Crypto.com is a crypto exchange and mobile trading app designed for UK users who want broad GBP crypto access in one place, offering a wide coin selection, maker taker spot fees, and simple in app tools such as limit orders and curated baskets.

Its main drawback is that costs and friction can rise around funding and support, with high card deposit fees, withdrawal charges, and largely automated help, which may matter more for frequent movers, active traders, or anyone who prioritises human support and deeper research tools.

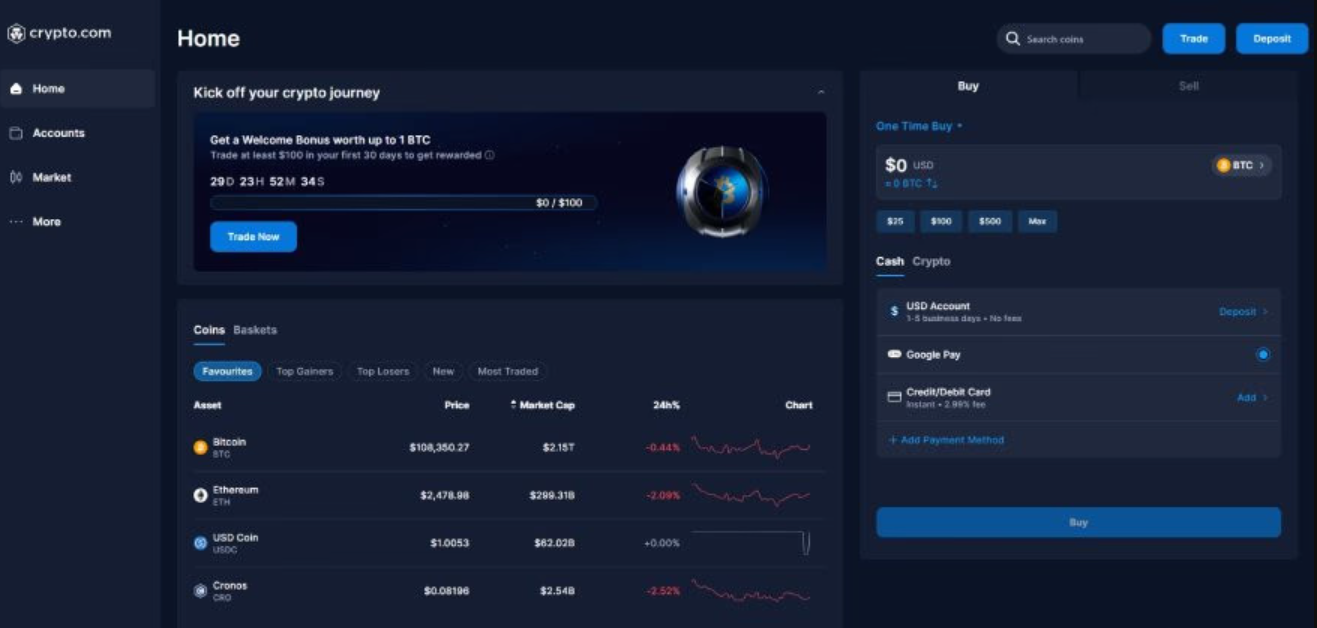

What is Crypto.com and how does it work?

Crypto.com is a centralised crypto exchange and trading app that lets UK users buy, sell, swap, and trade cryptocurrencies in GBP, with an optional non custodial DeFi wallet for people who want to hold their own private keys.

Is Crypto.com centralised or decentralised?

Crypto.com’s core trading platforms are centralised. That means trades are matched and settled inside Crypto.com’s systems after you open an account and complete identity checks. It also runs a separate DeFi wallet product that is described as non custodial, where the user controls the private keys and interacts with on chain services.

In practice, this creates two different ways to use the brand:

- Centralised exchange and app for trading, baskets, and fiat to crypto flows in GBP

- Non custodial DeFi wallet for self custody and decentralised finance features, where you manage the keys and network fees apply

Crypto.com was founded in 2016 by Bobby Bao, Gary Or, Rafael Melo, and Kris Marszalek, and the platform is described as having 50 million plus users globally. It is also linked to the Cronos (CRO) ecosystem, with CRO used for discounts and rewards in certain programmes.

What is the core trading model?

Crypto.com supports multiple ways to trade, but the core experience is spot crypto trading with a maker taker fee model.

- Spot trading with maker taker fees: If you place a limit order that adds liquidity, you pay maker fees that can start around 0.25% down to 0.08% based on volume tiers and programmes. If you trade instantly at market, taker fees can start around 0.50% down to 0.18%.

- App style instant buys and swaps: The app is built for quick execution and simplicity, but the website can feel very stripped back for price detail, including limited visibility on bid and offer spreads.

- Curated baskets: Crypto.com also offers “baskets”, which bundle multiple coins into one themed allocation. One example referenced is a Blue Chip Tokens style basket, where a single purchase can give exposure to assets such as Bitcoin, Ethereum, Solana, Cronos, and Ripple, with an option to rebalance to maintain target weightings over time.

This mix makes Crypto.com more of an “all in one” crypto platform than a simple buy and hold app, but the most consistent, repeatable pricing model described is still spot trading on maker taker fees.

Who is Crypto.com designed for?

Crypto.com is best described as a platform for beginners through to active traders, with the experience leaning slightly more towards newer and intermediate users on mobile, and fee focused spot traders on the exchange.

- Beginner friendly entry point: The app is designed to be easy to use, with straightforward navigation and a broad range of supported coins and fiat currencies. It also supports features that appeal to newer users, such as baskets for diversification.

- Active trader fit on fees, but not tools: The exchange style maker taker pricing can be competitive for people placing limit orders and trading more regularly, and there are ways to reduce fees further through CRO based discounts or subscription programmes such as Level Up. However, the tools are not as deep as specialist trading platforms, and order types are described as limited.

- Advanced users may find gaps: If the priority is deep market data, richer research, and more manual control, Crypto.com can feel light. The app includes an Insights feed with news and signals, but research tools are still described as limited, and signals should be treated cautiously and verified independently.

The basic flow for a UK user

- Create an account and complete verification: Crypto platforms typically require identity checks before unlocking full functionality.

- Fund the account in GBP:

- Card deposits can be quick but are expensive here, with a stated 2.99% fee for credit or debit card deposits.

- Open Banking is available, but the flow referenced is limited to ClearBank and BCB.

- Choose how to trade:

- Use the app for simple buys, sells, and limit orders

- Use baskets if you want a pre built diversified allocation in one purchase

- Use the exchange style spot interface if fees and maker taker pricing matter

- Withdraw funds if needed: UK withdrawals are described with a £1.90 fee and a £70 minimum for fiat withdrawals, and crypto withdrawals can vary by asset.

A quick reality check on risk and protections

Crypto.com is presented as using common security controls like two factor authentication, whitelisting, and a mix of cold storage and hot wallet operations, and it references operational and security standards such as ISO 27001:2022 and SOC 2 Type II.

Even so, crypto remains high risk. In the UK, crypto holdings are generally not covered by the same investor protection schemes people associate with traditional investments, so losses from market moves or certain platform failures may not be recoverable.

Finally, customer support is described as mostly automated, with no phone line, which is worth factoring in if the expectation is quick human help during account or withdrawal issues.

Crypto.com overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | Available in the UK and over 90 countries globally. Reported to serve more than 50 million users worldwide. |

| Exchange type (centralised or decentralised) | Primarily a centralised exchange for trading and fiat on ramps, with a separate non custodial DeFi wallet for on chain use. |

| Regulator or registration status | Operates globally under multiple regional registrations. Crypto trading is not regulated in the UK in the same way as traditional investments. |

| Custody model (custodial or non custodial) | Custodial on the main exchange and app. Non custodial option available via the Crypto.com DeFi wallet where users control private keys. |

| Investor protection (usually none) | No UK investor protection such as FSCS. Crypto holdings are not protected if the platform fails or markets move sharply. |

| Supported cryptocurrencies | Over 400 cryptocurrencies globally. Around 150 cryptocurrencies available to trade directly in GBP, reducing FX conversion costs. |

| Trading types (spot, derivatives, margin) | Spot trading with a maker taker model. |

| Fiat on ramp and off ramp | GBP deposits via debit or credit card, Open Banking (limited to ClearBank and BCB), bank transfer, and selected e wallets. Supports over 20 fiat currencies including GBP, EUR, and USD. |

| Trading fees | Maker taker pricing. Maker fees typically range from 0.25% down to 0.08%. Taker fees range from 0.50% down to 0.18%, depending on volume and programmes such as CRO based discounts or Level Up. |

| Deposit and withdrawal fees | Debit and credit card deposits charged at 2.99%. GBP withdrawals charged at £1.90 with a £70 minimum. Crypto withdrawal fees vary by asset and network. |

| Security features | Two factor authentication, withdrawal whitelisting, cold storage for most assets, Proof of Reserves, and use of institutional custody solutions. References certifications such as ISO 27001 and SOC 2 Type II. |

| Mobile app and web platform | Native mobile apps for iOS and Android. Web platform available but relatively basic compared to specialist trading interfaces. |

| Ease of use level | Beginner to intermediate. App is simple and accessible, with limit orders and crypto baskets. Advanced traders may find order types and research tools limited. |

What assets and markets are available on Crypto.com?

Crypto.com supports hundreds of cryptocurrencies with strong GBP market coverage, offering spot trading, selected derivatives products, stablecoin pairs, and bundled crypto baskets. UK users can trade around 150 assets directly in GBP, reducing FX costs, while deeper global markets and CRO based incentives support liquidity across major coins.

Number and range of supported cryptocurrencies

Crypto.com lists 400 plus cryptocurrencies globally, covering large caps like Bitcoin and Ethereum, mid caps such as Solana, Cardano, and Polkadot, and a wide range of smaller tokens. For UK users, around 150 cryptocurrencies are available with direct GBP pairs, which helps avoid forced USD conversion and FX spreads.

Spot markets

Spot trading is the core offering on Crypto.com. Users can place market and limit orders via the mobile app and web platform, with pricing based on a maker taker fee model. Liquidity is strongest in major pairs such as BTC GBP, ETH GBP, BTC USDT, and ETH USDT, reflecting Crypto.com’s large global user base of 50 million plus accounts.

Derivatives and perpetuals

Crypto.com also operates derivatives style markets in certain regions, including futures and perpetual contracts on major cryptocurrencies. These products carry higher risk and are not suitable for all users, particularly beginners. Availability and leverage limits vary by jurisdiction and regulatory rules.

Stablecoin and fiat pairs

The platform supports a broad range of stablecoins, including USDT and USDC, alongside fiat currencies such as GBP, EUR, and USD. UK users benefit from GBP spot pairs, which reduce FX friction compared with exchanges that require USD only trading. Stablecoin pairs provide additional liquidity and are commonly used for transfers, hedging, and staking products.

Liquidity depth and market coverage

Crypto.com is considered a high liquidity exchange for major assets, supported by its scale, global reach across more than 90 countries, and active CRO token ecosystem. Order book depth is strongest on top tier coins, while smaller tokens can show wider spreads, particularly during volatile market conditions.

TLDR: Crypto.com scores well for asset breadth, GBP market access, and stablecoin support, making it suitable for beginners and intermediate users seeking wide crypto exposure. Advanced traders may find derivatives access useful, though order types and market depth are more limited compared with specialist trading platforms.

How good is the trading experience and toolset on Crypto.com?

Crypto.com delivers a solid mobile first trading experience with reliable execution, maker taker pricing, and simple order controls. The app supports limit orders, crypto baskets, and fast trade execution across hundreds of assets, but the web platform and advanced trading tools remain basic compared with specialist exchanges.

Web and mobile platform usability

Crypto.com is clearly built mobile first. The iOS and Android apps are well rated and designed for quick execution, portfolio tracking, and simple navigation. Buying, selling, and placing limit orders is straightforward, even for new users.

The web platform is functional but minimalist. Pricing pages lack detailed bid offer depth, and advanced market views are limited compared with exchanges like Binance or Kraken. For frequent traders, most activity is better handled inside the app rather than the browser.

Order types available

Crypto.com supports a limited but practical set of order types, focused mainly on spot trading:

- Market orders for instant execution

- Limit orders for lower maker fees and price control

- Recurring buys for long term accumulation

Advanced conditional orders such as stop limit, OCO, or trailing stops are not widely available on the retail interface, which limits flexibility for more sophisticated trading strategies.

Charting tools and indicators

Charting tools are basic but usable. The app includes standard price charts, time frame switching, and simple indicators suitable for trend awareness rather than deep technical analysis.

There is no integrated professional charting suite with extensive indicators, drawing tools, or custom overlays. Users who rely heavily on technical analysis often combine Crypto.com with third party charting platforms for decision making.

Advanced tools such as APIs or automation

Crypto.com offers API access for exchange users, enabling programmatic trading, balance checks, and order execution for developers and quantitative traders. This makes it possible to build bots or connect external trading systems, although API documentation and tooling are not as extensive as specialist trading venues.

There is no native automation or strategy builder within the retail app itself.

Performance and reliability

Crypto.com operates at significant scale, with 50 million plus users across more than 90 countries, and generally shows stable performance during normal market conditions. Execution speed on major pairs is reliable, supported by deep liquidity on top assets.

During periods of extreme volatility, smaller tokens can show wider spreads and slower execution, which is typical for large retail focused exchanges. Platform uptime is generally strong, supported by institutional custody infrastructure and global operations.

TLDR: Crypto.com scores well for usability, mobile execution, and everyday spot trading. It is suitable for beginners and intermediate users who value simplicity and GBP access. Advanced traders may find the toolset restrictive due to limited order types, basic charting, and a relatively simple web interface.

How competitive are Crypto.com’s fees and pricing?

Crypto.com uses a maker taker pricing model on its exchange, combined with wide GBP market access that helps UK users avoid FX conversion costs. Trading fees are competitive for limit order users and higher volume traders, but overall costs can rise quickly once card funding, fiat withdrawals, and convenience features are factored in.

Trading fees (maker taker model)

Crypto.com applies a maker taker structure based on 30 day trading volume, with optional reductions through CRO holdings and paid programmes.

| 30 day spot volume | Maker fee | Taker fee |

|---|---|---|

| Under $10,000 | 0.25% | 0.50% |

| $10,000 to $49,999 | 0.20% | 0.40% |

| $50,000 to $249,999 | 0.15% | 0.25% |

| $250,000 to $499,999 | 0.10% | 0.20% |

| $500,000 and above | 0.08% | 0.18% |

- Makers placing limit orders benefit from meaningfully lower fees

- Takers trading at market pay noticeably more

- Holding CRO (Cronos) or joining the Level Up subscription can reduce fees further, though this requires locking capital or paying a monthly cost

Compared with major global exchanges, these rates are competitive for spot trading, especially for users who consistently use limit orders.

Spread and execution costs

Crypto.com does not publish fixed spreads for instant buys. Instead:

- App based instant buys can include wider implicit spreads, particularly on smaller tokens

- Exchange limit orders generally offer tighter execution, especially on major pairs like BTC GBP and ETH GBP

- The web interface provides limited bid offer depth visibility, which can make it harder to assess true execution quality compared with more advanced platforms

In practice, users seeking lower all in costs are better served using limit orders inside the app or exchange, rather than one tap market buys.

Deposit fees

Deposit costs vary significantly by method:

- Debit and credit cards: 2.99% fee, which is high by UK standards

- Open Banking: Free, but currently limited to ClearBank and BCB

- Crypto deposits: Free for most assets

There is no formal minimum deposit for crypto or Open Banking transfers, but card funding quickly becomes expensive for larger amounts.

Withdrawal fees

- GBP withdrawals: £1.90 per withdrawal, with a £70 minimum

- Crypto withdrawals: Network based fees that vary by asset and blockchain

- Internal transfers to the Crypto.com DeFi Wallet can also incur network fees depending on the chain used

While the flat GBP withdrawal fee is not extreme, it is less competitive than platforms offering free Faster Payments.

Indirect and hidden costs to be aware of

There are no hidden trading commissions, but several indirect costs can affect overall value:

- High card deposit fees for convenience funding

- Wider spreads on instant buys versus limit orders

- CRO staking or subscription costs required to unlock best fee tiers

- Potential inactivity fee referenced in some regions after extended account inactivity

Crypto.com is transparent about headline fees, but the cheapest experience requires more active fee management from the user.

Fees and pricing verdict

Crypto.com scores well on spot trading fees, particularly for makers and higher volume users, and its GBP trading pairs help UK users avoid FX charges entirely. However, card deposit fees, withdrawal charges, and convenience spreads reduce its appeal for casual or buy and hold investors. It is best suited to users willing to place limit orders, use Open Banking, and actively manage how they fund and withdraw from the platform.

How secure is Crypto.com and how are assets held?

Crypto.com operates a custodial exchange model, combined with an optional non custodial DeFi wallet, giving users two distinct ways to hold crypto assets. Security controls are broadly in line with large global exchanges, but assets held on the main platform remain exposed to platform level and operational risk.

Custody model

- Main app and exchange: Custodial. Crypto.com controls the private keys for assets held on the trading platform and wallet balances inside the app.

- Crypto.com DeFi Wallet: Non custodial. Users hold their own private keys locally on their device and interact directly with on chain networks and protocols.

This split means users trading on the exchange rely on Crypto.com’s internal custody systems, while self custody is only available if assets are moved out to the DeFi wallet.

Cold storage and asset segregation

Crypto.com states that the majority of customer crypto assets are held in offline cold storage, with a smaller portion kept in hot wallets to support daily withdrawals and trading activity.

Custody infrastructure references include the use of institutional grade cold storage providers, including Ledger Vault style systems, with multi signature controls and restricted access policies. Assets are described as being backed 1:1 and verifiable through proof of reserves disclosures, although users must still trust Crypto.com’s operational controls and reporting processes.

Cold storage reduces exposure to online attacks, but does not remove risks linked to insolvency, governance failures, or internal controls.

Account level security controls

Crypto.com provides standard exchange level account protections, including:

- Two factor authentication (2FA) for login and withdrawals

- Withdrawal address whitelisting, with time delays when new addresses are added

- Biometric authentication on supported mobile devices

- Email and phone verification for account actions

- Session and device monitoring to flag unusual activity

These controls reduce the risk of unauthorised access, but they rely on users maintaining strong personal security practices and protecting their devices.

Security standards and audits

Crypto.com references multiple international security and operational standards, including:

- ISO/IEC 27001:2022 (information security management)

- ISO/IEC 27701:2019 (privacy information management)

- ISO 22301:2019 (business continuity)

- SOC 2 Type II compliance

- PCI DSS v4.0 Level 1 compliance for card related infrastructure

These certifications indicate formal security processes and external audits, but they do not guarantee protection against losses or platform failure.

Incident history and platform risk

Crypto.com has operated since 2016 and reports more than 50 million users across over 90 countries. Like most large exchanges, it has faced security scrutiny and operational incidents over time, though no exchange is immune to outages, account level compromises, or third party risk.

There is no UK investor protection such as FSCS coverage for crypto holdings. If Crypto.com were to experience a severe operational failure, insolvency event, or withdrawal suspension, users may not have a statutory route to recover losses.

Clear risk disclosures

- Crypto assets held on Crypto.com are not regulated investments in the UK

- Funds are not protected by FSCS or similar compensation schemes

- Transactions are irreversible once processed on chain

- Losses can occur due to market volatility, platform issues, or account compromise

Users choosing the custodial model are accepting counterparty risk, while self custody through the DeFi wallet shifts responsibility entirely to the user.

Security and custody verdict

Crypto.com offers a robust but standard exchange level security setup, with cold storage, audited controls, and strong account protection tools. However, assets held on the main platform remain custodial and exposed to platform risk, and full self custody requires active use of the separate DeFi wallet. This structure is suitable for active traders who value convenience, but it requires a clear understanding of the trade off between ease of use and custody risk.

How do deposits and withdrawals work on Crypto.com?

Crypto.com supports a wide mix of fiat and crypto funding routes, with strong GBP coverage and direct GBP trading pairs. The overall system is functional and transparent on headline fees, but costs can rise quickly depending on the funding method used, and some limits and minimums reduce flexibility for smaller or infrequent users.

Fiat on ramp and off ramp support

For UK users, Crypto.com supports several ways to move money in and out of the platform:

- Debit and credit cards (Visa, Mastercard, Maestro): Card deposits are instant but carry a 2.99 percent fee, which is high compared with UK focused competitors. This applies whether cards are used directly or through supported mobile wallets such as Apple Pay or Google Pay.

- Open Banking bank transfers: GBP deposits via Open Banking are free, but current support is limited to ClearBank and BCB. This method is slower than cards but avoids percentage based fees and is generally the most cost effective option for UK users.

- Bank transfers and wires (international): Wire transfers are supported in multiple currencies and regions, though processing times and fees depend on the currency and banking network used.

- Supported fiat currencies: Crypto.com supports more than 20 fiat currencies, including GBP, EUR, USD, AUD, CAD, BRL, and USDC. GBP balances can be used directly to trade around 150 cryptocurrencies without forced USD conversion, reducing FX friction.

On the withdrawal side:

- GBP withdrawals are subject to a £1.90 flat fee, with a minimum withdrawal amount of £70.

- Processing is typically completed within one to two business days, though delays can occur during peak demand or additional compliance checks.

There is no FSCS protection for fiat or crypto balances held on the platform.

Crypto deposits and withdrawals

Crypto.com supports deposits and withdrawals for hundreds of cryptocurrencies across multiple blockchain networks.

- Crypto deposits are generally free, aside from standard network transaction fees paid on the sending wallet side.

- Each asset has a dedicated deposit address and supported networks must be matched correctly. Deposits sent on unsupported chains can be permanently lost.

- Crypto withdrawals incur network based fees that vary by asset and blockchain. For example, Bitcoin withdrawals are charged a fixed BTC fee that reflects network conditions at the time.

- Withdrawals require confirmation through account security checks and are processed once blockchain confirmations are met.

Transfers between the Crypto.com app and the Crypto.com DeFi Wallet are supported, but these still incur standard on chain network fees.

Processing times

- Card deposits: Near instant once approved, subject to card issuer checks

- Open Banking deposits: Typically same day or next business day

- GBP withdrawals: Commonly one to two business days after request

- Crypto deposits: Credited after the required number of blockchain confirmations

- Crypto withdrawals: Broadcast after internal checks, then confirmed based on network speed and congestion

During periods of market volatility, crypto withdrawals and confirmations can take longer due to network congestion.

Limits and minimums

- Minimum deposit: No formal minimum for crypto or Open Banking deposits. Card deposits are subject to card issuer limits.

- Minimum GBP withdrawal: £70

- Trading limits: No practical upper limit for crypto trading volumes, with fee tiers based on 30 day trading activity

- Inactivity fee: A £4.95 monthly inactivity fee may apply after extended periods of account inactivity

Limits can vary by user verification level and jurisdiction.

Reliability and transparency

Crypto.com publishes clear headline fees for card deposits, fiat withdrawals, and trading commissions.

However:

- Percentage based card fees materially increase the cost of small or frequent deposits

- Crypto withdrawal fees vary by asset and are not fixed across the platform

- Open Banking access is more limited than some UK competitors

From a reliability perspective, Crypto.com operates at large scale, serving over 50 million users across more than 90 countries, and funding and withdrawal systems generally function as expected. Most issues reported by users relate to delays, automated support responses, or fee confusion, rather than outright failures.

Deposits and withdrawals verdict

Crypto.com provides broad fiat and crypto funding coverage, with strong GBP support and direct GBP trading pairs that reduce FX costs. The system works best for users who fund via Open Banking and manage withdrawals in fewer, larger transactions. Card deposits, smaller withdrawals, and convenience funding significantly reduce overall value, which holds back its score in this category.

How trustworthy is Crypto.com in terms of regulation and support?

Crypto.com operates as a large global crypto platform with registrations across multiple jurisdictions, a clear compliance led onboarding process, and published risk disclosures. However, crypto specific regulation remains fragmented, customer support is largely automated, and UK users do not receive the same protections associated with traditional regulated financial services.

Regulatory and registration status

Crypto.com was founded in 2016 and now serves 50 million plus users across more than 90 countries, placing it among the largest crypto platforms globally by user count. The group operates through a network of regional entities rather than a single globally regulated exchange.

In the UK, Crypto.com is not authorised or regulated by the Financial Conduct Authority (FCA) as an investment firm, meaning crypto trading on the platform does not fall under the same regulatory framework as stocks, funds, or derivatives. As with all UK crypto platforms, customer assets are not protected by the Financial Services Compensation Scheme (FSCS).

Internationally, Crypto.com states that it complies with local registration and licensing requirements where applicable, including operating under regulatory approvals or registrations in jurisdictions such as Singapore, the EU, Australia, and parts of North America. This jurisdiction by jurisdiction approach is standard across large crypto exchanges, but it places responsibility on users to understand which local entity they are dealing with.

Jurisdictional transparency

Crypto.com is relatively transparent about its corporate structure, leadership, and operational footprint. The platform publicly lists its founders Bobby Bao, Gary Or, Rafael Melo, and Kris Marszalek, and clearly separates its main custodial exchange from its non custodial DeFi wallet product.

That said, the platform does not operate under a single, unified global regulator. This means:

- Legal protections and complaint routes differ by region

- UK users interact with Crypto.com as a crypto service provider rather than a regulated investment firm

- Dispute resolution and escalation options are more limited than with FCA regulated brokers

Crypto.com publishes Proof of Reserves data and states that customer assets are backed 1:1, which improves transparency compared with some competitors, but this does not equate to statutory protection.

Customer support channels and responsiveness

Customer support is an area where Crypto.com scores below traditional finance platforms.

Support is available 24/7, but channels are limited to:

- In app live chat, which is heavily automated and bot led

- Email support, with variable response times

- A self service help centre covering common issues

There is no telephone support, which is typical for large crypto exchanges but remains a drawback for users dealing with urgent funding, withdrawal, or account access issues.

In testing, automated responses were fast, but escalation to a human agent was inconsistent. This aligns with wider user feedback across review platforms, where Crypto.com receives high app store ratings for usability but more mixed sentiment around customer service responsiveness and issue resolution.

Clarity of risk warnings and disclosures

Crypto.com provides clear and frequent risk warnings across its platform and marketing materials. These consistently state that:

- Crypto assets are high risk and volatile

- Users may lose all invested capital

- Crypto investments are not protected under UK investor compensation schemes

- Transactions are irreversible once processed

These disclosures are visible during onboarding, trading flows, and product pages, and align with UK and international expectations for crypto risk communication.

However, like many crypto platforms, Crypto.com combines trading, rewards, cards, staking, and promotional features in a single app. This all in one approach can blur the distinction between speculative investing, spending tools, and yield products, increasing the importance of users reading product specific terms carefully.

Trust, regulation, and support verdict

Crypto.com is a legitimate, well established global crypto platform with a long operating history, large user base, published reserves data, and strong internal security standards. It is transparent about crypto risks and does not present itself as a regulated investment provider in the UK.

The main trust trade offs are limited regulatory protection, no FSCS coverage, and support that relies heavily on automation rather than direct human access. As a result, Crypto.com is best suited to users who understand crypto specific risks, are comfortable operating outside traditional financial protections, and prioritise market access and functionality over regulated safeguards and high touch customer support.

What are the pros and cons of using Crypto.com?

Pros

- Strong GBP market access: Around 150 cryptocurrencies can be traded directly in GBP, avoiding forced USD conversion and FX charges that apply on many global exchanges.

- Competitive maker taker trading fees: Spot trading fees start at 0.25% for makers and 0.50% for takers, falling as low as 0.08% maker and 0.18% taker at higher volume tiers. This rewards users who place limit orders rather than trading at market.

- Wide asset range and product depth: Supports 400+ cryptocurrencies globally, alongside spot trading, crypto baskets, staking style products, a non custodial DeFi wallet, and the Crypto.com Visa Card ecosystem.

- Crypto baskets for diversification: Curated baskets such as Blue Chip Tokens allow exposure to multiple large cap assets like Bitcoin, Ethereum, Solana, Cronos, and Ripple in a single allocation, with optional rebalancing.

- Large, established global platform: Founded in 2016, with 50 million+ users across 90+ countries, published proof of reserves, and recognised security certifications including ISO 27001 and SOC 2 Type II.

Cons

- High card deposit fees: Debit and credit card deposits incur a 2.99% fee, which materially increases costs for smaller or frequent top ups.

- Withdrawal friction for GBP users: GBP withdrawals carry a £1.90 fee and a £70 minimum, making small or frequent withdrawals inefficient.

- Customer support is largely automated: Support is limited to in app chat and email, with no phone support and inconsistent escalation to human agents during testing.

- Limited advanced trading tools: Order types are basic, charting is light, and the web platform lacks detailed bid offer depth, making it less suitable for advanced technical traders.

- No UK investor protection: Crypto holdings are not protected by the FSCS, and the platform is not regulated as an FCA investment firm.

Who is Crypto.com best for?

- Beginner to intermediate users who want a simple mobile first app with broad crypto access

- GBP focused traders looking to avoid FX charges by trading directly in pounds

- Limit order and fee conscious users who benefit from maker taker pricing

- Altcoin focused users seeking access to hundreds of cryptocurrencies

- Diversification minded users interested in crypto baskets rather than single asset exposure

Who is Crypto.com not ideal for?

- Users who need strong regulation and statutory protection, such as FCA oversight or FSCS coverage

- Advanced traders requiring deep order books, advanced order types, and professional grade charting

- Buy and hold investors who want low cost, simple fiat withdrawals

- Users who rely on phone based customer support for account or funding issues

- Cost sensitive users planning to fund accounts mainly via debit or credit card

How to get started with Crypto.com

- Create an account: Download the Crypto.com app or sign up via the website using an email address and mobile number.

- Complete verification: Identity checks are required to unlock full functionality, including fiat deposits and withdrawals.

- Deposit funds: Fund the account using Open Banking where available, crypto transfers, or debit or credit card (fees apply).

- Place a trade: Buy or sell crypto using market or limit orders, or allocate funds to a crypto basket for diversified exposure.

- Withdraw or secure assets: Withdraw GBP or crypto to an external wallet, or move assets to the Crypto.com DeFi Wallet for self custody.

FAQs

Is Crypto.com safe in UK?

Crypto.com is a large global exchange with tens of millions of users and uses standard security measures such as two factor authentication, withdrawal controls, and cold storage for most customer assets. However, crypto assets are high risk and UK users are not protected by the FSCS if something goes wrong.

Is Crypto.com legal in the UK?

Yes. Crypto.com is legally available to UK users and operates through UK compliant entities that meet local anti money laundering requirements. This allows it to offer crypto trading and related services to UK residents.

Can I withdraw from Crypto.com in the UK?

Yes. UK users can withdraw both cryptocurrency to external wallets and GBP to a linked bank account, subject to verification. GBP withdrawals typically have a fee and a minimum amount, which makes larger withdrawals more cost efficient.

Is Crypto.com legal in the UK?

Yes. Crypto.com is permitted to offer crypto services in the UK under the current regulatory framework for cryptoasset businesses. This does not mean crypto is fully regulated like stocks or funds, but the platform itself can legally operate.

Can I withdraw from Crypto.com in the UK?

Yes. Withdrawals are supported, but fees and minimum limits apply, and processing times depend on the withdrawal method used. Bank transfers are usually cheaper than card based routes.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.