Bitstamp is a long running cryptocurrency exchange designed for UK retail investors and institutions who want a regulated on ramp with straightforward spot trading and a more advanced Pro interface when needed.

It performs best on security and core trading reliability, with decent volume based pricing and solid GBP funding options like Faster Payments.

Its main drawback is that the product set is not as broad as larger exchanges, with limitations around earn style features in the UK plus mixed feedback on withdrawals, KYC checks, and support, which may matter most for active traders who need fast fiat cash outs and consistently smooth account access.

What is Bitstamp and how does it work?

Bitstamp is a centralised cryptocurrency exchange that lets UK users buy, sell, hold, and trade digital assets through a custodial account, meaning Bitstamp holds the assets on your behalf while you trade and withdraw.

Is Bitstamp centralised or decentralised?

Bitstamp is a centralised exchange (CEX). That matters because:

- You trade through an account opened with Bitstamp, rather than connecting a self custody wallet to a decentralised protocol.

- Identity checks are required. UK users must complete know your customer verification before accessing most features.

- It is a custodial setup. Bitstamp stores customer crypto in its custody, with most assets held offline for security (commonly stated as around 95% in cold storage, with the remainder kept online for day to day liquidity).

How Bitstamp works in the UK step by step

- Create an account and complete verification

- Bitstamp operates a KYC process that typically involves uploading photo ID and proof of address.

- This is linked to anti money laundering requirements. In the UK, Bitstamp UK Limited is registered with the Financial Conduct Authority as a cryptoasset business under the Money Laundering Regulations.

- Fund the account with GBP or crypto

- GBP deposits are commonly supported via Faster Payments.

- Other funding options mentioned for UK users include bank transfer, debit or credit card, and wallet based payments such as Apple Pay, Google Pay, and PayPal (availability can vary by method and account eligibility).

- Crypto deposits are made by sending coins to a Bitstamp deposit address.

- Place a trade

- Bitstamp supports spot trading, which is the standard buy and sell market where you exchange one asset for another at the current price.

- Orders can be placed as market (fills immediately at the best available price) or limit (fills only at your specified price).

- On the more advanced interface, Bitstamp also supports additional order types such as stop limit and, in some contexts, trailing or conditional style orders, although availability can change by product and region.

- Pay trading fees

- Bitstamp uses a maker taker fee model on spot markets.

- Pricing starts at 0.30% maker and 0.40% taker, with lower fees for higher 30 day trading volumes.

- Instant buy features and card based deposits can add extra costs, such as a percentage fee applied to the purchase.

- Withdraw GBP or crypto

- GBP withdrawals typically go back to a bank account in the same name as the Bitstamp account, and bank withdrawal timeframes are usually quoted in business days.

- Crypto withdrawals are on chain, so timing depends on network confirmations and congestion.

- Some methods come with fixed fees (for example, Faster Payments withdrawals are often listed with a flat GBP fee), and crypto withdrawals vary by asset.

Core trading model: spot, derivatives, and swaps

Bitstamp’s core model is built around exchange trading rather than broker style pricing.

- Spot markets (core product): Most users will use Bitstamp for spot trading in major cryptocurrencies and stablecoins, with both crypto to crypto and crypto to fiat pairs (for example, BTC to GBP or BTC to EUR where available).

- Derivatives (available on some accounts and regions): Perpetual futures on a limited set of major assets (examples given include BTC, ETH, SOL, and XRP) with up to 5x leverage, plus a separate maker and taker fee schedule for derivatives. Access to derivatives can depend on jurisdiction, onboarding, and eligibility, so UK users should check what is enabled on their account.

- Swaps and instant buy: Bitstamp also supports simpler “buy” style flows for quick purchases, but these typically involve an added service fee or wider effective pricing than placing a limit order on the exchange.

Who is Bitstamp designed for?

Bitstamp is positioned as a “core exchange” for users who want a straightforward trading venue with a long operating history and a choice of simple or advanced interfaces.

- Beginner to intermediate users

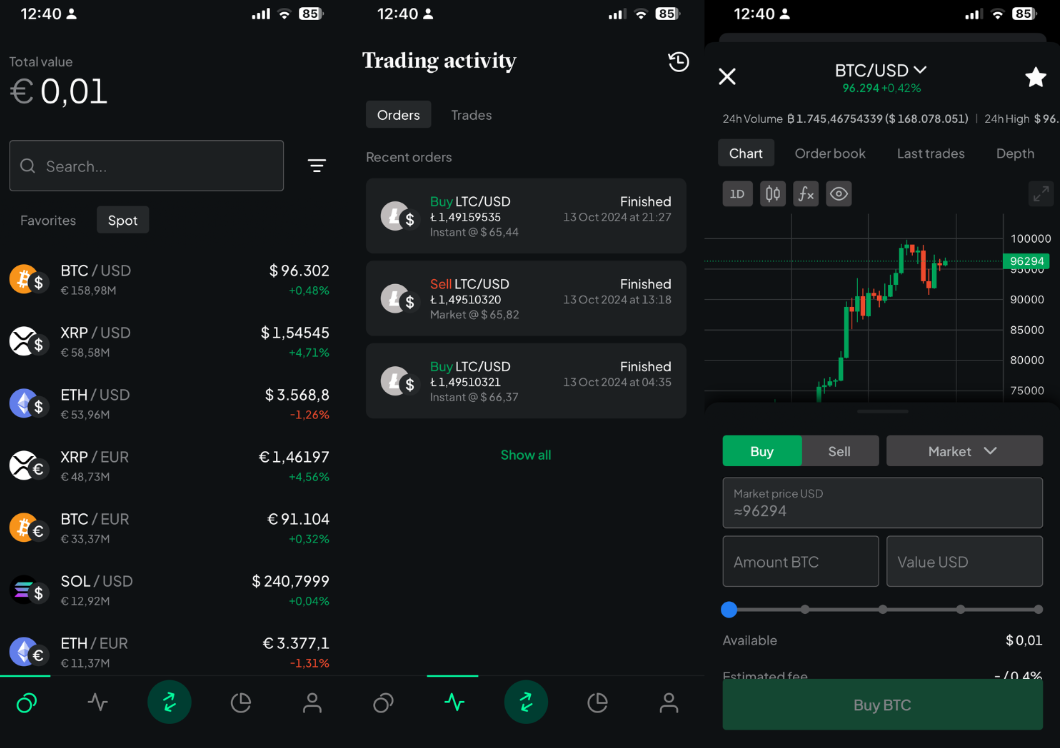

- The Basic mode and mobile app focus on simple buying, selling, and portfolio tracking.

- The learning section is aimed at newer users who want plain language explanations.

- Active traders

- The Pro interface adds deeper order books, charting, and more order types.

- Volume based fees can become more competitive for frequent traders.

- Advanced and institutional users

- Institutional grade execution technology and API connectivity (REST, WebSocket, FIX) for firms or high volume traders.

- Some institutional only features, such as OTC style request for quote, may not be available to UK retail users.

Quick view: what you actually do on Bitstamp

| What you want to do | How Bitstamp handles it | What to keep in mind |

|---|---|---|

| Buy or sell crypto quickly | Basic mode, instant purchase flow, card or wallet payments | Convenience can cost more than placing an order on the exchange |

| Trade with tighter pricing | Spot exchange with maker taker fees | Base fees are often shown as 0.30% maker and 0.40% taker, then reduce with volume |

| Use advanced tools | Pro interface with full order book and charting | Better for active traders, less beginner friendly |

| Earn on holdings | Staking and lending | Availability can be restricted in the UK, and earn products are not protected like a bank savings account |

| Cash out to GBP | Faster Payments and bank transfer rails | Withdrawals can take 1 to 5 business days depending on method and bank processing |

Bitstamp overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | UK supported. Available in 100 plus countries overall (with restrictions in some jurisdictions). |

| Exchange type (centralised or decentralised) | Centralised exchange (CEX). |

| Regulator or registration status | UK: Bitstamp UK Limited is FCA registered as a cryptoasset business under the Money Laundering Regulations 2017 (AML registration). Also holds 50 plus global licences and registrations (examples referenced include MiCA, MiFID, BitLicense). |

| Custody model (custodial or non custodial) | Custodial. Around 95% of assets stored in cold wallets, 5% kept online for liquidity. |

| Investor protection (usually none) | No FSCS protection for crypto. FCA registration does not mean crypto is regulated as an investment product. |

| Supported cryptocurrencies | 130 plus cryptocurrencies referenced (asset availability can vary by region). |

| Trading types (spot, derivatives, margin) | Spot trading (crypto to crypto and crypto to fiat). Perpetual futures referenced on limited assets (BTC, ETH, SOL, XRP) with up to 5x leverage. No spot margin trading referenced. |

| Fiat on ramp and off ramp | GBP deposits and withdrawals supported. Funding options referenced include Faster Payments, bank transfer, debit or credit card, Apple Pay, Google Pay, and PayPal. PayPal withdrawals are stated as not supported. |

| Trading fees | Spot: 0.30% maker and 0.40% taker, reducing with 30 day volume. Derivatives: minus 0.005% maker and 0.015% taker referenced. Instant buy fee referenced at 4%. |

| Deposit and withdrawal fees | Faster Payments deposit: free. Faster Payments withdrawal: 2.00 GBP referenced. SEPA withdrawal: 3.00 EUR referenced. Card deposit fee: 5% referenced. Wire and crypto withdrawal fees vary by method and asset. |

| Security features | 2FA, cold storage, multisig, encryption, withdrawal address whitelisting, biometric login on mobile. |

| Mobile app and web platform | Web platform plus iOS and Android apps with Basic and Pro modes. App ratings referenced around 4.8 (Apple) and 4.6 (Google Play). |

| Ease of use level | Easy for beginners in Basic mode. Better suited to active traders on Pro due to order book and charting tools. |

What assets and markets are available on Bitstamp?

Bitstamp offers a curated crypto lineup for UK users, with 130 plus cryptocurrencies and 230 plus trading pairs, mainly focused on spot markets for major coins and stablecoins. Some users may also get access to perpetual futures on a small set of assets. Coverage is strongest on large cap markets rather than long tail tokens.

Number and range of supported cryptocurrencies

Bitstamp’s market list is designed around mainstream demand rather than maximum token count.

- 130 plus cryptocurrencies available overall (availability can vary by country and product)

- Strong coverage of large cap names such as BTC, ETH, XRP, SOL, ADA, DOT, LINK

- Includes a mix of categories:

- Layer 1s: BTC, ETH, SOL, ADA

- DeFi: UNI, AAVE, COMP

- Meme coins: DOGE, SHIB, PEPE, BONK

- Gaming and metaverse: MANA, AXS, IMX

- The platform is described as “curated”, meaning it may not list every trending asset you see on larger exchanges.

Spot markets

Spot trading is the core of Bitstamp.

- Crypto to crypto markets (example pairs referenced: LTC/BTC, XRP/BTC)

- Crypto to fiat spot markets (examples referenced include BTC/USD and BTC/EUR)

- Typical order functionality includes:

- Market orders

- Limit orders

- Stop limit orders (availability can vary by interface and product)

Bitstamp’s Basic mode is geared towards simpler spot buying and selling, while Pro is aimed at active traders using order books and charting.

Derivatives or perpetuals

Limited derivatives offering:

- Perpetual futures on a small set of assets: BTC, ETH, SOL, XRP

- Up to 5x leverage

- Collateral currencies referenced: USD, EUR, BTC

- Derivatives fees referenced: minus 0.005% maker and 0.015% taker

This is not positioned as a broad derivatives venue. Market selection is narrow compared with large derivatives focused exchanges.

Stablecoins and fiat pairs

Bitstamp supports both stablecoin markets and fiat rails that matter for UK users.

- Stablecoins: 12 stablecoins, with examples like USDT, USDC, DAI, PYUSD

- Fiat currencies supported: GBP, EUR, USD are referenced

- Pair coverage includes:

- Stablecoin pairs such as USDT/EUR (example referenced)

- Fiat denominated pairs such as BTC/USD and BTC/EUR

- Some reviews also mention fiat to fiat pairs (for example, GBP/USD and GBP/EUR) as a differentiator versus many crypto only competitors.

Liquidity depth and market coverage

Bitstamp tends to have its best depth and pricing on the markets that matter most to UK users:

- Stronger liquidity and tighter spreads are typically expected on BTC, ETH, XRP, major stablecoins, and top fiat pairs

- Coverage is weaker on smaller altcoins because Bitstamp lists fewer niche tokens than “everything” style exchanges

- Execution is positioned as institutional grade in Pro, with references to Nasdaq matching engine technology, plus APIs (REST, WebSocket, FIX) for more advanced trading workflows

TLDR: Bitstamp scores well for core market coverage and major asset liquidity, but it is not the best fit for traders who want the widest possible altcoin catalogue or a deep derivatives menu.

How good is the trading experience and toolset on Bitstamp?

Bitstamp delivers a stable, professional trading experience built around reliability rather than feature volume. Its web and mobile platforms cover essential spot and futures trading well, with strong execution, clean interfaces, and institutional grade infrastructure. However, the toolset is narrower than feature heavy competitors, particularly for automation, margin, and advanced derivatives.

Web and mobile platform usability

Bitstamp offers two clearly separated experiences across web and mobile:

- Basic mode is designed for beginners and casual traders, with simple buy and sell flows, portfolio views, and minimal configuration.

- Pro mode targets active and institutional users, with full order books, advanced charts, and granular order placement.

Both modes are available on:

- Web platform

- iOS and Android apps

Mobile usability is a strong point. App ratings consistently sit around 4.8 on the Apple App Store and 4.6 on Google Play, reflecting a clean interface, fast navigation, and reliable performance. One drawback is that users must switch between Basic and Pro modes manually, as certain features like instant buys are not available in Pro.

Order types available

Bitstamp supports the core order types expected from a professional spot exchange:

- Market orders

- Limit orders

- Stop limit orders

Historically supported features such as trailing stops and stop market orders have been reduced, which may disappoint more advanced traders. There is no spot margin trading, and leverage is limited to derivatives products only.

For many users, the order set is sufficient for disciplined spot trading, but it lacks the flexibility seen on more advanced trading platforms.

Charting tools and indicators

Charting is strongest on the Pro platform:

- TradingView powered charts

- Over 100 technical indicators

- Customisable timeframes, drawing tools, and overlays

- Integrated depth charts and Level 2 order books

Charts are responsive and stable, making Bitstamp suitable for technical analysis on major pairs. However, tooling depth is geared toward traditional TA rather than strategy automation or advanced quantitative workflows.

Advanced tools such as APIs or automation

This is where Bitstamp leans into its institutional roots.

- APIs supported: REST, WebSocket, and FIX

- Designed for high frequency, low latency execution

- Used by brokers, fintechs, hedge funds, and banks

- Backed by Nasdaq matching engine technology, with order matching cited as significantly faster than retail grade systems

Bitstamp also offers Crypto as a Service and white label infrastructure for businesses. That said, there is no native trading bot marketplace, no copy trading, and no built in automation tools for retail users.

Performance and reliability

Performance is one of Bitstamp’s strongest attributes.

- Operating continuously since 2011

- One major security incident in 2015, with full customer reimbursement

- 95% of assets held in cold storage

- Consistently high uptime during periods of market volatility

- Strong execution quality on major pairs such as BTC, ETH, and XRP

Execution reliability, order matching consistency, and platform stability are frequently cited positives, particularly by institutional and high volume traders who value predictability over rapid feature changes.

TLDR: Bitstamp scores well for execution quality, platform stability, and professional grade infrastructure. It is less competitive for traders who want advanced retail tools such as margin, complex derivatives, strategy automation, or frequent feature updates. For disciplined spot traders and institutions, the trading experience remains dependable and mature.

How competitive are Bitstamp’s fees and pricing?

Bitstamp uses a transparent, volume based maker taker fee model that favours frequent traders but can be expensive for casual users who rely on cards or instant buys. Core exchange fees are competitive at higher volumes, while convenience features carry clear cost trade offs.

Trading fees (maker taker model)

Bitstamp applies a maker taker pricing structure based on a rolling 30 day trading volume.

- Base spot fees

- Maker: 0.30%

- Taker: 0.40%

- Fees fall as volume increases, reaching 0% maker and 0.03% taker at the highest institutional tiers.

- No subscription plans or token based discounts.

Derivatives (perpetual futures):

- Maker: −0.005% (rebate)

- Taker: 0.015%

- Liquidation fee: 0.05%

- Leverage capped at 5x, which limits risk but also limits fee efficiency for aggressive traders.

Spot trading fee tiers (illustrative)

| 30 day trading volume | Maker fee | Taker fee |

|---|---|---|

| Under $10,000 | 0.30% | 0.40% |

| $500,000+ | 0.08% | 0.18% |

| $1B+ | 0.00% | 0.03% |

For low volume traders, fees sit above ultra low cost exchanges. For high volume traders, pricing becomes more competitive.

Spread costs and instant buys

- Order book trades: No fixed spread markup. Pricing depends on market liquidity and order type.

- Instant Buy / Quick Buy:

- 4% service fee applied to card and wallet based purchases (debit card, credit card, Apple Pay, Google Pay, PayPal where available).

- This effectively replaces tight spreads with a convenience premium.

This makes instant buys one of the most expensive ways to trade on Bitstamp.

Deposit fees

| Method | Fee |

|---|---|

| Faster Payments (UK) | Free |

| SEPA transfer | Free |

| Crypto deposits | Free |

| International wire | ~0.05% |

| Debit or credit card | ~5% |

Bank transfers are cost efficient. Card funding is fast but costly.

Withdrawal fees

| Method | Fee |

|---|---|

| Faster Payments (UK) | £2.00 |

| SEPA transfer | €3.00 |

| International wire | ~0.1% |

| Crypto withdrawals | Network dependent |

Crypto withdrawal fees vary by asset and blockchain conditions.

Indirect or hidden costs to be aware of

- Instant buy fee: 4% is the biggest hidden cost for beginners.

- Card funding fees: Around 5%, which can outweigh trading fees entirely.

- Earn product commissions:

- Staking: 15% to 25% of rewards depending on asset.

- Lending: 15.50% to 27.27% of earned interest.

- FX conversion: Fiat to fiat or fiat to crypto conversions can introduce minor FX costs depending on route.

There are no account maintenance fees and no inactivity charges.

Fee competitiveness summary

- Strengths

- Clear pricing structure

- Competitive fees for high volume traders

- No spread manipulation on order book trades

- Free GBP deposits via Faster Payments

- Weaknesses

- High costs for card users and instant buys

- Less competitive for small, infrequent trades

- Earn product commissions reduce headline yields

TLDR: Bitstamp’s fees are fair and transparent, but best suited to bank funded, higher volume traders. Casual users prioritising speed and convenience will pay a noticeable premium.

How secure is Bitstamp and how are assets held?

Bitstamp uses a traditional centralised, custodial security model focused on asset segregation, cold storage, and account level controls rather than self custody or on chain proof of reserves. Its approach prioritises operational resilience and regulatory compliance over user controlled custody.

Custody model

- Custodial exchange: Customer crypto assets are held by Bitstamp, not in user controlled wallets.

- Users do not receive private keys. Asset access depends on account status, compliance checks, and platform availability.

- Custody is shared across Bitstamp’s internal infrastructure and regulated third party custodians for certain institutional products.

This model simplifies trading and fiat integration but creates counterparty risk, as access to funds ultimately depends on the exchange remaining operational and compliant.

Cold storage practices

Bitstamp states that approximately 95% of customer crypto assets are held in offline cold storage, with the remaining 5% kept in hot wallets to support day to day liquidity and withdrawals.

- Cold wallets are not connected to the internet, reducing exposure to remote attacks.

- Hot wallets are limited in size and used operationally.

- Institutional products reference third party custodians such as BitGo for segregated, professional grade storage.

Bitstamp does not publish real time wallet balances or on chain proof of reserves, so users must rely on disclosures rather than independent verification.

Account level security controls

Bitstamp supports standard account protection features expected from a long running exchange:

- Two factor authentication (2FA) for login and sensitive actions

- Withdrawal address whitelisting, limiting withdrawals to pre approved addresses

- Device and session monitoring

- Email confirmations for withdrawals and security changes

- Biometric authentication on mobile apps (Face ID or fingerprint)

Security features are optional in some cases, meaning account protection depends partly on user configuration.

Incident history and operational track record

- 2015 security incident: Bitstamp lost approximately 18,866 BTC (around $5.2 million at the time) following a phishing attack targeting employees and hot wallet credentials.

- Trading was suspended temporarily, infrastructure was rebuilt, and affected customers were fully reimbursed.

- Since 2015, Bitstamp has not reported further major asset loss incidents.

Longevity reduces operational risk, but past incidents highlight that even mature exchanges remain exposed to internal and social engineering threats.

Certifications and external assessments

Bitstamp references multiple security and compliance credentials:

- ISO/IEC 27001 information security certification

- SOC 2 Type II controls reporting

- Repeated AA ratings from CCData

- Inclusion in Forbes’ lists of trusted crypto exchanges (methodology varies)

These assessments relate to internal controls and governance rather than guaranteeing asset safety.

Regulatory context and asset protection limits

- In the UK, Bitstamp UK Limited is registered with the Financial Conduct Authority under the Money Laundering Regulations.

- This registration covers AML and counter terrorism financing only.

- Crypto holdings are not protected by the Financial Services Compensation Scheme (FSCS).

- Disputes may not fall under the Financial Ombudsman Service.

If Bitstamp were to become insolvent, asset recovery would depend on insolvency proceedings and custody arrangements, not statutory protection.

Risk considerations for users

- Custodial risk: users depend on Bitstamp’s solvency, controls, and compliance decisions.

- Withdrawal and account freezes can occur due to KYC reviews or regulatory obligations.

- Earn products (staking or lending) introduce additional counterparty and liquidity risk and are not insured.

- No guarantees apply to asset safety, access speed, or recovery outcomes.

TLDR: Bitstamp demonstrates mature operational security, conservative cold storage practices, and long term survivability. However, it remains a centralised custodian without statutory investor protection, and users must balance convenience against counterparty and regulatory risk when holding assets on the platform.

How do deposits and withdrawals work on Bitstamp?

Bitstamp offers a broad but traditional funding setup focused on bank transfers and on-chain crypto movements rather than instant fintech style payouts. For UK users, GBP support via Faster Payments is a key strength, while card based funding trades speed for higher costs.

Fiat on ramp and off ramp support

UK users can deposit and withdraw GBP directly through regulated banking rails.

Supported fiat funding methods (UK):

- Faster Payments (FPS) – primary GBP on-ramp and off-ramp

- SEPA transfers (EUR)

- International wire transfers (SWIFT)

- Debit and credit cards (Visa and Mastercard)

- Digital wallets: Apple Pay, Google Pay, PayPal (deposits only)

Key points:

- Bank accounts must be in the same legal name as the Bitstamp account

- Third party or mismatched bank details are commonly rejected

- PayPal withdrawals are not supported, only deposits

Crypto deposit and withdrawal process

Bitstamp supports standard on-chain crypto transfers for all listed assets.

Deposits:

- Each asset has a dedicated deposit address

- Crypto deposits are typically free (network fees paid by the sender)

- Minimum deposit amounts apply per asset to avoid dust transactions

Withdrawals:

- Withdrawals are processed on chain

- Fees vary by blockchain and asset

- Users can enable withdrawal address whitelisting for added security

- Once broadcast, transactions cannot be reversed

Errors such as sending the wrong asset to a network or address can result in permanent loss, which is standard across centralised exchanges.

Processing times

Fiat processing times (typical):

| Method | Processing time |

|---|---|

| Faster Payments (GBP) | Same day to 1 business day |

| SEPA (EUR) | 1–2 business days |

| International wire | 3–5 business days |

| Card deposits | Instant |

| PayPal deposits | Instant |

Crypto withdrawals:

- Initiated quickly by Bitstamp

- Final timing depends on blockchain confirmations and network congestion

Withdrawal delays can occur during enhanced compliance checks, high volatility periods, or network outages.

Limits and minimums

- Minimum fiat deposit: typically $10 / £10 equivalent

- Minimum order size: $10

- FPS withdrawal limit: up to £250,000 per transaction

- Card and PayPal purchase limits: typically capped at £2,500 per day and £20,000 per month

- Crypto minimums and maximums vary by asset and network

Higher limits may apply to verified or institutional accounts.

Fees overview (summary)

| Method | Fee |

|---|---|

| Faster Payments deposit | Free |

| Faster Payments withdrawal | £2.00 |

| SEPA withdrawal | €3.00 |

| Card deposits | ~5% |

| International wire | ~0.05%–0.1% |

| Crypto deposits | Free |

| Crypto withdrawals | Network dependent |

Using bank transfers is significantly more cost efficient than cards or instant purchase options.

Reliability and transparency

Bitstamp is generally regarded as operationally reliable, with:

- Clear published fee schedules

- Predictable bank processing times

- Strong audit and compliance controls

That said, user feedback highlights recurring friction points:

- Account reviews and KYC checks can temporarily block withdrawals

- Support response times during disputes are often described as slow

- No instant GBP cash-out feature comparable to newer fintech exchanges

TLDR: Bitstamp scores well for bank based GBP access, transparency, and regulatory alignment, but falls short on speed and convenience compared with newer platforms offering instant fiat withdrawals or app based payouts.

How trustworthy is Bitstamp in terms of regulation and support?

Bitstamp is generally regarded as a high trust, compliance first crypto exchange, particularly for UK and European users. Its credibility rests on long operating history, multi jurisdictional registrations, and conservative disclosures, although customer support responsiveness and consumer protections remain mixed.

Regulatory and registration status

Bitstamp operates under a registration based regulatory model, rather than full investment regulation.

United Kingdom

- Operates through Bitstamp UK Limited

- Registered with the Financial Conduct Authority under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017

- Permitted to provide:

- Crypto custody services

- Fiat to crypto and crypto to fiat exchange

- Crypto to crypto trading

Important limitation

- The FCA does not regulate cryptoassets themselves

- This means:

- No Financial Services Compensation Scheme (FSCS) protection

- Limited or no access to the Financial Ombudsman Service

- Consumer protection is focused on AML compliance, not loss recovery

Global footprint

- 50 plus licences and registrations worldwide

- Notable regulatory frameworks referenced:

- MiCA (EU Markets in Crypto Assets)

- MiFID registrations for certain services

- BitLicense in New York

- Active in 100 plus countries, with clear exclusions where regulation does not permit operation

This breadth of registrations places Bitstamp among the more compliance aligned global exchanges.

Jurisdictional transparency

Bitstamp demonstrates relatively strong transparency for a centralised exchange.

- Founded in 2011, making it the oldest continuously operating crypto exchange

- Headquartered in Luxembourg

- Operates through clearly disclosed legal entities in:

- UK

- United States

- EU

- Singapore

- British Virgin Islands

- Publicly lists restricted countries and regions, including:

- Canada

- China

- Russia

- Iran

- North Korea

- US states such as Hawaii and Nevada

In 2025, Bitstamp was acquired by Robinhood for approximately $200 million, increasing financial transparency and balance sheet backing.

Customer support channels and responsiveness

Bitstamp offers more support access than many crypto exchanges, but user satisfaction varies.

Available support channels

- Email support

- Phone support (24/7, including UK users)

- Help centre and Learn section

- Social media escalation routes

Typical response times

- Phone support: often under 10 minutes

- Email support: typically 24 to 72 hours

- Complex cases involving:

- KYC reviews

- Source of funds checks

- Withdrawals

may take longer

User feedback trends

- Mixed reviews across Trustpilot and community forums

- Common complaints include:

- Account freezes during compliance reviews

- Delayed withdrawals linked to enhanced checks

- Slow resolution of verification issues

- Positive feedback tends to focus on:

- Professional phone support

- Clear communication once cases are escalated

This suggests support quality is uneven, with strong access but inconsistent resolution speed.

Clarity of risk warnings and disclosures

Bitstamp is relatively conservative and clear in how it communicates risk.

- Explicit disclosures that:

- Cryptoassets are high risk and volatile

- Users may lose all invested capital

- Funds are not protected under UK compensation schemes

- Clear separation between:

- Trading services

- Earn products (staking and lending)

- Earn related disclosures note:

- Funds are not insured

- Returns are not guaranteed

- Assets may be locked during staking or lending periods

Bitstamp also publishes:

- Detailed fee schedules

- Withdrawal limits and processing timelines

- Compliance requirements and account restrictions

While disclosures are thorough, they are legalistic rather than user friendly, which may overwhelm less experienced users.

Trust and regulation summary

Strengths

- FCA registered in the UK

- 50 plus global licences

- 14 plus years of uninterrupted operations

- Clear jurisdictional disclosures

- Conservative approach to risk communication

Limitations

- No FSCS protection for UK users

- AML registration only, not investment regulation

- Mixed customer support experiences during compliance events

TLDR: Bitstamp scores well for regulatory credibility, transparency, and longevity, but loses points for consumer protection limitations and inconsistent support resolution. It is best suited to users who value compliance and operational maturity over fast issue resolution or enhanced retail protections.

What are the pros and cons of using Bitstamp?

Pros

- Long operating history and regulatory footprint: Founded in 2011, Bitstamp is the oldest continuously operating crypto exchange, with 50 plus licences and registrations across the UK, EU, and US. This reduces counterparty risk compared with newer platforms.

- Strong security posture: Around 95% of customer assets are held in cold storage, supported by multi signature wallets, withdrawal whitelisting, ISO 27001 and SOC 2 Type II certifications, and a clean post 2015 security record.

- Transparent, volume based fee structure: Spot trading fees start at 0.30% maker and 0.40% taker, falling to near zero for high volume traders. Fees are published clearly with no hidden spreads on Pro trades.

- Institutional grade trading infrastructure: Built on Nasdaq matching engine technology, Bitstamp offers stable execution, deep liquidity on major pairs, and FIX, REST, and WebSocket APIs for professional and institutional users.

- Reliable GBP banking support: UK users benefit from Faster Payments deposits and withdrawals, with predictable processing times and clear limits, making fiat movement more dependable than many offshore exchanges.

Cons

- Limited crypto selection compared with major competitors: With roughly 100 to 130 supported assets, Bitstamp lags behind platforms offering 300 to 500 plus coins, and excludes popular networks such as BNB and TRX.

- No spot margin trading and low futures leverage: Spot margin is unavailable, and perpetual futures are capped at 5x leverage, which limits flexibility for active or high risk traders.

- High fees for instant purchases: Card, Apple Pay, Google Pay, and PayPal purchases carry a 4% to 5% fee, making Bitstamp expensive for small or frequent instant buys.

- Earn products are restricted by region: Staking and lending availability is inconsistent, with UK, US, Singapore, and Japan users excluded from certain Earn products, reducing passive income options.

- Customer support issues during compliance checks: While phone support exists, users frequently report account freezes, delayed withdrawals, and slow resolution during KYC or source of funds reviews.

Who is Bitstamp best for?

- Compliance focused traders: Users who prioritise regulatory alignment, transparency, and long term operational stability over rapid feature releases.

- Active spot traders on major coins: Traders focused on BTC, ETH, XRP, and large cap pairs who benefit from reliable execution and predictable fees.

- Institutional and API driven users: Firms and professionals needing FIX connectivity, OTC RFQ services, and stable fiat to crypto infrastructure.

- UK users needing reliable bank transfers: Those who value Faster Payments access and clear GBP withdrawal limits over instant fintech style cash outs.

Who is Bitstamp not ideal for?

- Altcoin and DeFi focused users: Traders seeking early stage tokens, meme coins, or broad ecosystem coverage will find the asset list restrictive.

- Leverage and margin traders: Users requiring spot margin or high leverage derivatives will be better served elsewhere.

- Cost sensitive beginners using cards: New users relying on debit cards or digital wallets face high purchase fees compared with broker style platforms.

- Users expecting strong consumer protection: FCA registration is AML only, meaning no FSCS protection and limited recourse if disputes arise.

- Those wanting fast, friction free withdrawals: Compliance checks and manual reviews can delay withdrawals, especially during periods of heightened scrutiny.

How to get started with Bitstamp

- Create an account: Go to Bitstamp and sign up with an email address, password, and country of residence. Turn on two factor authentication as soon as the account is created.

- Complete verification if required: Bitstamp uses identity checks before most fiat and crypto features are enabled. Expect to provide a government ID, a selfie or liveness check, and proof of address. In some cases, Bitstamp may request source of funds information.

- Deposit funds: Choose a funding method based on speed and cost. UK users typically use bank transfer via Faster Payments for GBP deposits. Card and wallet options can be faster but usually cost more. Crypto deposits require selecting the asset and copying the correct wallet address and network.

- Place a trade: Use Basic mode for simple buy and sell, or Bitstamp Pro for order book trading. Select a market pair, choose an order type such as market or limit, confirm the fees, then submit the order.

- Withdraw or secure assets: Withdraw GBP back to a linked bank account, or withdraw crypto to a personal wallet for self custody. If keeping assets on the exchange, tighten security settings by using withdrawal address whitelisting and reviewing device and login activity.

How we tested and methodology

Each crypto exchange is evaluated using a standardised six category scoring framework, with every category scored out of 5. This approach ensures consistency, comparability, and a clear link between platform features and real user impact.

The six scoring categories are:

- Supported assets and markets: Depth and quality of available cryptocurrencies, trading pairs, fiat support, and access to spot, futures, or other markets.

- Trading experience and tools: Platform stability, order execution quality, charting, order types, mobile and web usability, and availability of advanced tools such as APIs.

- Fees and pricing: Trading fees, spreads, instant purchase costs, deposit and withdrawal charges, and overall pricing transparency.

- Security and custody: Asset storage practices, cold wallet usage, account level protections, security certifications, past incidents, and custody structure.

- Deposits and withdrawals: Fiat and crypto funding options, processing times, limits, reliability, and friction during withdrawals.

- Trust, regulation, and support: Regulatory registrations, jurisdictional clarity, customer support access and responsiveness, and quality of risk disclosures.

Scores are based on hands on platform testing, including account setup and live trades, fee analysis, security and regulatory review, and usability checks across web and mobile platforms. User feedback and reported issues are considered as supporting context but do not replace direct testing.

FAQs

Is Bitstamp trustworthy?

Yes. Bitstamp has operated continuously since 2011, holds 50 plus global registrations, and follows a compliance first model. Its long track record and conservative approach make it one of the more established crypto exchanges.

Is Bitstamp a safe exchange?

Bitstamp is considered safe by industry standards. Around 95% of customer assets are held in cold storage, supported by multi signature wallets, withdrawal whitelisting, and recognised security certifications such as ISO 27001 and SOC 2 Type II.

Is Bitstamp legal in the UK?

Yes. Bitstamp operates legally in the UK through Bitstamp UK Limited, which is registered with the UK regulator for cryptoasset activities under anti money laundering rules.

Is Bitstamp good for beginners?

Bitstamp can work for beginners who want a simple, regulated platform, especially using its Basic mode. However, higher card fees and a more limited feature set mean some beginners may find broker style platforms easier.

Can I withdraw money from Bitstamp?

Yes. UK users can withdraw GBP to a linked bank account using Faster Payments, as well as withdraw crypto on chain to an external wallet. Withdrawals may be delayed if compliance checks are triggered.

Which is better, Coinbase or Bitstamp?

It depends on the user. Coinbase offers more assets, consumer features, and beginner tools, while Bitstamp focuses on stability, lower Pro trading fees, and institutional grade execution.

Does Bitstamp report to HMRC?

Bitstamp may share user data with HMRC when legally required. UK users remain responsible for reporting crypto gains and income accurately on their tax returns.

What is the withdrawal limit for Bitstamp UK?

For GBP withdrawals via Faster Payments, the typical limit is up to £250,000 per transaction. Crypto withdrawal limits vary by asset and account verification level.

Is Bitstamp regulated by FCA?

Bitstamp is registered with the Financial Conduct Authority as a cryptoasset business for AML purposes. This is not the same as full FCA regulation and does not provide FSCS protection.

How reliable is Bitstamp’s customer service in the United Kingdom?

Support access is good, with 24/7 phone and email options available to UK users. Reliability is mixed, as routine issues are handled well but KYC or withdrawal related cases can take longer to resolve.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.