody risk remains with the provider rather than the user

There is no option to manage private keys directly within the Revolut app.

Account security controls

Revolut applies banking level account security across its platform, including crypto features.

Available controls include:

- Two factor authentication

- Biometric login options such as fingerprint or facial recognition

- Transaction monitoring and automated fraud detection

- In app security alerts for unusual activity

Crypto specific controls such as withdrawal address whitelisting and granular permission management are more limited than on dedicated exchanges.

Incident history

Revolut has not reported a major platform level crypto breach to date.

However:

- Some users have reported phishing or social engineering attacks

- These incidents typically involve compromised user credentials rather than system failures

- Losses caused by user error or scams are generally not recoverable

As with all custodial platforms, user security practices play a significant role in overall risk.

Regulation and risk disclosures

Important risk considerations include:

- Crypto trading on Revolut is not regulated by the FCA in the same way as shares or funds

- Crypto holdings are not protected by the Financial Services Compensation Scheme

- In the event of custodian failure, recovery of assets may be uncertain

- Market volatility can result in rapid and significant losses

Revolut clearly presents crypto risk warnings in app, including knowledge checks before first time purchases.

TLDR: Revolut offers strong account level security and institutional custody standards, but the custodial model, lack of key ownership, and absence of investor protection mean it carries structural risks typical of centralised crypto platforms.

How do deposits and withdrawals work on Revolut?

Revolut offers fast and accessible fiat on ramps, with crypto withdrawals supported for most major assets. Funding and cashing out is tightly integrated with the Revolut banking app, making the process simple and reliable for beginners, though crypto transfers involve network and service fees and can vary in speed.

Fiat on ramp and off ramp support

Revolut’s strongest area is fiat movement.

Supported fiat currencies include:

- GBP

- EUR

- USD

Users can add and withdraw money using:

- UK and EU bank transfers

- Debit cards linked to the Revolut account

- Internal transfers between Revolut balances

Fiat deposits are usually instant or same day, especially for GBP and EUR via bank transfer. Fiat withdrawals back to a linked bank account are typically processed within one business day, and often faster.

There are generally no fees for standard fiat deposits or withdrawals, depending on account plan and transfer method.

Crypto deposit and withdrawal process

Revolut supports both buying crypto with fiat and sending crypto to external wallets.

Key points:

- Crypto purchases are made directly from the fiat balance

- Withdrawals can be sent to supported external blockchain addresses

- Depositing crypto from an external wallet is supported for selected assets

When withdrawing crypto:

- A network fee applies, paid to miners or validators

- A Revolut service fee is added for processing

- The full cost breakdown is shown in app before confirmation

Revolut uses a custodial wallet model, meaning crypto transfers are executed on the user’s behalf.

Processing times

Processing speed varies by transaction type.

- Fiat deposits are usually instant or same day

- Fiat withdrawals typically complete within one business day

- Crypto withdrawals depend on blockchain congestion and confirmation times

For major networks such as Bitcoin and Ethereum, transfers generally complete within minutes to a few hours, but delays are possible during periods of high network activity.

Limits and minimums

Revolut has lowered barriers for small investors.

- Minimum crypto trade size was removed in March 2025

- Users can now place trades below £1.49

- Upper limits depend on account verification level and plan

Crypto withdrawal limits may apply based on:

- Account tier

- Asset type

- Compliance and security checks

Limits are displayed in app before confirming a transaction.

Reliability and transparency

Revolut is clear about how funds move and what users pay.

Transparency features include:

- Upfront display of all fees before execution

- In app tracking of fiat and crypto transfers

- Clear transaction history and confirmations

While crypto withdrawals can vary in speed due to external networks, Revolut reliably communicates expected costs and processing status, reducing uncertainty for users.

Deposits and withdrawals summary

| Transaction type | Method | Typical speed | Fees |

|---|---|---|---|

| Fiat deposit | Bank transfer or card | Instant to same day | Usually free |

| Fiat withdrawal | Bank transfer | Same day to one business day | Usually free |

| Crypto purchase | Fiat balance | Instant | Trading fee applies |

| Crypto withdrawal | External wallet | Minutes to hours | Network fee plus service fee |

| Crypto deposit | External wallet | Network dependent | No Revolut fee |

TLDR: Revolut scores highly for fiat accessibility, speed, and clarity. Crypto transfers are reliable but subject to network fees and external delays, making the setup best suited to casual investors rather than frequent on chain movers.

How trustworthy is Revolut in terms of regulation and support?

Revolut operates as a regulated financial institution for banking services, but its crypto offering sits outside traditional investment protections. Trust is supported by clear jurisdictional structure, strong compliance standards, and transparent risk disclosures, while customer support is functional rather than high touch.

Regulatory and registration status

Revolut’s regulatory position depends on the product being used.

Key points:

- Revolut’s banking services are provided by Revolut Bank UAB, which is licensed in Lithuania

- Banking operations are passported across the UK and EEA

- Cryptocurrency services are not regulated by the FCA in the same way as stocks or funds

- Crypto assets are not covered by the Financial Services Compensation Scheme

This distinction is made explicit in app, particularly during the onboarding and first crypto purchase flow.

Jurisdictional transparency

Revolut is clear about its corporate structure and operating jurisdictions.

- Founded in 2015 and headquartered in Europe

- Registered banking entity based in Vilnius, Lithuania

- Serves over 30 million customers globally

- Publicly discloses which products fall under banking regulation and which do not

Crypto services are offered as part of a broader financial app, rather than through a separate offshore exchange entity, which improves transparency but does not change regulatory coverage for digital assets.

Customer support channels and responsiveness

Customer support is delivered digitally and prioritised by account tier.

Available support options:

- In app help centre and ticket based support

- Automated assistance for common issues

- Direct reporting tools for fraud or account security concerns

Limitations to be aware of:

- No public phone support line

- No real time live chat for standard users

- Response times vary based on plan level

Support is generally adequate for account and transaction queries, but less responsive than platforms offering 24/7 live chat.

Risk warnings and disclosures

Revolut is clear and proactive in communicating crypto risks.

Users are presented with:

- Prominent capital at risk warnings

- Mandatory risk acknowledgements before trading

- Knowledge checks such as the “how well do you understand crypto” quiz

- Clear statements that crypto prices are volatile and losses may be total

Disclosures also explain:

- Custodial wallet structure

- Lack of statutory investor protection

- The difference between banking regulation and crypto activity

TLDR: Revolut benefits from operating within a regulated banking framework and being transparent about what is and is not protected. However, limited crypto specific regulation, absence of investor compensation, and basic customer support prevent it from scoring at the very top of this category.

What are the pros and cons of using Revolut?

Pros

- Extremely easy entry to crypto: Buying crypto takes minutes and sits inside a familiar banking app, reducing friction for first time users.

- Strong fiat integration: GBP, EUR, and USD on ramps and off ramps are fast, reliable, and usually free via bank transfer.

- Wide mainstream asset coverage: Over 200 cryptocurrencies available, including all major large cap coins and stablecoins.

- Very low minimum trade sizes: Removal of minimum trade limits allows purchases below £1.49, suitable for testing or small allocations.

- Optional step up with Revolut X: Advanced users can access order books, TradingView charts, and lower maker taker fees.

Cons

- High percentage based fees for small trades: 1.99% on Basic plans and 1.49% on paid plans materially increases costs for frequent buyers.

- Custodial wallet only: Users do not control private keys, creating dependency on Revolut and its custody partners.

- No advanced trading features: No derivatives, margin, APIs, automation, or algorithmic trading tools.

- Limited crypto research tools: Educational content and analytics are basic compared with specialist crypto platforms.

- Crypto not covered by investor protection: Holdings are not protected by the Financial Services Compensation Scheme.

Who is Revolut best for?

- Beginners who want a simple way to buy Bitcoin, Ethereum, and other major assets.

- Casual investors making occasional or small crypto purchases.

- Users already using Revolut for banking who want everything in one app.

- Buy and hold users who prioritise convenience over cost efficiency.

- Traders stepping up gradually via Revolut X without moving to a full exchange.

Who is Revolut not ideal for?

- Active traders who need advanced order types, leverage, or automation.

- Low fee seekers trading frequently or in larger volumes.

- Self custody advocates who require direct control of private keys.

- Users needing strong crypto specific regulation and statutory investor protection.

- Professional or institutional traders requiring APIs, deep liquidity tools, or complex strategies.

How to get started with Revolut

Getting started with crypto on Revolut is designed to be fast and largely friction free, especially for users who already have a Revolut banking account.

The process below applies to both standard crypto investing in the Revolut app and trading via Revolut X.

- Create an account: Download the Revolut mobile app on iOS or Android and sign up using a mobile number. New users must set a passcode and enable basic security features before accessing any financial products, including cryptocurrency.

- Complete verification if required: Identity verification is mandatory. This typically involves uploading a government issued photo ID and completing a short selfie check. Crypto access may also require passing a short knowledge assessment that highlights volatility and risk warnings.

- Deposit funds: Add money to the account using a UK bank transfer, debit card, or another supported fiat method. GBP, EUR, and USD balances can be used directly to buy crypto. Bank transfers are usually free and near instant for UK users.

- Place a trade: Navigate to the Crypto section in the app, select a supported asset, and choose Buy or Sell. Enter the trade size and review the quoted price and fees before confirming. More advanced users can switch to Revolut X to place trades via a live order book with charting tools.

- Withdraw or secure assets: Crypto holdings can be held within Revolut’s custodial wallet or withdrawn to an external crypto wallet, subject to network and service fees. Users not withdrawing should secure their account with strong passcodes, biometric login, and two step verification to reduce account level risk.

How we tested and methodology

Each crypto exchange reviewed is assessed using a standardised six category scoring framework, with every category scored out of 5 to ensure consistent, side by side comparisons across platforms. The six evaluation areas are:

- Supported assets and markets

- Trading experience and tools

- Fees and pricing

- Security and custody

- Deposits and withdrawals

- Trust, regulation, and support

Scores are determined through hands on testing of the platform, including account setup, funding, trading, and withdrawals. This is combined with detailed fee analysis, a review of custody and security practices, and structured usability checks across mobile and web interfaces. Regulatory disclosures, risk warnings, and customer support accessibility are also examined to assess transparency and overall reliability.

FAQs

Is Revolut crypto friendly in the UK?

Yes. Revolut supports crypto buying, selling, holding, and withdrawals for UK users, with GBP on and off ramps built into the app. Crypto activity is permitted, but it is not regulated in the same way as UK investments.

Does Revolut tell HMRC about crypto?

Revolut can share customer data with HMRC when legally required. UK users are responsible for tracking and reporting any crypto gains or income for tax purposes.

What are the risks of Revolut crypto?

Crypto assets are volatile, held in a custodial model, and not protected by the FSCS. There is also regulatory risk, as crypto services do not fall under full FCA investment protections.

Why are Revolut crypto fees so high?

Revolut charges convenience focused pricing, especially on smaller trades, rather than exchange level fees. Fees reflect simplicity and integrated banking rather than active trading cost efficiency.

Is it good to buy crypto through Revolut?

It works well for small, occasional purchases and beginners. It is less suitable for frequent traders or users seeking the lowest possible fees.

Can I cash out my crypto on Revolut?

Yes. Crypto can be sold back into fiat and withdrawn to a UK bank account, typically within minutes once the trade is completed.

Is it safe to hold my crypto on Revolut?

Crypto is held in custody via third party providers with account level security controls in place. However, users do not control private keys, and holdings are not covered by deposit protection schemes.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.