Bitpanda is a cryptoasset broker designed for beginners and long-term crypto holders, offering a wide choice of digital assets, a clean mobile-first experience, and simple pricing across core crypto trading features. Its main drawback is the lack of advanced trading tools and higher spread-based fees, which may matter for active traders or users seeking margin trading and lower execution costs.

How does Bitpanda rate overall?

Overall rating: 4.7 out of 5.

Bitpanda rates highly for ease of use and crypto asset variety. It is well suited to beginners and long term crypto holders who value simplicity, transparent pricing, and strong security. The platform’s intuitive interface and broad asset coverage make it a solid option for buying and holding digital assets.

What is Bitpanda and how does it work?

Bitpanda is a centralised crypto platform and broker that lets UK users buy, sell, swap, and hold cryptocurrencies in one account. Trading is mainly spot crypto with a simple “instant buy sell” style price (fee included), plus extras like staking and crypto indices. It is built for beginners and long term holders, not advanced derivatives traders.

Bitpanda’s UK offering works like this:

- Centralised or decentralised

- Bitpanda is centralised, meaning it is a company run platform that holds accounts, runs custody and security controls, and processes orders inside its own systems rather than on chain peer to peer.

- In the UK, Bitpanda’s crypto business is registered with the Financial Conduct Authority under the UK anti money laundering regime for cryptoasset firms. This is not the same as being FCA authorised for investments, and crypto holdings are not covered by FSCS protection.

- Core trading model

- The core product is spot crypto: users buy or sell coins at a quoted price where Bitpanda’s premium and spread are built into the rate shown at the point of trade. Bitpanda also supports swap style conversions between cryptoassets.

- For UK users, Bitpanda positions itself around simple spot access and packaged products like crypto indices, rather than derivatives. Public UK facing coverage of the launch highlights access to 600 plus cryptoassets at launch.

- Advanced derivatives features such as margin trading and futures are not presented as part of the core UK broker proposition, so it will suit buy sell and hold behaviour more than short term leveraged strategies.

- Who Bitpanda is designed for

- Bitpanda is aimed at beginner to intermediate users who want a straightforward app experience, broad coin choice, and add ons like staking and indices without learning an advanced exchange interface. The UK relaunch messaging focuses on accessibility and range, including the £1 minimum and the “wide range” approach.

- More active traders may find the pricing model less competitive versus maker taker exchanges because costs are primarily expressed through the all in price rather than an order book fee schedule.

How a typical Bitpanda trade flows in the UK:

- Create an account and complete checks: identity verification is required for a regulated cryptoasset business under UK money laundering rules.

- Complete UK risk steps: UK crypto firms operate under tighter financial promotion requirements, which can include prominent risk warnings and user appropriateness style prompts depending on the product flow.

- Deposit and trade: users deposit funds and place spot buys, sells, or swaps. The trade screen shows the price with Bitpanda’s fee structure embedded.

- Hold, stake, or use indices: eligible assets can be staked and crypto indices allow exposure to a basket approach, depending on what is available to UK users at the time.

Security and custody context that affects how it works:

- Bitpanda highlights ISO 27001:2022 certification for information security management and also references independent testing and auditing as part of its security posture.

- Bitpanda also states it has attained a SOC 2 Type 1 report, which is a commonly used assurance report for controls at service organisations.

Bitpanda overview – crypto exchange key facts

| Category | Details |

|---|---|

| Availability | UK residents can open a Bitpanda account and trade crypto in GBP. Bitpanda launched its UK offering in August 2025 and markets access to 600 plus cryptoassets. |

| Exchange type (centralised or decentralised) | Centralised platform run by Bitpanda. Trades are executed through Bitpanda’s systems, with pricing shown as an all in quote at the point of order confirmation. |

| Regulator or registration status | In the UK, Bitpanda operates as a registered cryptoasset business with the Financial Conduct Authority under the Money Laundering Regulations 2017 for AML and CTF supervision. This is registration, not FCA authorisation for investments. |

| Custody model (custodial or non custodial) | Primarily custodial, meaning Bitpanda holds and secures assets within the platform’s custody set up rather than giving users full self custody control by default. |

| Investor protection (usually none) | No FSCS protection for crypto holdings, and crypto complaints are not handled the same way as regulated investment products. Bitpanda’s UK risk summary also stresses that FCA registration is for AML and CTF supervision only. |

| Supported cryptocurrencies | 600 plus cryptoassets available to UK users. |

| Trading types (spot, derivatives, margin) | Focused on spot crypto and crypto to crypto swaps with simple order flows. UK proposition is not built around derivatives or margin trading. |

| Fiat on ramp and off ramp | GBP funding options commonly include bank transfer, debit card, Apple Pay, and PayPal depending on the user and account checks. |

| Trading fees | Pricing is typically expressed as a premium included in the quoted price. Bitpanda states 0.99% premium for Bitcoin buys and sells, with other crypto premiums varying and shown at trade confirmation. |

| Deposit and withdrawal fees | Bitpanda states no platform fee to open and maintain an account, and no Bitpanda fee for many funding methods. Crypto withdrawals can still incur blockchain network fees. |

| Security features | Security controls include ISO 27001:2022 certification, SOC 2 Type 1 report, and standard account protections such as two factor authentication and approval steps for sensitive actions. |

| Mobile app and web platform | Full feature access via iOS and Android apps, plus a web platform for account management and trading. |

| Ease of use level | Beginner friendly. Bitpanda is designed around simple buy sell flows, clear pricing at checkout, and a mobile first experience rather than a complex pro trading terminal. |

What assets and markets are available on Bitpanda?

Bitpanda gives UK users access to 600 plus cryptocurrencies covering large caps, mid caps, smaller tokens, and stablecoins, with trading mainly via spot buy sell and swaps rather than a pro style derivatives venue. It also offers crypto indices for basket exposure and staking on 50 plus coins, but no futures or perpetuals on the UK platform.

Number and range of supported cryptocurrencies

Bitpanda’s UK relaunch positioned the platform around breadth of choice, with more than 600 cryptoassets available at launch. This typically includes:

- Major coins like Bitcoin and Ethereum

- Large stablecoins such as USDT and USDC

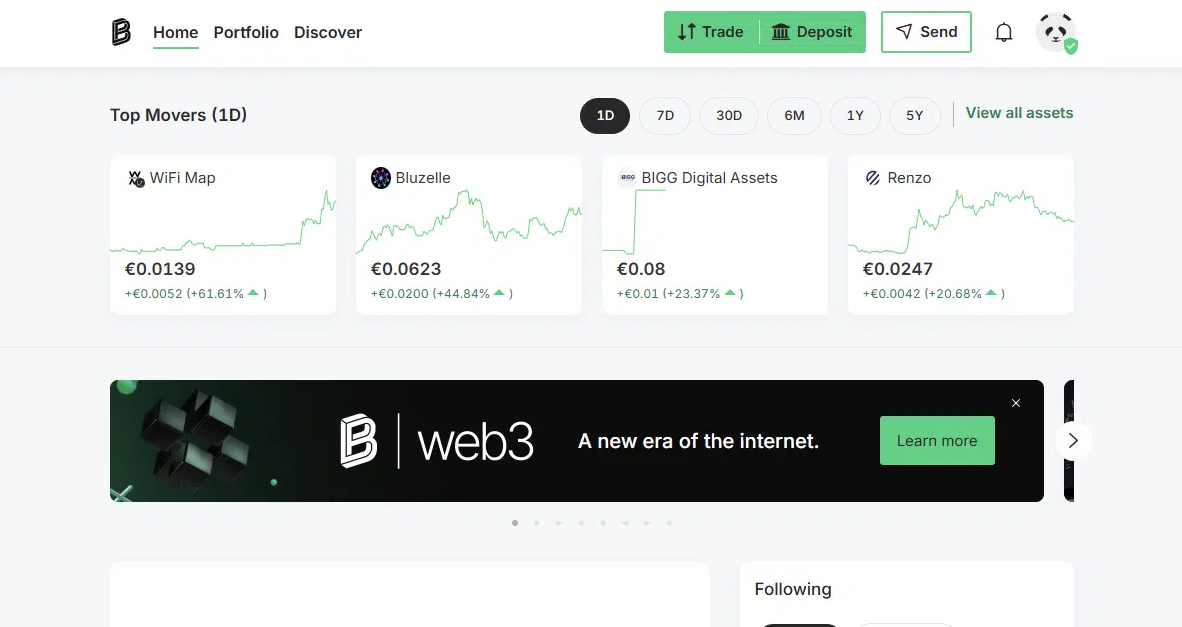

- A long tail of emerging tokens, plus a built in feature set aimed at helping users surface newer assets (for example, Spotlight)

For longer term holders, the range is widened further by passive style products:

- Crypto indices that provide one click exposure to a basket of cryptocurrencies, managed and rebalanced using a rules based methodology supported by MarketVector Indexes, a VanEck company.

Spot markets

Bitpanda is primarily a spot crypto venue for UK users. The broker style trading flow means the platform generally shows an all in quoted price at the point of confirmation, with the fee built into the quote.

- Bitcoin premium: 0.99% for buying and selling BTC (included in the price shown)

- Other crypto premiums can be higher and are shown at checkout rather than via a maker taker fee schedule.

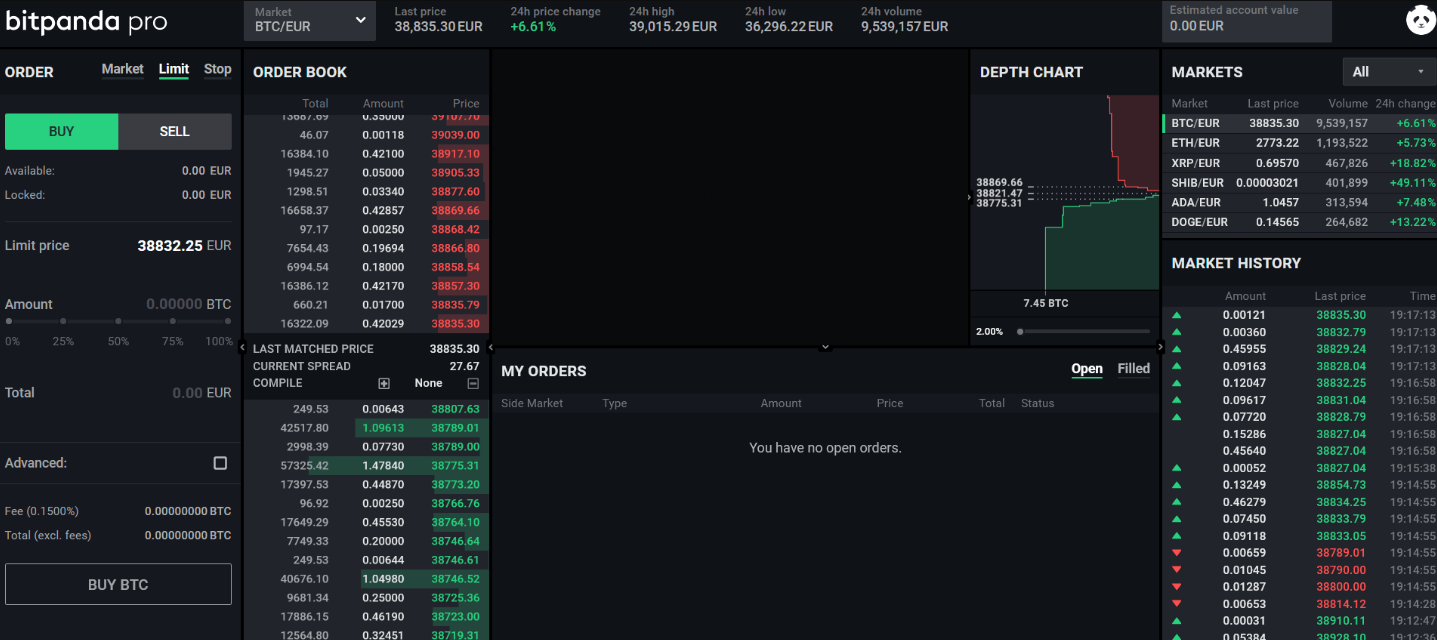

Bitpanda also supports common spot order controls such as market and limit orders, which is useful for users who want basic execution control without a full pro terminal.

Derivatives or perpetuals if offered

Bitpanda’s UK platform is not positioned as a futures or perpetuals exchange. The UK offering does not include futures trading.

Bitpanda does promote margin trading in some regions, with leverage up to 10x across a large set of assets, but it is described by Bitpanda as spot based rather than futures or derivatives. Availability can vary by country and product rollout, so UK users should confirm access inside the app.

Stablecoin and fiat pairs

Bitpanda’s UK expansion coverage highlights access to stablecoins alongside major cryptocurrencies. UK users also typically fund and withdraw in GBP, so the core experience is built around a GBP fiat on ramp and off ramp with crypto conversion handled inside the platform.

Practical implications:

- Fiat funding is designed for simple entry and exit in GBP.

- Stablecoins are available for users who prefer trading and holding in a crypto denominated unit rather than pure fiat exposure.

Liquidity depth and market coverage

Bitpanda’s UK product behaves more like a broker than an order book exchange, so users typically do not see a full public order book with live bid ask depth across every pair. Instead, the platform focuses on:

- Market coverage: broad asset list and continuous 24 7 access

- Execution clarity: the platform shows the final price and quantity at confirmation, with the premium included in the quote

A useful way to think about liquidity on Bitpanda in the UK:

- For high liquidity assets like BTC, ETH, and major stablecoins, the experience is usually smooth because these markets are deep globally.

- For smaller tokens, spreads can widen during volatility, which matters more for frequent traders because the premium is embedded in the price.

Supported assets and markets score

For the Supported assets and markets category, Bitpanda scores strongly in the UK due to:

- 600 plus supported cryptoassets

- Crypto indices for diversified exposure

- Staking across 50 plus coins

The main limitation is that the UK platform is not built around derivatives and perpetuals, which reduces market coverage for advanced traders who want leveraged, two way strategies.

How good is the trading experience and toolset on Bitpanda?

Bitpanda’s trading experience is built around a clean mobile first interface that makes it easy to deposit, buy, sell, and hold crypto, with simple tools like limit orders, staking, and crypto indices. It performs best for beginners and long term investors, but it lacks advanced features such as deep order books, complex charting, and pro grade APIs.

Web and mobile platform usability

Bitpanda is designed as a broker style crypto platform, so the focus is on speed and simplicity rather than a technical trading terminal.

- Mobile app: Available on iOS and Android, with full account access and a layout built for quick trades and portfolio tracking. The interface is described as clean and smooth, making it practical for users who manage positions on the go.

- Web platform: Also available for trading and account management, with the same simplified flow as the app.

- Onboarding: Account opening follows standard crypto KYC, including ID checks and video verification. UK users also complete an appropriateness style questionnaire and a 24 hour cooling off period before trading, reflecting the UK’s tightened crypto promotion rules.

- Minimum trade: Users can start from £1, which fits the platform’s beginner positioning.

Why that matters for the tool score: the platform removes friction for new users, but experienced traders may miss granular controls and pro analytics.

Order types available

Bitpanda supports the basics most UK retail users need for spot crypto:

- Market style buy and sell: Simple “instant” style conversions where the quote includes Bitpanda’s premium.

- Limit orders: Available, which is a key step up from broker apps that only offer instant buys. Limit orders allow users to set a target price and automate execution when the market hits it.

- Recurring style investing: While not framed as a full trading tool, Bitpanda’s product set leans toward long term accumulation, with crypto baskets through indices and staking.

What is missing for active traders:

- No native futures or perpetuals trading in the UK product positioning.

- No margin trading tools in the UK.

- No advanced order types like stop loss, take profit ladders, OCO orders, or conditional triggers are highlighted in the UK set.

Charting tools and indicators

Bitpanda is not built as a chart first trading platform.

- Charting is typically basic price tracking with clean asset pages and portfolio views, which suits buy and hold behaviour.

- There is no emphasis on large indicator libraries, multi time frame analysis, drawing tools, or strategy back testing.

Practical impact: it works well for checking performance and placing straightforward spot trades, but it is not ideal for users who rely on technical analysis and complex indicators.

Advanced tools such as APIs or automation

Bitpanda’s UK proposition is product led rather than tooling led.

- Automation style features: The most relevant “automation” tools are simple investor features like limit orders and crypto indices, where the portfolio is managed and rebalanced using a rules based approach. The indices are managed with support from MarketVector Indexes, a VanEck subsidiary, which adds structure for users who want diversified exposure without manual rebalancing.

- APIs: No public trading API acces, which usually indicates the platform is not targeting algorithmic traders or automated execution workflows.

Performance and reliability

Bitpanda’s platform experience is designed around reliability and straightforward execution.

- 24/7 crypto trading: Crypto markets run continuously and Bitpanda supports around the clock access.

- Stability under demand: User feedback trends suggest the biggest issue during market surges is not core platform usability, but slower support response times and occasional delays around verification.

- Security posture tied to reliability: Bitpanda’s broader security setup supports platform stability, including cold storage, 2FA, and ISO aligned controls, though security is scored separately in your framework.

Trading experience and tools score context

Bitpanda scores well for trading experience because:

- The app and web platform are simple, fast, and easy to navigate.

- Core tools are strong for a broker style platform, including limit orders, staking, and crypto indices.

- The platform supports easy portfolio monitoring and frequent small trades with a low entry point of £1.

The trade off is that the toolset is not built for advanced trading:

- No strong emphasis on charting depth or indicator suites

- No clear API and automation ecosystem

- Limited advanced order types and pro execution features

How competitive are Bitpanda’s fees and pricing?

Bitpanda uses a simple flat pricing model where trading costs are built into the quote you see before confirming a buy or sell, rather than a maker taker fee schedule. In the UK, the platform is strong on zero fee deposits and withdrawals, but trading can be more expensive than pro exchanges because spreads and premiums can reach up to about 2.49% on some assets.

Bitpanda fees at a glance (UK)

| Fee type | What Bitpanda charges | What to watch for |

|---|---|---|

| Trading fee model | Flat premium included in price quote (not maker taker) | Costs are not shown as separate “commission” lines, so the effective fee is the difference between market price and the quote you accept |

| Bitcoin trading | From 0.99% premium | Lower than some broker apps on BTC, but still higher than pro order book exchanges for high frequency traders |

| Other crypto trades | Up to ~2.49% premium in some cases | Smaller tokens and volatile markets can mean wider spreads and higher all in costs |

| Deposit fees | No Bitpanda deposit fees | Card issuers may charge their own fee, often quoted at around 1.5% depending on provider |

| Withdrawal fees | No Bitpanda withdrawal fees for fiat | Crypto withdrawals can still include network fees charged by the blockchain |

| PayPal deposits and withdrawals | Free on Bitpanda | PayPal limits and processing checks can apply depending on account status |

| Inactivity fees | None stated | No penalty for occasional users |

Trading fees (flat pricing, not maker taker)

Bitpanda’s UK platform works more like a broker than a traditional exchange. Instead of charging a separate commission with maker and taker tiers, Bitpanda typically shows an all in price that already includes its trading premium.

- Bitcoin: trading starts from 0.99% premium

- Other cryptoassets: premiums can rise to around 2.49% depending on the asset and market conditions

This model is easy to understand because you see the final price before confirming. The trade off is that users cannot reduce fees through maker orders, volume tiers, or advanced routing, which is why frequent traders often prefer order book exchanges.

Spread costs and why they matter

Because Bitpanda’s cost is baked into the quote, the practical “spread cost” is the difference between:

- the underlying market reference price, and

- the buy or sell quote shown in the app at checkout

This can be less noticeable for long term investors making occasional buys, but it becomes expensive for:

- frequent trading

- short term strategies

- smaller cap coins where spreads can be wider

The clearest way to manage this on Bitpanda is to use limit orders where available, so execution happens at a price you set rather than accepting an instant quote during fast market moves.

Deposit fees (and indirect costs)

Bitpanda states no platform fees for deposits, which is a strong point for UK users moving money in and out regularly.

However, indirect costs can still appear depending on the payment rail:

- Debit card and Apple Pay: Bitpanda may not charge, but card issuers can apply their own fees, sometimes cited at around 1.5%

- Bank transfers: typically the cheapest route since there are fewer intermediary fees

- PayPal: described as free for deposits and withdrawals on the Bitpanda side, but PayPal account rules and limits can still affect usability

Withdrawal fees (fiat and crypto)

Bitpanda positions itself as zero fee for withdrawals on its side for fiat methods.

For crypto, it is important to separate:

- Bitpanda’s withdrawal fee: stated as none

- Blockchain network fee: still applies when withdrawing coins, because miners or validators charge to process on chain transactions

This means withdrawing crypto is rarely “free” in practice, even when the platform itself does not add a separate charge.

Any hidden or indirect costs to know about

Bitpanda’s pricing is generally transparent at checkout, but there are still costs that can feel hidden if users do not know what to look for:

- Premium and spread are embedded: there is no line item commission, so users need to judge the quote versus the live market rate

- Payment provider charges: card issuer fees can add cost even if Bitpanda is fee free

- Network fees on crypto withdrawals: paid to the blockchain, not Bitpanda

- Opportunity cost for active traders: no maker taker tiers or volume discounts, so high turnover accounts can pay materially more over time than on pro exchanges

Fees and pricing score context

Bitpanda scores well for pricing structure because it is simple and avoids common friction costs:

- No deposit fees

- No withdrawal fees

- No inactivity fees

- Clear all in quotes at the point of trade

The main drawback is that trading premiums and spreads can be higher than platforms built around order books, especially for users who trade frequently or focus on lower liquidity coins.

How secure is Bitpanda and how are assets held?

Bitpanda is a custodial, centralised crypto platform, meaning the company holds client crypto within its custody setup rather than users controlling private keys by default. It combines cold storage for most user funds, account level controls like two factor authentication, and operational security standards such as ISO 27001 certification. Crypto remains high risk and is not protected by the FSCS in the UK.

Custody model

Bitpanda operates as a cryptoasset broker with a custodial model. In practice:

- Assets bought on Bitpanda are held in wallets managed by the platform, not in a self custody wallet where the user controls private keys.

- This model simplifies recovery, trading, and staking, but it introduces platform risk because users rely on Bitpanda’s controls, custody processes, and solvency.

UK users should also separate custody from regulation:

- In the UK, Bitpanda is registered with the Financial Conduct Authority for cryptoasset services under anti money laundering supervision. This is registration, not the same as being FCA authorised for investments.

Cold storage practices

Bitpanda states that it uses cold wallet storage for most user funds, which means the bulk of crypto is held in wallets not connected to the internet, reducing exposure to online attacks.

Cold storage typically sits alongside a smaller “hot wallet” balance used for day to day withdrawals and operational liquidity. The user does not choose the split, because custody is managed centrally.

Account security controls

- Two Factor Authentication (2FA): adds a second login step beyond a password, usually via an authenticator app.

- Email confirmation for sensitive actions: used as an additional check for events like withdrawals or major security changes.

- Multi factor authentication built in: positioned as standard for account protection.

Withdrawal whitelists are not mentioned, so it should not be assumed as a standard feature for UK accounts. If whitelisting is important, users typically need to confirm availability inside account security settings.

Security standards and data handling

Bitpanda highlights several formal security and privacy standards:

- ISO 27001 certification: an international standard for information security management systems, generally used to demonstrate structured security policies, controls, and ongoing risk management.

- ISO 27018 certified data handling: focused on protection of personally identifiable information in cloud environments, which is relevant given the amount of identity data collected during KYC.

- Enterprise grade security positioning: used to communicate institutional style controls, though the most useful takeaways are the named standards and practices above.

These standards do not remove risk, but they indicate that the platform has a documented, auditable security framework rather than informal controls.

Incident history

No publicly reported security breaches were noted as of 2026. That is a point in time statement, not a guarantee about future outcomes. Security incidents can occur at any exchange or broker even when strong controls are in place.

Clear risk disclosures for UK users

Bitpanda’s UK messaging includes a prominent risk warning:

- Don’t invest unless you’re prepared to lose all the money you invest. This is a high risk investment and you should not expect to be protected if something goes wrong.

Key points behind that warning:

- Cryptoassets are volatile and can drop sharply with little notice.

- Custodial platforms create counterparty risk. If the platform is disrupted, withdrawals can be delayed or restricted.

- In the UK, crypto holdings are not covered by the Financial Services Compensation Scheme (FSCS), and the Financial Ombudsman Service (FOS) does not handle complaints in the same way it would for regulated investment products.

Security and custody score context

Bitpanda scores strongly for security and custody because it combines:

- Cold storage for most funds

- 2FA and confirmation checks for sensitive actions

- Recognised security standards such as ISO 27001 and ISO 27018

The main limitation is structural: Bitpanda is a custodial platform, so users are trusting a third party to safeguard assets, process withdrawals, and maintain operational continuity.

How do deposits and withdrawals work on Bitpanda?

Bitpanda supports simple GBP fiat deposits and withdrawals for UK users through mainstream payment methods, with no Bitpanda fees for deposits or fiat withdrawals. Crypto deposits are made by sending coins to a Bitpanda wallet address, and crypto withdrawals include the usual blockchain network fee. The process is straightforward, but verification checks and peak demand can affect processing speed.

Fiat on ramp and off ramp support

Bitpanda is set up for UK users who want to move money between a bank and a crypto account without extra platform charges.

Supported deposit methods (UK):

- Bank transfer

- Debit card

- Apple Pay

- PayPal

Supported withdrawal methods (UK):

- Bank transfer

- PayPal (listed as free for both deposits and withdrawals)

Fees:

- Deposits: Bitpanda charges no deposit fee across methods.

- Withdrawals: Bitpanda charges no withdrawal fee for fiat withdrawals.

Indirect costs to note:

- Card deposits are described as Bitpanda fee free, but card issuers may charge their own fee, often cited around 1.5% depending on the provider and card type.

Crypto deposit and withdrawal process

Because Bitpanda is a custodial platform, crypto transfers work through Bitpanda managed wallets.

Crypto deposit steps (typical flow):

- Open the wallet for the specific coin inside Bitpanda.

- Copy the deposit address (and memo or tag if required for that network).

- Send the crypto from an external wallet or exchange.

- Wait for blockchain confirmations before the balance shows as available.

Crypto withdrawal steps (typical flow):

- Select the asset and choose withdraw.

- Paste the destination wallet address (and memo or tag if required).

- Confirm the withdrawal and complete security checks.

- Bitpanda processes the request and the blockchain confirms the transaction.

Network fees:

- Bitpanda describes deposits and withdrawals as free on its side, but crypto withdrawals still carry a network fee charged by the blockchain, not the platform.

Processing times

Bitpanda does not present a single fixed processing time for every payment rail or crypto network, because timing depends on the method used and real time conditions.

What typically drives timing:

- Bank transfers: depend on bank processing windows, cut off times, weekends, and the transfer system used.

- Debit card and Apple Pay deposits: usually appear quickly once authorised, but may be delayed by extra checks.

- PayPal deposits and withdrawals: can be fast, but PayPal account limits and compliance checks can slow movement.

- Crypto deposits and withdrawals: depend on blockchain confirmations and network congestion, which vary by coin and time of day.

User reported friction points:

- The most common issues mentioned are delays during identity verification and slower service during market surges, rather than persistent payment failures.

Limits and minimums

Bitpanda is positioned for low minimum entry.

- Minimum trade: users can start from £1, which is useful for first time buyers and testing the platform with small amounts.

- Crypto index minimum: the crypto index product is described as starting from £10.

- Deposits and withdrawals: specific maximum limits are not provided, and in practice can vary by payment method and account verification level.

Reliability and transparency

Bitpanda’s deposit and withdrawal setup scores well for transparency because:

- No platform fees for deposits or fiat withdrawals simplifies cost expectations.

- Trading and withdrawal screens typically show the final amount before confirmation, which reduces fee surprises.

- The platform also uses common security steps like 2FA and confirmation checks for sensitive actions, which can add friction but are intended to reduce fraud risk.

Where users may still see variability:

- Peak market periods can increase support response times.

- Payment providers and banks can delay transfers even when Bitpanda charges no fees.

- Blockchain network congestion can slow crypto transfers, independent of Bitpanda’s processing.

How trustworthy is Bitpanda in terms of regulation and support?

Bitpanda is a Vienna based crypto broker founded in 2014 that relaunched its UK platform in August 2025, operating as an FCA registered cryptoasset business for anti money laundering supervision. It publishes clear high risk warnings and runs a help centre plus in app and email support, but response times can slow during volatile markets and there is no guaranteed investor protection for crypto.

Regulatory or registration status

Bitpanda’s UK position is best described as registered, not regulated for investments.

- UK status: Bitpanda is registered with the Financial Conduct Authority (FCA) to carry out cryptoasset activities under the UK’s anti money laundering framework. This is aimed at financial crime controls like KYC and ongoing monitoring, not day to day consumer protection for investments.

- What this does not mean: FCA registration for crypto does not mean Bitpanda is authorised in the same way as an FCA regulated investment firm offering stocks, funds, or CFDs.

Jurisdictional transparency

Bitpanda provides reasonably clear corporate and operational context for UK users.

- Founded: 2014

- Headquarters: Vienna, Austria

- Scale: often described as having 7 million plus users globally

- UK launch timing: the UK product is described as officially relaunched in August 2025

For UK users, the important point is that the product is a crypto broker offering spot crypto access rather than a full multi asset investment platform.

Customer support channels and responsiveness

Bitpanda’s support setup is typical for large retail crypto platforms: mostly digital, with self serve resources and ticket based help.

Support channels:

- In app support

- Email support

- A detailed support centre or helpdesk with guides and troubleshooting articles

What is limited:

- Live chat is not always available

- No direct phone support

Responsiveness and common issues:

- Users frequently rate Bitpanda positively on usability and asset choice, with Trustpilot averages commonly cited around 4.2 to 4.5 stars.

- The most common complaints referenced are slower customer support during market surges and occasional delays tied to identity verification or account checks.

Clarity of risk warnings and disclosures

Bitpanda’s disclosures are direct and prominent, which improves trust even when the product remains high risk.

- The core warning used across the UK messaging is clear: don’t invest unless you’re prepared to lose all the money you invest and you should not expect to be protected if something goes wrong.

- Protection limits: crypto investments are not covered by the Financial Services Compensation Scheme (FSCS). The Financial Ombudsman Service (FOS) also does not treat crypto complaints in the same way it would for regulated investment products, which matters if there is a dispute.

Trust, regulation, and support score context

Bitpanda scores well here because it is transparent about what it is, uses prominent risk warnings, and operates under FCA cryptoasset registration with standard identity checks. The main trade offs are structural: crypto itself has limited consumer protection, and support response times can be slower during high volatility periods when demand spikes.

What are the pros and cons of using Bitpanda?

Pros

- 600 plus cryptocurrencies in the UK: broad access to major coins, stablecoins, and smaller tokens without needing multiple exchanges.

- Zero deposit and withdrawal fees on Bitpanda’s side: cheaper to move GBP in and out compared with platforms that charge funding or cash out fees.

- Low entry point: £1 minimum trade makes it practical to start small, test the app, or build positions gradually.

- Beginner friendly design: clean mobile first experience with simple buy sell flows and a clear final quote before placing a trade.

- Extra crypto features without complexity: crypto indices for basket exposure and staking on 50 plus coins for users who want passive style crypto tools in one place.

Cons

- Trading costs can be high on some assets: flat premiums start at 0.99% on Bitcoin and can rise to around 2.49% depending on the coin and market conditions.

- No advanced trading platform in the UK setup: limited pro grade tools, no deep exchange style terminal, and fewer advanced order types beyond basics like limit orders.

- No stocks, ETFs, or metals in the UK product: users wanting a multi asset investing app need a separate platform.

- Support can be slow during peak volatility: delays are most often reported when markets surge and demand spikes.

- No FSCS protection for crypto: UK users should expect no compensation scheme cover if something goes wrong with crypto holdings.

Who is Bitpanda best for?

- Beginners who want a simple app, small starting amounts, and a straightforward way to buy and hold crypto.

- Altcoin focused users who want one of the widest UK selections, with 600 plus coins available.

- Long term holders who value easy GBP deposits, basic order controls like limit orders, and portfolio tracking.

- Users who move money frequently and want no Bitpanda deposit or withdrawal fees on fiat transactions.

- Passive style crypto users interested in staking (50 plus coins) and crypto indices rather than active day trading.

Who is Bitpanda not ideal for?

- Low fee seekers and high frequency traders who need maker taker pricing, tight spreads, and volume based discounts.

- Advanced traders who want futures, perpetuals, margin tools, APIs, or a full pro trading terminal.

- Users needing strong regulation and protections: crypto is not covered by FSCS, and FCA registration is not the same as FCA investment regulation.

- Investors wanting a single app for everything: no UK access to stocks, ETFs, or commodities in the Bitpanda product described.

- Users who rely on immediate human support: phone support is not positioned as a core channel and response times can slow in busy periods.

How to get started with Bitpanda

- Create an account: Visit the Bitpanda website or download the mobile app and sign up using an email address and password. You will need to accept the platform’s terms and acknowledge the mandatory crypto risk warnings during registration.

- Complete verification if required: UK users must complete a standard Know Your Customer (KYC) process. This typically involves uploading a valid photo ID, completing a short video verification, and passing an appropriateness assessment required under UK crypto rules. A 24 hour cooling off period usually applies after verification.

- Deposit funds: Once verified, add funds in GBP using supported methods such as bank transfer, debit card, Apple Pay, or PayPal. Bitpanda does not charge deposit fees, although card providers may apply their own charges.

- Place a trade: Choose from 600 plus cryptocurrencies, crypto indices, or staking eligible assets. Trades can start from £1, and prices are shown upfront with the full premium included before confirming the order. Basic tools like market buys and limit orders are available.

- Withdraw or secure assets: Funds can be withdrawn back to a bank account or PayPal without Bitpanda withdrawal fees. Crypto can also be sent to an external wallet, with only the standard blockchain network fee applying. Users can additionally secure accounts by enabling two factor authentication (2FA) and email confirmations for sensitive actions.

How we tested and methodology

Each crypto exchange is assessed using a standardised six category scoring framework, designed to compare platforms on the factors that matter most to UK users. Every category is scored out of 5, with the combined results forming the overall platform rating.

The six scoring categories are:

- Supported assets and markets: range of cryptocurrencies, availability of altcoins, staking options, and any additional crypto products.

- Trading experience and tools: ease of use on web and mobile, order types, charting features, and overall platform performance.

- Fees and pricing: trading costs, spreads, deposit and withdrawal fees, and pricing transparency.

- Security and custody: custody model, cold storage practices, account security controls, and incident history where applicable.

- Deposits and withdrawals: fiat on ramp and off ramp support, crypto transfer processes, processing times, and reliability.

- Trust, regulation, and support: regulatory or registration status, jurisdictional transparency, customer support access, and clarity of risk disclosures.

Scores are based on hands on testing, detailed fee analysis, review of security and custody practices, and platform usability checks across both desktop and mobile. Publicly available disclosures and user feedback are used to support findings, but ratings prioritise direct testing and verified platform information rather than marketing claims.

FAQs

Can Bitpanda be trusted?

Yes. Bitpanda was founded in 2014, serves over 7 million users, and has no publicly reported security breaches as of 2025. It uses cold storage for most assets, mandatory 2FA, and ISO certified data handling, which supports a strong trust profile for a crypto broker.

Does Bitpanda work in the UK?

Yes. Bitpanda officially relaunched in the UK in August 2025 and supports GBP accounts, UK payment methods like bank transfer, debit card, Apple Pay, and PayPal, and full access via web and mobile apps.

Is Bitpanda regulated in the UK?

Bitpanda is registered with the Financial Conduct Authority (FCA) for cryptoasset services, but it is not FCA regulated in the same way as investment firms. Crypto assets are not covered by the FSCS, and complaints related to crypto fall outside the Financial Ombudsman Service (FOS).

Is Bitpanda a safe wallet?

Bitpanda acts as a custodial wallet provider rather than a self custody wallet. Most user funds are held in cold storage, sensitive actions require email confirmation, and account level protections like 2FA are standard. It is secure for holding crypto, but users do not control private keys directly.

Can I withdraw money from Bitpanda?

Yes. UK users can withdraw GBP to a bank account or PayPal, and crypto can be sent to external wallets. Withdrawals are generally reliable, with processing times depending on the payment method or blockchain network.

Are Bitpanda fees high?

Trading fees are higher than advanced exchanges but transparent. Bitcoin trades start at 0.99%, while some assets can reach around 2.49% via the built in spread. There are no deposit, withdrawal, or inactivity fees, which offsets higher trading costs for many users.

Is Bitpanda a broker or exchange?

Bitpanda is a crypto broker, not a traditional exchange. Prices are quoted upfront with fees included, and there is no public order book or maker taker pricing model.

How much does Bitpanda charge for withdrawal?

Bitpanda charges £0 for fiat and crypto withdrawals. The only cost when withdrawing crypto is the standard blockchain network fee, which is set by the network, not Bitpanda.

Tobi Opeyemi Amure is a cryptocurrency and financial markets writer covering blockchain, digital assets, and Web3 trends. He writes for leading finance platforms including Investopedia, Investing.com, and Cryptopolitan, with a focus on market analysis, DeFi, NFTs, and crypto regulation. With a background in crypto trading and fintech marketing, he also advises Web3 projects while producing clear, research driven content for global investors.